Long stories short, the six things of interest in the political economy in Aotearoa around housing, climate and poverty on Friday January 24 are:

PM Christopher Luxon’s State of the Nation speech in Auckland yesterday, in which he pledged a renewed economic growth focus;

Luxon’s focused on a push to bring in foreign sovereign wealth funds to pay for new motorways through Public Private Partnerships and promoted farming, mining and fast-track-consenting as sources for growth in the longer run;

His announcement with outgoing Science Minister Judith Collins of reforms to shut down Callaghan Innovation and create four Public Research Organisations (PROs) out of the current seven Crown Research Institutes (CRIs);

The mathematical impossibility for the Government of restarting real per-capita GDP growth while it is also pursuing the most aggressive budget spending cuts since the early 1990s (over $60 billion in spending over the next three years) to crunch the size of Government down from 34% of GDP to under 30% of GDP;

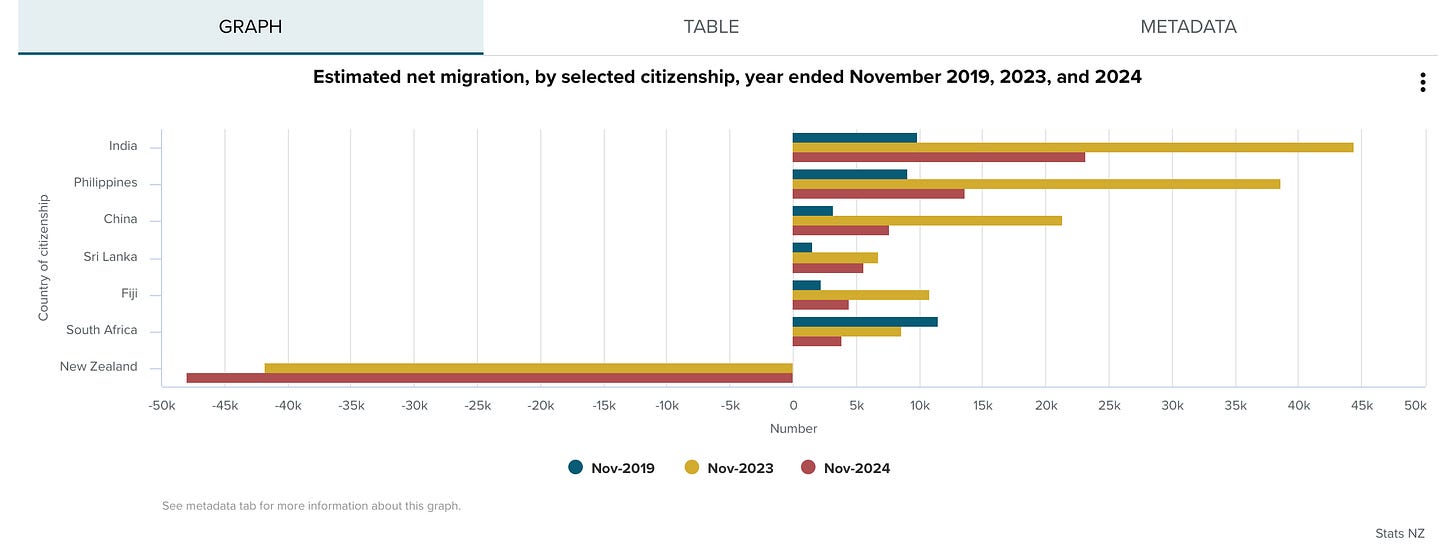

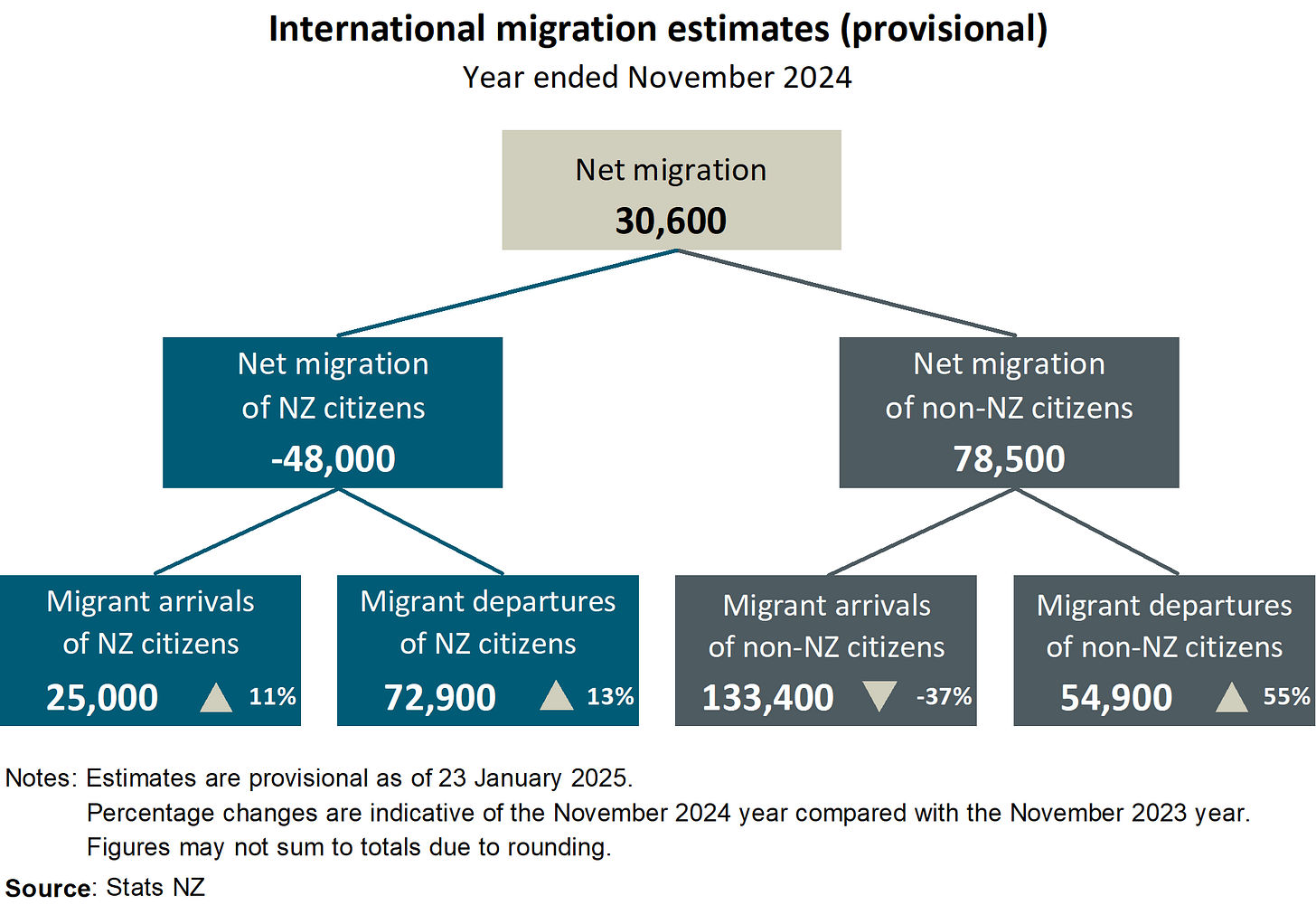

Luxon’s comments about going for short term growth by ramping up tourist numbers and rapidly expanding international student numbers, both of which rely on low-wage population growth, migrant exploitation and nominal GDP growth to drive activity without much investment;

The internal contradictions in the coalition Government crippling a drive to encourage sovereign wealth funds to invest in PPPs, given the last major sovereign-wealth-fund-funded infrastructure project (the Auckland to Airport light rail link project backed by the NZ Super Fund and Quebec’s CDPQ sovereign wealth fund) was blocked at the last minute by NZ First.

