TLDR: Te Pūtea Matua (Reserve Bank) Governor Adrian Orr has argued the central bank needs to increase joblessness to control inflation, which is seen as meaning the RBNZ looks set to hike hard again next month, possibly by as much as 75 basis points to 4.25%.

Understandably, Orr is using the only monetary policy tool he has (interest rates) and is only restating the economic orthodoxy of the home-grown Phillips Curve relationship that shows the trade-off between falling inflation and rising unemployment.

It may work, but is that fair on the most vulnerable in our society? And does the central bank still have the social license to demand the public’s trust again after its over-loosening in 2020 and 2021 made asset owners dramatically richer and the resulting inflation shock thumped low-income renters with lower real disposable income.

This all came to a head again yesterday when Orr gave a speech highlighting higher unemployment was necessary to fight inflation, on the same day ANZ reported record profits because of both the higher interest rates the Reserve Bank is imposing and because of the surge in cheap mortgages used during Covid to create the wealth effect needed to rescue the economy.

Is it fair that low-income renters will be punished again, while the beneficiaries of a central bank policy mistake win again big time because of the way the central bank is fixing its mistake? Is it still appropriate for a Government body run independently of voters’ representatives to still make these sorts of big redistributive and social calls?

Paying subscribers were able to see and hear more in my commentary below the paywall fold (here) and in the podcast above first. They voted below to open this one up to the public fully (here).

Is the RBNZ's fast tightening fair to covid's losers?

It was the best of times (again) for some. It was also the worst of times (again) for others. But the net result is the same. Covid’s winners are mostly winning again and Covid’s losers are being punished again for the sins of the winners.

Aotearoa’s ongoing and fastest monetary policy tightening in a generation is throwing up all sorts of questions about the fairness of how monetary policy is operated in an economy that is now barely more than the world’s most expensive housing market with bits tacked on, and whether our central bank still has our societal agreement to do what it’s doing.

One thing we do know is that both the massive loosening in 2020 and early 2021 and now the fast tightening in 2022 has been the best of times for banks.

They are profiting now from all the extra mortgage lending they were encouraged to do by the Reserve Bank in 2020 and 2021, and from the higher interest rates the central bank created in 2022, which have lifted their profit margins. They’re also profiting because the aggressive rescue in 2020 stopped bad debts from increasing.

That is crystal clear in the latest bank profit results.

