TL;DR: The Labour Government announced $4 billion of spending cuts over four years late yesterday, just 12 hours before the release of an IMF report calling for a tighter budget, either through spending cuts or taxes on capital gains.

Labour chose the spending cuts, although they amount to less than 0.3% of GDP or the equivalent of $10 per household per week. They’re also unlikely to lead to actual public sector job losses or spending cuts from current levels, given most of the cuts are to budgeted increases and future capital spending.

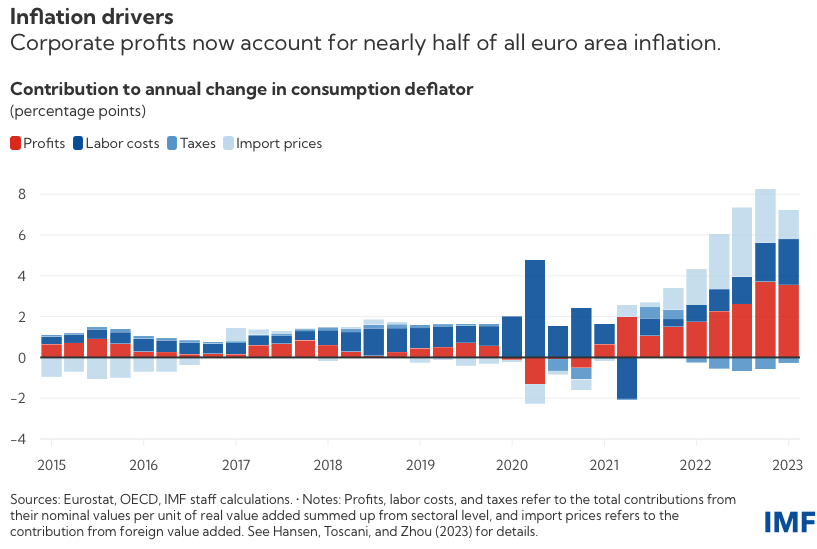

Just as well, because the ‘optics’ of choosing to cut Government spending to solve an inflation problem caused mostly by higher corporate profits are unattractive, especially when the call for ‘hairshirt’ austerity economics comes from the IMF, which itself identified corporate profits as the main driver of inflation in Europe. Without a lot of self-reflection, the IMF also recommended a corporate tax cut, when Governments in Europe and elsewhere have instituted windfall profit taxes on companies to claw back some of the excess profits captured during and after covid, as well as to ensure the burden of lower Budget deficits falls on those who can afford it most.

Labour has repeatedly refused to bring in a special windfall profit tax or special bank profit tax, even though they are conventional policy tools used overseas.

