TLDR: Today’s Budget will cement in three decades of Government spending, tax and investment incentives that delivered a low investment, low wage and high house price economy. The already-low chances of a ‘Build Back Better’ pivot have now completely disappeared as both sides of politics get back to business as usual after Covid.

See more detail and my analysis below the paywall fold. I will open it up for all if paid subscribers would like that. Just say so in the comments below.

Elsewhere in the news overnight and this morning:

global stock markets slumped again this morning as fears profit-harming recessions are brewing in the world’s biggest economies, although market interest rates fell too;

Turkey blocked an attempt overnight by Sweden and Finland to formally apply to join the 30-country NATO alliance, which needs unanimous approval to expand; and,

Fonterra is looking to break into the US infant formula market to fill massive supply shortages caused by a lack of imports because of domestic industry protections and a lack of competition between a few dominant players.

The ‘Build Back Better’ moment has passed

The framework of this afternoon’s Budget, the first built for a post-Covid world, is already in place, and it’s largely the same as budgets of years gone by. The ‘Build Back Better’ moment has passed and the Government is now back to business-as-usual, which means:

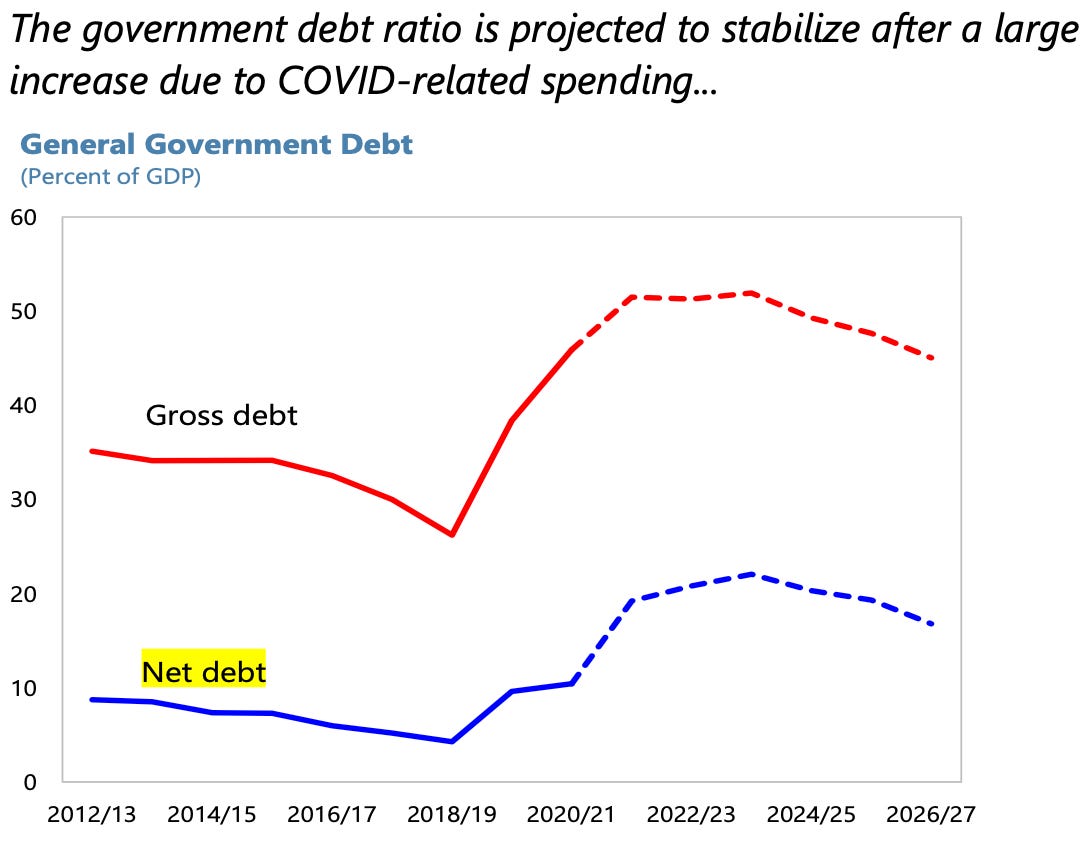

‘keeping a lid’ on public debt so private homeowners can keep low interest rates, high mortgage debt and continue reaping highly-leveveraged and tax-free capital gains;

sticking with a low public investment approach that starves cities of infrastructure for housing and low-emissions transport to keep debt low and avoid a supply-driven crash in house prices;

retaining a punitive and inadequate welfare system that sentences yet-more-tens-of-thousands of kids to yet-more generations of poverty in order to keep the size of Government around 30% and deliver regular income tax cuts for those on middle incomes;

keeping the investment incentives in favour of leveraged investment in residential land, rather than in research, development and international business expansion;

holding on to an economic growth formula of relatively high migration of guest workers, low wages and low productivity growth, where the way to get ahead is to buy residential land and hold on for the next burst of tax-free capital gains; and,

maintaining the size of Government at around 30% of GDP in the long run and using any fiscal headroom to hand back cash through tax cuts and middle-class welfare.