Happy days for the big four, and especially the biggest one

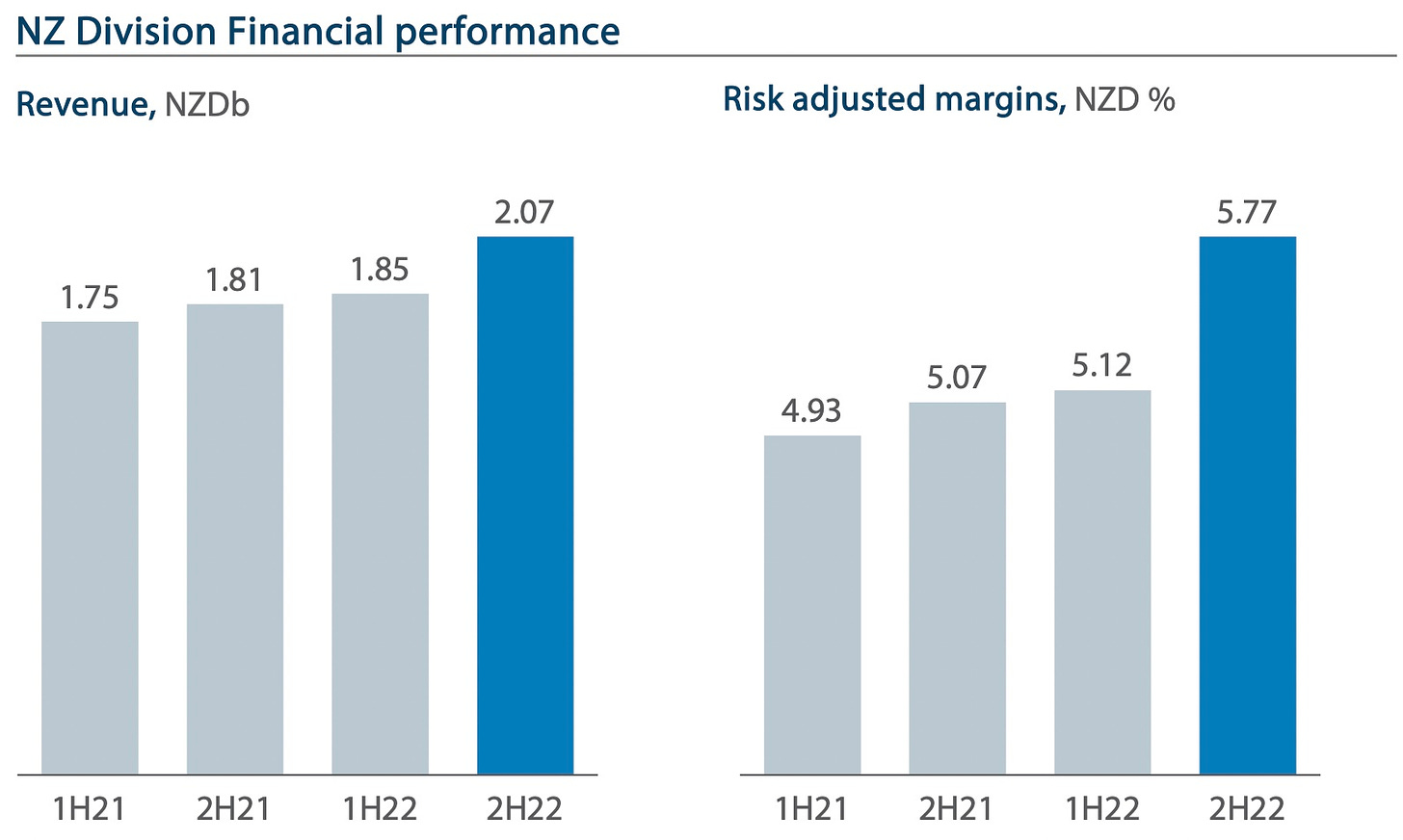

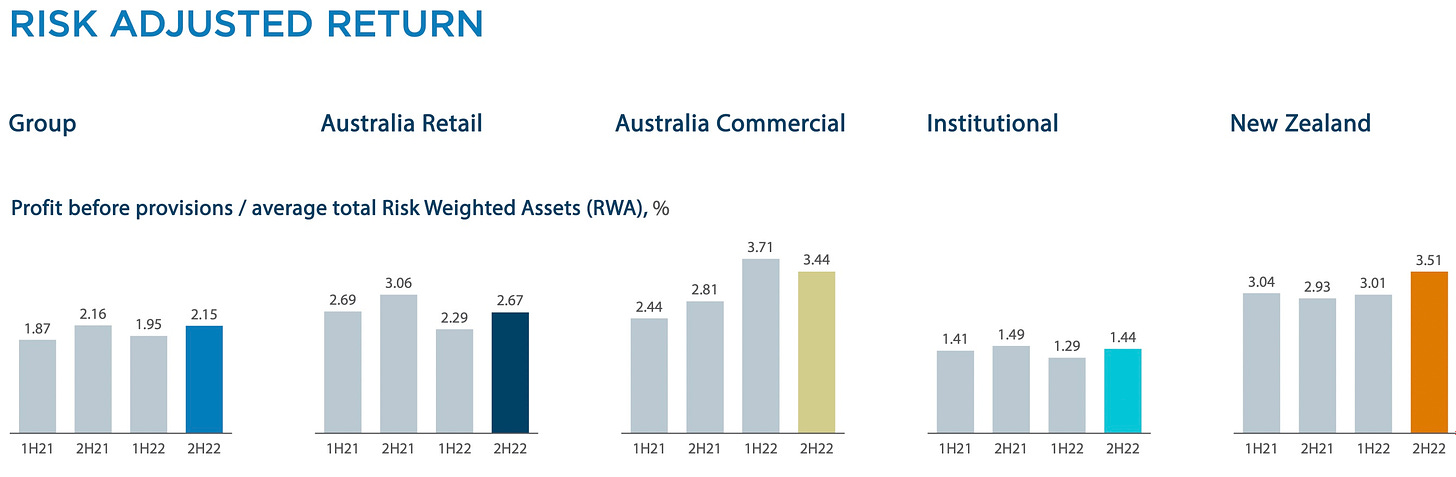

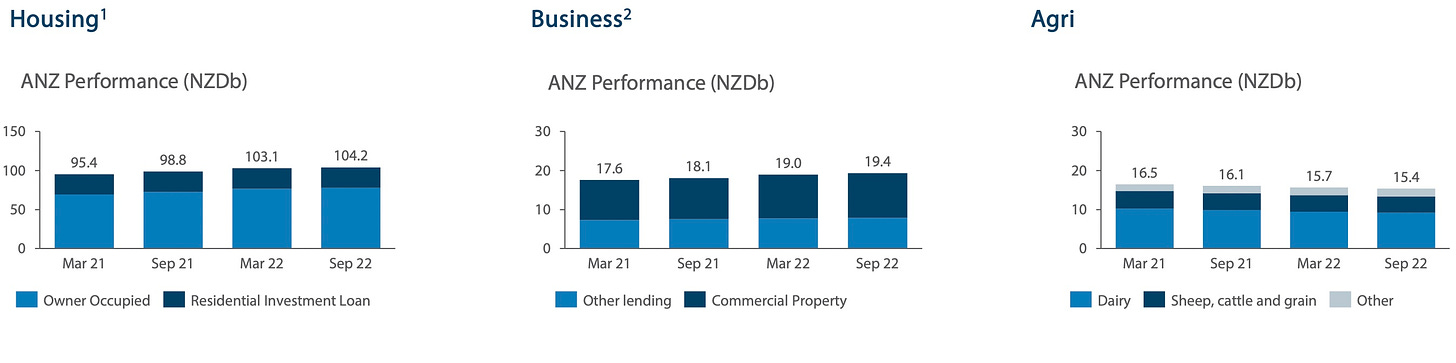

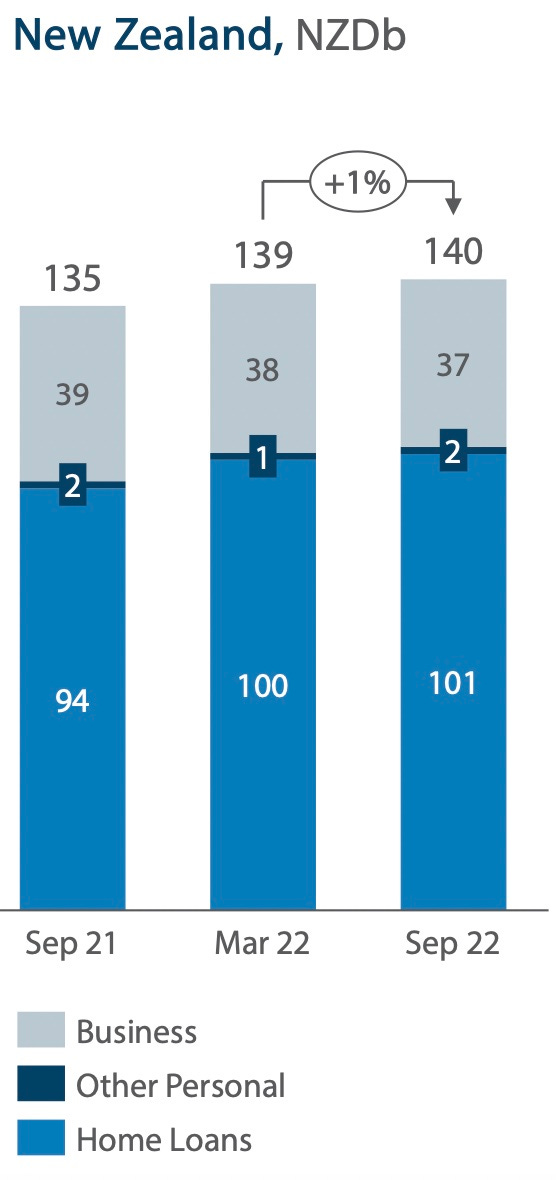

ANZ reported a record annual profit yesterday of $2.3b, up 20% from a year ago because it benefited from the higher interest rates the Reserve Bank is now cranking into the economy, and because of the extra $14b of home loans it made since Covid (over a time ANZ lent less to businesses and farmers and shed staff). Adjusted for the risk weightings of its loans and in outright terms, ANZ’s profit margins hit record highs and were higher than ANZ’s fellow divisions in Australia.

What the biggest bank does in a housing market with bits tacked on

ANZ’s strong performance as Aotearoa’s biggest bank is a reflection of how our economy is now completely dominated and driven by lending into the housing market, and how the incentives for savers and bankers are lined up to double down in the hunt for leveraged tax-free capital gains on land price appreciation, and to avoid investing in businesses, technology, training or infrastructure that doesn’t have access to that same leverage or those same tax advantages.

