TL;DR: The new Government’s first Budget due today at 2:00 pm is focused on delivering ‘cost of living relief’ in the form of income tax cuts for middle income families, but many of the coalition’s actions have already pumped up costs and lowered incomes, especially for the poor and disabled.

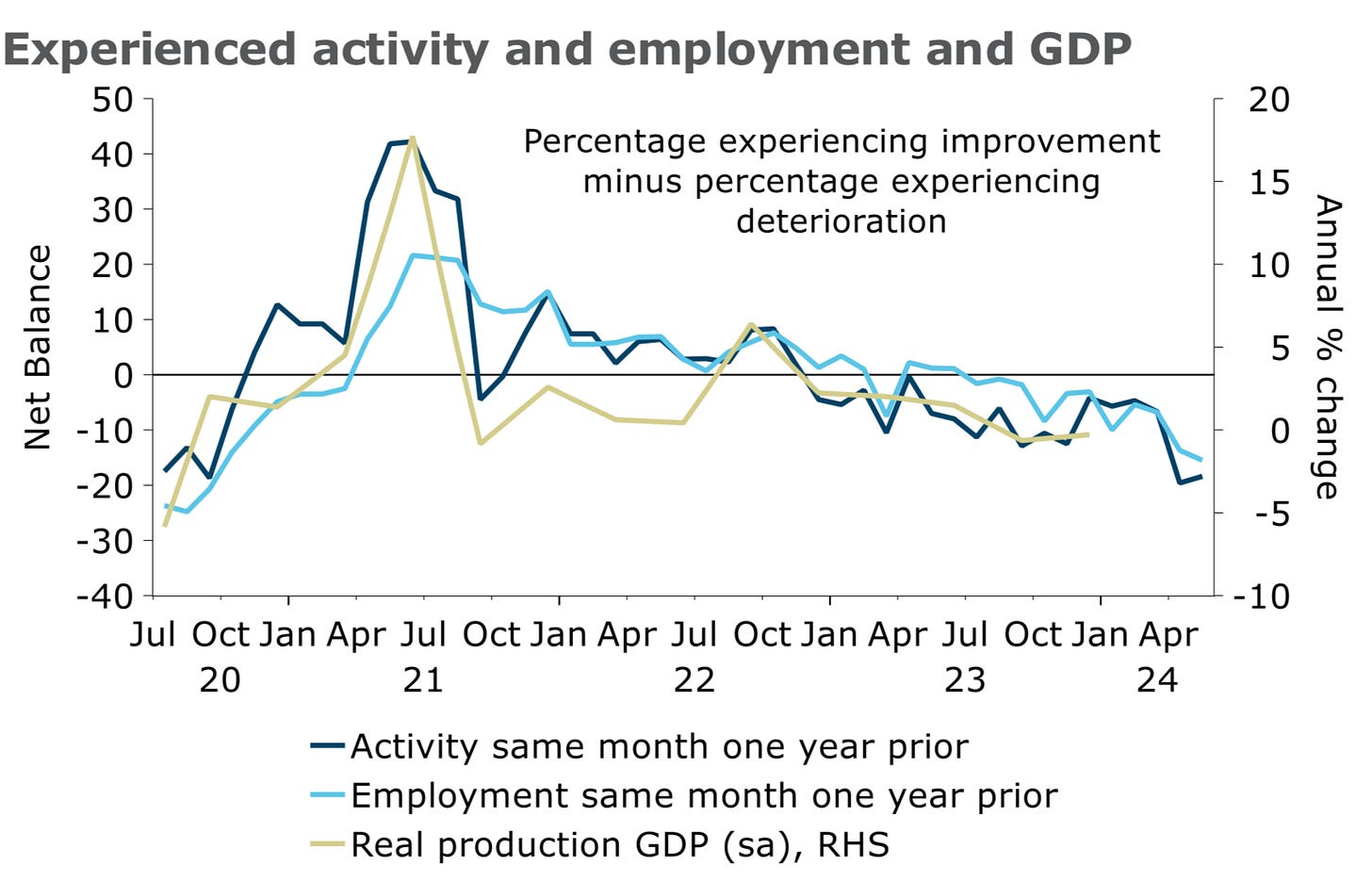

This Budget will include tax cuts and an expected $10-15 billion increase in borrowing to up to $167 billion, which the Government will try to blame on a weak economic inheritance from Labour. However, the Government’s actions since November have frozen large parts of the economy in a state of suspended animation, which was clear in a business confidence survey yesterday showing a depressed outlook for construction and retail spending.