How do we know not much has changed?

Finance Minister Grant Robertson has already set the parameters for Budget 2022 and they remain in line with the low public debt, low infrastructure investment, punitive welfare and climate inaction settings of previous Governments of both colours.

The brief period in the wake of the first Covid elimination about ‘Building Back Better’, a slogan reanimated by US President Joe Biden’s new administration (and also now rarely used), has faded into the noise of calls for tax cuts, complaints about Government spending ‘too much’ and a surging polling performance by the National-ACT opposition under new leadership.

Robertson has already said in various speeches and comments in the last two months that:

the $6b operating allowance for the first year of the four year period to be laid out in Budget 2022 will not change from when it was first announced in the Half Yearly Economic and Fiscal Update (HYEFU) in December;

this allowance will be mostly taken up with retrospective spending on cleaning up the deficits and restructuring costs inherited from DHBs as they are wound up and put into two new authorities from July 1 as Health NZ-Hauora Aotearoa and the Māori Health Authority-Te Mana Hauora Māori;

the multi-year capital spending allowance of $9.8b set in December after a $2b increase then would not change because of fears it might boost construction cost inflation;

the Government would not use the 15 percentage points of GDP of fiscal headroom available under its new debt ceiling track to invest in new housing or climate infrastructure any time soon;

the Emissions Reduction Plan revealed this week would spend just $1.17b of a $4.5b Climate Emergency Fund over the next two years while also being fiscally neutral and unable to use the Crown’s balance sheet; and,

a slower economic outlook would mean a return to surplus one year later than the 2023/24 forecast in December, increasing the pressure to restrain spending and borrowing.

The Government is prioritising keeping a ‘lid on debt’ above longer term investments or changes in welfare, housing and climate spending, as indicated in this Question Time exchange (Hansard Question 2) in Parliament yesterday between PM Jacinda Ardern and National Leader Christopher Luxon (bolding mine):

Christopher Luxon: How can Kiwis have any confidence in tomorrow's Budget spending announcements when one of her first big promises—Auckland light rail—was supposed to be finished two years ago, but still doesn't even have a business case, let alone a single piece of track?

Rt Hon JACINDA ARDERN: Because in the middle of an economic crisis, the likes of which we've not seen in a hundred years, we have received two triple A credit ratings from the two leading agencies, GDP is up 5.6 percent, we have some of the lowest unemployment on record, and our economy is in a better position than it was pre-COVID. If the only other point of comparison is, for instance, how this Government has done compared to the Government post the last economic crisis from the global financial crisis, then, toe to toe, we have outperformed.