(There is more detail, analysis and links to documents below the paywall fold and in the Dawn Chorus podcast and video above for paying subscribers. If we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing. I’m opening this one up early)

‘It’s so great to be here and I’m ready and pumped for 2025’

PM Christopher Luxon focused his State of the Nation speech yesterday at an Auckland Chamber of Commerce luncheon event at the Cordis Hotel on the need to pull the economy out of a two-years-and-counting recession.

He doubled down on the view his Government had tamed inflation by cutting Government spending, which had allowed the Reserve Bank to cut interest rates, which would in turn stimulate the economy.

He emphasised the need to remove obstacles to investing in infrastructure and ushering in foreign investment by sovereign wealth funds to pay for that new infrastructure.

Here’s a sample:

It’s so great to be here and I’m ready and pumped for 2025. I’m here today to talk about the economy – and almost nothing else.

More than ever, I believe that New Zealand is the best country on Planet Earth, and I want to work tirelessly so that we achieve our potential.

I want New Zealand to be a country of aspiration, ambition, and opportunity.

But to meet that moment and to make that vision a reality, we have to go for growth.

It’s just not up for negotiation anymore. Luxon’s State of the Nation speech.

‘We’ll chaperone in tens of billions of sovereign wealth’

The main ‘news’ for the economy in the speech was the creation of a new agency within NZTE to chaperone investment by foreign sovereign wealth funds in PPPs for infrastructure projects.

Substantial changes to the Overseas Investment Act will also be critical, to encourage more investment to flow into our economy.