(Paying subscribers can see and hear more detail and analysis below the paywall fold and in the Dawn Chorus podcast above. We’ll open it up for public reading, listening and sharing if we get over 100 likes. Update: Achievement unlocked!)

Here’s my top six ‘pick ‘n’ mix’ of links to news, analysis and opinion articles, announcements, official reports, reviews and research in the last day or so to 7:06 am on Thursday, May 30:

1: Power transmission costs to rise 48% in five years

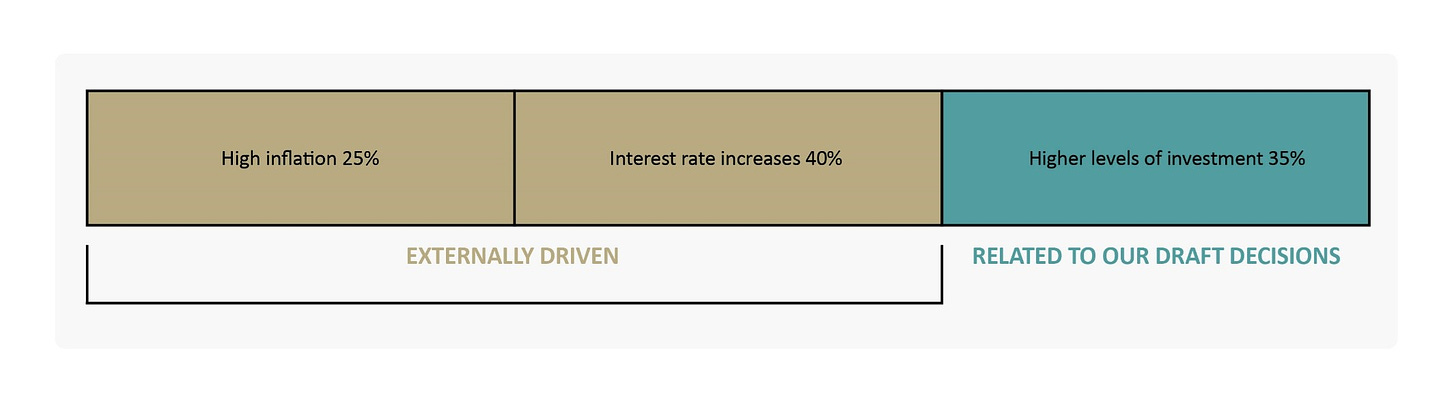

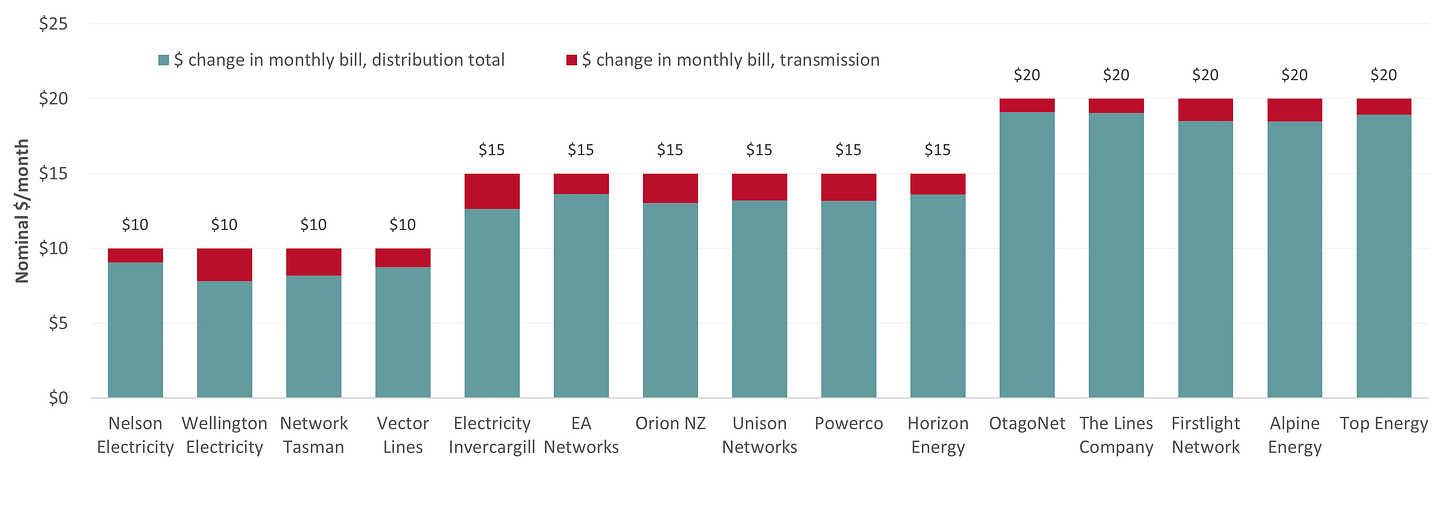

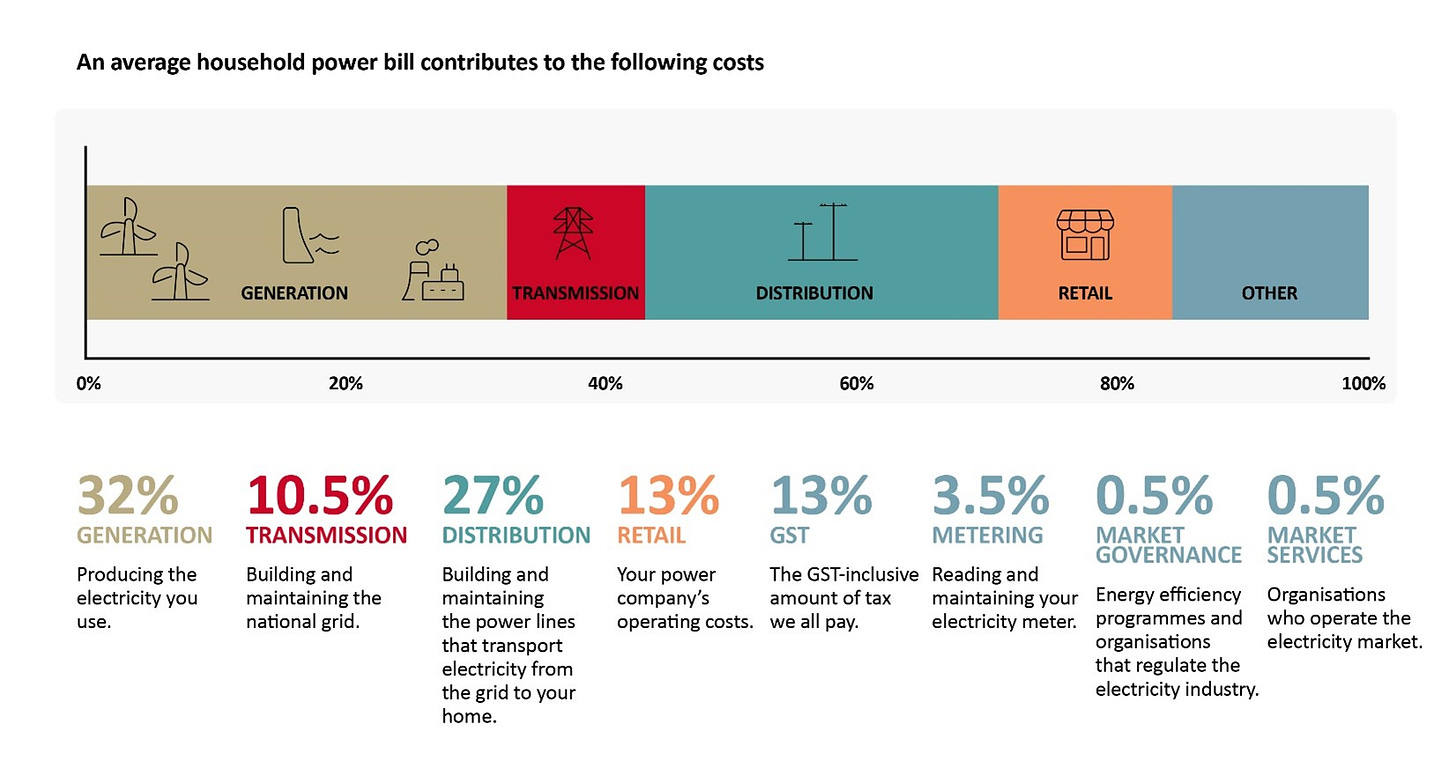

Cost of living: The Commerce Commission yesterday announced its draft decisions1 on regulated electricity transmission costs for the next five years. It decided the nationwide transmission and local lines companies distribution costs in power bills would have to rise 48% in the next five years to a combined $17.8 billion over that period. These costs make up a combined 37.5% of power bills.

The Commission cited extra investment to repair the grid, deal with population growth and prepare for the electrification needed for reach carbon zero. But it said most of the extra costs came from inflation in construction and maintenance costs and higher interest rates, which are accounted for in the Commission’s regulated returns on investment calculations.

Here’s the Commission’s graphics showing the initial regulated increases for each lines network, the break-down of these costs as a part of total power bills, and the respective shares of the total cost increases. They’re within a very useful explainer of the decision by the Commission.