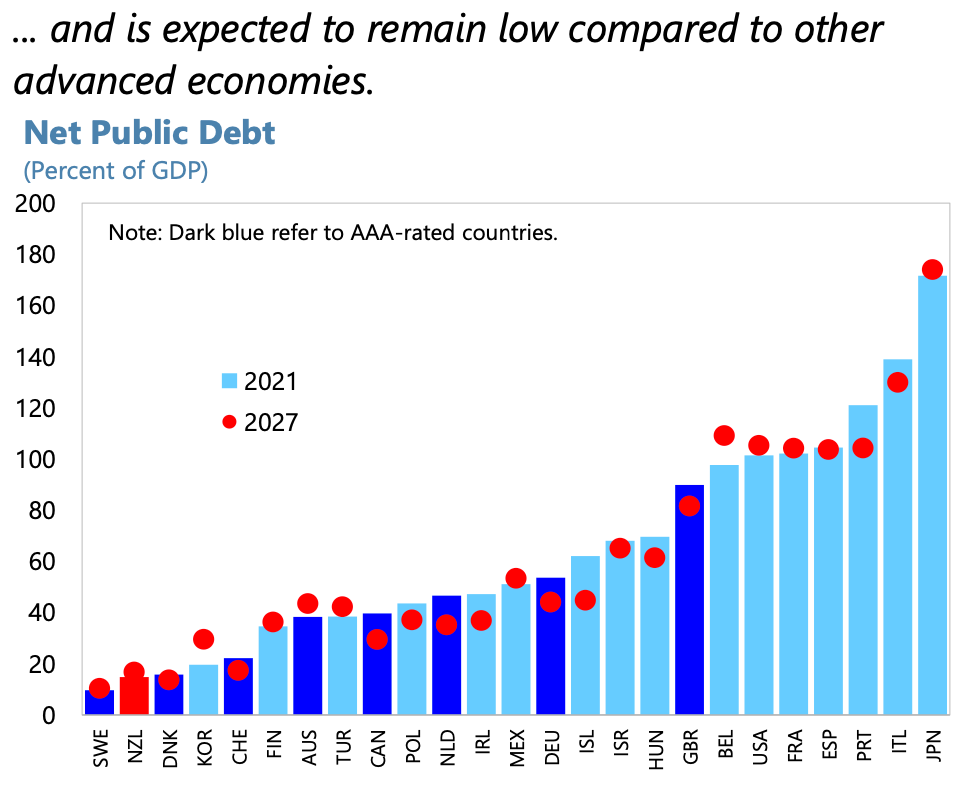

The PM’s first response when challenged on the investment failure was to trumpet the AAA credit ratings, which are an endorsement of the low debt, low investment, low interest rate, low productivity and low wage strategy.

Robertson also previewed the Budget on Tuesday by promoting the Government’s management of the state’s finances to ‘keep a lid on debt’ and keep pressure off inflation. It is the central priority of the Government, as it was for previous Governments led by National, and is being reinforced by the Opposition’s argument that Government spending is driving inflation.

That is not correct, as shown in this IMF chart released this week showing most of the domestic inflation was caused by the Reserve Bank’s loosening of LVR controls and $55b of money printing (domestic demand), albeit with the expressed approval of Robertson and the Government. The domestic supply issues are a function of the long term problems of under-investing in R&D, international business, infrastructure and housing.

Until the core incentives changes, nothing else does

The battle over the direction of the Government depends on a collective decision on how to tax wealth from capital gains on residential land. Until that core incentive and the surrounding supports of low mortgage rates, low public debt and low public investment to increase housing supply are changed, nothing much else changes. That’s reflected in the current calls for much higher migration of guest workers, which were the main source of nominal economic growth in the decade before Covid. The Reserve Bank’s decision to unleash a housing-wealth-driven stimulus to rescue the economy in March 2020 was responsible for the economic growth since then.

This Budget is very much back to business as usual with no prospect for a change in those underlying settings of Government, given the PM has ruled out a wealth tax during her time in politics and the National-ACT Opposition is set to win back Government next year with promises to double-down on the status quo settings by reinforcing the incentives for multiple home ownership and high temporary net migration.

What the status quo has delivered

The best illustrations of the result of the three-decade bipartisan approach to public finances are these IMF charts showing:

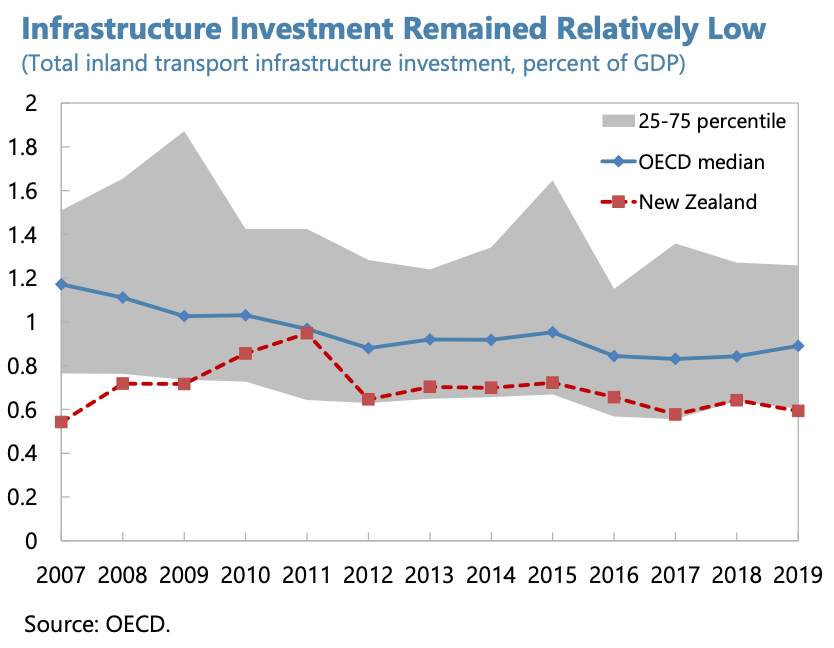

Aotearoa-NZ’s poor track record of public investment in ground transport, which includes roads;

