Mōrena. Long stories short; here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Wednesday, August 21:

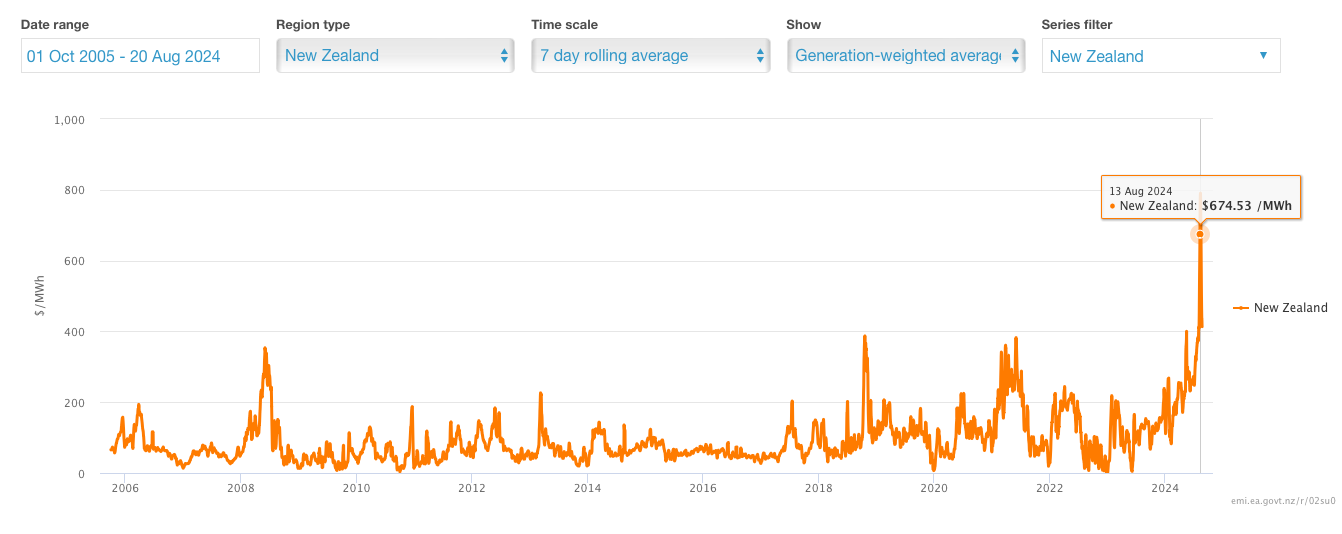

Winstone announced yesterday it would close its pulp mill and sawmill near Ohakune permanently because wholesale electricity prices tripled since July 1, costing 230 jobs and escalating a nationwide manufacturing and exporting crisis.

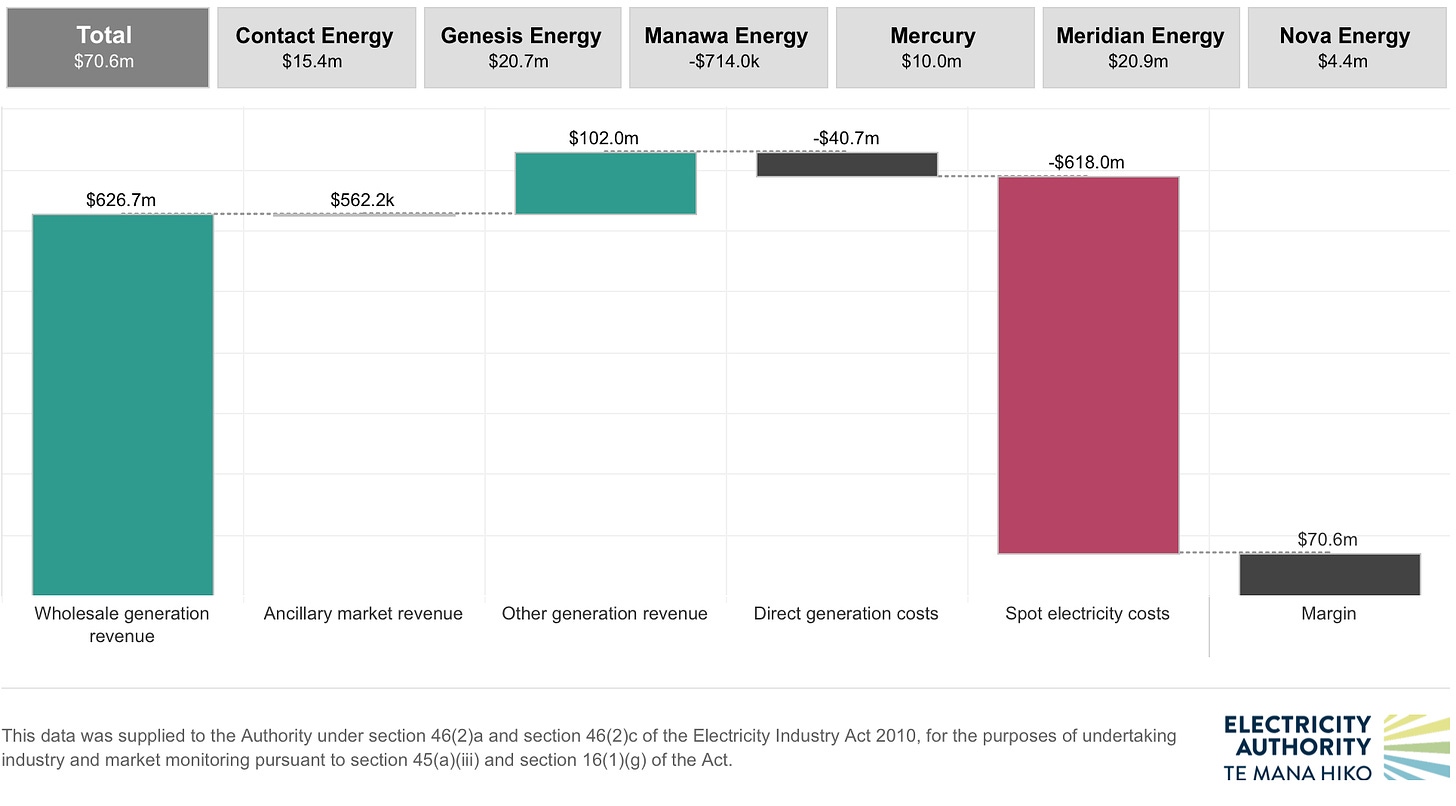

New profit margin data published by the Electricity Authority shows the gentailers (including the big four of Contact, Genesis, Meridian and Mercury) made a combined $512.4 million in profits in the six weeks since July 1.

