TL;DR: National’s tax switch plan creates a direct wealth transfer from beneficiaries to landlords totalling $2 billion over four years, CTU analysis out this morning finds, including mega-landlords with over 200 rentals each getting $1.3m. Each.

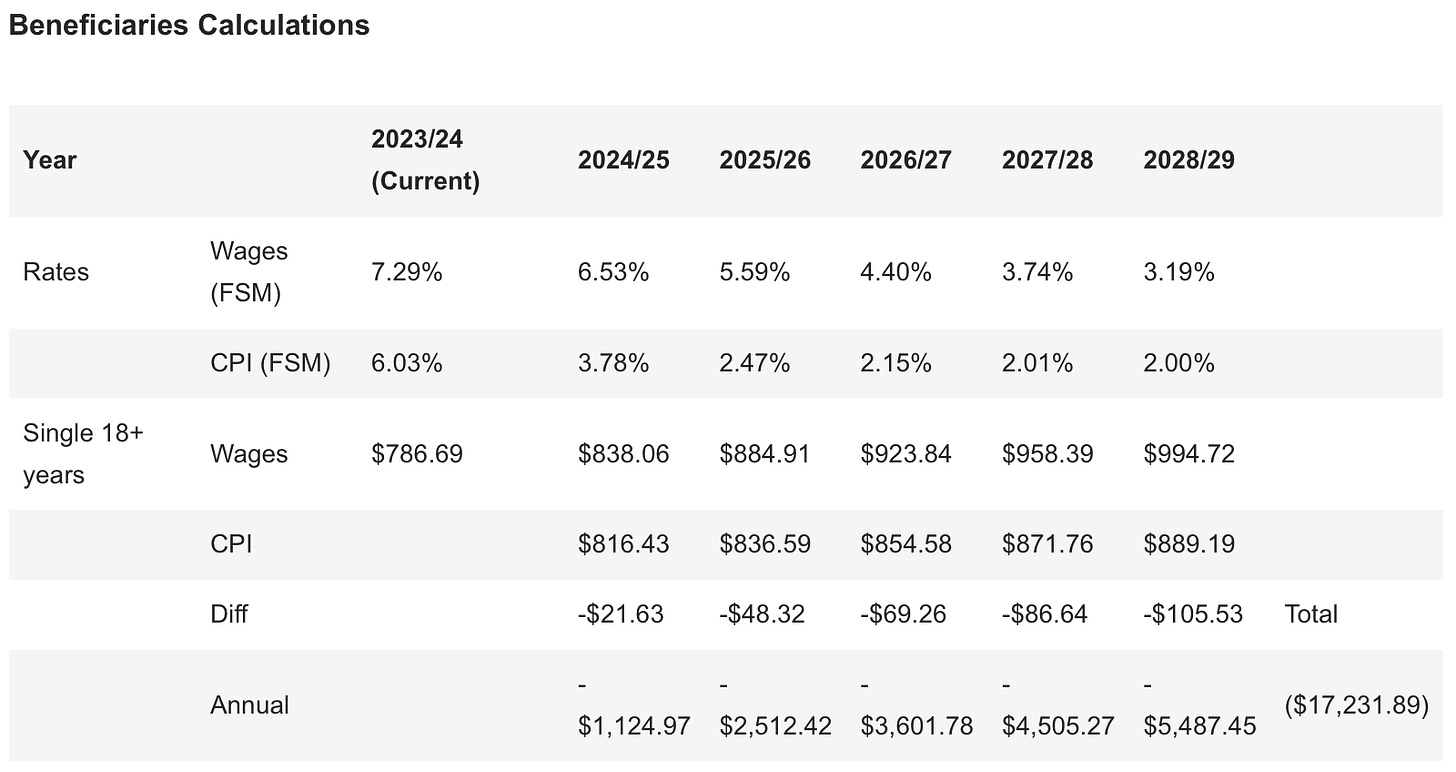

The proposed tax switch of changing interest deductibility rules and reducing the bright line test for capital gains from rental property trading in exchange for moving indexation for beneficiaries from wages to prices will see $464 million in tax benefits go to 346 landlords with over 200 rentals each, while 350,000 people on benefits will each receive $17,000 less in benefits over four years.

