Why the banking study was needed and where it should look

Govt orders market study into retail banking only; business banking carved out; initial issues paper due in August, but final report due Sept 2024; Draft open banking bill due later this week

TL;DR: As foreshadowed on The Kaka last month, the Government has announced a market study into high bank profits, but unexpectedly carved business banking and bank culture out of the inquiry.

Finance Minister Grant Robertson also appeared to pre-determine that banks did not make windfall profits during Covid, even though they received billions in subsidised loans and high interest deposits from Te Putea Matua (The Reserve Bank), which also relaxed regulation limiting the banks’ growth in risky (but profitable) home loans during the crisis.

Robertson and Commerce Minister Duncan Webb announced the inquiry this afternoon and gazetted the terms of reference1. which were notable for not including the words ‘profit’ or ‘profitability’ in them. The focus was very much on barriers to entry for competitors, the ability to switch banks easily and openness to new technology and services.

Given the shape and detail of the terms of reference, my expectations now are:

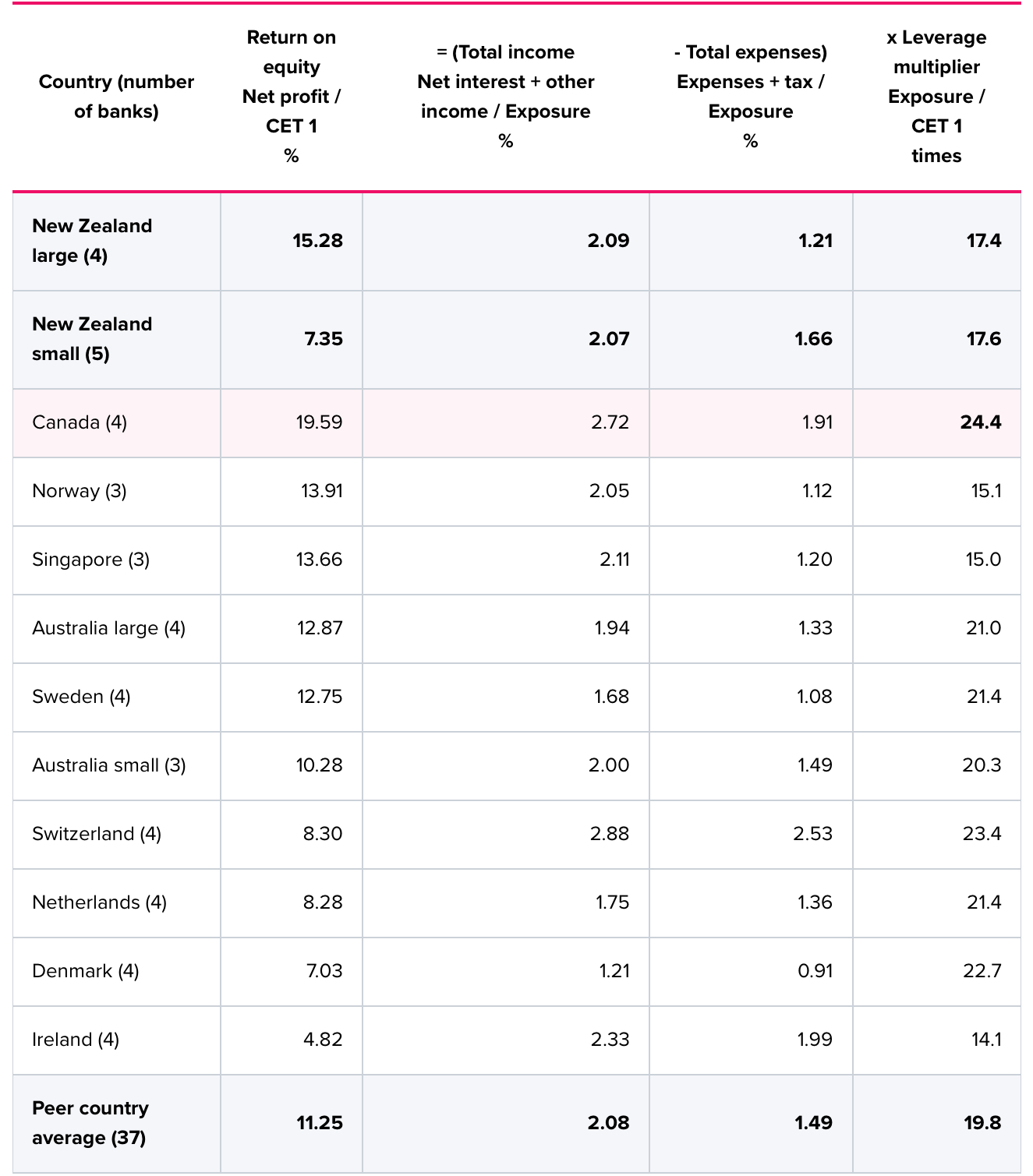

the big four Australian-owned banks will be able to easily fend off any meaningful change to their mortgage banking business model, which makes them the most profitable banks in the world relative the risks taken by the banks’ shareholders and is essential to the savings and investment lives of median voters who pump most of their wealth into leveraged land not subject to taxes on capital gains;