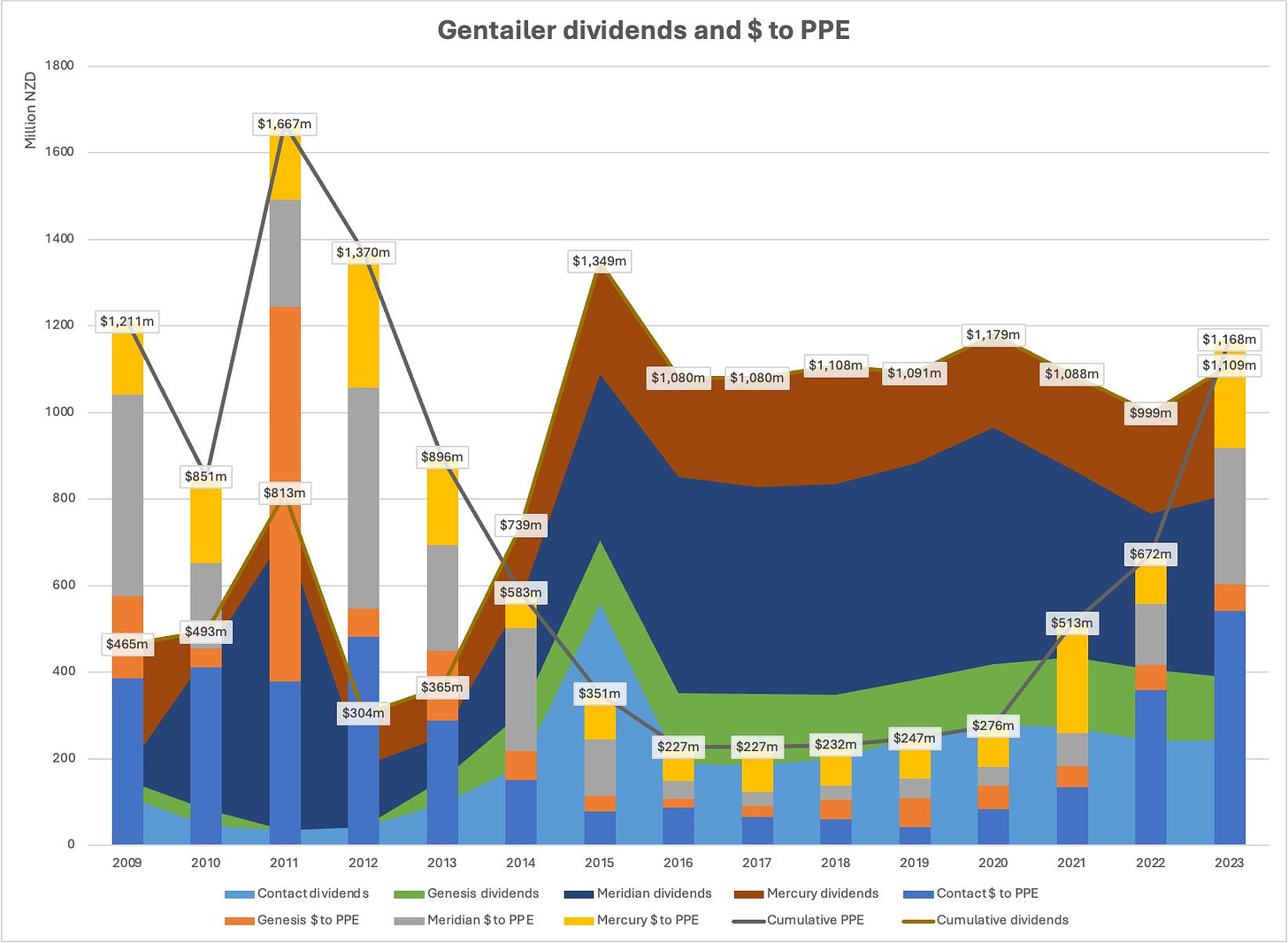

The gentailers, including the 51%-state-owned Genesis, Meridian and Mercury, paid out four dollars in dividends for every dollar in investment in new generation in the decades since the part-privatisation of those three gentailers in 2013, leaving the market short of electricity in a situation where gas supplies run short and a dry winter empties hydro lakes, as has happened this winter.

Aotearoa’s industrial power users last night begged households to turn off their lights, turn down their heat pumps and not charge their cars to help keep pressure off the system (and prices), while Contact and Mercury set dividend payouts of $508 million and said the market was working to solve the crisis.