In my view, this fails the ‘distributionally neutral’ test set by John Key and Bill English in 2010 when they engineered their GST-hike for tax-cuts switch, albeit after Key had ruled out a GST hike in the 2008 election campaign.

Elsewhere in the news this morning:

The Port Waikato by-election will be held on November 25, which means a hung Parliament or close election forcing extended coalition negotiations could delay the final makeup of Government until well into December;

Christchurch’s mens prison hit its operational capacity of 700 over the weekend, forcing prisoners to be held in Police cells and forcing Corrections into “emergency planning,” Stuff reported this morning; and,

Over 200,000 people don’t have a GP, The Post-$$$ reported this morning from data obtained under the OIA, while more than half of parents are concerned for the mental health of their children, a survey for NIB NZ in June found.

Paying subscribers can see more detail below the paywall fold and hear more of my analysis in the podcast above. I welcome comments and ‘likes’ from paying subscribers about whether to open this up for public consumption and redistribution. I’ll open it if we get over 50 likes. Thanks to paying subscribers in advance.

The wrong kind of tax switch

The great GST-hike-for-income-tax-cuts switch engineered by then-PM John Key and then-Finance Minister Bill English in 2010 has been a model over the years for both sides of politics. It seemed to thread the needle of political impossibility by ‘buying’ one type of tax hike with an equal amount of tax cuts elsewhere, while also avoiding being seen as a ‘cash splash’ that would create inflation.

Finance Minister Grant Robertson and then-Revenue Minister David Parker both referred to the ‘fair tax switch’ idea to justify their now-abandoned idea for a wealth-tax-for-income-tax switch earlier this year.

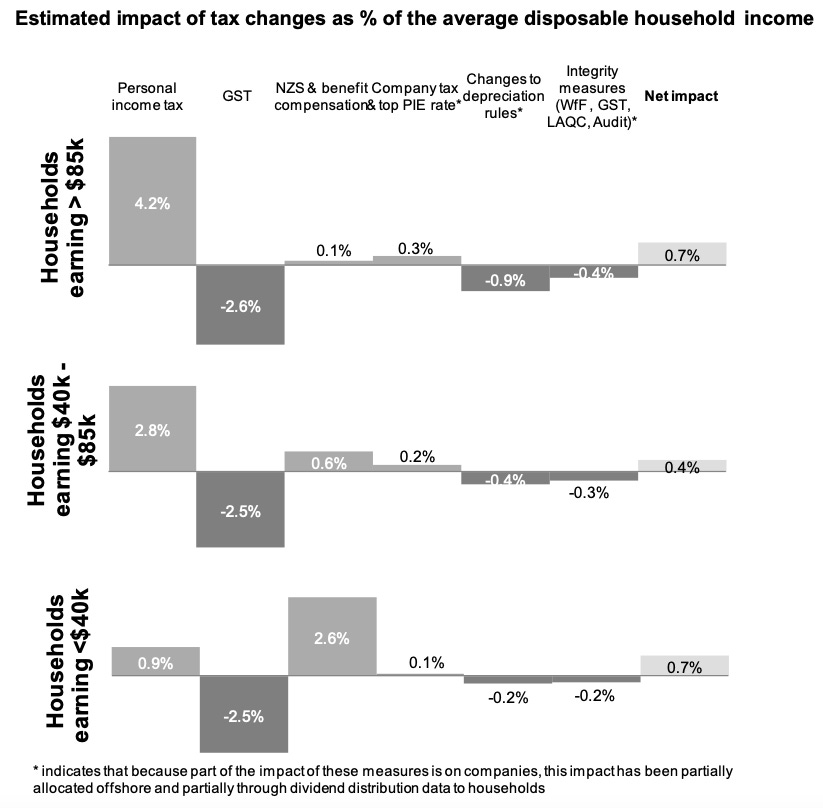

The ‘Great Tax Switch’ in 2010 was presented as fair in that the losses from the GST hike from 12.5% to 15% were presented as gains for the same (or least similar) taxpayers in the form of income tax cuts and tweaks to Working For Families. Key and English sold it as both fair and fiscally neutral, which negated any fair any tax cut stimulus would simply be offset by higher mortgage rates.