the banks will be able to further delay any substantial opening up of their networks and customer data to FinTech competitors by warning about risks to payments infastructure from cyber-attacks, despite UK and European banks already having to offer open data APIs for FinTechs for 15 years; and,

the banks are likely to ramp up their competition for mortgage lending in the coming months through to the election, using some of their higher lending profit margins from recent years to cut fixed mortgage rates; and,

the banks will be ready to launch a new explosion in mortgage lending cross-subsidised from deposit and business bank customers to first home buyers and rental property investors if there is a change of Government, given recent relaxations in Reserve Bank, CCCFA and Kainga Ora home loan rules on leverage and early signs from mortgage brokers banks have already begun loosening their home loan purse strings.

Usually, I put in a paywall for paying subscribers at this point in the email newsletter. But I want to experiment until the end of June with publishing everything to everyone immediately to see what happens with subscription rates, revenues and email opening rates. I want to thank paying subscribers in advance, who are still the only ones able to comment and get access to our very active chat section and webinars. Join our community by subscribing in full to support my journalism in the public interest about housing (un)affordability, climate change (in)action and poverty (not enough) reduction.

A partial bank inquiry and an early judgement

The announcement of a (retail only) banking inquiry shorn of the ability to look at bank culture and behaviour suggests less-than-threatening outcomes for the banks are likely, just as they ended up being for retail fuel, supermarkets and building materials.