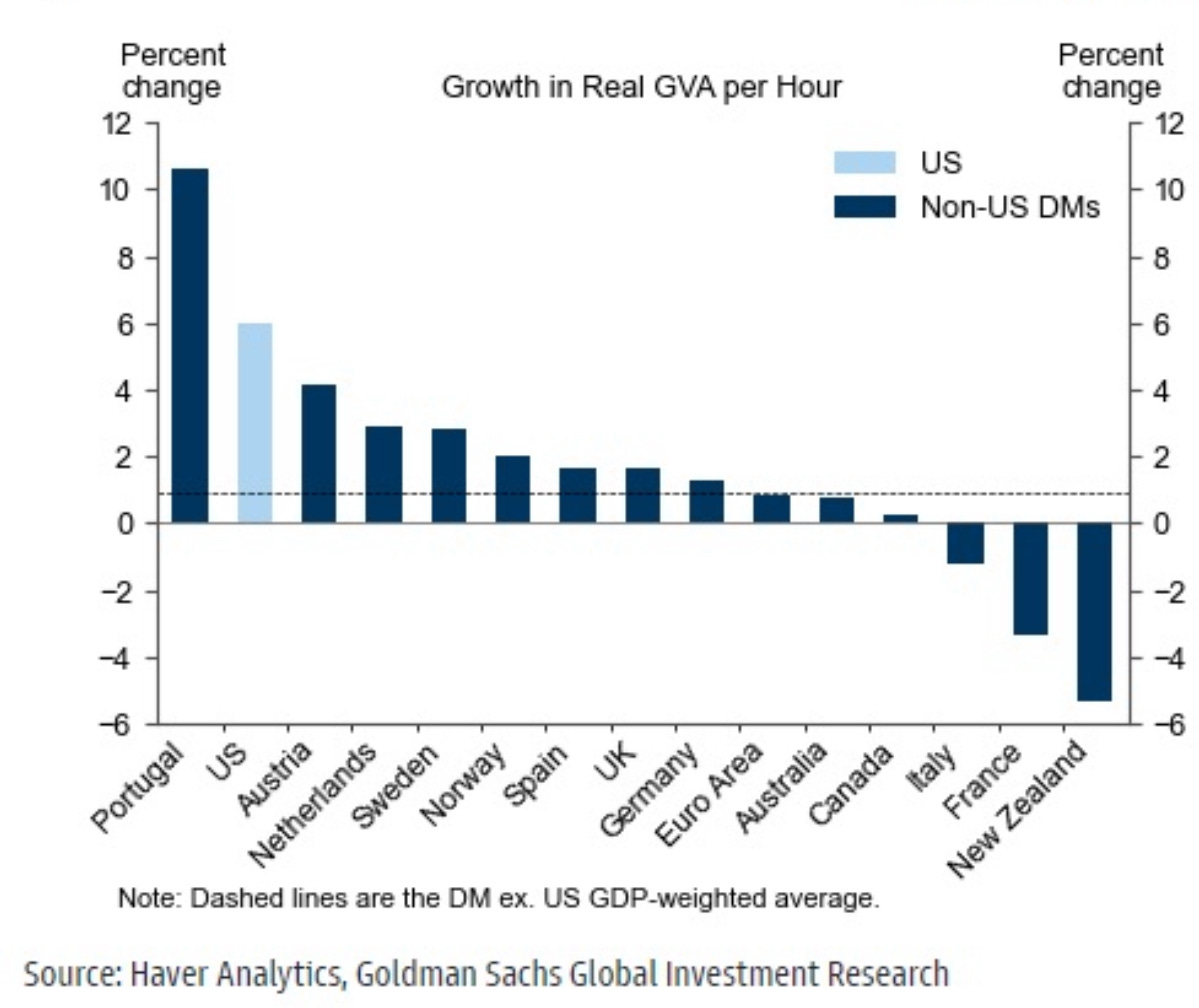

A Goldman Sachs analysis of productivity has found New Zealand performed the worst of any developed economy in the last four years, per worker and per hour.

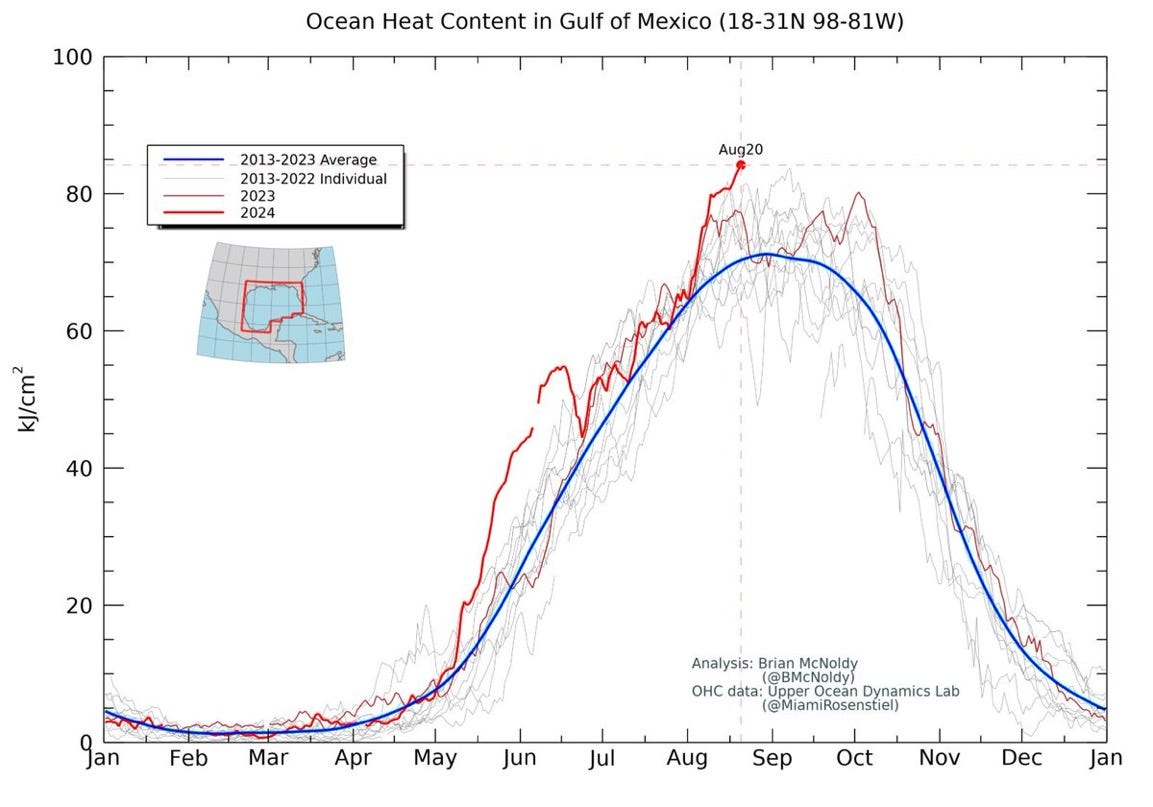

Sea temperatures in the Gulf of Mexico, where many hurricanes emanate, yesterday hit an all-time record high of 21% above averages for the last decade.

The Top Six short stories longer for August 21

1. Factories closing after electricity price shock

Pulp and timber mills shut after tripling of power prices in six weeks

The Malaysian-owned Winstone Pulp International (WPI) announced yesterday it would close its Karioi pulp mill and Tangiwai sawmill near Ohakune permanently because wholesale electricity prices have tripled to over $600/MWh since July 1, costing 230 jobs and escalating a nationwide manufacturing and exporting crisis.

“We can’t pass these increases on to our customers because this is an NZ issue, and we sell into a commodity market where the price is the price. For comparison, our overseas competitors are paying between NZ$60 to NZ$100/MWh this month. It’s a challenge we’ve been grappling with for years, but the mountain keeps getting higher.” WPI CEO Mike Ryan told BusinessDesk-$$$’s Oliver Lewis

This follows temporary closures by Japan’s Oji of its pulp plants at Whirinaki near Napier and in Auckland’s Penrose last week, and fears other large manufacturing and meat processing operations may close soon.

Unions fear a cascade of job losses.

“WPI have warned that around two hundred and thirty directly-employed jobs could be cut as a result of the possible closure, but there would be further job losses for adjacent staff like contractors and even bigger losses for the wider Ruapehu community, where these mills are the lifeblood of the local economy.” FIRST Union organiser Liam Malone statement.

2. While gentailer profits explode with prices

Profit margins total $512.4 million in just six weeks

This week the Electricity Authority began publishing weekly data on wholesale and retail revenues for the electricity gentailers, allowing it to calculate their individual and collective profit margins.

