TLDR & TLDL: A new report shows councils and the Government will have to invest between $120b and $185b in water infrastructure over the next 30 years to catch up with past skimping on investment, deal with climate change and make the necessary improvements in the quality of drinking, waste and storm water.

Completely coincidentally, the Reserve Bank signalled in an important speech on its newly-enlarged balance sheet that it expected it to remain large for decades to come and may even use it to help deal with climate change. In particular, the Reserve Bank suggested it may invest in climate friendly assets and sell fresh-minted NZ dollars to increase its foreign currency reserves. (See more from me below and hear more from me above in the podcast on how that Crown balance sheet could help solve that Crown’s water financing issue).

News elsewhere globally overnight

Pfizer side-effects: Israel reported minor side effects from its Pfizer rollout. A study of of 5m Israelis vaccinated with Pfizer found 275 men aged 16-30 experienced myocarditis (0.0055%), although 95% of the cases were mild and spent less than five days in hospital. NZ is relying on Pfizer alone to vaccinate everyone this year. (Reuters)

Beef hack: Almost a quarter of American beef plants are shut because of a Russian ransomware attack and Joe Biden plans to raise the attack with Vladimir Putin in their summit in Geneva on June 16. Retailers are bracing for shortages and price hikes after all JBS’ beef plants shut. (CNN) It reinforces the economic risks of cyber-attacks.

Trans-Tasman progress? Australia appears to have finally agreed to send Manus Island asylum seekers to NZ after years of requests. (SMH) This may be the biggest move out of the weekend talks between Jacinda Ardern and Scott Morrison, alongside their strong common position pushing back at China on human rights etc.

Another week: Victoria extended Melbourne’s Covid-19 lockdown for another week and New South Wales put restrictions on some towns on the main road from Victoria, Gundagai and Goulburn, after one family with Covid drove into New South Wales. (SMH) My base case is no reopening beyond Australia until late 2022.

Bonza! Australia’s GDP rose 1.8% in the March quarter from the December quarter and output is now 1.1% back above pre-Covid levels. Consumer spending and record-high iron ore prices more than offset the effects of China’s blocks on other Australian exports. (ABC) This is great news for potential tourists from our neigbouring economy.

In the clouds: Australian online training start-up, A Cloud Guru, was bought for a multi-billion dollar sum by America’s Pluralsight. A Cloud Guru has 2.5m users from 4,500 organisations globally, and was generating over A$115m in annualised revenues as of last June. (AFR-$$$) Online SAAS firms are super hot right now as some of the US$10t in freshly printed money filters out from bond funds to VC and PE funds.

News in our political economy this morning

Help!: Wellington City Council will urgently ask the Government for $400m of help to keep running its social housing units, or offload them into a Community Housing Provider (CHP) able to get Government rent subsidies. (Stuff’s Bill Hickman) Nelson and Christchurch have already done this. Grant Robertson and Nicola Willis told me this week they preferred WCC go down the CHP route.

Buying off the plan: The Government is set to pick up and run with National’s private members bill to update the unit titles act to make apartment living and investment easier and safer. (Stuff’s Thomas Coughlan)

Searching for tax: Google paid $2.26m in tax in NZ in 2019, which was less than $2.49m paid the previous year, even though revenues from here are thought to risen to almost $1b. (NZ Herald’s Chris Keall)

Down for a fortnight: Here, the Waikato DHB said yesterday it was still a couple of days away from reopening its sites after two weeks of being shut because of a ransomware attack. It has restarted half its systems on local servers and has not paid the ransom. (RNZ)

‘Your problem’: A precedent-setting legal review of coastal erosion policy for the Hawkes Bay found regional councils should be responsible for managed retreats and building sea walls to cope with rising sea levels. (Stuff’s Marty Sharpe)

Yikes: National’s losing candidate for Upper Harbour at the 2020 election, Jake Bezzant, resigned from the party after admitting pretending to be his ex-girlfriend online and sending NSFW pictures of her to others in exchange for other NSFW pictures. (Stuff’s Henry Cooke) That adds to the list of National MPs who have left early due to HR or other issues in the last four years, including Todd Barclay, Andrew Falloon, Jamie-lee Ross, Nick Smith, Hamish Walker and Jian Yang.

Council water bills may total $185b by 2052

Local Government Minister Nanaia Mahuta released reports yesterday showing the cost of improving water quality, catching up with past under-investment and dealing with climate change could cost councils between $120b and $185b by 2051.