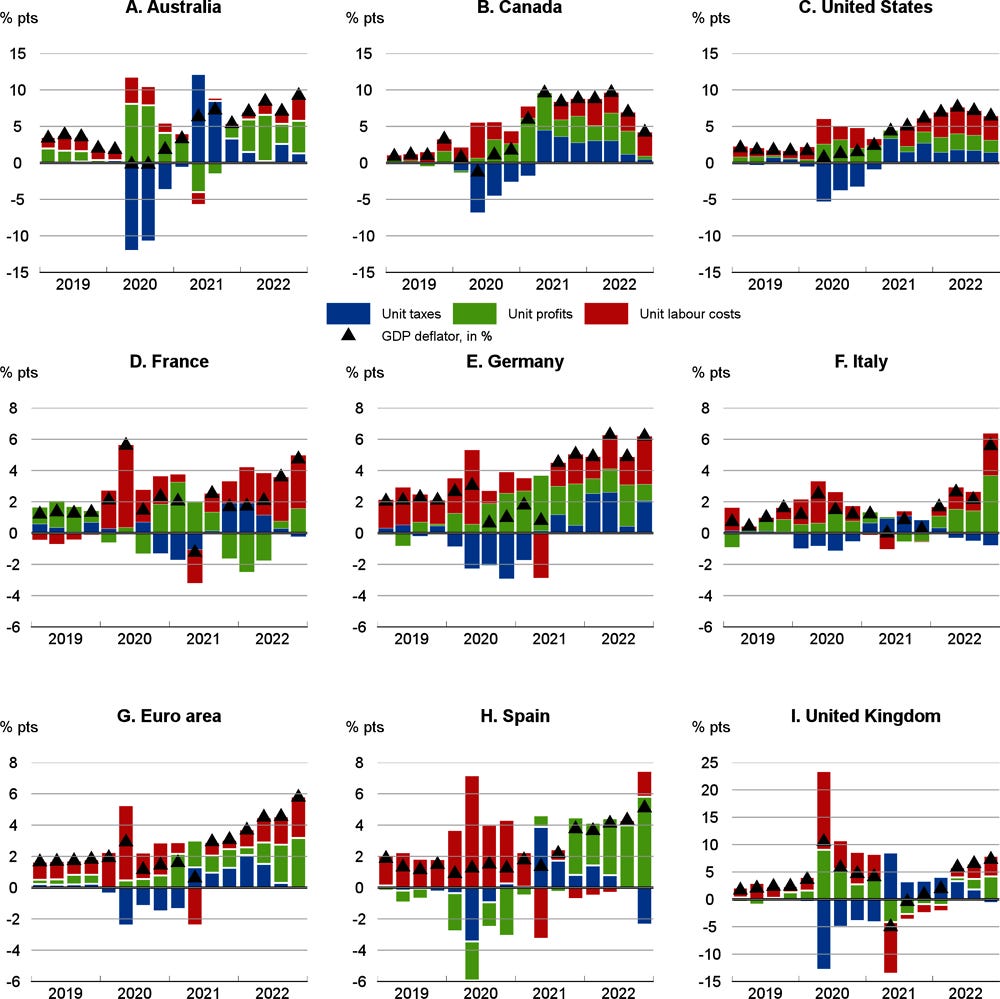

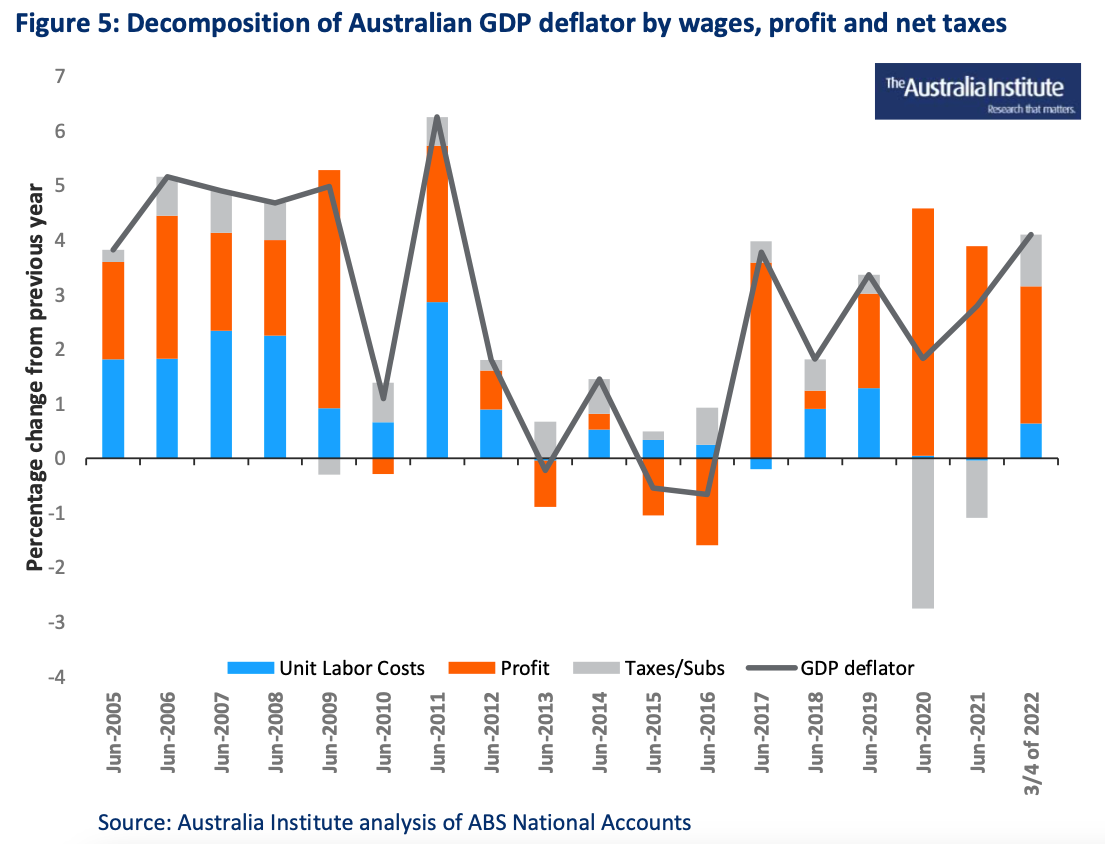

As it was, Labour got ahead of the ‘optics’ of the IMF report, but it does beg the question about who is paying to squelch inflation, when the IMF’s own analysis and an analysis in Aotearoa published yesterday using similar methods adopted by the OECD, the ECB, the US Economic Policy Institute and the Australia Institute have found companies, rather than workers or the Government are the main inflation culprits.