It was presented thus in their May 21, 2010 announcement at the culmination of their Tax Working Group1 reform process through 2009 and early 2010 (bolding mine)

The overall tax package has a broadly distributionally-neutral impact across household groups as a proportion of income. These form part of a package of changes that overall are broadly fiscally neutral. Beehive’s May 21, 2010 announcement

Clever, but not fair

This idea of a politically clever ‘fair and fiscally-neutral tax switch is at the heart of National’s proposal at this election for $14.6 billion worth of tax cuts, paid for by:

cutting Government spending on ‘back offices’ and contractors;

using climate funds being paid to corporates and Tesla buyers;

removing depreciation as a tax break for commercial building owners; and,

a new tax on foreigners buying properties worth more than $2 million.

The ‘losers’ in the switch are presented as corporate welfare types, foreign buyers and wasteful bureaucrats, while the winners are the ‘squeezed middle’ dealing with the ‘cost of living’ crisis.

But unlike the ‘Great Tax Switch of 2010, this one is not presented as distributionally neutral, either in income or wealth terms. The suggestion (only) is that it’s fair because ‘hard-working Kiwi families’ are the winners and ‘others’ are the losers, including ‘others’ seen as allies of National and the centre-right in the form of corporates, commercial property owners and foreign buyers.

But, in my view, there’s a big problem with this argument. It is deeply unfair in a way the 2010 tax switch was not.

In effect, it is a one-for-one switch in cash going from 350,000 beneficiaries who can least afford it to less than 100,000 landlords and don’t need the cash, including a quarter of that $2 billion going to less than 350 landlords.

The losers are the 350,000 beneficiaries who will miss out on about $2 billion in income over the next four years because of a type of ‘neutron bomb’ cut to benefits through a change in indexation for ‘main’ benefits from wage inflation to price inflation. The proof it is targeted at the poor, rather than is applied fairly across the board, is that recipients of NZ Superannuation will continue to get their $19 billion a year of benefits indexed to wages. Changing that would have cut benefit costs by $12 billion.

The beneficiaries of this one-for-one switch of $2 billion over four years are rental property investors through the reversal of the interest deductibility rule and winding the bright line test back from 10 years to two years.

$1.3m per mega-landlord, while disabled benefit cut by $17,000

CTU economist Craig Renney published an analysis verified by tax accountant Terry Baucher this morning that pulled together data and reports from various official sources to show:

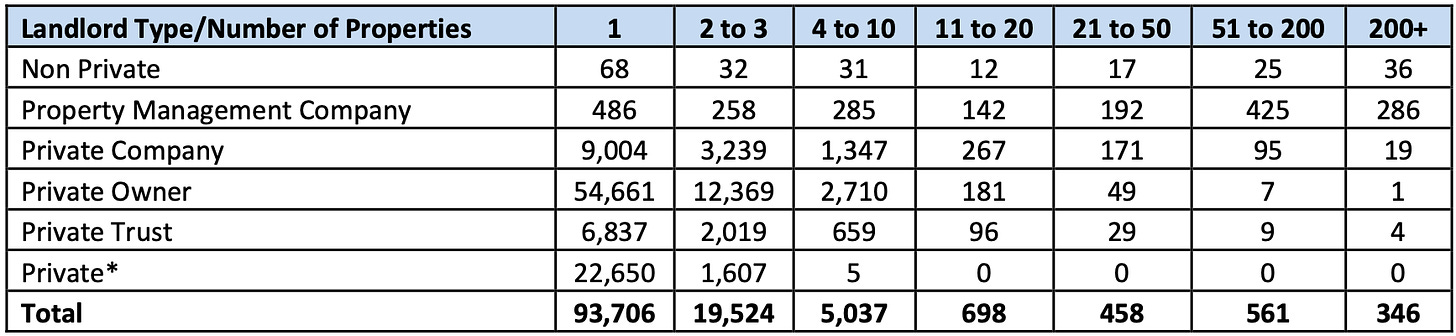

MBIE data from bond lodgement data in 2021 revealing that 346 landlords owned more than 200 rentals each, with around 20,000 of the 120,000 landlords who have lodged bonds owning more than 200,000 rentals;