Mahuta argued it increased the urgency for the Government’s current Three Waters reforms towards telescoping down 67 council-owned water owners to three to five water authorities over the next three years. Mahuta wants a couple of them in place before the next council elections in October next year.

The reports by Scotland’s water authority, which undertook a similar amalgamation over the last 20 years, and consultants Farrierswier, Deloitte and Beca made the case for combinations down to between three and five bodies. They pointed to potential savings for ratepayers in the absence of action of around $2,000 a year as the larger authorities found efficiencies and cheaper borrowing costs. Here’s one projection for four bodies.

The reports argued reforms to reduce the number authorities and keep them in state ownership would deliver a $14b to $23b increase in GDP and between 5,900 and 9,300 new jobs.

“It is clear the affordability challenges facing our water infrastructure are too great for councils alone,” Mahuta said, adding cabinet decisions on the proposed numbers of authorities and boundaries were likely in the “coming months.”

‘Do it, or it’ll cost you’

The projected cost is up from between $70b and $96b in the first study by the Scottish authority. This second round estimate sees the costs of upgrading the existing asset base at between $57b to $100b billion, and of maintaining and refurbishing existing or new assets at between $63b to $85 billion.

This compares with current council long term plans for investment of between $42 billion to $81 billion over the next 30 years. That implies council plans are currrently $80b to $100b below requirements.

The study by the Water Infrastructure Commission of Scotland (WICS) estimated average household costs for New Zealand’s rural councils would need to increase by between three and 13 times current costs without the amalgamations and investment, while the average for provincial councils was expected to be between two and eight times. The big city average was for a cost increase of between 1.5 and seven times current costs without the reforms.

Benefits and preferences

Deloitte estimated the investment at the higher level would increase average real annual wages by 0.16% - 0.26% over the same period, “reflecting an increase in productivity and higher skilled employment opportunities.”

“The WICS analysis shows that scenarios ranging from one to four entities provide the greatest opportunities for scale efficiencies and related benefits in terms of improved levels of service and more affordable household bills (when compared against the ‘without reform’ counterfactual),” the report said.

“Due to the large accumulated investment deficit, reflecting historic under-investment, price rises won’t be avoidable in some areas under a reform scenario. However, expected price increases would be far less than would otherwise be necessary without reform,” it said.

‘They stole this much from the future’

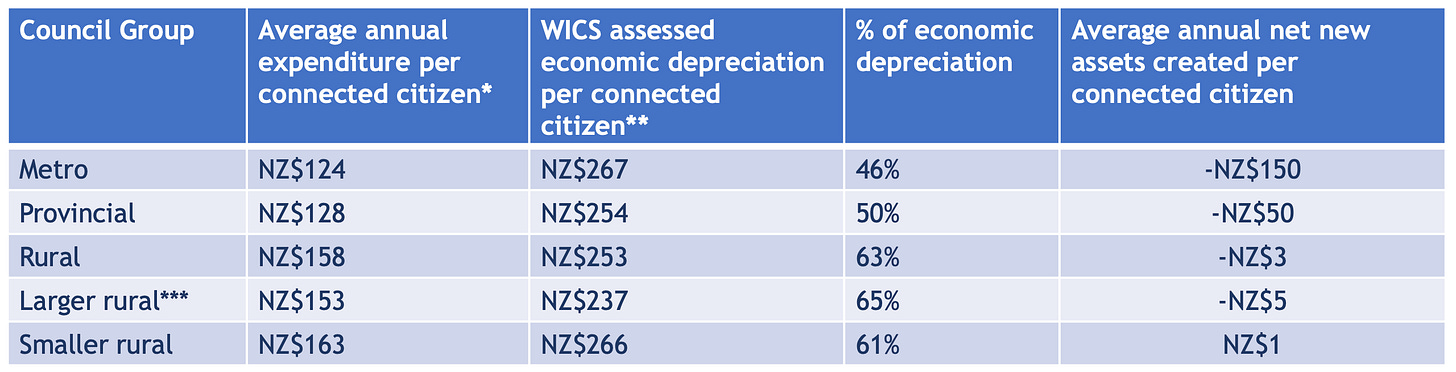

The report reinforced just how many councils had not reinvested in line with their own depreciation forecasts — effectively reducing spending and loading up the true costs on future generations.