Here’s the detail in these two charts of how ANZ’s mortgage lending grew $8.8b in the last 18 months (first chart), while non-property business lending was flat and farm lending fell by $1.1b. The shift was even more pronounced in the last year (chart below), with home lending rising by $6b to over $100b for the first time in the year to September 30, while business lending fell by $2b.

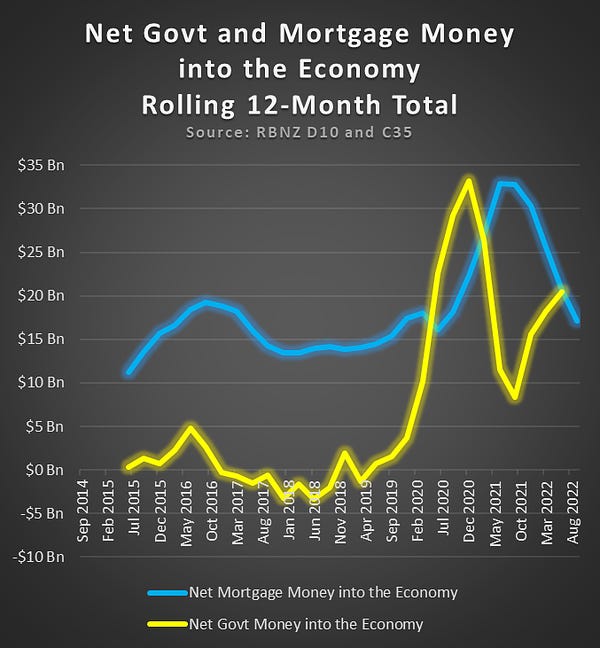

ANZ’s mortgage book has risen from 61% of total loans just before Covid to 74.9% by the end of September. Our largest bank effectively became the biggest weapon in the Reserve Bank’s ‘wealth effect’ arsenal. In the process of rescuing Aotearoa’s economy from Covid, our independent central bank helped make 1.1m home-owning households $550b richer and has almost doubled the profits of our biggest banks to almost $7b per year.

Why bank profits rise when interest rates rise

The key detail for any banker is that rising interest rates allow banks to increase their profit margins on lending. This is partly due to banks interest margins tending to rise when short term interest rates are rising, as this June 2020 paper “Does Monetary Policy Influence the Profitability of Banks in New Zealand?” from the University of Waikato found.