Yesterday afternoon I spoke to CTU Economist Craig Renney and FIRST Union Economist Ed Miller about their report with ActionStation into Profit-led inflation in Aotearoa. Here’s that full discussion in video form here for all, along with an audio version in the podcast above.

I detailed the specifics from the CTU/FIRST/ActionStation paper in yesterday morning’s email, but I’ve included a compilation here below of the charts from the various studies using the methodology used in the CTU/First/ActionStation paper, along with links to the studies that produced the charts.

Here’s the IMF one:

Here’s the US Economic Policy Institute one:

Here’s the OECD study:

Here’s the Australia Institute One:

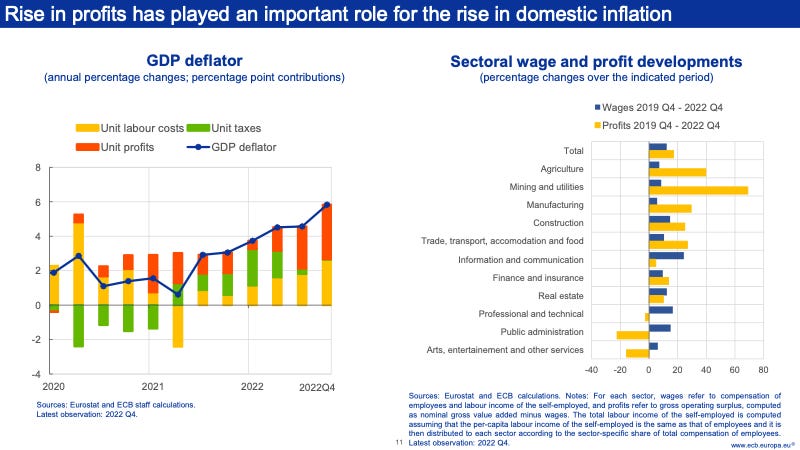

And here’s the ECB one:

Deep-dives elsewhere

The death of PTOM and the birth of SPTF

Joel McManus has written a great obituary for PTOM, the Public Transit Operating Model that saw council bus services contracted out to private companies. It was colonised by private equity, wages were driven as low as possible, and then Covid labour shortages exposed the model. Michael Wood just killed it and it has just been repealed through Parliament and replaced by Sustainable Public Transport Frameworks. SPTF does not roll off the tongue. It may well be Wood’s great legacy. The Spinoff article

The parties’ policies on water quality

The Public Health Communications Centre Aotearoa from the University of Otago’s Department of Public Health has produced a useful comparison of the parties’ policy on water quality, wrapped up by Marnie Prickett, and including analysis by Tim Chambers, Nick Wilson, Michael Baker, Adele Broadbent, John Kerr and Simon Hales. Here’s a snippet from the PHCCA article (bolding mine).

What is striking, particularly from the two main parties, is the lack of a cohesive, confident vision for moving to more sustainable, healthy land use. Primary risks to drinking water sources are agricultural pollution and over-extraction of water for irrigation. Furthermore, Cyclone Gabrielle very recently demonstrated how poor land use can impact water services following heavy rainfall events (e.g. silt and forestry slash damaging infrastructure).

National did not mention land use or farming practices at all. While Labour did, it appeared focused on incremental rather than transformational changes. The Greens noted a need for a fair allocation of water use and that they do not support large-scale irrigation schemes (a driver of intensified land use). Te Pāti Māori was the only party to identify the need to support farmers as they redesign their farming systems to have less impact.

No party mentioned climate change, which is projected to amplify existing issues with water quality and resilience of water infrastructure. PHCAA article

Interview of the day

Rodney Jones on China with Jack Tame

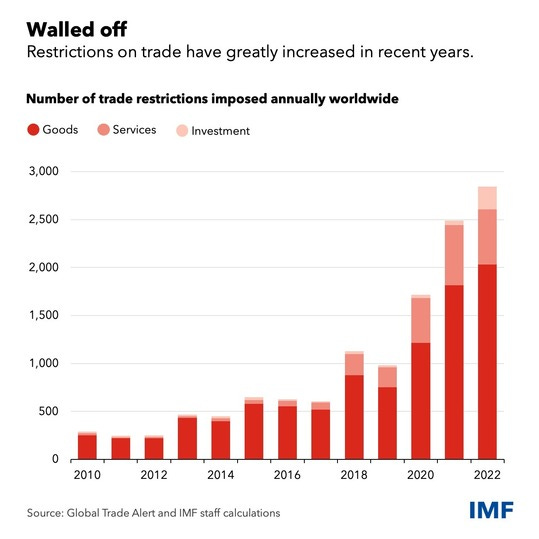

Chart of the day

The problem with growing trade restrictions

Cartoon of the day

A Wile E Coyote moment?

Ka kite ano

Bernard

Share this post