It said seven councils had ‘Three Waters’ revenues that did not cover all their operating costs or interest costs, or any depreciation of water infrastructure, while four councils reported investment expenditure to replace and refurbish assets of less than 30% of the economic depreciation. There were 22 councils who had invested less than 50% of depreciation, 33 who had invested less than 60% and 51 councils who had covered less than 80% of depreciation.

Just less than half of ratepayers don’t have a water meter and 20 councils have no residential water metreing in place. Stormwater was almost universally funded through general council rates, the report found.

My view of the issues

The Government’s drive to reform the sector and somehow engineer lower financing and per-unit costs by pulling together the disparate 67 authorities is laudable, as is the long-run view of the problem.

Nanaia Mahuta’s ‘thousand cups of tea’ approach with councils has managed to calm the farm so far and avoid a rash of easily-triggered anti-amalgamation protests by Mayors and councillors raging against ‘Wellington bureaucrats’ trying to take their assets cheaply or force their ratepayers to subsidise.

Until now.

Auckland Mayor Phil Goff is pushing back hard at the proposals and many mayors are starting to get antsy about the lack of detail on the ‘deals’ being offered. The devil is always in the detail of the assets being parcelled up and allocated, who pays for them, who maintains them and who runs them.

Mahuta announced a $791m fund last year to offer carrots out of to tempt councils to agree to hand over their assets (or should that be net liabilities) to the water authorities to be shot of the likely future montrous cost.

But that seems wholly inadequate given the scale of the future costs involved and the risk for many councils that they will be lumped with future water charges for someone else’s growth problem. Take, for example, small towns such as Wairoa or Dannevirke, which would find themselves effectively paying for the much stronger, longer and bigger growth, climate and quality problems in places such as Palmerston North, Wellington and the Kāpiti Coast.

The much bigger issue is future borrowing by these entities, and the likely cost. Under-borrowing and uninvestment has been endemic by councils and the Government over the last 30 years. That’s in part because of a legislated and very ‘cultural’ drive to reduce the size of Government and keep Government debt low (in order to allow private household debt to grow with low and falling interest rates to boost house prices).

Larger authorities would allow much easier and cheaper borrowing, but they would have to be very large and it does beg the question of why the Crown as an entity doesn’t just do it in one fell swoop and parcel the money out from the centre.

Could the Reserve Bank help?

This big water report dump happened at exactly the same time as the Reserve Bank’s Head of Economics and Chief Economist, Yuong Ha, delivered a speech to a debt investors’ conference on behalf of the bank’s Head of Financial Markets, Vanessa Rayner.

They were of course unconnected, but the Reserve Bank speech offered a potential way the funding issue, particularly around climate change, could be dealt with in future.

