TLDR: Liz Truss resigned as PM this morning after global investors forced her to abandon plans for unfunded tax cuts for the rich and to start fracking for gas under the British countryside.

Christopher Luxon should note how the global financial orthodoxy has moved away from trickle-down economics and is increasingly sceptical about Governments that shirk their international climate change commitments. It turns out global investors don’t want heavily indebted countries to further impoverish most of their workers to reward a small minority who have captured their Governments. And they don’t want them to stop or reverse action to address climate change.

Luxon still seems attached to the tax-cutting and climate-lite policies that are increasingly discredited by global capital pools. He denies the similarities with Truss’ disastrous pivot back to Thatcherite policies, but her demise in less time than it takes for a lettuce to dry up should be seen as a cautionary tale for the fundamentalists in the National caucus that Luxon appears drawn to.

Paying subscribers can see more detail and analysis below the paywall fold and in the podcast above. I’ll also be inviting paying subscribers to our weekly Ask Me Anything session on The Kākā at midday and our ‘hoon’ webinar at 5pm.

This time the bond vigilantes have a green tinge

Liz Truss was playing to her Conservative Party members and her wealthy backers when she promised them big tax cuts funded by borrowing and/or public spending cuts. Harking Back To The Future (1985) of Reagan-ite and Thatcher-ite thinking that tax cuts would speed up economic growth and make everyone richer, she had missed the actual research from the natural experiments of the last 30 years that showed those policies simply widened inequality, depressed investment, lowered productivity growth and destabilised social cohesion in democracies.

Others harking back to these trickle-down policies should take note, largely because the bond vigilantes of yesteryear are back with a vengeance, but this time they’re just as likely to be brandishing the United Nations Sustainable Development Goals and the Paris Agreement on climate change as a warning of a credit rating downgrade.

Fund managers looking after US$35 trillion in assets now class themselves as responsible investors, which means they avoid investments in and loans to companies and Governments “that systematically cause harm to the environment, society and the economy.”

Tax cuts for the wealthiest, welfare spending cuts that worsen poverty and policies that don’t reduce climate emissions are no longer part of the economic orthodoxy. They are anything but, as shown in repeated research and reports by the likes of the IMF, the World Bank and the OECD, in the last decade which showed the unreconstructed Reagan/Thatcher-era ideas about tax-cut-driven, trickle-down and supply-side economics simply didn’t work.

The straw that broke the camel’s back for Truss was a vote on fracking yesterday that turned into a vote of no confidence in the Government.

‘Growing the economy lifts everyone’ Really?