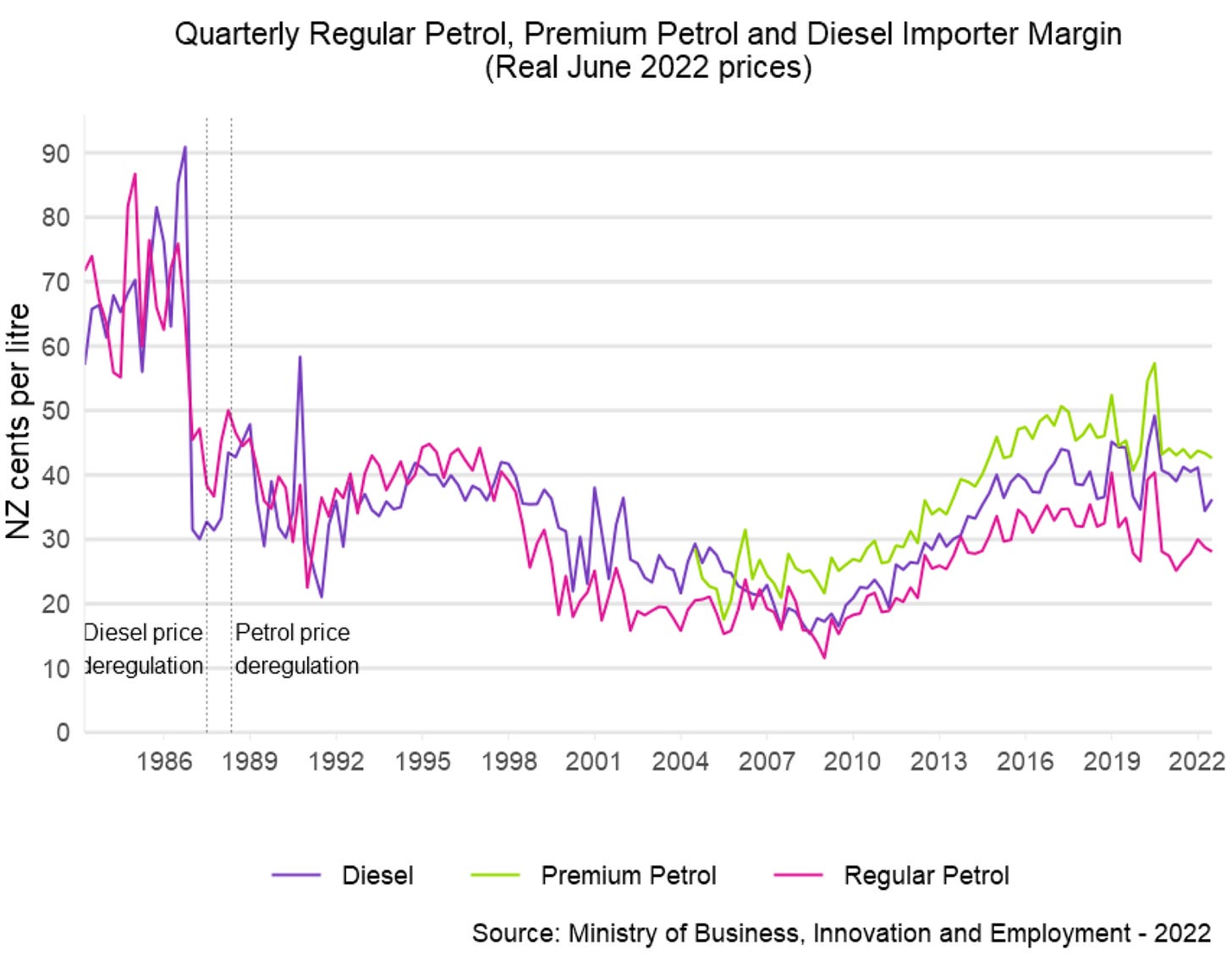

Retail fuel margins (see chart below) have stopped rising since tweaks to industry rules were made in the wake of its market study, rather than fallen after sharp rises in preceding years. Supermarket profit margins remain robust with growing questions about whether they will pass on lower global food prices. Building materials makers have reported buoyant profits this year after increasing prices faster than inflation generally in the years during and after the inquiry.

We live in a vetocracy where the forces of the status quo are usually able to effectively block major change by delay, denial, dissembly and defending existing market structures.

What’s in and what’s out

The terms of reference for the banking study have carved out substantial areas for the Commerce Commission to study and, as mentioned above, failed to mention profits (although profitability was mentioned in the ministerial statement). In particular, the Government has decided not to look at bank ‘conduct and culture,’ which was studied by the FMA and RBNZ in 2018 and reported on, with few consequences for the banks, or their profits, which have risen sharply since.

Here’s the comments from Robertson and Webb on these issues, and the full news conference below that.

“I want to be clear this study is not about bank conduct and culture. The Financial Markets Authority and Reserve Bank carried out an investigation in 2018 into this issue which has already resulted in a number of measures to protect consumers.” Grant Robertson in the announcement.

Webb talked about an early report in August this year, before a final report in August of next year, and the Government’s ongoing work on open banking.

“As part of the study, the Commission will examine banks’ profitability and other financial measures to assess competition in the sector. The study will be completed by the end of August 2024 and will determine any actions needed to make sure competition is working for bank customers.

“In the interim, the Commission is expected to release a preliminary issues paper in August this year. I expect this paper will describe the structure of the industry and provide early indications on the nature of competition. It will set a clear signal of direction for the study and may uncover discrete issues which the Government could take steps to resolve, ahead of the final report.” Duncan Webb

The language in these statements, and in the news conference below, suggests few major changes are contemplated or likely to be announced before the election. Robertson said there was no significant evidence to suggest banks made huge windfall profits during Covid. (13 mins) See more here from me in July last year on the subsidies.