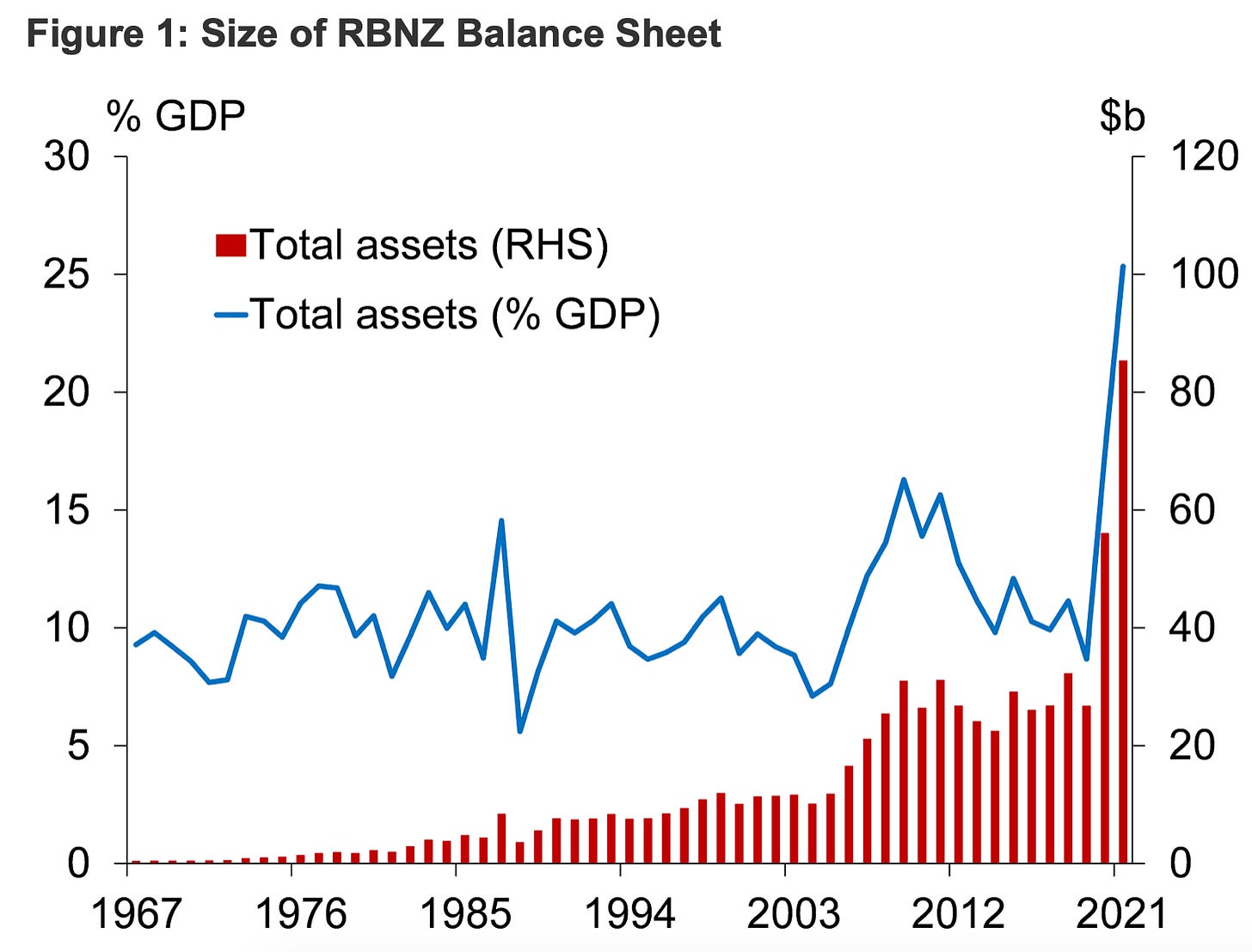

Surprisingly, the speech talked about how the Reserve Bank expected its newly-enlarged balance sheet to remain large for decades to come, and how it may even use it to help deal with climate change.

