TL;DR: My top six news of note on the morning of Thursday, March 28 include:

The Government will have to borrow between $10 billion to $15 billion more than previously expected in order to make up for a slowing economy and to pay for $14.9 billion of tax cuts, according to economists for Westpac and ANZ.

Despite growing calls from the Government’s usual supporters for delays to the tax cuts, Finance Minister Nicola Willis said Budget 2024 on May 30 would include ‘responsible and affordable’ income tax reductions.

Former ACT Party leader Richard Prebble has called on the new Government to delay tax cuts, saying “unfunded tax cuts causing inflation and increased borrowing, will be both a political and economic disaster.” NZ Herald-$$$

Willis broke the convention of committing in the Budget Policy Statement to a spending allowance, saying only it would be less than Labour’s $3.5 billion, and that the slower economy meant a Budget surplus in 2026/27 was no longer assured.

The Government rejected Auckland Mayor Wayne Brown’s demand it rebate over $415 million of GST charged on top of rates paid to Auckland Council and start paying $36 million a year of rates on Crown land in Auckland. RNZ

Auckland Council said the Government’s public transport funding cuts and its refusal to rebate GST or pay rates would force cuts to schedules and increase fares, which would worsen congestion, increase emissions and further inflate the cost of living. Some suburbs would have no public transport at all. RNZ

(Paying subscribers can see more detail and analysis below the paywall and in the podcast above. We’ll open it up for public reading, listening and sharing if they give permission by getting over 100 likes.)

Elsewhere in Aotearoa’s political economy and geo-politics at 9:06

GCSB likely hosted US spy system used in global capture-kill operations. Newsroom Nicky Hager

The Ministry for Pacific Peoples is looking to slash its workforce by 40% or 63 roles in a proposal labelled as “brutal” The Post-$$$ Anna Whyte

Christchurch City Council has been given another year to consider housing density The Press-$$$ Tina Law

MBIE boarding house probe finds defective smoke detectors, unmonitored alarms 1News

Property owner says council's low-ball valuation skewing buyout process RNZ Jimmy Ellingham

High levels of nitrate found in Canterbury drinking water RNZ

Cleanup underway after mushrooms grow on walls of Sommerville school in Panmure 1News

Government agencies referring needy Kiwis to unfunded foodbank Newshub

Hutt City rates set to rise 16.9%, developers face big fee increase, paid parking for Petone and Petone wharf to be demolished The Post-$$$ Nicholas Boyack

Daniel Kahneman, the best-selling psychologist of Thinking, Fast and Slow, dies at 90 NPR

Borrowing even more to pay for tax cuts

The new Government’s Budget Policy Statement yesterday showed Treasury expects an economic slowdown will reduce forecast income taxes by $13.9 billion over the next four years. That means the Government’s borrowing programme over the next three years will have to be $10 billion to $15 billion bigger than forecast last December, according to notes from economists for Westpac and ANZ.

That’s if the Government goes ahead with its promised $14.9 billion worth of tax cuts over the same period, which Finance Minister Nicola Willis again committed to broadly, describing it as “responsible tax relief.”

Fiscal conservatives who normally support the new Government didn’t see it the same way. Former ACT Leader Richard Prebble yesterday joined NZ Initiative Executive Director Oliver Hartwich in calling for the tax cuts to be delayed, via his NZ Herald-$$$ column

“This Budget, if it contains unfunded tax cuts causing inflation and increased borrowing, will be both a political and economic disaster. Luxon must tell his Finance Minister and his coalition partners that the country voted for sound economic management. If that means the tax cuts and other policies must be delayed, so be it.” Former ACT Leader Richard Prebble via his NZ Herald-$$$ column