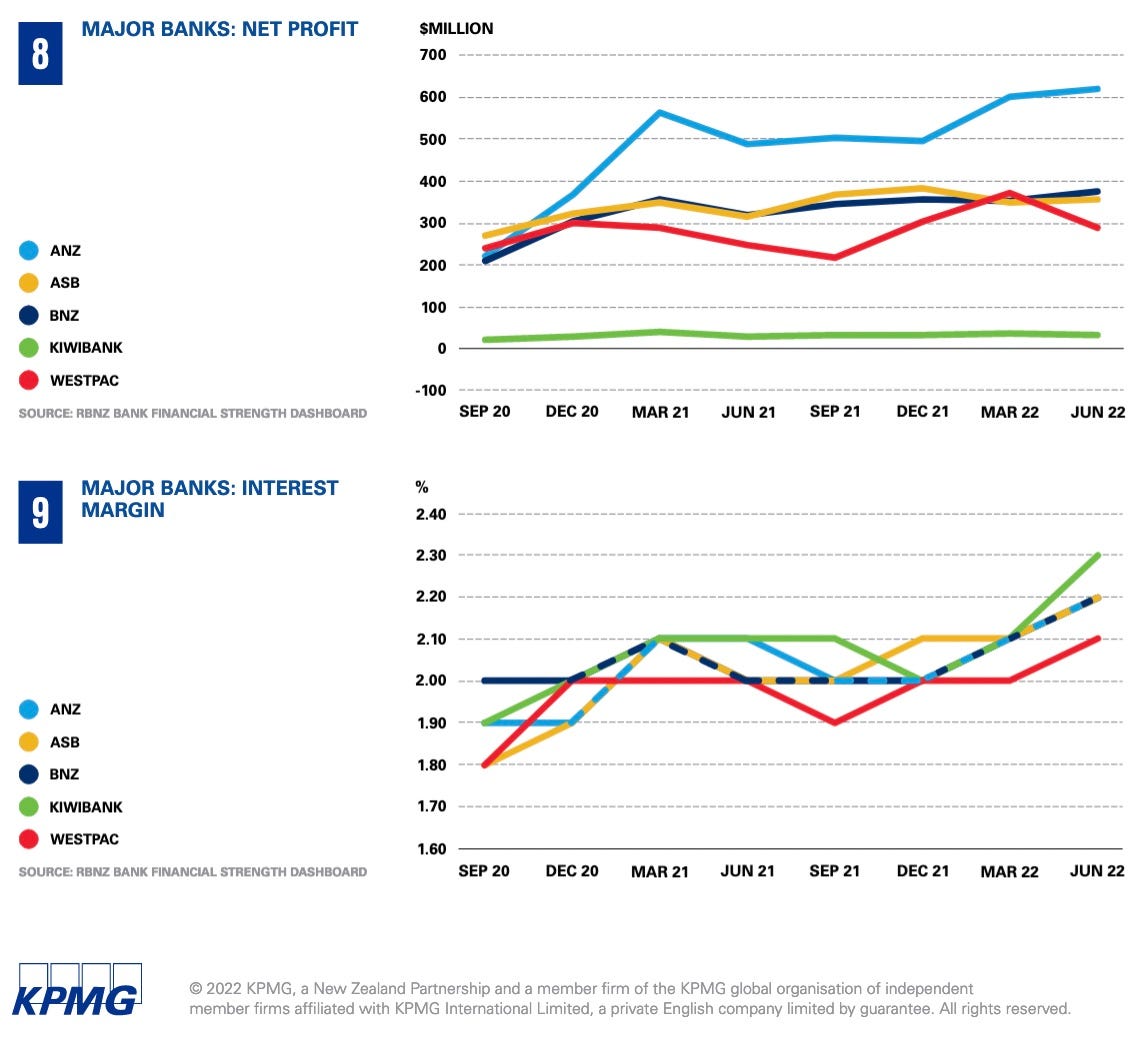

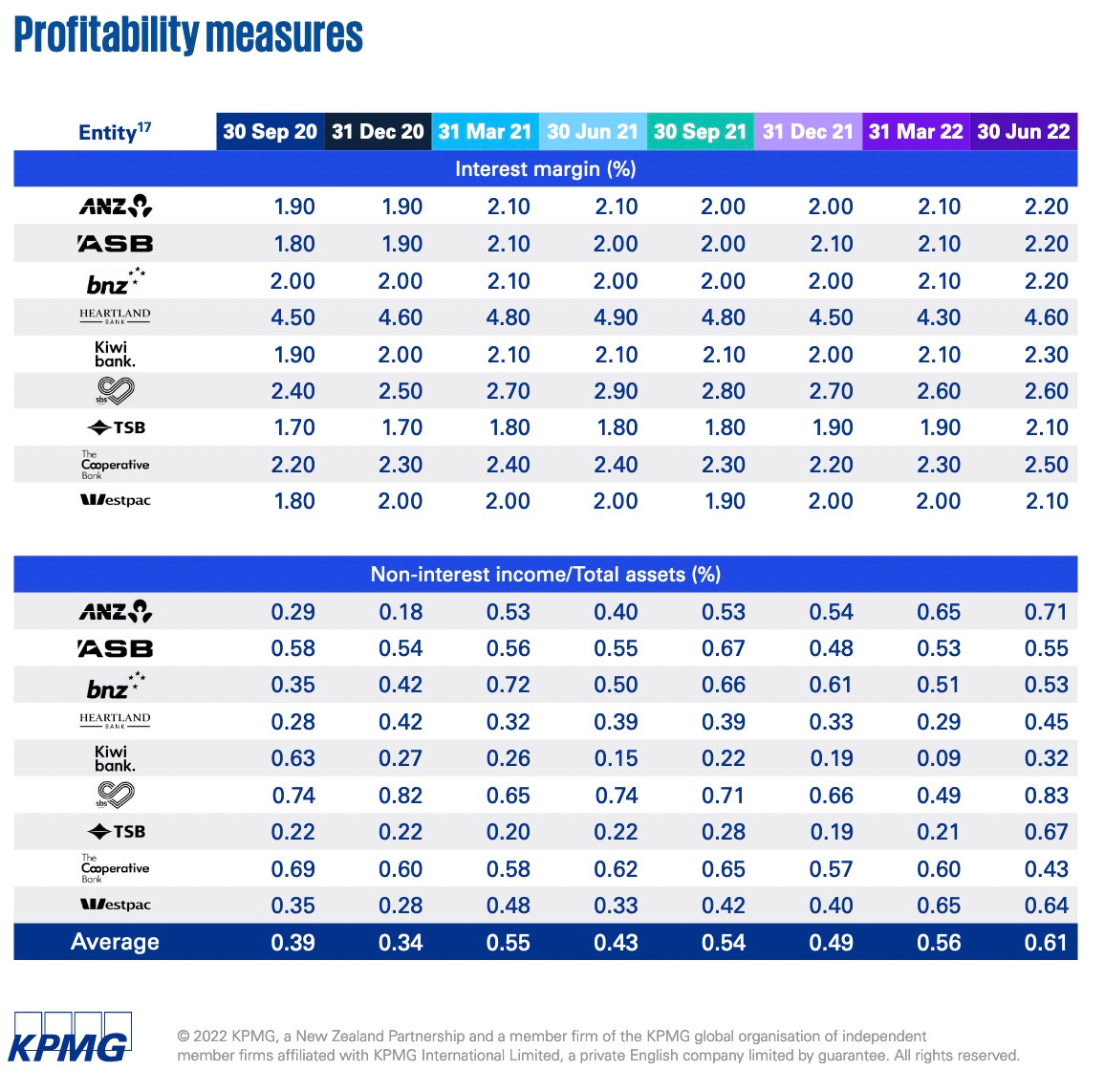

KPMG’s industry-wide analysis from the June quarter, which included all the bank results, shows this too. The profit results are quarterly.