our weak investment in public and private R&D (after all, why invest in a business when the returns from rental property can be leveraged, are tax-free for owner-occupiers, are Government Guaranteed, and are much less volatile than real business or capital market investors);

the performance of our housing market relative to other countries;

the formula of high household debt to back leveraged tax-free property matched with low public debt to keep interest rates relatively low; and,

the resulting underperformance on productivity and outperformance on property price inflation.

The formula is intact with little change in this Budget and is set to be strengthened with a change of Government that:

keeps public debt and interest rates low by investing relatively little in public infrastructure so households can leverage up for tax-free capital gains;

keeps choosing residential land investment and high household debt over business investment because of the tax and leverage benefits for voting home owners; and

keeps wage inflation relatively low and nominal GDP growth relatively high through high net migration of temporary workers, which serve to both keep both public debt and interest rates low, and keep upward pressure on house prices.

I’ll be in the Budget lockup with Lynn from 10am to 2pm today and we will put out a special Budget 2022 email and podcast soon after the release of the Budget at 2pm. I welcome suggested questions and lines of inquiry from paid subscribers below.

In geopolitics, the global economy, business and markets

Stocks slump again - US stocks fell 4-5% this morning on renewed fears this year’s real wage deflation and cost inflation shock, along with a rapid tightening of monetary policy, is driving the US economy towards a recession that hammers corporate profits. CNBC

Walmart and Target crash - Walmart’s shares fell nearly 20% in two days trade, its worst performance since 1987, after it warned high inflation was ramping up wage costs and inventory problems were hurting sales. Target shares also crashed 25% this morning after a similar profit warning. YahooFinance

Taihoa ehoa - Turkey blocked initial applications by Sweden and Finland to join NATO overnight, saying it was unhappy with their support of PKK Kurdish rebels fighting for independence from Turkey. Insiders believe Turkey’s block is a negotiating tactic and it will eventually relent after concessions on the Kurdish question. CNN

‘Foreign agent’ - The U.S. Justice Department took the unprecedented step overnight of accusing casino mogul Steve Wynn of being a foreign agent of China, saying he lobbied former US President Donald Trump on Beijing’s behalf in 2017. Wynn owns casinos in Macao. CNN

Warming and acidifying oceans - The World Meteorological Organization published its 'State of the Global Climate in 2021' report overnight showing the world's oceans grew to their warmest and most acidic levels ever in 2021, while melting ice sheets lifted sea levels to record highs. The report will be used as an official document for the UN Climate Change negotiations known as COP27 to take place in Egypt later this year.

Russian climate move - The European Union announced a €300b package of spending to slash Europe’s emissions by 55% from 1990 levels by 2030 as it scrambles to wean itself off oil and gas full stop, as well as Russian oil and gas. AP

Heading for 10% - Britain’s Office of National Statistics reported overnight that UK consumer price inflation rose to an annual rate of 9% in April from 7% in March. However, the result was a touch below economists’ forecasts for around 9.1%.

High, but stable - Eurostat reported Euro area inflation was 7.4% in April from a year ago, which was an unchanged annual rate from March.

Scoops and news of note here

‘We want to help’ - Fonterra, which has been locked out of the US infant formula market for decades because of domestic industry protections, is looking to break in to help the United States deal with supply crises. The Food and Drug Administration announced overnight a lifting of restrictions of imports of various types of formula to help ease the shortage.

Jonesy Construction fails - Geraden Cann has another story of a first home buyer, Rahul Srivastav, done over by a small construction firm collapse, via Stuff. This time it’s in Wellington. More is brewing

Srivastav said he had joined 31 other affected buyers on a WhatsApp group, and many were in a worse position, having paid large amounts towards builds that were less complete. Srivastav said he was an unsecured creditor, and he did not know what would happen to his home.

One reason for the collapse was a shortage of building materials, which Jonathan Milne reports on in detail for Newsroom.

A fun thing

Ka kite ano

Bernard

Share this post