TL;DR: Prime Minister Christopher Luxon has adopted the language of Ruth Richardson before her 1991 ‘Mother of All Budgets’ in arguing for benefit sanctions to bolster the Government finances, which he said were in such a mess that there was a risk of losing the confidence of creditors.

Luxon said it was time New Zealanders had a ‘grown-up conversation’ about the ‘brutal facts of our reality’ and he would not shy away from taking ‘hard decisions’.

But just how perilous is the Government’s financial position? And if it is in such a mess, who should bear the brunt of the ‘hard decisions'?

Actually, the evidence shows Aotearoa-NZ’s financial position is nowhere near as troubling as it faced in 1991 and even if it was, the really ‘hard decisions’ would be to follow the advice of the financial grown-ups of the world. The IMF, the OECD and the World Bank have advised New Zealand to tax capital gains, to focus on much faster reductions in climate emissions and to avoid pointless austerity that widens inequality and would scar another generation, similar to the scars still there from the 1991 ‘Mother of All Budgets.’ (Paying subscribers can see more below the paywall fold and hear more in the podcast above, although they’re also welcome to ask me to open it up for public consumption. I’ll also open it up if there’s more than 50 likes.)

Elsewhere in the news in Aotearoa-NZ’s political economy today:

ANZ’s economists have published a longer-term forecast with a scenario that would require the Reserve Bank to increase the Official Cash Rate another 150 basis points to 7.0% to control inflation, which would see mortgage rates rise towards 10%;

Waka Kotahi-NZTA staff bought unbranded high-viz jackets and hard hats for Christopher Luxon and Transport Minister Simeon Brown to wear at the reopening of State Highway 25a late last year, in order to avoid them being shown wearing jackets and hats with the ‘wrong’ branding highlighting the Waka Kotahi part of the agency’s name, which Brown had just ordered be changed, Newshub’s Amelia Wade reported last night.

Buildhub, an Auckland-based labour hire firm specialising in importing temporary construction and trades workers from Latin America, collapsed on Friday with as many as 200 migrant workers left in limbo, similar to the situation faced by migrant workers on Accredited Employer Work Visas stranded after the collapse of ELE Holdings just before Christmas. Immigration NZ statement Stuff Susan Edmunds RNZ (August)

Why we’re nowhere near as fragile or lazy as Luxon says

Prime Minister Christopher Luxon and Social Development Minister Louise Upston justified threats to cut the benefits of people on the jobseeker benefit last night by arguing the nation’s finances were in a mess and ‘hard decisions’ were necessary.

Upston announced she had written to the CEO of MSD, Debbie Power, ordering a more rigorous application of existing sanctions, and the preparation of a new ‘traffic light’ system for later in the year:

“Our priorities are for a much stronger focus on the obligations of jobseekers to actively look for work and to take all practical steps to prepare themselves for work. If they fail to take work that is available, to attend interviews or to complete their pre-employment tasks, there needs to be consequences. This could encourage people to then meet work obligations and gain the benefits from being in employment.

“I understand that a more comprehensive sanctions package including the traffic light system will take some time and needs to go through a careful policy programme. However, in advance of that substantive piece, it is my expectation that the Ministry apply the obligations and sanctions that already exist.” Upston letter to Power.

Luxon introduced Upston at his post-Cabinet news conference last night with this pre-amble:

“This Government inherited a country in decline, and as you heard in my state of the nation speech yesterday, this will require some hard decisions to repair. But we are also a Government that is prepared to make those hard decisions.” Luxon in post-Cabinet news conference transcript

It followed on from his State of the Nation speech on Sunday, in which he argued:

We need to get the public finances back in order.

That means a return to the orthodoxy of tight budgets, careful stewardship of public money, and a determined focus to keep or return the books to surplus.

Strong public finances aren’t enough of course to deliver a strong economy in their own right – but they are a critical pre-requisite.

We can’t build infrastructure if we can’t be trusted to borrow money. Businesses can’t attract investment if there’s no confidence in the value of our currency.

And should disaster strike, we will need the financial freedom that low debt and healthy surpluses provide to fund the necessary rebuild.