The initial data released showed revenues and margins for the six weeks from July 1, over a period when wholesale prices tripled to as high as $674/MWh, as gas shortages, low hydro lake levels and strong demand saw marginal prices explode. Marginal prices for marginal generation, often by coal, gas and diesel generation from ‘peaker’ plants, are then applied to all generation units, including from hydro and wind, which have no marginal costs.

The combined profit margins for the gentailers for the six weeks was $512.4 million.

3. So how did this happen?

Investors & finance ministers opted for dividends, rather than new plants

The gentailers, including the 51%-state-owned Genesis, Meridian and Mercury, paid out four dollars in dividends for every dollar in investment in new generation in the decades since the part-privatisation of those three gentailers in 2013, leaving the market short of electricity in a situation where gas supplies run short and a dry winter empties hydro lakes, as has happened this winter.

Both Labour and National Governments have benefited from the dividends paid for their 51% stakes in the gentailers, making the underinvestment and deliberately scarce supply situation a type of extra tax on consumers and producers, as detailed in this updated analysis by 350Aotearoa, NZ CTU and FIRST Union titled: Generating scarcity: how the gentailers hike electricity prices and halt carbonisation.

This is the key chart showing what happened. PPE stands for Plant and Property Expenditure, which is the gentailers’ description for investment and maintenance of plant, so this figure over-estimates investment in new generation as it includes maintenance of existing generators.

Meanwhile, Contact and Mercury published annual profit results on Monday and Tuesday, including combined dividend payouts of $508 million. Their CEOs said the electricity market was working fine and the Government shouldn’t intervene.

Commenting on strong profit results

“This year, under a market-led system, we have been able to manage that (reliable supply). Yes, spot prices have been high, but few have been exposed to those.” Mercury CEO Vince Hawksworth via BusinessDesk-$$$. He was referring to retail customers not paying the much higher wholesale prices. Yet.

“Our investments are paying dividends, but obviously, a volatile market requires a fair amount of hard work and creativity to navigate successfully.” Contact CEO Mike Fugue in Contact’s profit statement

Commenting on talk of price caps and Government intervention

“Politicians don't make necessarily well-reasoned, instantaneous market interventions and it's important that everyone just stays calm and lets the investment flow because that investment is what ultimately will solve this issue

“Unfortunately, power stations don't get built according to the electoral cycle. We're encouraging the politicians to keep their hands in their pockets. Don't fiddle with the market.” Mike Fuge via BusinessDesk-$$$ last Monday.

Contact made a profit of $15.4 million in the seven days before he made this comment, EA data showed.

4. Quote of the day

‘Please turn off the lights so we can keep the factories running’

“I suggest if there's any load that you don't need to use through peak, so the morning and the evenings if you can delay things - those who've got the ability to charge electric vehicles, or (use) the dishwasher later in the day to do that, keeping the temperatures of the heat pump at a reasonable sort of 21C to be healthy, keeping lights off in offices in places where you aren't. So ideally we want to avoid this because it's such an essential for homes and businesses to have electricity.” Major Energy Users Group (MEUG) director Karen Boyes via RNZ

5. Charts of the day

NZ productivity was worst in the world since 2019

6. Climate graphic/chart/pic of the day

Record high heat in the place hurricanes come from

The best of the rest

Top six scoops and deep dives for August 21

Housing scoop: Minister not seeking answers over where kids went after emergency motels. The Government celebrated a milestone of getting 1000 children out of emergency housing, but can’t say where one in five went to. Stuff’s Glen McConnell

Climate deep dive: Utter joke': Govt abandons building sector climate-change regulations BusinessDesk-$$$’s Cecile Meier

Health deep dive: Woman faces 14-hour round trips to doctor as shortage bites RNZ’s Peter de Graaf

Climate interview: Government moves to raise carbon price, says petrol will only rise 3c a litreRNZ’s Eloise Gibson

Health explainer: St John workers on strike: The funding fight around the ambulance service1News’ Anna Murray

Housing deep dive: Nine-year battle over whether Auckland house is a ‘boarding house’ Stuff’s Marty Sharpe

The Kākā’s Journal of Record for August 21

Climate: Climate Change Minister Simon Watts announced that the number of Emissions Trading Scheme units available between 2025 and 2029 will be reduced from 45 million to 21 million to push up the carbon price. ANZ said that since the changes were announced, the spot price for carbon had risen roughly $5.

Economy: The Commerce Commission recommended a suite of changes to increase competition in the banking sector after its market study characterised NZ's banking sector as a "two-tier oligopoly." Recommendations included Government actions to ensure open banking is fully operational by 2026 and that Kiwibank becomes a more disruptive competitor.

Economy: Nicola Willis & Andrew Bayly announced that the Government will act on all 14 of the Commerce Commission’s recommendations for the banking sector, and have asked Treasury to engage with Kiwibank's parent company over raising new capital. Willis says she will take the proposals to Cabinet no later than December. RNZ

Economy: The Electricity Authority began releasing weekly data on energy margins generators are making when selling into the wholesale market.

Health: University of Otago Wellington research published yesterday found 901 deaths, 1250 cancers, 29,282 hospitalisations, and 128,963 ACC claims were attributable to alcohol in 2018.

Housing: The Real Estate Institute of New Zealand reported that property sales increased to 5,806 in July, up 14.5% from July a year ago and up 19.7% from June. The median price fell 2.2% to $753,000 in July a year ago and the same amount month on month.

Back on track?

“There has been downward pressure on prices in most parts of the country this year and sales volumes have been lower than average as the cost of living, concerns around job security and interest rates challenge many people in New Zealand. However, it seems this sentiment is beginning to change. The slight decline in interest rates in July, and a belief that there are more to come, appears to have encouraged buyer activity, as reflected in the increase in sales.” REINZ CEO Jen Baird