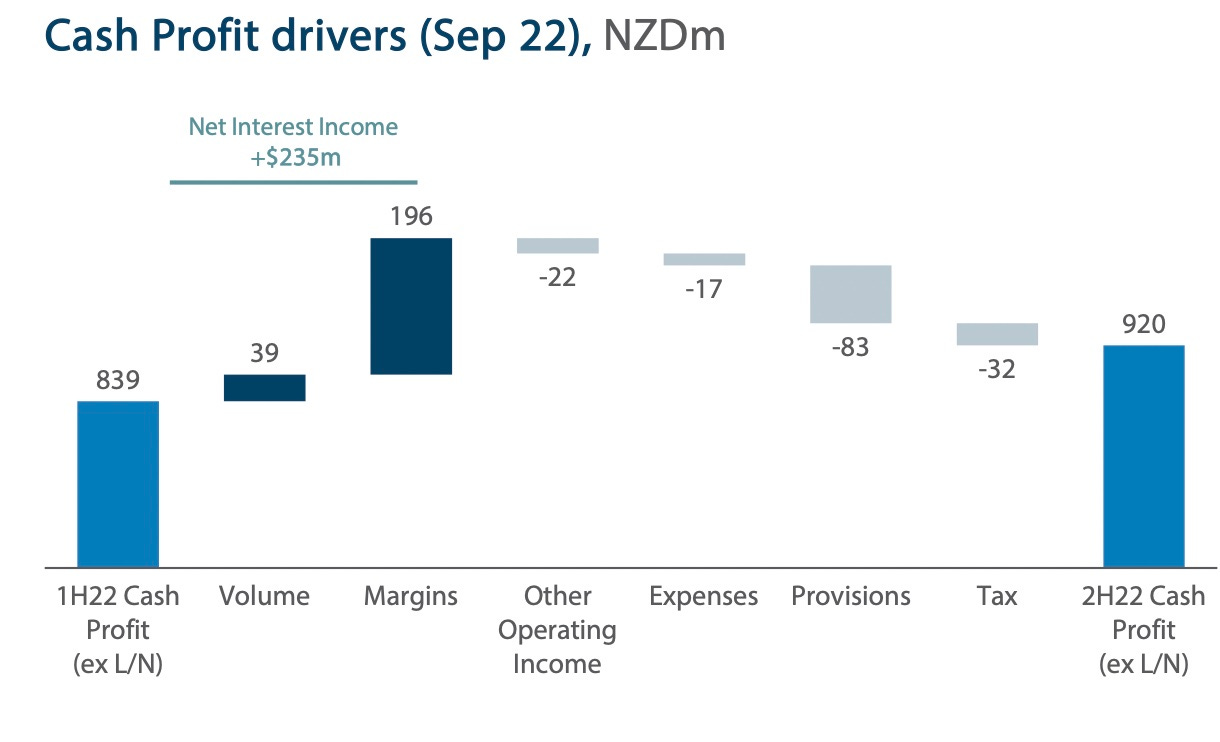

ANZ made the rising net interest margin clear in its explanation of its higher cash profits in the second half from the first half.