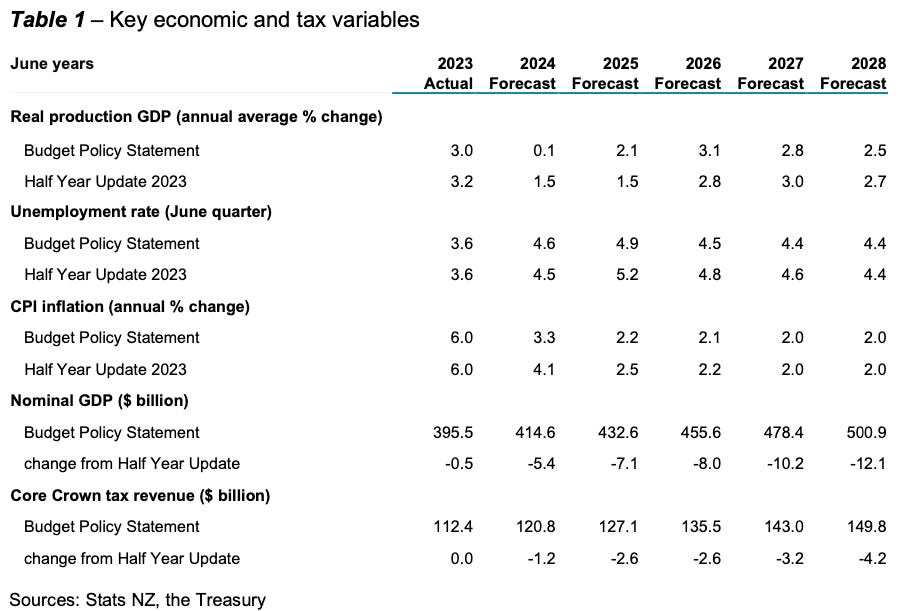

Here’s the Treasury forecasts for a lower nominal GDP than forecast at December’s Half Yearly Fiscal Update (HYEFU) and the resulting fall in tax revenue.

Bank economists see extra borrowing of same size as tax cuts

The slower economic growth forecast means Treasury sees less tax revenue, which in turns means higher Government borrowing over the next four years, as long as the Government carries through with its tax cuts. The amounts are almost exactly equal over the next four years:

Tax cuts proposed in National election policy costed $14.9 billion;

Tax revenue reductions due to slower real GDP growth and lower inflation total $13.9 billion; and,

Higher borrowing of $10 billion to $15 billion if the Government carries through with its tax cuts, say Westpac (up to $15 billion) and ANZ ($10 billion to $12 billion.

Here’s Westpac Senior Economist Darren Gibbs in his note yesterday (bolding mine):

In summary, today’s news confirms that the government borrowing programme will likely be raised significantly when Budget 2024 is released on 30 May. Given the extent of the downgrade in the tax forecasts, the size of that increase could be as much as $15bn across four years rather than the $7-10bn we surmised in our BPS Preview. However, much will depend upon decisions taken between now and the Budget, especially regarding the size and timing of tax cuts.

The operating spending allowance will be less than $3.5bn in Budget 2024 (the Half-Year Economic and Fiscal Update (HYEFU) set the allowance at $3.5bn). Unusually, the Government declined to set out operating spending allowances for subsequent years, which will instead be revealed in Budget 2024. We suspect that these spending allowances will depend on how the fiscal bottom line is shaping up late in the forecast process.

In Budget 2024 the Government will add up to $7bn to the Multi-Year Capital Allowance (MYCA) to fund new capital investment spending over the four-year Budget horizon. Not all this top-up will necessarily be funded within the four-year forecast horizon in Budget 2024. However, the top-up alone could lift the four-year government borrowing requirement by about $5bn compared with the HYEFU projection.

The Treasury is now also forecasting a lower trajectory for inflation. With CPI inflation expected to be close to the RBNZ’s 2% midpoint by the middle of next year, the forecast for nominal GDP is significantly lower across the forecast horizon – indeed by a cumulative $42.8bn – implying a markedly smaller tax base.