Now that won’t be popular with everyone – but it is necessary. More spending, more borrowing, and more taxes isn’t a pathway to prosperity, it’s a recipe for more of what we’ve seen from the last few years. Rampant inflation, higher interest rates, and an economy going nowhere fast.

The state of the nation is fragile. Luxon State of the Nation speech

Challenged in the news conference if he was being serious with his warnings, or was simply managing expectations, Luxon said:

“No, not at all. What I’m just trying to do is—I just think that. I just think that New Zealanders need to have a grown-up conversation and that the Prime Minister should be able to say, really upfront and really straight-up, “Hey, look, these are the challenges that we’ve got. This is the situation we’ve inherited. This is the mess that we’ve got left behind by the previous Government. Let’s face up to the brutal facts of our reality whether we like to hear it or not, and then let’s put a plan together to actually get ourselves to a much better place.” Luxon in the news conference transcript.

So are the Crown’s finances fragile? And what do the grown-ups say?

There are ways to measure how fragile a sovereign nation’s finances are and there is an entire group of well-paid and independent professionals who assess the fiscal ‘fragility’ of Governments on a day-by-day and minute-by-minute basis.

A ‘fragile’ nation on the verge of being locked out of global financial markets would be one where ratings agencies have warned of ratings downgrades, bond yields were rising sharply and the margin between New Zealand and US Treasury bond yields, the base for global interest rates, would be blowing out.

The most obvious signs of fragility or some sort of financial stress would be when New Zealand Government bond yields jump unexpectedly and more than bond yields in countries such as Australia, Britain, Canada, the European Union and the United States, all of which have similarly open and democratic economies with truly floating currencies and free movements of capital. Remember that bond yields rise when bond prices fall.

The best example was from early 1991 when S&P threatened New Zealand with a two-notch downgrade, forcing Richardson to fly to New York to beg not to be downgraded. That was back when New Zealand’s government debt was issued in foreign currencies, high relative to GDP and issued for short terms. She agreed to cut benefits early in 1991. They were announced in the 1991 Budget.