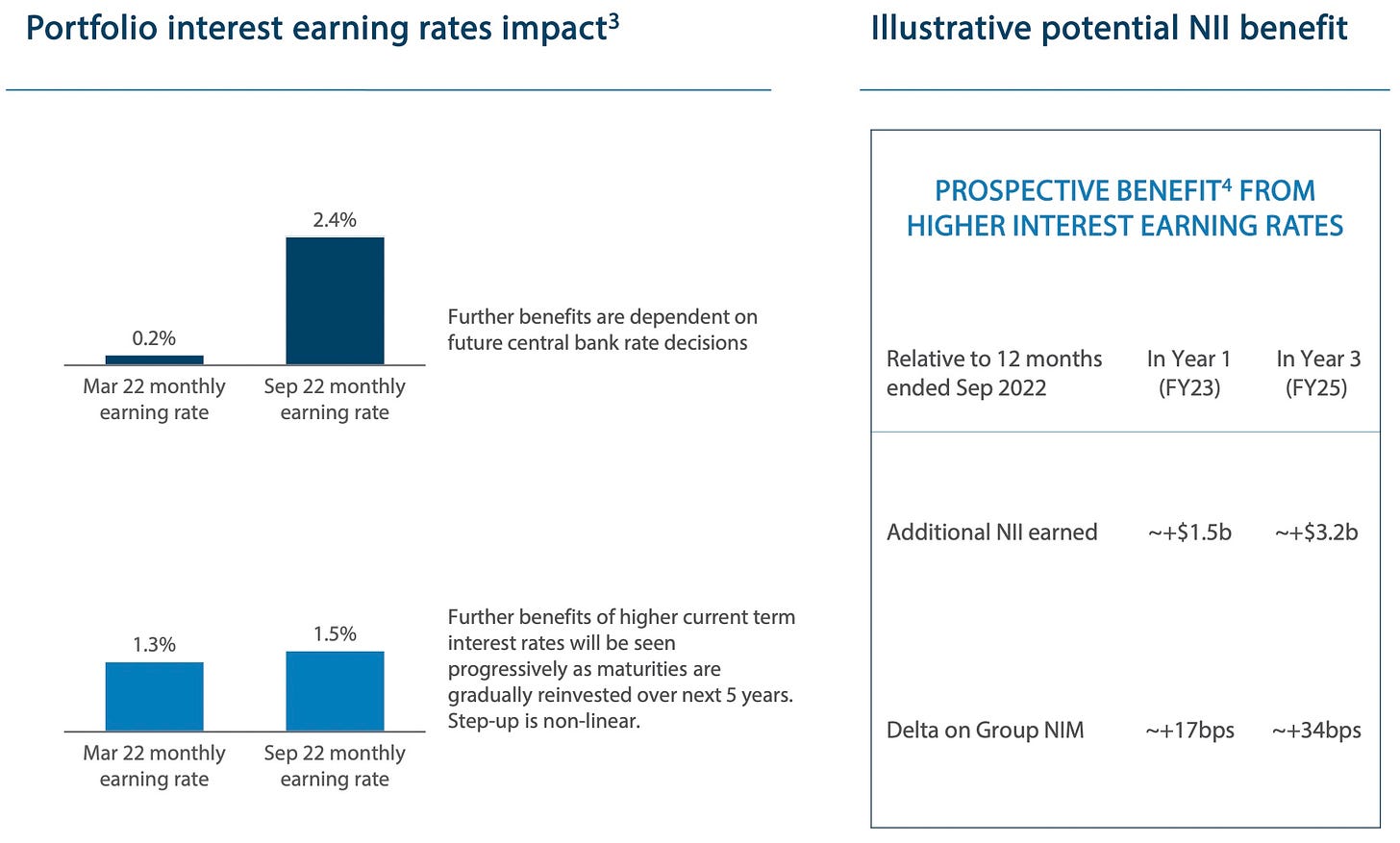

ANZ even included a slide in its group result showing how higher interest rates from monetary policy boost profits from net interest income (NII).

Now it’s time to fix the mistake. But who should pay?

It’s been a great year for the banks, but it’s been a bad year for the Reserve Bank itself, and for those low-income renters who saw prices of the things they spend all their disposable income on rise faster than their wages, including rents.

Asset owners, meanwhile, have seen their nominal asset values and the real value of their savings fall this year, but the hits to their spare disposable income and financial positions was relatively much less painful. They have buffers and savings to fall back on and they’re still sitting on net worth of $2.35t as at the end of June, up by $550b since Covid. Those who may have lost work and income during Covid and did not get the wage subsidy cash kept by their employers are on their own fighting consumer price inflation, without the buffers of savings or other assets.

The Reserve Bank has yet to acknowledge it publicly, but it over-stimulated the housing market and the economy in 2020 and 2021 by printing $55b to buy Government bonds to lower longer term mortgage rates and removed high LVR borrowing restrictions. That powered a 45% rise in house prices in 18 months and wiped out another generation’s hopes of home ownership. That monetary policy response, along with $20b worth of cash handouts to business owners that they banked, helped fire up inflation in 2021 and 2022 to over 7%.

To be fair, the Reserve Bank realised it had over-cooked the economy earlier than other central banks, stopping its money printing in mid-2021 and starting rate hikes in October 2021. It also reimposed and then toughened the LVR rules late last year, which finally put out the fire.

However, until now, it has defended its decisions and issued research, along with Treasury, that fudged on whether there was any inter-generational or inequality effects of its actions in 2020 and 2021.