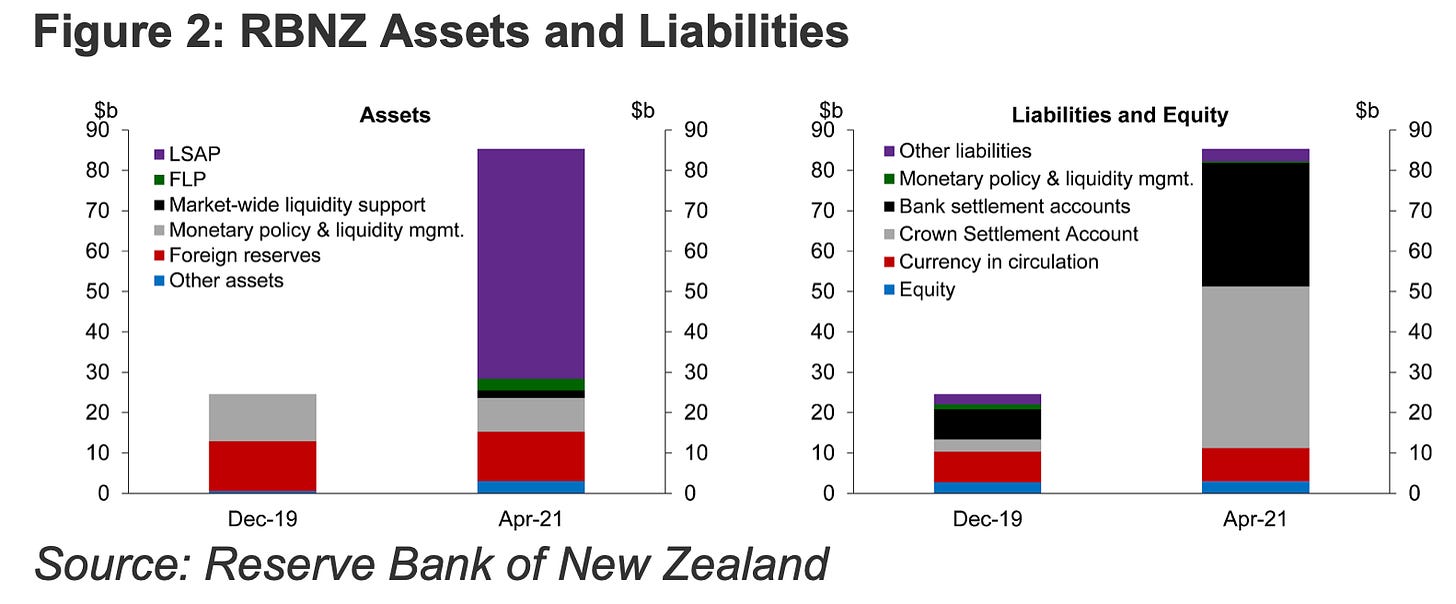

In particular, the Reserve Bank suggested it may invest in climate friendly assets and sell freshly-minted NZ dollars to increase its foreign currency reserves. Here’s the key quotes and charts (the bolding is mine):

The actions taken over the past year mean that the Bank’s balance sheet will remain large for a long time, and new monetary policy tools will likely remain mainstream for as long as global central bank policy rates remain at, or near, record lows.

Held to maturity, it would take decades for these assets to mature and roll-off the balance sheet, irrespective of any reinvestment policy decisions.

In many cases overseas, central bank balance sheets have remained large for a prolonged period. There have been some limited instances where the size of balance sheets have started to reduce when policymakers had sufficient confidence their policy objectives could be achieved with less support, like in the case of the Federal Reserve in 2018 and 2019.

Some of our assets from the Large Scale Asset Purchase (LSAP) programme have a maturity of up to 20 years in the future. Held to maturity, it would take decades for these assets to mature and roll-off the balance sheet, irrespective of any reinvestment policy decisions.

Balance sheet ‘innovation’

Innovation and evolution in Te Pūtea Matua’s balance sheet, currently at $85 billion, will continue to support the Bank’s monetary policy and financial stability objectives, including climate change, well into the future.

When looking at the future of our balance sheet, it should come as no surprise that climate change and sustainable finance is at the forefront of our minds. One way the Bank can give effect to its climate change strategy is through the use of its balance sheet.

The Reserve Bank is considering how to incorporate sustainability objectives into its balance sheet operations. There are a number of opportunities that the Bank will be exploring over the year ahead and learning from global central banking peers.

‘But we’re independent…’

As we have emphasised in the past, the MPC has operational independence to change LSAP settings (as with all monetary policy settings) at any time in order to achieve its inflation and employment remit objectives. While the LSAP programme lowers the government’s financing costs, it is a monetary policy tool, not a tool for financing government expenditure (in contrast to so-called direct monetary financing).