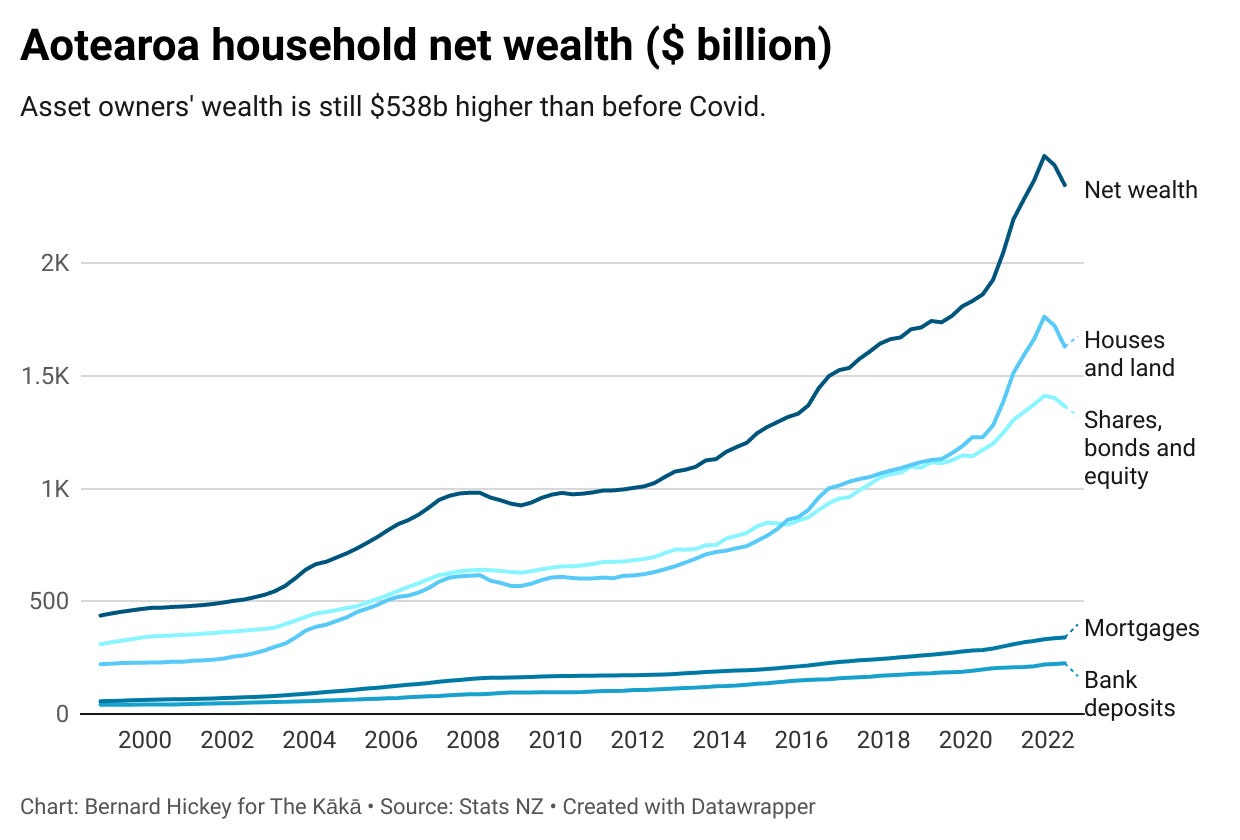

National and Opposition Leader Christopher Luxon’s first policy last year was an unfunded tax cut for the wealthiest, followed by promises to repeal taxes on landlords and home owners who are actually worth $2.34 trillion as at the end of September and were made $538 billion richer during Covid (even after the recent 12% fall in house prices and stock market slumps).

He has also promised to repeal a levy designed to reduce emissions from our largest source of emissions — farms — and his transport spokesman is an aggressive campaigner against mode shift and cycleways.

Luxon has also yet failed to say how the billions in tax cuts would be paid for and indicated earlier this week we would not find out until a month before next year’s election.

Luxon has also repeatedly argued tax cuts would grow the economy in a way that would ‘lift all boats’

“Growing our economy and raising productivity are the single biggest things we can do to improve the lives of all New Zealanders. And the National Government I will lead will be a government of action.

“We will bring the tide back in and lift all boats.” Luxon’s first speech as leader.

But his most detailed economic views were saved for a speech to the London-based thinktank, the Policy Exchange, which is video form below.

The Policy Exchange has been a promoter and supporter of the libertarian hard-right economic policies of Truss. This video from the day after the ill-fated mini-budget of September 23 gives you an idea of just how enthusiastic it is.

Luxon’s speech and Q&A to the London audience above was the one where he referred to businesses here as soft.

Luxon has also not used the same framing for tax cuts used in the ‘Big Switch’ engineered by John Key and Bill English in 2010, which was that the increase in GST and various income tax and Working For Families changes were distributionally neutral.

A tendency to play to his crowd and a tolerance for zealotry on economic and climate policies could trip up Luxon.

Elsewhere in the news to me this morning:

US bond yields jumped 10 basis points to a 14-year high of 4.23% on fears the US Federal Reserve will have to shunt short term rates over 5% to control inflation;

Boris Johnson is reported to be interested in bidding again to be UK PM to replace Liz Truss; and,

Marlborough Lines has put Yealands Group up for sale fully to Australian investors.