Finally, some fun things

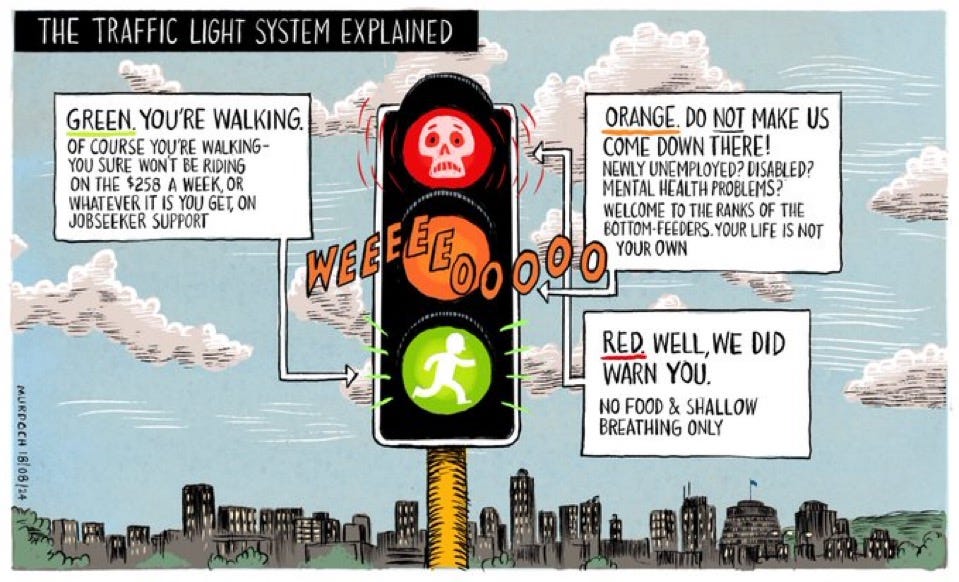

Cartoon of the day

‘No food & shallow breathing only’

Timeline-cleansing nature pic:

Land coral

Mā te wa

Bernard

Ruapehu district has been battling for years to keep its snow and outdoors tourism industry going; now electricity prices are forcing timber mill and pulp paper plant closures that will cut 230 jobs out of the community. What is our government even doing?

Accepting the dividends and focusing on getting debt down to ensure home owners get an extra basis point or two of rate reduction, and to preserve high land values.

...much of this *waves hands in all directions* economic, social and political carnage is the result of a rookie political leader prepared to strike bizarre coalition deals to take power.

I've said all along that he is so far out of his depth. Hubris has got him this far - the real power brokers are happy to have him there but will throw him overboard as soon as convenient. I'd almost feel sorry for him as he is such a chump, but he's unworthy.

The light at the end of the tunnel is the Winston train about to derail the government when he is no longer DPM.

The Greens and Labour really have to get their shit together and avoid distractions like "should Tana be an MP". Focus on working to throw this hydra headed coalition out and fixing the myriad of problems that are becoming untenable, because I think we will have an election next year.

So did I get this right: we are supposed to keep ourselves cold and dirty while investors and the govt reap the dividends?

Yep. Brrrrrrr

Hi Dan

Are the ski fields keeping their snow guns working?

Job losses in some town far, far away doesn't impact 'my' life, but not being able to go skiing - oh, the inhumanity (s).

Hey Steve, town has been packed with snow folk for the last few weeks, business people smiling and cash flowing into the local economy..then this.

I think the factory should be putting solar panels up immediately with an subsidy from the Govt and whoever the electricity company who supplies them should give them a huge discount in order to keep those jobs. Honestly surely there is a way round this. Also apparently the snow is great at the moment. Lots of snow bunnies enjoying the slopes. Let's hope it gives the town a bit of joy and fills the koffers of locals.

Aotea Great Barrier Island is off the grid completely and has a large array of panels powering a group of shops, the gas station and a variety of businesses while saving power. It can be done and businesses should be getting interest free loans to go off grid.

Great for GB, but who funded it?

the people who live there, mostly.

And it's kinda expensive to just exist there.

Thing is- these kind of industrial users do use vast amounts of electricity- far more than a roof-full of panels could provide. Their power bill probably exceeds their wages bill even in normal times tbh (just me guessing). More hydro / storage + field-scale solar +wind, is probably the only way to get the power levels required. The great thing about electricity networks is they naturally work in both directions (distribution to users and aggregation to storage facilities from small-scale producers) but such operations are not commercially compatible with the current business model.

Liked it, even though I do not like it. What a disaster.

Kia ora Bernard, really interesting and important work! Have you tried to get in touch with Scott Willis from the green party? He's currently got a bill in thr biscuit tin aimed at fixing some of the market issues. Could be an interesting chat

Glad you called out the 'red herring' re: oil and gas exploration decisions - both the Labour and National-led governments have been deliberately misleading about this, which has then been picked up and promulgated by others. Let's be clear - there was never a 'ban' on this exploration, so there was actually nothing to be reversed. The 'ban' applied to the seeking of new permits only - there were/are plenty of existing permits - as you noted, the issue is that these existing permits have not found (at least not as much) as was expected. Further, if seeking new permits hadn't been banned, these permits would have been in areas that had largely already been declared as uneconomic to explore (by the oil & gas exploring companies themselves). It's been a classic case of deflective politics from both major parties with most of the unaware victims being their own voters.

This is the comment of the day !

Hi again Bernard. Great comments on the supposed energy”market”. Perhaps some electrons may “trickle down

Kia ora tatou.

Your reference Bernard to the extra level of tax coming from the very high prices of electricity and the big payouts to shareholders is true.

It is another layer of taxation indeed a secondary tax paid by domestic consumers. And it is paid from nett income after normal taxes been paid. And all this time there have been consents for many solar and wind farms. Bring back the Electricity Department now !

Lichen your photo very much @ E.E. Grieveson.

https://inaturalist.nz/ #citizen scientists

Lichen it too - and growing coral on land is a real thing:

https://earthshotprize.org/winners-finalists/coral-vita/

Oops pushed wrong button! It fascinates me that the small end consumer of electrons is asked to take cold showers( we have 18 panels on our roof) while the shareholders still get huge returns. Is it not possible that the shareholders could “take a haircut” like the rest of us to keep NZ workers in jobs? Or am I just a naive socialist and do not understand shareholder primacy? Or in fact neoliberal”Dog eat Dog capitalism”. I await our patient Alopecia suffering PM and the three headed Taniwha to explain it all to me. Does the system need changing?

Regards and thanks

Patrick Medlicott

I get your gist but the fact Luxon is bald is about as relevant as Jacinda Ardern having prominent teeth.

Tautoko! Luxon is utterly deplorable, no doubt. But critiquing his lack of hair is no different to many of the lazy insults hurled at Ardern. There is so much to criticise Luxon for both as a PM and a numbered corporate employee!

Like a pay to save situation? surely that can be sorted with smart meters now? if you say sure I will reduce my power usage, if you pay me to, just like the smelter?

I'm with Octopus for electricity and they have been running regular trials where customers are refunded $2/kWh for every unit they don't use compared to regular usage. Most recent was 7.30-9am yesterday. I had an evening shower, delayed the washing machine and dishwasher and turned off the heat pump. On a previous session I was refunded $10. Not everyone can shunt their usage around, I wasn't willing to send my teenage son to school without a shower for example, but if we all did what we could and we're rewarded for it,that might make some difference. Of course, I'm still grumpy about the shitty policy settings that got us here. Maybe this ready-fire-aim govt can turn their attention to pushing a useful change through in the next week or so? Would make a change from bashing the health system or beneficiaries.