The ‘wisdom of the crowds’ in financial markets is that NZ is just fine

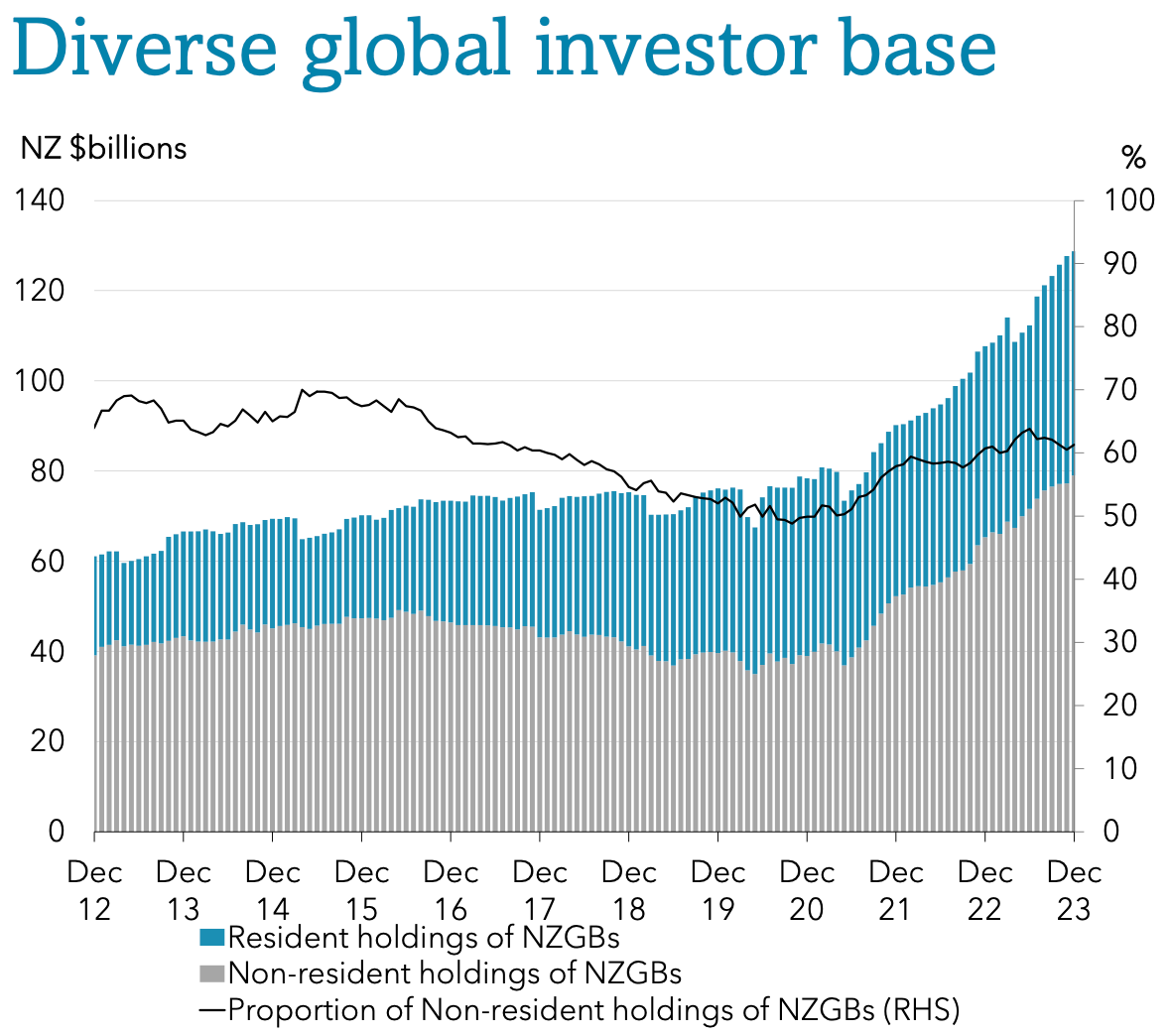

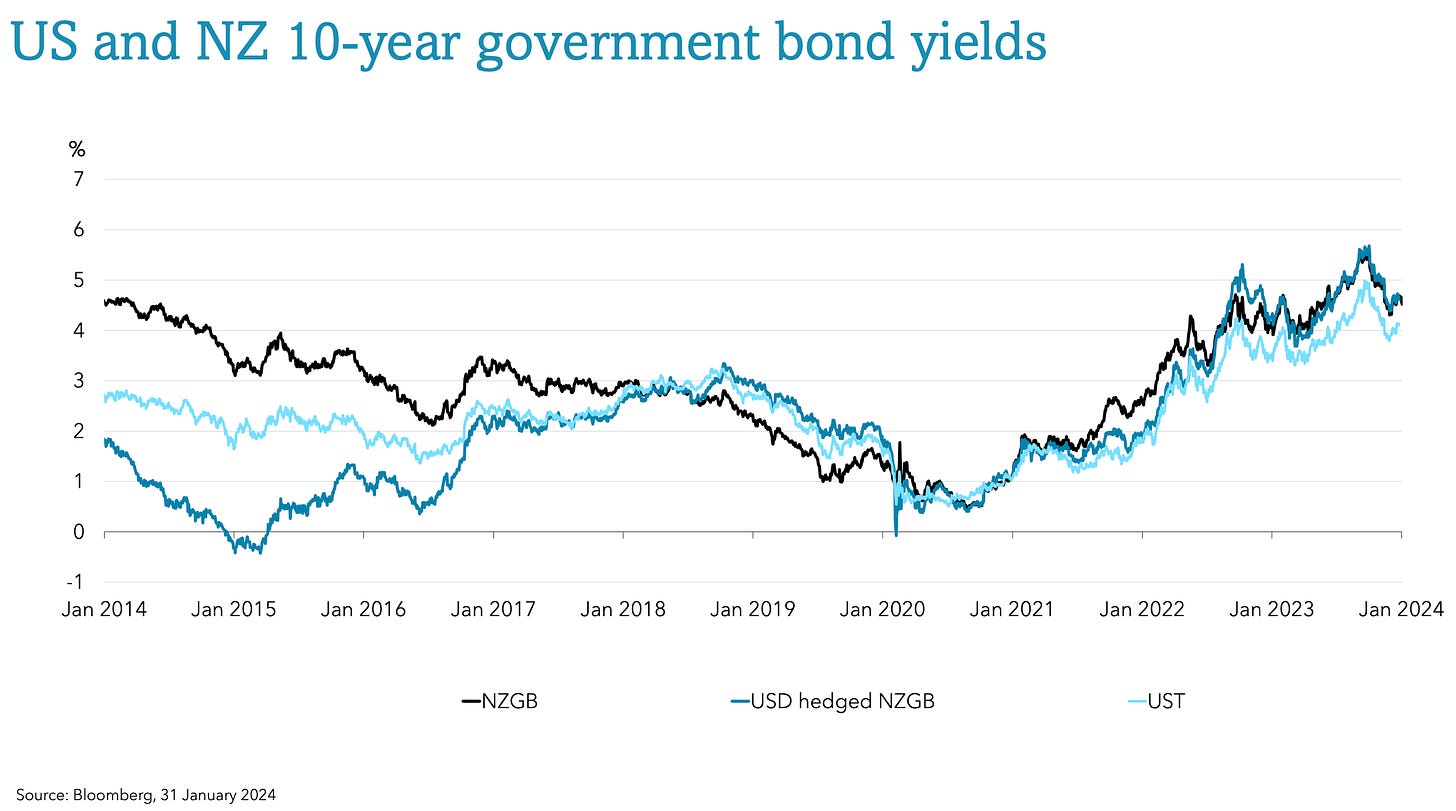

Here’s the chart showing New Zealand 10-year Government bond yields and the margin to US 10-year Treasury yields over the last ten years, including that there was an improvement (ie a smaller margin) of about 150-200 basis points from 2014 through until late 2020 and then relative stability within a range of 20-50 basis points ever since. Some of the improvement reflects a worsening of the US fiscal position under President Donald Trump.

International investors have increased their holdings of New Zealand Government bonds by about $25 billion to almost $60 billion since Covid. Local Kiwisaver and other funds are also big buyers of NZ Government bonds, increasing their holdings by around $20 billion to $35 billion.

Standard and Poor’s reaffirmed New Zealand’s AAA sovereign local currency and AA+ sovereign foreign currency credit rating with a stable outlook at the beginning of September. The Government issues bonds in New Zealand dollars now and for long durations, rather than foreign currency bonds it used to issue for short durations.

“The stable outlook on our long-term sovereign credit ratings on New Zealand reflects our assessment that the country's excellent institutions, wealthy economy, and moderate public indebtedness will balance credit risks associated with a large current account deficit, high levels of external and private-sector debt, and volatile property prices over the next two years.” Standard and Poor’s rating verdict statement.

Moody’s reaffirmed its AAA sovereign foreign currency credit rating with a stable outlook on December 13.

What about now? Surely the ‘budget surprises’ are spooking investors?

No. The grown-ups in the room are actually reporting strong demand for New Zealand Government bonds in the last week, including a solid response to a new 30-year duration bond announced by Treasury’s Debt Management Office (NZDM) today.

Here’s BNZ’s Senior Markets Strategist Jason Wong commenting last Friday after a successful Government bond auction last week (bolding mine):

The NZDM weekly tender attracted strong demand, helped by NZGBs underperforming swaps heading into the event. Bid cover ratios were between 3-4 across the three lines of nominal bonds offered, signalling strong demand, a good signal ahead of next week’s likely syndication of new 30-year bonds. By the close, NZ rates had ended up falling by even more than Australian rates, with a chunky 14bps fall in NZGB yields across the curve.

BNZ Senior Market Strategist Jason Wong.

That is not a picture of fragile confidence in the New Zealand Government’s finances. That says investors are more confident, and relatively more confident than in even Australian bonds (on that day at least).

So are sanctions actually a good idea independently?