What was news to me in Aotearoa yesterday

Mallard’s final suggestions on housing and monetary policy

Former Speaker Trevor Mallard’s valedictory speech in Parliament last night is worth watching, including for a couple of ideas he put up on housing and monetary policy.

We currently spend $4.7 billion dollars a year in family tax credits, in work tax credits and subsidies to landlords called the accommodation supplement.

We should use the strength of the one of the strongest crown balance sheets in the world and present value calculations to make available advance payments as we did for family benefit capitalisation for use as a partial deposit.

It would involve no extra cost to the crown in the medium term, a bit of belt tightening for new home owners – as is always the case – but enormous education, health and community benefit. The second order savings would be massive.

And now for the left field suggestion.

I’ve long been concerned that the Reserve Bank only has one instrument (other than printing money) to wind up or cool down the economy. With so many mortgages being fixed, the cash rate tool has become a bit like using a hammer to fine tune an EV. The results are both slow and unpredictable. An extra tool for the Reserve bank could be to give them discretion over say the last 2% of individuals Kiwisaver contributions.

They could increase or decrease net pay almost immediately and that way boost or tighten the economy- it would have much more immediate effect than interest rates.

And most of us would prefer to see a bit more of our incomes go into our Kiwisaver than to banks which put mortgage and loan rates up faster than petrol retailers and drop them just as slowly. Look at their profits. Trevor Mallard’s valedictory speech

Deck clearance - PM Jacinda Ardern announced that December 10 would be the day for the by-election for Hamilton West.