The weaker outlook for nominal GDP means that core Crown tax revenue in the current 2023/24 fiscal year is forecast to fall $1.2bn short of the HYEFU forecast – broadly in line with our own forecasts. The shortfall grows to $3.2bn by 2026/27 and to $4.2bn by 2027/28. The cumulative shortfall over the five years to 2027/28 is $13.9bn. Westpac Senior Economist Darren Gibbs in his note

‘Not much of a fiscal tightening’

ANZ Senior Economist Miles Workman also forecast a big increase in borrowing from the December forecast, if the tax cuts go ahead. Here’s his comments via this note (bolding mine):

Overall, while the fiscal policy mix has certainly changed (ie tax and spending cuts), we’d say the signal today is that discretionary fiscal policy settings (capex + opex) will be about par or perhaps mildly less expansionary than that baked into the Half-Year Update outlook over the next four years. But this all comes down to how much the operating allowance is reduced from Budget 2024 onwards (we estimate this could be cut by as much as $5-7bn over 4 years). But the economic drivers of fiscal outcomes are likely to more than offset that.

The Budget Policy Statement also included an interim update to the Treasury’s economic outlook. This points to a much smaller nominal economy over the next four years and a lot less tax revenue as a result (around $14bn less).

Our attempts to net out the weak economic signal with today’s signal on discretionary policy suggests bond issuance could be upgraded by around $10-12bn over the next four years come Budget. But we will refine that estimate closer to the time to reflect the latest monthly financial statements and any other pre-Budget announcements.

Putting it all together, the weaker tax outlook and higher capital spending look like they will add around $18bn to NZDM’s funding requirement over the next four years. However, this will be partially offset by the “less than $3.5bn” operating allowance in Budget 2024, and possibly a downgrade to the operating allowance from Budget 2025 onwards. It’s very loose, but we’d say we’re steering down the barrel of a $10-12bn upgrade to (bond) issuance guidance come Budget (at this stage). ANZ Senior Economist Miles Workman via this note

ASB Chief Economist Nick Tuffley also wrote in this note he saw a higher borrowing requirement, but did not specify a forecast. Here’s his comments (bolding mine):

The Budget Policy Statement indicates the Government is still intent on delivering tax cuts later this year and still aiming to get the operating balance back into surplus within an acceptable timeframe. Doing so will involve trade-offs between how much spending can be curbed and preparedness to borrow greater amounts, against the size of the tax cuts the government has previously committed to delivering. The challenge is the cupboard is looking pretty bare at the moment. ASB Chief Economist Nick Tuffley in this note

BNZ Senior Interest Rate strategist Stuart Ritson also saw higher borrowing, albeit without a specific forecast.

The borrowing programme will be updated alongside the Budget in May, with risks skewed towards an upward revision, given the Treasury’s revised growth and tax outlook. BNZ Senior Interest Rate strategist Stuart Ritson in this markets note.

Doing the Willis shuffle away from the coalition’s own feedback loop

Willis went out of her way yesterday to say the tax cuts would not be paid for with borrowing. In my view, that would be true if the economic situation had not deteriorated since December, reducing the revenues elsewhere. The effect of that means a discretionary decision by the Government will mean it has to borrow almost exactly the same amount as the tax reductions.

Here’s how she described the mix of spending, taxation and borrowing in this statement:

“Tax reductions will be funded within the operating allowance through a mixture of savings, reprioritisation and additional revenue sources.

“Funding tax relief in this way means we won’t have to borrow extra to provide tax relief and we won’t be adding to inflationary pressures.” Nicola Willis statement

That is a disingenuous view at best. At worst it is misleading.

The pressure is now mounting from National’s own side of politics. Her comments around the scale of the tax cuts left some wriggle room to be less than the $14.9 billion promised next year, but not that much, given the changes to childcare rebates, interest deductibility and the bright-line test have already been legislated.

The irony of course is that the economy slowdown is due at least partially to the Government’s own actions. Its freezing of funding decisions by Waka Kotahi-NZTA and Kāinga Ora, along with refusal to help councils with funds for water projects, has plunged the development and infrastructure sectors into a state of suspended animation. Spending cuts across most Government departments of 6.5% and 7.5% has chilled consumer and business spending in many places, especially Wellington.

Charts of the day

Time for a Kit Kat?

Maybe not

Cartoons of the day

Blink off

Timeline-cleansing nature pic

Spot the bokeh

Ka kite ano

Bernard

PS: There will be a Hoon tonight. And have a safe and relaxing Easter.

PPS: Check out the chat among the Kākā’s paying subscribers via the app. It’s amazing.

Share this post