The news conference exchanges showed that Upston and Luxon had ignored the 2018 conclusions of the Welfare Expert Advisory Group (WEAG) that there was little evidence to show sanctions actually worked to push people into work in any sustainable way that wasn’t also damaging to wellbeing. Here’s the MSD conclusion from 2018 (bolding mine):

“The available empirical literature and complementary contextual studies suggest that policy design and administration needs to carefully balance the benefits and potential negative effects of work-related sanctions. Empirical evidence provides no guidance on sanction severity that could be considered ‘ideal’ in achieving this balance. However studies of regimes less severe than New Zealand’s show they can be effective in encouraging movement from benefits to work.

“Evidence from the US and UK suggests that a very harsh sanctions regime can have important adverse effects that drive people away from, rather than closer to, employment, and might worsen rather than improve the long-term chances of children in the families affected.” MSD advice to WEAG in 2018.

Instead, Upston and Luxon repeatedly referred to broad OECD research from overseas in 2010, which did not consider New Zealand data.

This Beneficiary Advisory Research note from 2021 found:

The financial penalty of a sanction resulted in research participants and/or their dependents going without necessities, for example, food, electricity and medications. Research participants reported using food banks/ community pantries, stealing, and foraging for food because of sanctions, as well as taking out loans and begging.

Over and above the immediate financial pressure of sanctions, participants reported a significant degree of ongoing anxiety related to income precarity.

Many participants reported being sanctioned because of administrative errors or because they lacked a clear understanding of the obligations associated with their benefit.

Our findings contribute to a growing body of research that suggests sanctions encourage ineffectual compliance rather than encourage positive job-seeking behaviour. Beneficiary Advisory Research paper funded by NZ Lottery Grants board.

‘Well…there’s a correlation that looks like causation’

When pressed on why the Government was pressing ahead without a financial imperative or recent local research to show sanctions worked to increase labour force participation, Upston and Luxon pointed to higher numbers on the Jobseeker benefit and the decline of the use of sanctions since 2017.

“The current data that we have around jobseeker numbers and the decline of use of sanctions gives up a pretty good steer.” Louise Upston in the news conference.

So the Government is relying on a bald statement of financial fragility unsupported by bond prices, ratings agencies and bond investor sentiment, and a pure reckon based on a correlation between two numbers and a 14-year old view from overseas, rather than peer-reviewed research from New Zealand data collected by MSD five years ago.

This is not an evidence based policy. Eventually, Upston and Luxon admitted the policy was a directive based on the perception it was unfair for taxpayers to pay money to people who did not work, or look for work. Here’s the exchange:

Media: Why would you prioritise the research of an OECD report that is 14 years old that encompasses a bunch of countries rather than MSD research that is specifically about New Zealand and done in a shorter space of time? Your critics might look at that and say you're cherry-picking data.

Hon Louise Upston: Look, if you want, there's two sets of research that give different messages, but the statistics, that is the strongest empirical evidence.

Media: But how? The MSD ones are talking about New Zealand—

Hon Louise Upston: 70,000 more people on the jobseeker benefit at the same time that we've seen a 58 percent reduction in the use of sanctions. That’s evidence enough for me to be deeply worried about the number of New Zealanders not in work today that we could be supporting to be a life of greater choice and opportunity through work.

PM: It’s about principles—that you have an obligation, and we want to make sure— Media: It should be about statistics, not principles.PM: No, it is about principles. Because, actually, we have an obligation here in New Zealand to make sure that you're holding your end up. Taxpayers are paying your benefits— so they support you at a time when you desperately need it. That's great. That's what we want to make sure is always the case here in New Zealand. We’re just making sure that everyone understands their obligation. The equivalent part of that equation is you've got to hold up your responsibility to deliver on your obligations. So just making sure that we are acting and making sure that we are enforcing the current sanction regime that has been in power, been in law, for a long period of time—that's not unreasonable.

The question then is what is reasonable for a taxpayer to expect for the money they pay to people to keep them out of poverty. And who is a free rider?

How about the $1.1 billion paid last year in New Zealand Superannuation payments to 55,000 people aged over 65 who were also earning over $100,000 per year from their jobs?

Cartoons of the day

Economic burdens

A happy tune?

Timeline cleansing nature pic

Got your fluff on?

Ka kite ano

Bernard