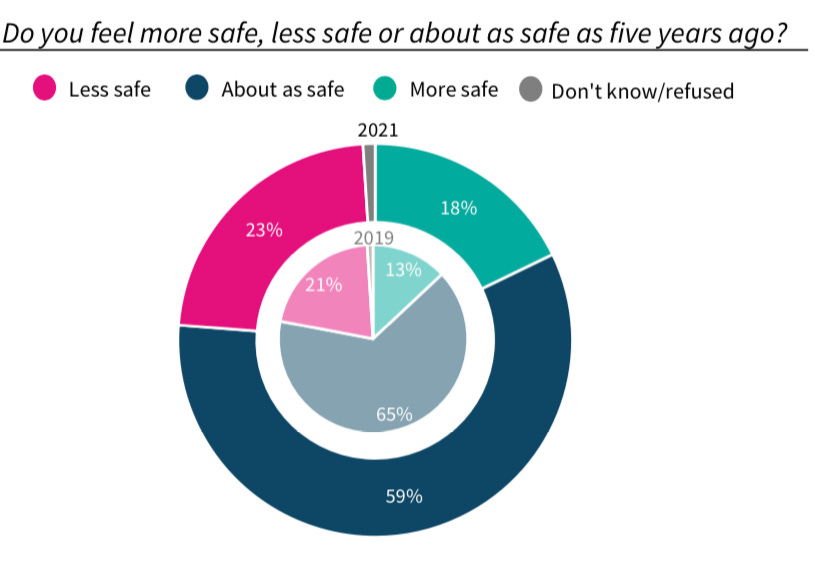

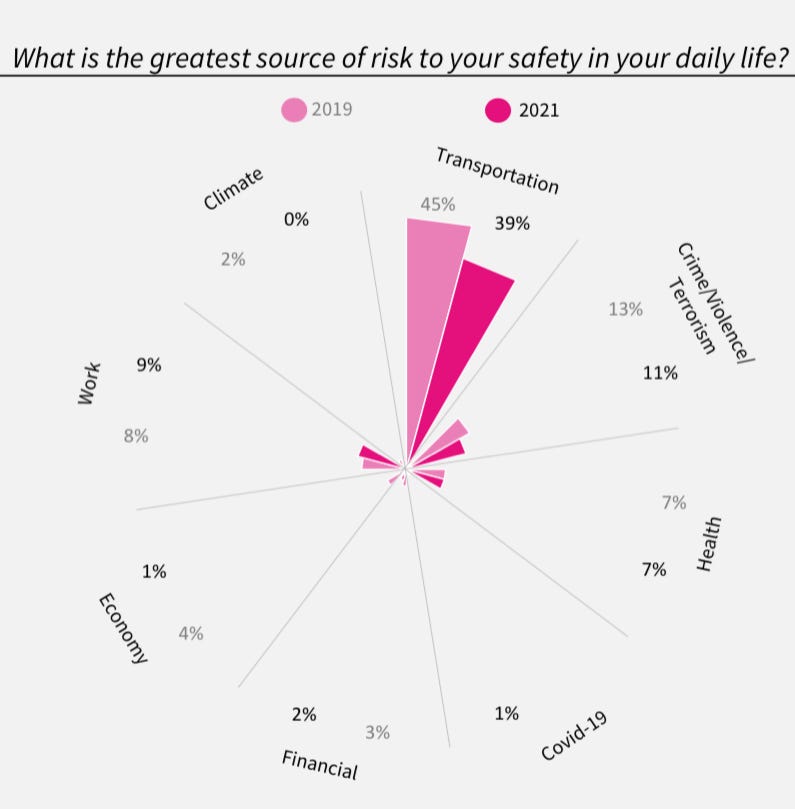

Yeah….nah… People in Aotearoa were slightly less worried about climate change in 2021 than they were in 2019, Gallup’s global risk survey for the Lloyds Register has found. The global survey of 125,000 people in 121 countries also included a survey of 1,000 people here in August 2021. Here’s the summary of the results from Aotearoa

It also found a slightly higher proportion felt less safe, but an even larger percentage felt more safe. Go figures…

It also found we thought transportation was the greatest source of risk in our daily lives.