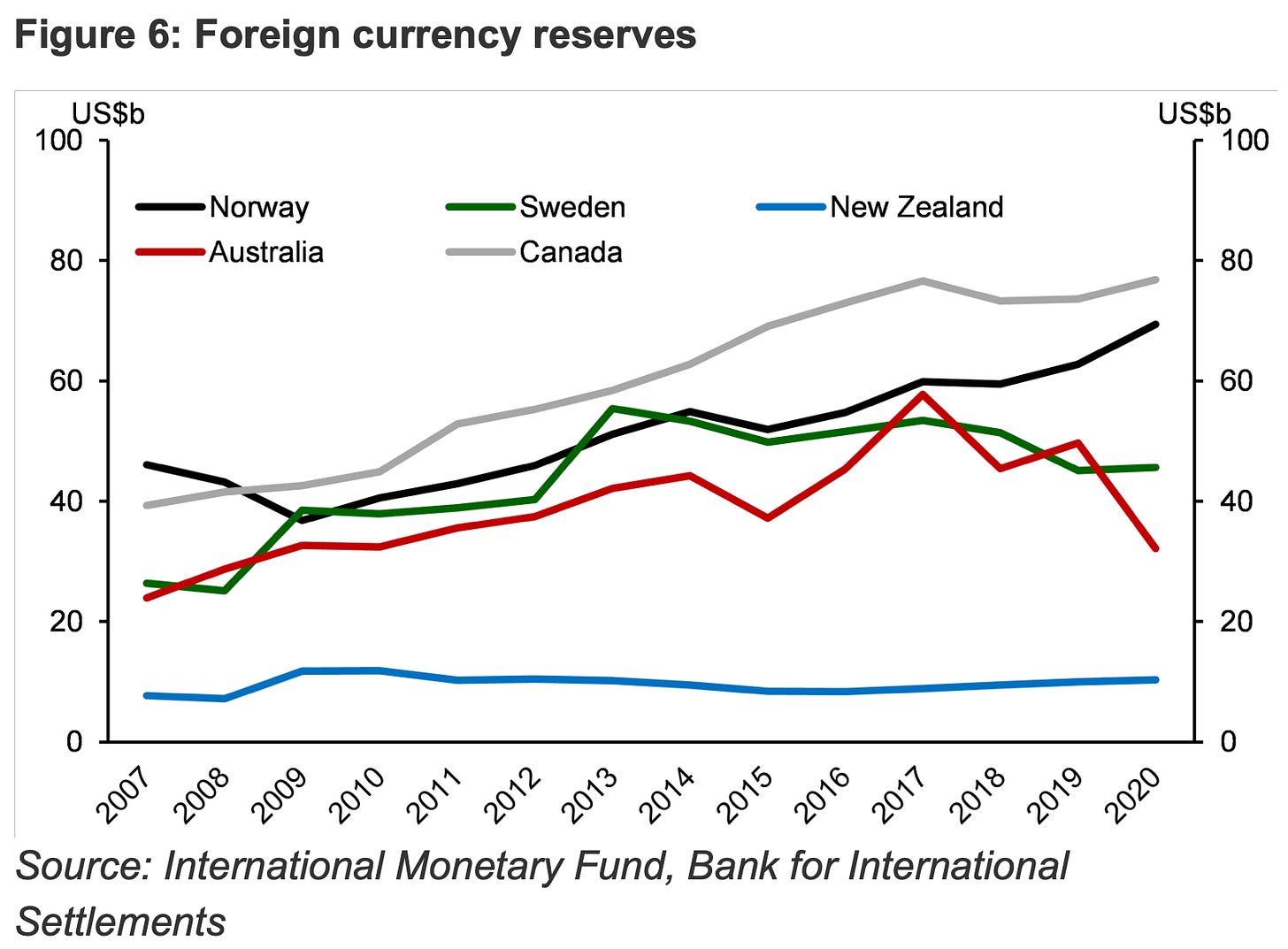

We are in the process of undertaking a comprehensive review of our foreign reserves management framework which will include governance arrangements, the objectives of holding foreign reserves, funding arrangements, and reserves adequacy. The level and adequacy of reserves will be an important consideration in this review.

‘Perhaps we should sell some NZ$’

Our foreign reserve holdings have been broadly unchanged since 2008. This differs from many other central banks that have increased the stock of their reserves since the GFC. A change in our foreign reserves would necessarily result in a change in the size of our balance sheet, and the composition of assets may change as we consider a broader set of objectives in our strategic asset allocation.

We understand sustainability is critical for our long-term future and we are mindful that any changes to our balance sheet need to be aligned with our ability to effectively and efficiently execute our existing policy objectives.

Interested in impact investing

We have already incorporated an element of ‘impact investing’ into our reserves portfolio, by investing US$100 million in the Bank for International Settlements’ US dollar Green Bond Fund in 2019.

But we intend to take a more holistic view in our upcoming review of our strategic asset allocation by considering the expanding universe of investment opportunities that will allow us to optimally combine our liquidity, safety and sustainability objectives.

We acknowledge that this investment universe will widen as liquidity in the sustainable finance market develops globally, and we have a role to play in supporting this market development. A ‘best in class’ strategy would involve assessing the climate impact at all stages of decision-making in the investment process.

So why not invest in ‘green’ infrastructure here?

At the moment, the councils and the Government are looking around for ‘someone else’ to pay for all this infrastructure investment to deal with climate change and population growth.

One way would be for the Reserve Bank to buy several truck loads of ‘green’ bonds backing water infrastructure designed to adapt to climate change and to clean up water supplies, both generally and for humans.