High profits for low risk

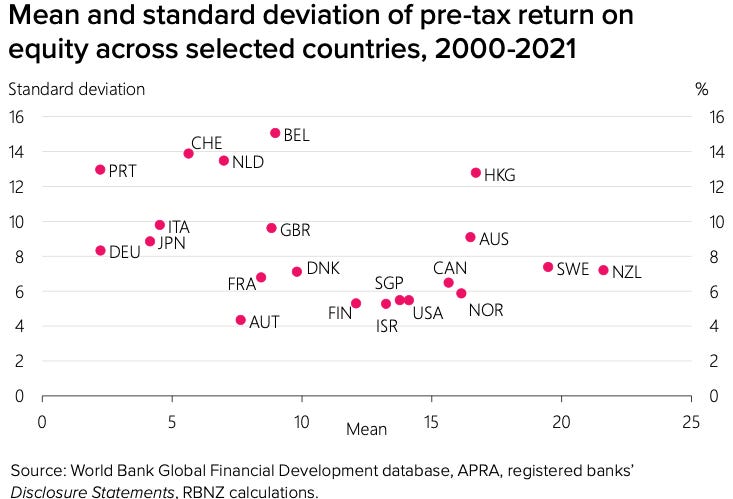

The best and most estimates of whether the banks are making super profits came from the Reserve Bank early last month in this paper, which I did an analysis of at the time. This chart below and table below that is clear evidence of record high profits with record-low risk, relative to other banks in other countries.

Other reactions to the inquiry

The NZ Bankers Association wrote its members would engage constructively with the inquiry. CEO Roger Beaumont was confident the sector would show New Zealanders were well served by banks. He gave an early indication of the banks’ lines of defence.

“Banks are among our biggest businesses so their profits look big. They also contribute their fair share to New Zealand. Last year banks made a net profit of $7.18 billion. They also spent $9.1 billion running their businesses and paying tax here. That’s a net positive contribution of $1.92 billion – before you take into account the contribution banks make in funding household and business needs, to the tune of $535 billion. Providing a return to shareholders helps maintain their investment in New Zealand, and ultimately some KiwiSaver funds share in those returns.” NZBA CEO Roger Beaumont in a statement.

MonopolyWatch NZ spokesperson Tex Edwards was less complimentary, describing it as a ‘Dr Dolittle’ inquiry and calling on the Commerce Commission to learn from the first three market studies.

“An initial gust promises change but ultimately fizzles out when it comes to recommending substantive changes that will improve competition and benefit consumers.

“The threshold of inquiry needs to be raised so it answers the question: what will it take to create more effective competition in banking? The role of the Commerce Commission should be to fix broken markets, not simply inquire into them, and a market study should be a means to that end, not an end in itself.” Tex Edwards in a statement.

Edwards called on the Commission to make it compulsory for industry members and Government departments to appear before the inquiry and make submissions. That was missing from previous inquiries.

Ka kite ano

Bernard

I have deleted the reference to the gazetted statement not including the word profitability. There was a paragraph at the end which referred to profitability, but appeared to me to be in the context only of new products and services, as opposed to banking as a whole. “Any impediments to new or innovative banking products or services comparative indicators of bank financial performance (including prof-itability).” It looks to me like a dropped bullet point. I apologise to readers and to Duncan Webb for my error. However, the exclusion of business banking from the study means it will be impossible for the study to properly measure or compare NZ bank profitability with overseas peers, who report profitability overall, including business banking.

Is there any sense to the notion that these market studies may even be worse for consumers in the medium term? Surely they at least give the industry an excuse to raise profits to hedge against 'the potential for increasing costs to regulatory compliance', or some other nonsense

So the last enquiry (supermarkets) concluded there was a severe structural problem then our Commissioners decided we did not need a structural solution. The continued failures to regulate competition are crushing productivity growth. The eventual outcome of this failure to "grow some" is that we will become a State of Australia. At least banking will be cheaper!!!!!!