Now we are talking!!

Given low lake levels and snow pack as we come into spring, I think we might be in a pickle next winter, going into the cold season with little water. It would be a good time to buy a diesel generator if you are running industrial freezers and so on for perishable goods.

I’m pretty sure it was this video that has (as well as good further info on the failed drilling in the last 5 years) a scary chart on what is expected to happen next year with even lower lake levels. https://youtu.be/VFzm7XjaGpg?si=dD1_Mnmpt_WBHvL-

Yeah an informative watch, thanks. The audio from 'The Detail' on RNZ last week is also quite informative about the situation, nice to get some cold hard facts and realities and not just silly idealism and blame games: https://www.rnz.co.nz/programmes/the-detail/story/2018951133/the-high-cost-of-our-energy-crisis

If anyone needs more convincing, here is the current state of the lake levels and snowpack respectively, compared to historic for this time of year:

https://www.transpower.co.nz/system-operator/notices-and-reporting/weekly-reporting/hydro-information

https://www.meridianenergy.co.nz/power-stations/snow-storage

I've just got off the phone to a solar installer who is happy to work with me (rather than offer me what is most profitable for them). The system being spec'd will include a battery so essential loads such as a freezer can be keep going even during an outage.

Geoff Bertram's recent comments on this power rort:

Comment posted on Newsroom story “Gas and solar to help answer ‘power profiteering’ claims” 14 August 2024

The call to roll out rooftop solar on a grand scale is absolutely right – but it’s important to remember why it hasn’t happened already. New Zealand was level-pegging with Australia on rolling out new renewables until 2013 , when part-privatisation killed new investment by the gentailers and anti- competitive market structures and pricing policies blocked private citizens from exercising their own initiative. (Besides which the installation cost of solar here is nearly double Australia’s because of the lack of scale and scope economies to date).

There are three key changes needed right now to unlock rooftop solar and battery backup:

1. Repeal the lines-energy split that was central to the Bradford reforms. That would mean that the local distribution companies (or new entrants!) could get back to their long-ago role of integrated operation of local energy systems and markets – both investing in, and coordinating, decentralised renewable generation and battery backup at community level.

2. End Transpower’s monopoly pricing arrangement under which all grid charges are compulsorily passed through to lines companies to pass through to all connected customers as (steadily rising) fixed charges. Those fixed charges really hurt the economics of rooftop solar (because even if you no longer require grid-supplied power you still carry the full grid costs unless you disconnect completely). Ideally, go back to the old Bulk Supply Tariff pricing arrangement under which the big gentailers would have to pay Transpower to carry their power to Grid Exit Points, where bundled wholesale supply would have to compete head-to-head with local distributed renewable generation. It’s called “competition for the market” and it has been completely stifled by the Bradford arrangements. Oil companies don’t (because they can’t) impose a fixed charge to drive into a petrol station. Supermarkets don’t (because they can’t) charge entry fees. They have to recover their fixed costs through variable charges.

3. Break up the gentailers to eliminate the self-hedging, barriers to entry and market-sharing that has kept independent retail confined to a tiny fringe. (And yes, the distribution companies, if freed from the lines/energy-split shackles, could be part of a retail revival).

As for Contact’s self-serving rhetoric about big balance sheets to fund investment, check out the last two decades. These fat cats didn’t get fat just yesterday – they got fat and stay fat by squatting on undeveloped investment opportunities that they control directly, while blocking entry by distributed generation. As for the Electricity Authority, the important thing to remember there is that as soon as it was set up in 2013 it demanded a memorandum of understanding relieving it of responsibility for regulating prices.

Rooftop solar is useless for this dry year problem, the scale of energy needed is almost beyond comprehension. Read the executive summary of the NZ Battery Project Indicative Business Case, prepared by Ernst & Young for Megan Woods & co. Here is the link:

https://www.mbie.govt.nz/dmsdocument/26295-new-zealand-battery-project-indicative-business-case-and-appendices-february-2023

One of starting assumptions behind that report is that the current market and regulatory settings remain unchanged. A big assumption.

"Overbuilding is considered a feasible way to achieve 100% renewable generation as it makes use of mature and well understood technologies (wind and solar) that can be built at scale under existing market and regulatory settings."

And the rest of the paragraph? Fixing profiteering is a great idea but it doesn't solve the dry year problem any more than rooftop solar will, these are supporting measures, not solutions, to the problem of missing Terawatt hours.

The rest of the paragraph is dependent on the assumption of now change to regulation or market setup.

The executive summary clearly acknowledges that "it [the NZ battery project] aims to address an element that neither the market, nor policy or regulatory measures, are likely to solve on their own – the large-scale, long- term, and highly uncertain dry year problem."

Will better regulation save a bit of water? Sure.

Will it save enough to deal with NZ's unique dry year problem? Not even close.

How do we deal with the dry year problem at present? We light the fires of thermal, whenever we like. At least we did, until we started running out of gas - now we're having to de-industrialize too.

How do we deal with the dry year problem when thermal has been replaced with intermittent renewables? Terawatt hours worth of batteries! Overbuilding in the extreme!

We could explore the storage options tabled for further investigation by the project (link in my other post, nothing easy about those either), or we could drastically simplify our lives to live with an energy reduction (most sustainable, but impossible by choice). The most likely scenario I believe is we gradually build intermittent renewables backed up with imports of more gas/coal to keep the place civilised, and wait until the technology for NZ's unique energy security/storage/risk use case emerges at a viable price point and scale before we cut the fossils.

We had a solution for the dry year problem, but due to Willis insisting on tax cuts - and no doubt lobbying by the gentailers - it was one of the first items the hydra head threw on their bonfire.

Is rooftop solar useless, or are people missing the fact that using the solar at other times means less hydro needs to be used and therefore becomes the storage for the dry year, or those few months...

I found this info from Rewiring Aotearoa interesting: https://www.linkedin.com/posts/rewiring-aotearoa_who-woulda-thunk-it-when-theres-not-much-ugcPost-7231881946476208130-sn-9

Solar will help conserve water for sure, but the issue is our lakes are too small, they don't actually store much water. So if it's not raining we still end up with a problem. This is why things like Lake Onslow got explored; from a conceptual/theoretical point of view, solar backed up by pumped hydro is absolutely marvellous

Sadly this was inevitable and predictable from the outset!