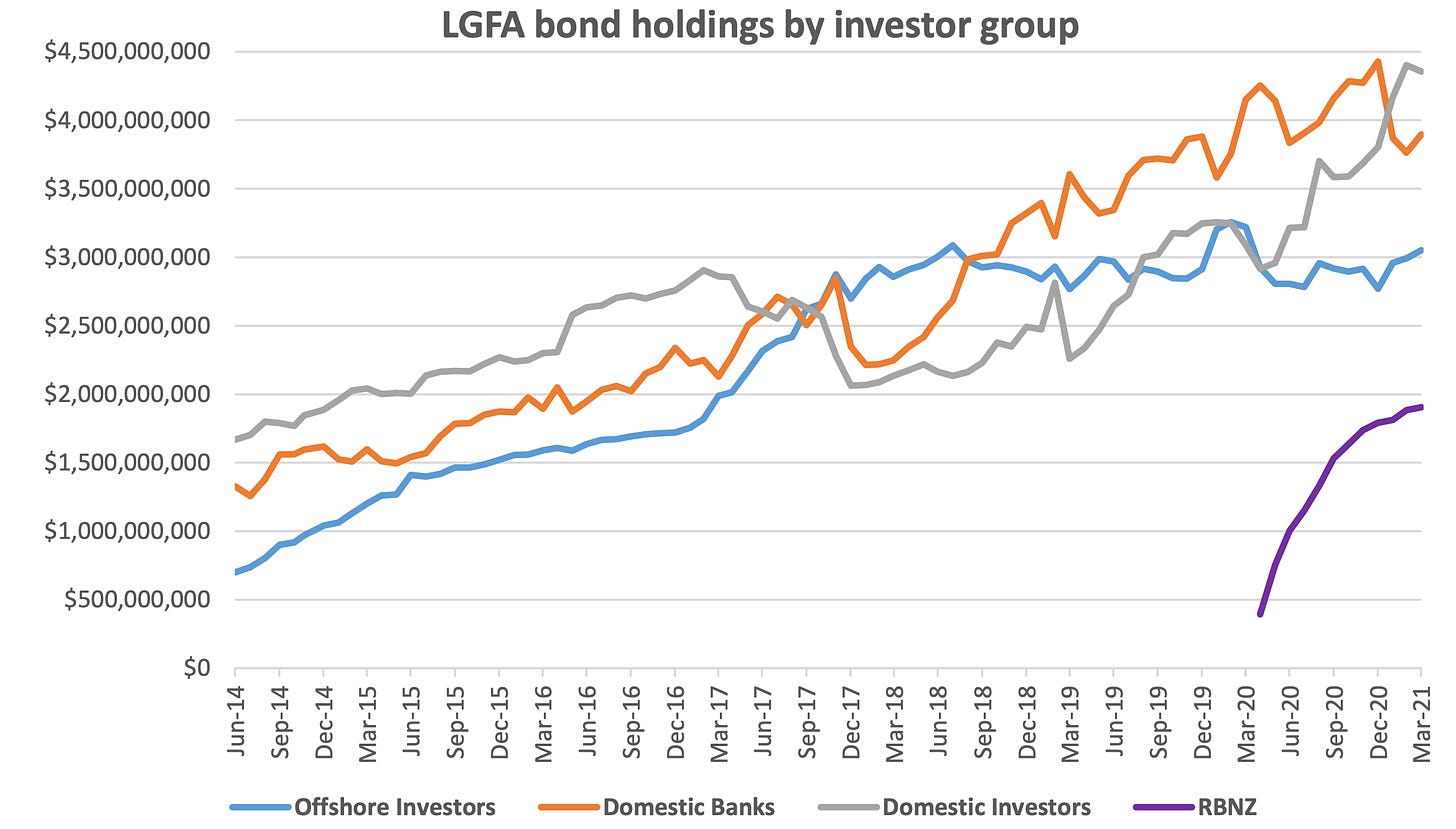

It’s already doing it. The Reserve Bank bought $1.9b worth of Local Government New Zealand bonds as part of its Quantitative Easing programme. Having the Reserve Bank effectively print money to fund Government spending makes some people nervous. That would be justified if it was creating inflation or unnerving foreign investors, but that’s not happening. The Reserve Bank has effectively bought all the $46b of bonds issued by the Government since the onset of Covid-19. It has bought $1.9b worth of the $3.9b of Local Government Funding Agency bond issuance since the onset of Covid.

Yet over that time, government and council bond yields have fallen and Standard and Poor’s has upgraded both New Zealand’s sovereign local currency and LGFA’s local currency credit rating to AAA.

At the moment, the problem for councils and the Government is fear about borrowing to fund this infrastructure. Their solution is right in front of their noses.

But will they use it?

Have a great day, and my apologies for the lateness of today’s chorus. I got on a roll and there were two great stories to tell.

Chart of the day

Share this post