But solving the legal barriers isn’t enough. That’s why, modelled off the success of Ireland and Singapore, I can announce today we have agreed to establish Invest New Zealand as the Government’s one-stop-shop for attracting foreign direct investment.

Invest New Zealand will roll out the welcome mat – streamlining the investment process and providing tailored support to foreign investors.

The objective is to increase capital investment across a range of critical sectors – like banking and fintech, key infrastructure like transport and energy, manufacturing, and innovation. Luxon’s State of the Nation speech

Callaghan Innovation canned and 7 CRIs cut into 4 PROs

Luxon suggested some of the foreign investment would go into science and R&D. He said New Zealand should copy the success of Ireland, Singapore & Denmark in ramping up foreign investment in technology and startups creating high-wage exports.

Here’s his thinking:

The prize – if we can get it right – could be game-changing for New Zealand.

In Denmark – a country like New Zealand of around five million people – recent pharmaceutical breakthroughs have delivered a modern economic miracle – creating a tidal wave of growth, employment, and opportunity. Luxon’s State of the Nation speech

In my view, there are problems using Ireland, Singapore & Denmark as models. Both Ireland and Denmark have promoted themselves as launchpads for US and Asian companies into the European Union, which New Zealand is not a part of.

Ireland has also used huge tax breaks to bring in Foreign Direct Investment (FDI), which New Zealand can’t and won’t do without a major restructure of its revenue base to tax wealth, income and spending more. Denmark has Novo Nordisk, which makes global weight loss blockbuster drugs Ozempic and Wegovy. We don’t.

Singapore has thrived by welcoming in foreign investors and funds with similar tax breaks and a focus on being a safe and secret place for wealth from China and Southeast Asia to be parked. It also bases its appeal on having a large and well educated workforce that can afford to live in state-provided housing.

The maths of relying on FDI & private debt doesn’t work

In my view, the maths behind relying on Foreign Direct Investment (FDI) and household and business investment to fill the gap left by the Government sucking four percentage points a year out of the economy just don’t work.

Luxon again made the point in comments in his ‘fireside’ chat with Chamber of Commerce CEO Simon Bridges that he was following the playbook of National’s Government from 1990 to 1996, which simply slashed spending to take inflationary pressure out of the economy and relied on lower interest rates to fill the gap.

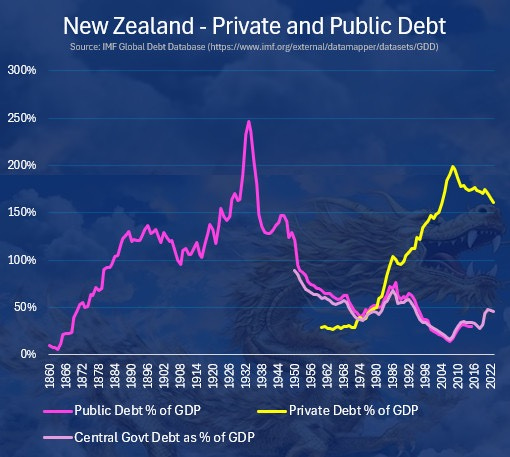

But back in the early 1990s, household debt was much lower and banks still lent to businesses to invest in growing businesses. Also, unemployment was much higher, so it was easier to grow through the 1990s by simply mobilising spare labour and using under-used infrastructure.

Now households either can’t afford to borrow more to pump into the economy through the housing market, or the Reserve Bank has put limits on how much they can borrow because the banks are now much more leveraged to a much-more-highly valued housing market.

In short: the Reserve Bank’s Debt To Income multiple limits applied from July 1 will shut down any attempt to replace the Government debt with household debt.

The scale of the gap at over $60 billion means there is nowhere near enough FDI investment to fill the gap, even if the sovereign wealth funds can get over the experiences of CDPQ and South Korea’s Hyundai Mipo Dockyard was stiffed by this Government’s decision to reneg on the iRex ferry deal.

‘We’ll use students & tourists to pump GDP in the short run’

In the fireside chat and in the post-speech news conference, Luxon repeatedly referred to tourism and international education as ways to juice GDP in the short run. That tallies with Nicola Willis’ comments on Wednesday about growing low-value tourism, which Queenstown’s mayor rightly questioned, given infrastructure shortages and a lack of Government investment.

The most interesting moment of the day was as Luxon was walking away from the news conference after talking about international students and tourism. TVNZ’s Maiki Sherman asked where the students would live and the tourists would stay.

She could easily have asked where they would go to the toilet as well.

Chart & table of the day

Cartoon of the day

Timeline cleansing nature pic of the day

Ka kite ano

Bernard

Join me for my next live video in the app

Share this post