In my view, this 9.8% increase each year for the next five years, which is five times the mid-point of the Reserve Bank’s inflation target band, is a defacto tax increase to pay for past under-investment in our state-built and (mostly) state-owned electricity grid and lines networks. It’s also caused by high interest rates themselves, which were applied to reduce inflation. This is one of those feedback loops where tight monetary policy causes inflation, along with higher Government and council fees and charges to reduce budget deficits partially caused by higher interest costs.

This is another example of past decisions to push investment and repair costs off into the future coming home to roost, all at once. Some of it is being physically forced by the climate punishing carbon emitters for past emissions with more extreme weather events that are causing higher costs now.

2. We’ll find out today how big the income tax cuts will be

Tax: We’ll all be watching at 2:00 pm today when Finance Minister Nicola Willis releases her first Budget, which she has promised will include the details of changes to income tax thresholds and rates promised in more broad terms before the election. National promised a family with children on an average income of $120,000 a year would be up to $250 a week better off, including lower childcare costs, while a childless couple on the average income would be up to $100 a week better off.

National removed the election-promise tax calculator from its website earlier this week, which will make it harder to compare the before and after. An official tax calculator will go up after 2:00 pm, but National’s full pre-election ‘Back Pocket Boost’ document with the tables showing promised benefits is below.

I’ll be looking out for the following:

Whether the tax threshold changes deliver the $8.985 billion promised over four years;

Whether the $5 prescription charges are re-introduced as promised;

Whether the funding for cancer drugs is delivered in full immediately, as promised;

Whether the changes in the Budget deliver a fiscal stimulus or contraction;

How much extra the Goverment will have to borrow (currently bank economists are forecasting a $10-15 billion increase); and,

Details of a new Infrastructure Funding Agency, including the capital contributed by the Government and its likely total fund raising.

I’m planning a ‘pop-up’ Hoon webinar on the Budget from 4:30 pm to 5:00 pm with former BERL Chief Economist and Productivity Commission Chair Ganesh Nana, just before the regular weekly Hoon.

3. Disabled already up to $5,742/year worse off - report

Poverty: The Fairer Futures advocacy group and the Disabled Persons Assembly published a report yesterday titled A Thousand Cuts that estimated a disabled person could already be up to $256 per fortnight or $5,742 a year worse off because of the Government’s changes to disability support, public transport subsidies, benefit indexation, the minimum wage and promised prescription charges.

The range of scenarios for different households with disabled people in different situations is mapped out on page 12 of the report. I’ve attached the full report below.