Which many, like Geoff Bertram and Molly Melhuish, did.

Here is a link to the documents produced for the NZ Battery Project "to explore possible renewable energy storage solutions for when our hydro lakes run low for long periods":

https://www.mbie.govt.nz/building-and-energy/energy-and-natural-resources/low-emissions-economy/nz-battery

I note that in the non-hydro options analysis report by WSP, 1TWh of storage was the minimum storage criteria to cover the dry year problem. The options it recommended for further study are bioenergy (grow & store wood to burn), controlled geothermal, and hydrogen stored as liquid ammonia. Batteries were not recommended for further study due to cost, nor was compressed air storage. Here is the link to that specific document:

https://www.mbie.govt.nz/dmsdocument/27128-other-technologies-feasibility-study-options-analysis-report

To put the scale of the storage problem in perspective, at around $1000 per kWh for batteries (e.g. Ruakaka Battery Park, 2024) you're looking at $1 trillion for 1TWh of storage.

Pursuing exponential growth and breaking fewer carbon-to-carbon molecular bonds are not compatible ideas at present, unfortunately...

Thank you Bernard. What a mess. The big picture and multi-pronged solutions are the only way out, which justifies your project of course. Decades of catering excessively to share prices, selling off assets, NZ laden with O/S owned companies using eye-watering amounts of energy with sweet deals eg Tiwai smelter (Rio Tinto and Sumitomo owned), Winstones(now Malaysian)and some very govt supported, et al They provide some NZ jobs but at extreme cost. This needs the large pic, with new and imaginative job creation, better laws and other regs round donations and lobbying, conflicts of interest in decision makers et al being a large part of it. So many things would be addressed if these regs were implemented, incl proposed gun laws, tobacco/vape issues, fast tracking of mining approvals without proper EIS et al. The current mob would not be there - another less damaging version of National might be but not this small minded lot. I do like some of their talk re a really competitive NZ bank but I am sceptical as it makes them look NZ-focussed while chances of it happening are negligible. The 4 main banks, the cartel, are US-owned and Australia managed I believe so much skin in the game. Some tightening of regs mentioned could happen quickly if the will were there and it won't be right now. Labour needs to transform itself and turn this around. It might get traction.. or a break away Nat party might do it.

More from Geoff Bertram:

Some immediate policy suggestions

• Get distributed renewables online as fast as possible to drive fossil fuels right out of the electricity generation mix

• Impose low-price contracts on established hydro generators (effectively tax away their rents)

• More fundamental: get ready to renationalise hydro into a single integrated operation and use it to counterbalance intermittent renewables – especially if in the meantime you have got local energy pools/networks going

• Even more fundamental: plan to re-integrate large hydro and geothermal generation with the Transpower grid to hold final price down while covering all costs

Lots more analysis by him on the electricity market and how flawed it has been since the 1990s at https://geoffbertram.com/publications/#the-new-zealand-electricity-industry

Re the comment by Contact CEO Mike Fugue "We're encouraging the politicians to keep their hands in their pockets. Don't fiddle with the market". Hah - a rather self serving comment. So he thinks its more important that the market stays the same than NZ businesses remain open? The market needs fundamental restructuring rather then fiddling! E.g. So that generation payments reflect the long run marginal cost not the short run marginal cost. To base payments for generation on the higher short-run marginal cost of fossil fuels such as coal when alternatives such as large scale batteries, wind and solar are cheaper than new large fossil fuel alternatives and when the cost structures between hydro and fossil fuel generation are fundamentally different does not send the appropriate incentive to invest in new, cheaper alternative generation. That the govt is talking about investing in LNG and more gas fired plants is not economically rational when there are these cheaper and more timely alternatives. And perhaps there should be incentives and sanctions for generators who hold resource consents for wind farms etc but don't actually build them. I understand that the full assessment of the Onslow pumped hydro storage option was not completed - it might have been a sound long term investment, not least if one assumes rising carbon prices.

A recommended principle for a restructured electricity market is that it results in the investment in the least-cost (including carbon cost) sources of supply based. (And that includes comprehensive investments in household energy efficiency, HH solar and HH batteries). This could be implemented through the Electricity Authority calling for bids for additional supply and using a national cost-benefit analysis approach that includes carbon costs to approving least cost new investments. Such systems apply in the US and Canada. E.g. in British Columbia the electricity companies and market regulator have mechanisms to encourage in investments in the least -cost alternatives, including investments in energy efficiency. E.g. British Columbia Hydro - a Canadian Crown corporation has incentives for hh solar and energy efficiency. https://www.bchydro.com/index.html

For those who'd like to read more on the British Columbia integrated planning approach: https://www.bchydro.com/toolbar/about/strategies-plans-regulatory/supply-operations/long-term-electricity-planning/integrated-resource-plan/integrated-resource-plan.html

Geoff Bertram of Victoria University has produced a number of papers etc on out electricity market and its flaws and his work is worth reading. https://geoffbertram.com/publications/#the-new-zealand-electricity-industry His work indicates that the problems with the market were forseen but ignored.

I don't want 'open banking', though I don't mind if others do.

I want a full-functional personal CBDC* account at the RBNZ, and fully bond-backed savings accounts there for my term deposits & Kiwisaver.

Oh, and while we're at-it, I want the banks out of the residential property market, and the re-establishment of old-fashioned Mutual / Building Societies for that purpose.

*Central Bank Digital Currency- pet hate of bankers and conspiracy fantasists.

Great example of "trickle UP" theory. Works marvelously for high waged CEO's and shareholders.

It would be nice if our local political bipartisanship was not in duplicating what is essentially short-termism and failure.

Those CEOs can lead by example and lose their jobs so the market can have a relief (from them and their BS).

Agreed. they offer nothing that engineers and correctly informed economists cannot offer. The whole point of a CEO is to know how to sail close to the boundary of corporate criminality without actually crossing that boundary. Not a good paradigm for conscientious and socially useful behaviour.

"The whole point of a CEO is to know how to sail close to the boundary of corporate criminality without actually crossing that boundary."

an interesting comment that hadn't entered my consciousness previously.

I believe that another "point" is to maximise their own income package. many ceos in NZ get multimillion dollar income packages which are disgusting obscenities!!!

And published today on The Conversation https://theconversation.com/nzs-electricity-market-is-a-mess-rolling-out-rooftop-solar-would-change-the-game-236943

Changing the chat topic for a moment. What, Bernard, do you consider is contributing to that worsening productivity data? Calls over the years by Treasury and reports from the Productivity Commission, have all, in my opinion failed to recognise that the productive base of such a sizeable chunk of the NZ economy, being the primary sector, makes it quite difficult to lift individual worker productivity. But what is happening to worsen the situation? Is it manufacturing decline? Failure to find new tertiary sector activities?