Adrian Orr says unemployment will have to rise

The need to rectify the mistake was clear, without using the ‘M’ word, in a speech Governor Adrian Orr gave yesterday at an INFINZ conference, in which he detailed how more unemployment was needed, and that its ongoing reviews of monetary policy would acknowledge its mistakes.

He described how the central bank was actively looking to slow domestic spending to constrain inflation.

This means employment prospects will be increasingly compromised, as people delay their spending and investment decisions.

The trade-off of the long-run benefits of low and stable inflation versus near-term spending and employment is being confronted in virtually every country simultaneously.

New Zealand is relatively well positioned but inflation is still too high in an absolute sense. Adrian Orr in a speech.

He said the themes talked about recent IMF meetings in Washington DC were familiar. He pointed in particular to the need for higher unemployment and the risk of a financial markets accident further complicating the outlook. Here’s his summary (bolding mine)

The list of near-term pressures goes something like:

Returning to low inflation will, in the near-term, constrain employment growth and lead to a rise in unemployment. The actual extent of this trade-off remains unclear however, given the significant labour shortages globally and the very different means of employment being adopted post-COVID. Importantly, it is highly unlikely that we are at maximum sustainable employment if inflation is still high and variable.

Rising nominal interest rates globally are, and will continue to, test the resilience of the financial system and all economic participants. The financial system is complex, making it hard to pinpoint what, if any, particular achilles heel exists in real time.

All we know is that the financial system has experienced many legal, operational, financial and/or reputational problems in the past – few of which were predictable in timing or scale. Most recently, for example, in the UK we saw liquidity issues rapidly escalate in their pension-investment industry as an unintended consequence of fiscal policy announcements. Adrian Orr

Orr has argued since the onset of Covid that the best thing the central bank could do was to take a ‘least regrets’ approach to stimulating the economy, given preserving employment would reduce the harm for low-income people by the most relatively.

However, the inflation outbreak has hurt those in low-paid and precarious work the most, particularly when they are renters with little spare disposable income, unlike asset owners.

Inflation hits spare disposable income the hardest

It has been a very bad year for low-income workers and beneficiaries who rent and were stung with much higher living costs relative to their incomes this year, and who got no benefit from the ‘wealth effect’ created by the Reserve Bank to stimulate the economy in 2020 and 2021.

So how could the Government and Reserve Bank do things differently so that the beneficiaries of rectifying the mistake are those hit hardest during Covid, rather than those who did best?

The Government has various tools at its disposable that would both reduce inflation immediately and take pressure off both those who are renting on low incomes and have little spare disposable income, and the Reserve Bank itself, which is stuck with its blunt instruments of its Official Cash Rate and reversing the ‘wealth effect’ via the housing market. In my view, they could include a windfall profits tax on banks, as has been done in Australia, which would help pay for:

immediate cash benefit increases and Working For Families increases for both those working and out of work;

temporarily reducing the rate of GST overall and/or reducing GST on food;

removing or rebating GST on council rates and paying rates on Crown land (current the Government does not pay) in exchange for rates decreases, along with rebating GST on building materials and building services to councils; and,

cutting public transport and other Government fees that hit the poorest and youngest hardest, including drivers’ licence testing, student fees and doctors fees.

In summary then: the Reserve Bank over-stimulated our economy in 2020 and 2021 by encouraging banks to pump extra debt into our economy (in particular our housing market with bits tacked on). Now it is having to increase interest rates to control the inflation it encouraged, which is in turn is inflating bank profits at a time the Reserve Bank says more people will have to lose their jobs to solve the inflation problem. Meanwhile, the low-income renters who are bearing the most inflation pain and got none of its asset-inflation gain, are set to bear the most pain again as the Reserve Bank tries to create more unemployment.

That’s the news: The Reserve Bank said more people would have to lose their jobs because it had no choice but to reduce the inflation it created and which made homeowners and banks hundreds of billions of dollars to stimulate the economy during Covid. It said this on the same day the single biggest beneficiary of the inflationary spike reported it’s making $6m in profit per day.

Dumb question: So why isn’t there a bank profits windfall tax to soften the blow to come of rising unemployment and higher living costs for those who don’t own homes or bank shares? And why isn’t the Government using its own tools to reduce inflation from fees, taxes and charges, along with reducing living costs for the poorest?

Should this be public?

Elsewhere in the news overseas and here overnight and this morning:

US economic growth data was stronger than expected, but in a ‘Goldilocks’ sort of way that allowed investors to continue believing the Fed will have to abandon its fast rate hikes ‘dovish pivot’ now expected later this year as the world’s biggest economy slides into recession;

The European Central Bank doubled its key interest rate to 1.5% overnight, but its comments about future rate hikes and more cautious Quantitative Tightening (reversing money printing) reinforced the wishful thinking of those in financial markets who see a ‘dovish pivot’ coming as Europe’s economy dives even deeper into recession;

The UN Environment Programme said overnight climate pledges were woefully inadequate and put the world on track for a temperature rise of between 2.4C and 2.6C by 2100; and,

Russia’s ambassador to the UK said overnight Russia was not going to use nuclear weapons as Vladimir Putin appeared to soften his rhetoric by calling for fresh negotiations ‘between equals’ to end the war it started in Ukraine.

Coming up later today…

Finally…a draft - The Review into the Future of Local Government governance and financing is set to release its twice-delayed draft report later today on its website here. I’ll be attending a briefing and will update paying subscribers with the initial news and my analysis in the chat on the Substack App.