4. An extra 752k in 10 years when 400k was expected

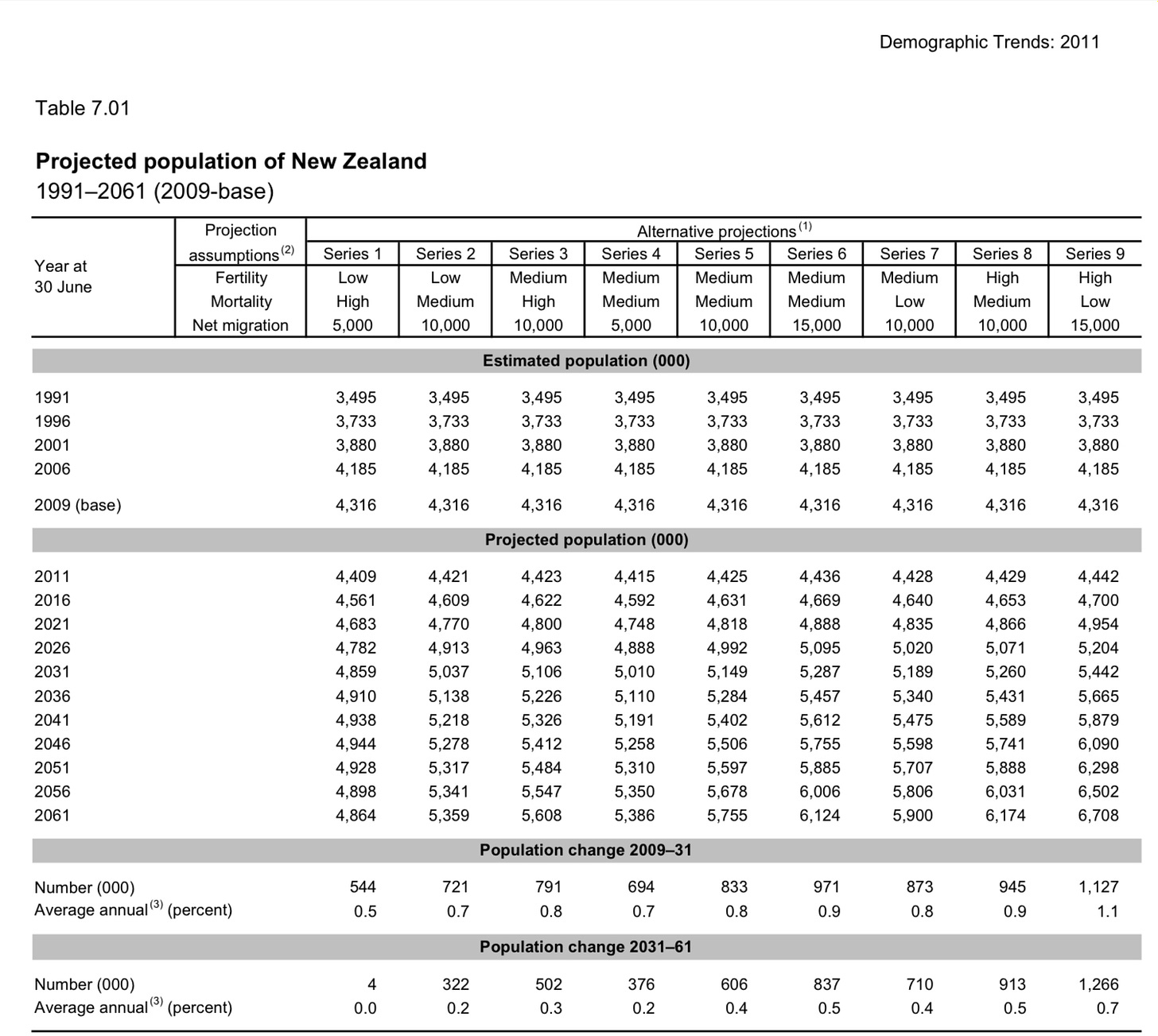

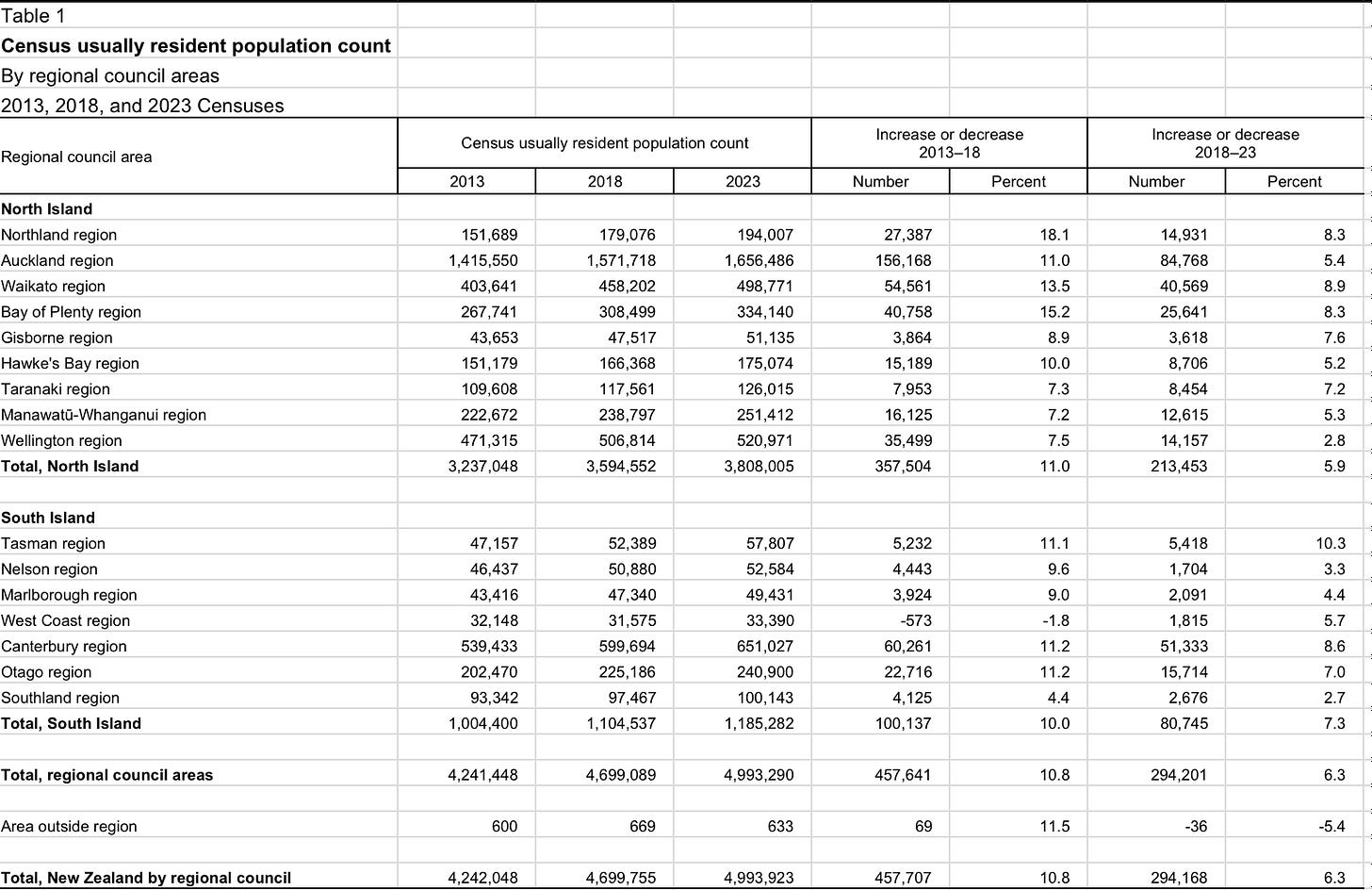

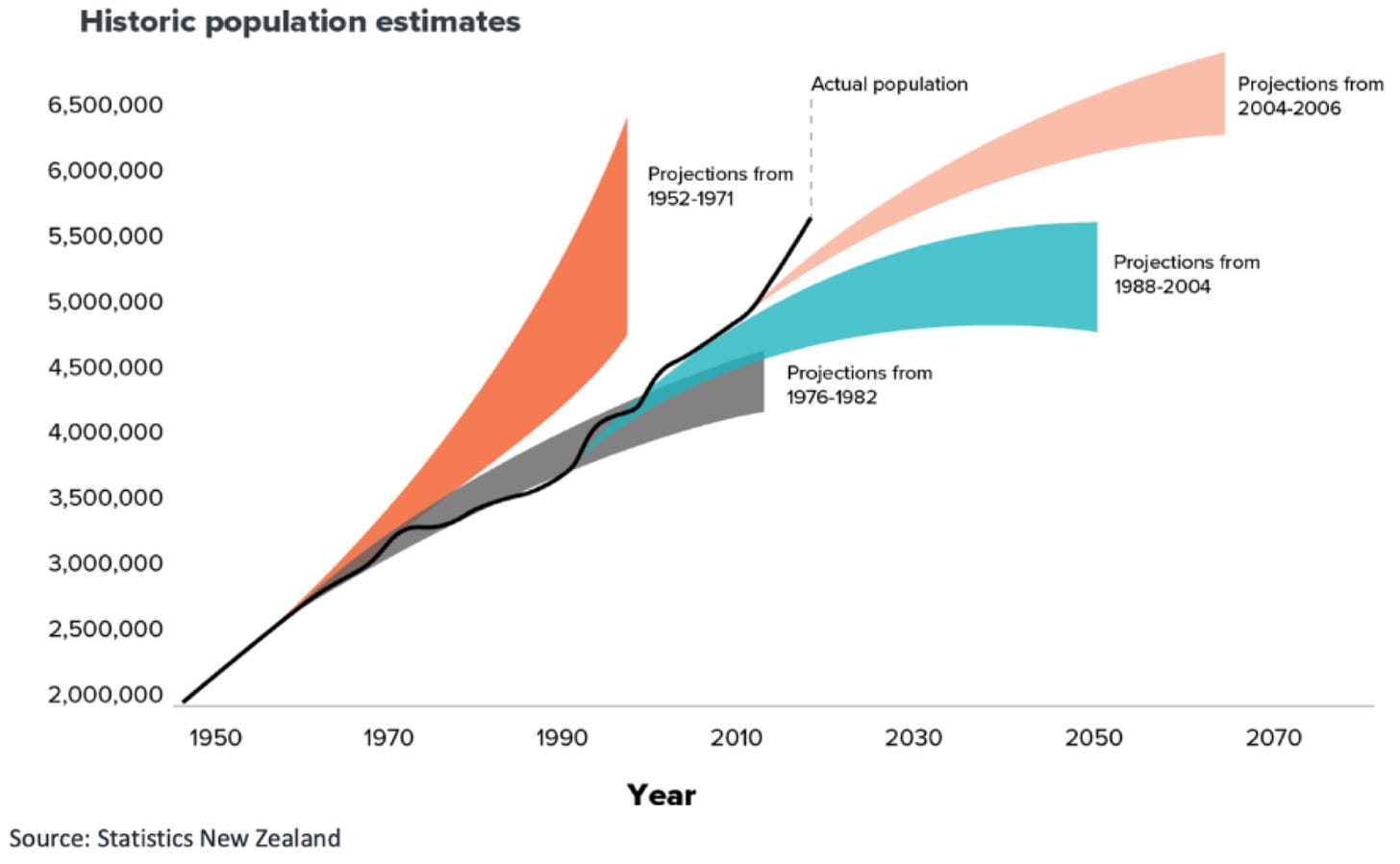

Population: Stats NZ released the first results of Census 2023 yesterday, showing an extra 751,875 people now live in Aotearoa-NZ, vs Census 2013. Stats NZ’s medium projection for population growth just before the 2013 census was for around 400,000 extra people and that we would not get to our current population until around

This first table includes the projections from Stats NZ just over 10 years ago, including central projections that the population has exceeded three years ahead of schedule.

How many we thought we’d have

What we actually got

The systematic under-forecasting of population growth since 1990

5. Quote of the day

Sweating assets

“This council is kicking the can down the road.” Christchurch City Council Councillor Sara Templeton in a debate about the Council funding just 500 of the 800 water network repair projects identified as needed doing in its Long Term Plan. Via The Press-$$$

6. Numbers of the day

27% - Christchurch City Council’s current water leakage rate of 26% means it loses 38 million litres a day, enough to fill 15 Olympic-sized swimming pools. Council staff plan to reduce the leakage rate to 20% by 2030, although international best practice is to have no more than 8% leakage.

Charts of the day

An extending recession

A closer view

Timeline-cleansing nature pic of the day

Nature is healing

Mā te wa

Bernard

Share this post