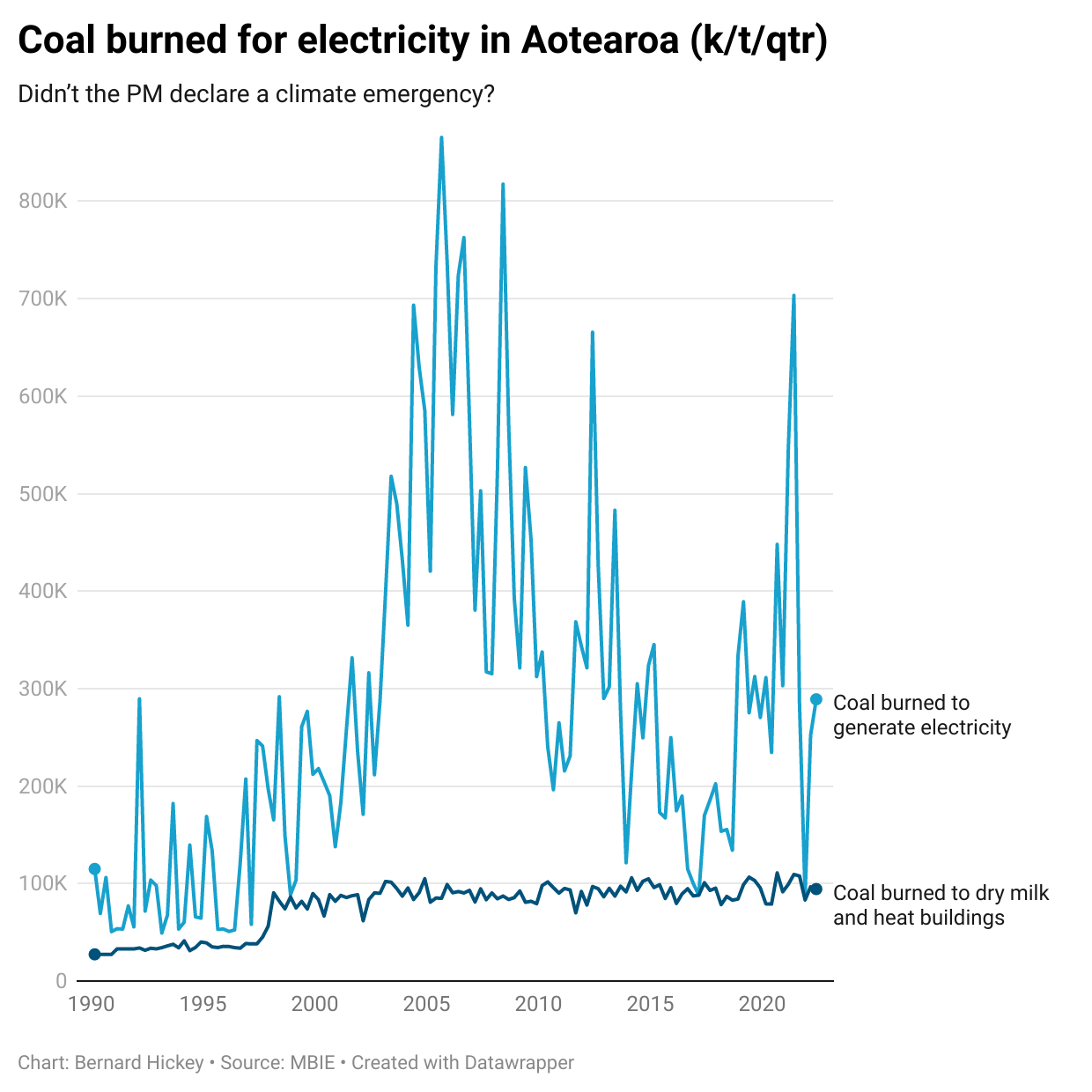

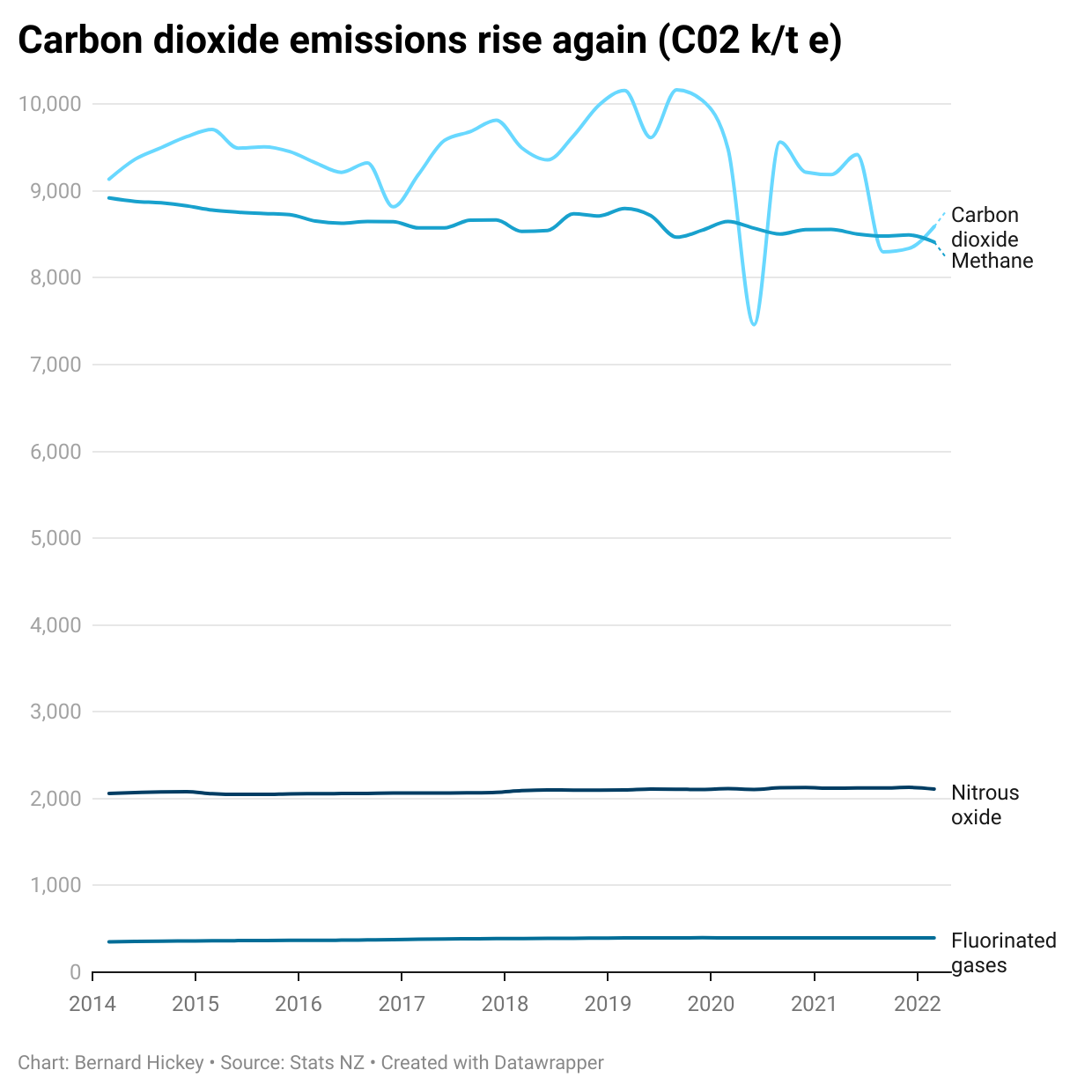

Coal for power - Statistics NZ reported greenhouse gas emissions rose 1.7% or 320k/t in the March quarter from the September quarter, largely due to a 37% or 509k/g rise in emissions from the electricity, gas, waste and water production sector. This was due to up 37 percent (509 kilotonnes); manufacturing, up 2.8 percent (72 kilotonnes); and services excluding transport, postal, and warehousing, up 9.5 percent (62 kilotonnes).

Numbers of the day

9% - ASB’s economists forecast yesterday that their peak forecast for the Official Cash Rate of 5.25% early next year would see most fixed-rate mortgages peak within a 7.0% to 7.5% range over the year ahead, with floating rates peaking around 9%.

“Our base expectation is mortgage interest rates over the next decade ahead will be around or below the long-run averages of the past 20 years, rather than press to the higher levels seen prior to the Global Financial Crisis.” ASB Senior Economist Chris Tennent-Brown in ASB’s home loan rate report.

Quotes of the day

“I accept that I’ve never been a good politician.” Trevor Mallard

"I've had enough, I've had enough of talentless people putting their tick in the right box, not because it's in the national interest but because it's in their own personal interest to achieve ministerial position. And I know I speak for hundreds of backbenchers who right now are worrying for their constituents all the time but are now worrying for their own personal circumstances because there is nothing as ex as an ex-MP.

"A lot of my colleagues are wondering, as many of their constituents are wondering, how they are going to pay their mortgages if this comes to an end soon.

"I'm leaving Parliament at the next general election and I'm leaving voluntarily. But unless we get our act together and behave like grown-ups I'm afraid many hundreds of my colleagues, perhaps 200, will be leaving at the behest of their electorate." Conservative MP Charles Walker in an interview with BBC. The video is worth a watch.

HT to Peter Bale in his weekly world Bulletin.

Some useful longer reads

Some fun things

Ka kite ano

Bernard

PS: I look forward to seeing you all on the Ask Me Anything at midday and the weekly Hoon at 5pm. Here’s the link.

Share this post