Also today, I’ll invite paying subscribers to my Ask Me Anything question and answer session on Substack at midday for an hour and The Kākā’s weekly ‘Hoon’ webinar with co-host Peter Bale at 5pm today for an hour.

And later tonight…the Bank of Japan is expected to leave its Yield Curve Control policy (money printing to buy Japanese Government bonds to keep its long term bond yields around 0.0% and below 0.25%) in place, but any change after six years to support a sagging yen could unleash global financial market turmoil. Inflation is now above the Bank’s 2% target.

And tomorrow morning…I’ll be appearing on the panel on TV3’s The Nation from 10.30 am from TV3’s Auckland studio.

In Aotearoa’s political economy

Off like Goff - In a surprise to no one, Foreign Affairs Minister Nanaia Mahuta announced former Auckland Mayor and former Labour Leader Phil Goff would be the next High Commissioner to the United Kingdom.

(Not) digging in the deep - Mahuta also announced Aotearoa would back a conditional moratorium on deep sea mining in areas beyond national jurisdiction.

Deputy Mayors - Laurie Foon and Desley Simpson were appointed Deputy Mayors respectively of Wellington and Auckland.

Sword attack - A 57-year old Coatesville woman was arrested after smashing the glass front door of Jacinda Ardern’s electorate office in Auckland with a sword.

In geo-politics, the global economy, business and markets

Head fake - Data out overnight showed US GDP bounced at an annualised rate of 2.6% in the September quarter, which was much better than the contractions of 0.6% and 1.6% reported respectively in the March and June quarters and better than expected. However, the number was driven mostly by weak consumer demand reducing imports and reducing the US trade deficit. The FT’s Colby Smith had this insight: “The most important proxy for underlying demand in the economy — final sales to domestic purchasers, excluding government spending — rose just 0.1%. That is down from 0.5% in the second quarter and 2.1%.”

Still recession bound - Most economists still see the US economy headed towards a recession by early next year because of the Fed’s tightening this year, which has been the fastest since 1979 and has seen 30 year mortgage rates jump from under 3% to over 7%. US house building and house prices are both now dropping fast.

Not so durable - The US Census Bureau reported overnight that durable goods orders rose 0.4% in September from August, which was less than the 0.6% consensus forecast. Orders for non-defence capital goods orders excluding aircraft, a closely watched measure of US business investment, fell 0.5%, which was the first monthly drop since February and well below the consensus forecast for a 0.5% rise.

So what? - The big question now is when the Fed pivots to slower tightening. It is expected to hike the Fed Funds rate another 75 basis points to a range of 3.75% to 4% next Thursday morning NZ Time (6am) and then signal a slowing in December and early 2023. Global markets saw the US GDP data reinforcing that ‘pivot’ narrative this morning. The US 2 year bond yield, a proxy for Fed Fund rate expectations, fell 9 basis points to 4.32% this morning and is down from a 15-year high of 4.61% last week.

The context - The key event in the last week was a Wall Street Journal piece by ‘Fed Whisperer’ journalist signalling a pivot from next month. The US 10 year yield, which sets the base for global interest rates and is closely watched here by fixed rate mortgage setters, fell decisively below 4% this morning. It fell 8 basis points to 3.92% this morning and is also well below last week’s 15-year high of 4.27%.

So really what? - This will take pressure off the big four banks here in Aotearoa to put up their best fixed mortgage rates by more in the next week before they see the whites of the Fed’s eyes, and we hear more comments from Adrian Orr next Wednesday.

We’ll see - A day before his takeover of Twitter is due to close, Elon Musk tweeted this to Twitter advertisers: “Twitter obviously cannot become a free-for-all hellscape where anything can be said with no consequences!” Having once tweeted that he hated advertising, he said he wanted Twitter to become the most respected advertising platform.

Double banger with a pivot - The European Central Bank doubled its key interest rate to 1.5% overnight, delivering a second consecutive 75 basis point ‘super-bazooka’ rate hike that was in line with market expectations and lifted rates back to 2009 levels. It said more hikes would be needed to shunt inflation lower. Euro zone inflation was 9.9% in September from a year ago. But ECB President Christine Lagarde appeared to soften her rhetoric about future rate hikes, saying the central bank was increasingly aware of the risk of a recession and its effects on the poor. Markets took this as another sign of a ‘dovish pivot’. The German two year bund yield fell 3 basis points to 1.97% overnight.

Climate failure - The UN Environment Programme said overnight climate pledges were woefully inadequate and put the world on track for a temperature rise of between 2.4C and 2.6C by 2100. The analysis of the targets announced by 194 countries, accounting for more than 90% of all greenhouse gases, found there was “no credible pathway to 1.5C in place.” “Global and national climate commitments are falling pitifully short,” said UN secretary-general António Guterres. “We are headed for a global catastrophe. The emissions gap is a byproduct of a commitments gap. A promises gap. An action gap.”

Faceplant - Shares in Meta, the parent of Facebook, fell 24% overnight to 2016 levels after it reported lower profits and lower ad revenue forecasts, which it blamed on a slowing global economy. The market value of Meta fell US$80b in a day to US$271b.

Charts of the day

European gas prices are down >60% from their late August peaks

Useful longer reads

Threads of the day

Spookies, curiosities, profundities and feel-goods

Fun things

Ka kite ano

Bernard

PS: Looking forward to seeing you all via the AMA and the Hoon later today.

Share this post