Possibly that we over the review period, had a more complete lockdown during Covid, than pretty much anywhere else?

I don't imagine abolishing the Productivity Commission was helpful. I'm sceptical that the red tape ministry of David Seymour will do a better job of increasing our productivity, even if it does have 3x the staff.

https://www.nzherald.co.nz/business/why-the-ministry-for-regulation-will-be-treble-the-size-of-the-productivity-commission/6WM7CTCZRREZPIZX2MLR3BQAFM/?fbclid=IwY2xjawEyjgNleHRuA2FlbQIxMQABHRBNw3nud99YW8rGISCZGeSx5IgEHAXDQ32EEYG2E3rUehMrYhW32MwGww_aem_JjrppOfD5viK0t4m_sXdqg

This govt have rushed through urgency a raft of terrible legislation, how about it rushes through something positive - require all commercial buildings to immediately install rooftop solar and batteries, paid for by the power companies.

Perhaps the government could by the mills that are closing down. Presumably there is still demand for the products.

That would keep people working and keep production in NZ.

Then maybe the government should look to resolve the electricity supply issues.

Very pragmatic; be sad that our current Govt does mostly dogmatic. Not pragmatic.

The underlying problem is that since Rogernomics was imposed, we are all brainwashed to believe the free market will solve everything. Both left & right political parties are scared to challenge this paradigm. The paradigm pushes privatisation and small government, driving for the market to operate unimpeded by regulation. The paradigm includes the idea that we are all individuals maximising our "utility", & denies the existence of "social groups", and human interaction that isnt about agreeing a price. We are sold lies about govt finances, govt competence, the commons, the origin of money, and have foist on us an "independent" Reserve Bank, run by an unelected technocrat steeped in the same dogma, who essentially runs the economy with one lever. I despair.

Agree, 40 years is enough, time for a radical change. Where are our economic visionaries?

yes. Roger Douglas is inhabited by something extremely evil.

I'm sure I'm being dumb, but how did you arrive at the 512.4m number Bernard?

The figures are on the EA website, but weekly. Add the 5 weeks published data and that's what I arrived at as well.

I agree that the gentailers profits are all out of whack, as are their invesment (or lack of) in solar, batteries and wind.

But why would both Winston, and Panpac, get bitten by not being hedged with long term contracts for power?

Seams like they wanted to play the market to get a _much_ cheaper rate, and are now being bitten... FAFO.

Panpac have one or two boffins sitting there watching the electricity markets... seams like a failing on their part? or was this so unexpected?

You can't take $70/Mwh power for most of the year, then wah about it when it hits $250-800/Mwh. Thats _literally_ what you should expect from a spot market.

"But why would both Winston, and Panpac, get bitten by not being hedged with long term contracts for power?" - I know it's Winstone but the mental image of our deputy PM being bitten is quite amusing!

oh THAT Winston would totally not hedge and the make it someone's fault, most likely the Murrays. Or the Woke. Or something.

Maybe it's Winston from John Wick. That man covers ALL the bases

After 1945 New Zealanders paid for a lot of infrastructure build. Hydro schemes, sealing and building roads, some rail and a good link across Cook Strait after 1961. Then some politicians bought into the BS treasury technocrats thought was a good idea. They sold the nations capital investments for a song, making NZ capital poor, like many other places in the world. The market solution has proven to be a failure and we need politicians bold enough to once again make the state capital rich with provision of services the motivation rather than profit. I am currently bike touring in Switzerland, a country that has always prioritised its investment in infrastructure.

I can click like. Unfortunately I can't click "hell yes" but you have hit the nail on the head. When will Labour expunge themselves of their failed neolib experiment ?

Max Bradford's scheme had a serious flaw. When demand exceeds supply, Private Power Companies make much more money at no cost by hiking up prices. The alternative, {building more capacity} costs money and does not increase profits.

All major generation in NZ was paid for by taxpayers, not private investors. and then sold off for a fraction of its true value. They should never have been sold off.

Stepping further back - is this a symptom of our transition into a lower fossil fuel economy. We will never again see the kind of return on investment that we have had previously. It may manifest in many forms. Is this perhaps one of them?

This is a really interesting article (focus on food prices) but same thing - energy drives our economy. GDP and energy are tightly linked. '....what if empty supermarket shelves and high prices are symptomatic of something much bigger? A sign of a broken system, now starting to show the tell-tale fissures of climate disruption, ecological collapse, energy descent and increased resource scarcity.'

https://newsroom.co.nz/2023/01/23/building-future-resilience-should-start-with-food-security/?fbclid=IwY2xjawEyi7BleHRuA2FlbQIxMQABHXRMFIbhgppXzEOrnvaLUc-f7TKnacS8OwaTg-Gn7S7JMcIFyAU6Eo4PSA_aem_XzM8M8sU_Ysy2F_znNPTNw

Take another step back, and view the dark forest if you dare, from here one can see the economic truism that the rate of profit falls over time under capitalism. The falling rate of profit is the lens that makes so much so clear, every where you look you can see it - at our little people level we can see capital moving away from productive (unprofitable) investment and into rentier investment. See also the explosion of financial speculation. After the GFC central banks printed around $35T (T for Tango) USD equivalent - how many factories and power stations and green energy things did our beloved genius's build with this ungodly sum? F## All - there's no profit in any of that nonsense, they used it to speculate on anything that moves, creating the everything bubble, speculation is the only game left in town, that's how you know we are in late stage capitalism, the next GFC will bring god knows what, can they print there way out again? Some (well Yanis Varofakis) would go so far as to say capitalism died in 2009 in London when Gordon Brown and Obama bailed out the banks, that was the tipping point where the economy now relies on printing money, he has point imo, he doesn't mention the organic composition of capital but its in the subtext I guess.

What if this winter drought in Te Wai Pounamu is the new, climate breakdown normal?

The east coast is expected to be drier, how much of the Waitaki and Clutha watershed will be affected ?

Just finished a good book on why capitalism will not save us from a fossil fuel based energy system in the EU, US, and globally. The Price is Wrong by Brett Christophers.

https://www.theguardian.com/books/2024/feb/15/the-price-is-wrong-by-brett-christophers-review-why-capitalism-cant-save-the-planet

Without profitability there is little investment in renewables, without government support (indirect or direct or both) there is not enough profitability to invest.

Lessons for NZ - regulated deregulation doesn’t work if we want to increase investment in renewable energy.