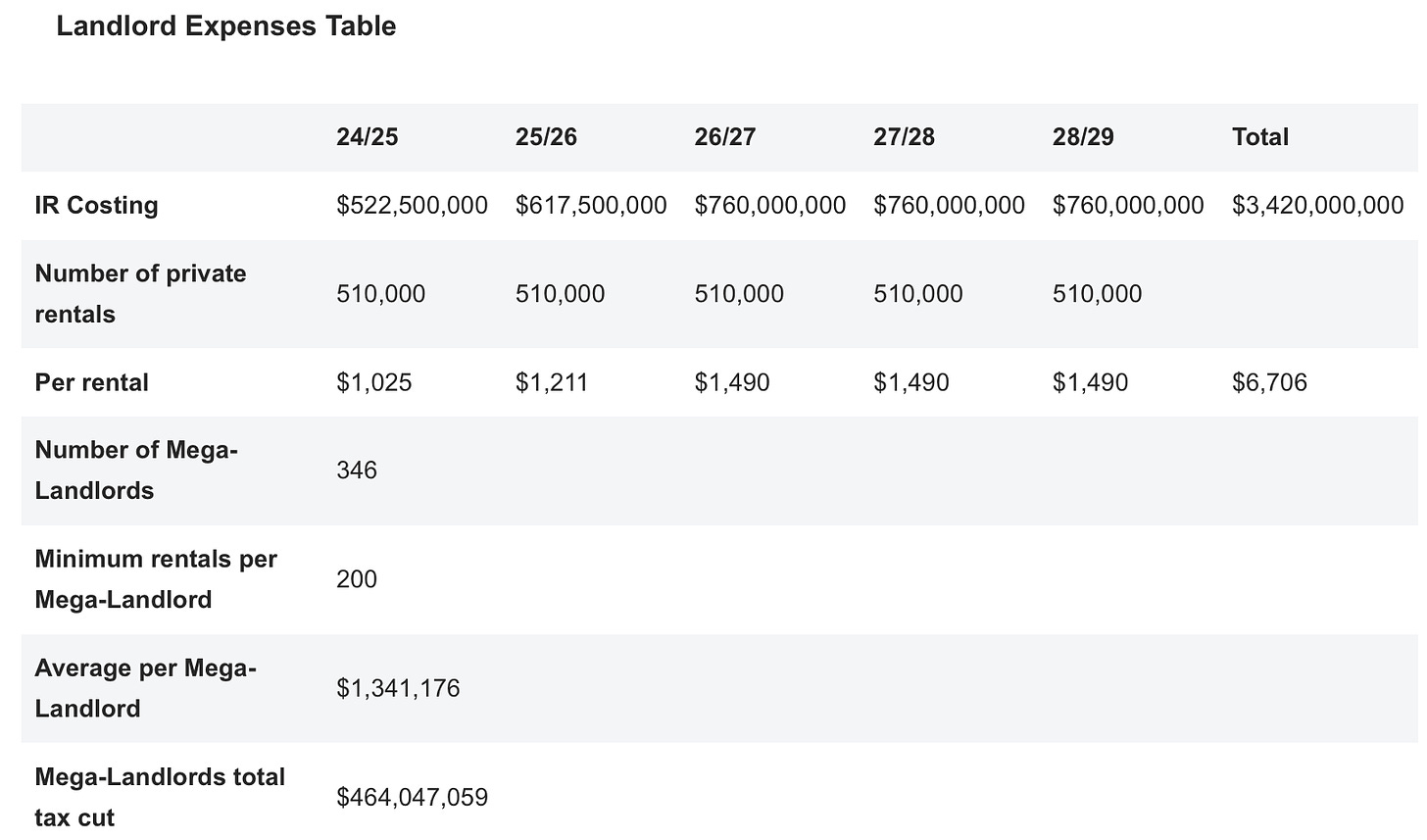

Which means the 346 ‘mega landlords’ would receive an average of $1.3 million each on average in tax breaks over five years, with a total of $464 million in tax breaks or almost a quarter of the total going to those 346 individuals; while,

350,000 beneficiaries, including 74,000 disabled beneficiaries, would receive $17,000 less in benefits over the five years due to the benefit policy.

Actually, $1.3m per landlord is an under-estimate

In reality, the amounts in tax breaks for landlords will be significantly greater because only three quarters of rentals are covered by the bond lodgement data because bonds are not lodged for some properties.

“This is just another example of National’s reverse Robin Hood tax plan. We found out only last Friday that National plans to take $2 billion off those on benefits, including disabled people, to help fund its tax cuts. Our most marginalised would suffer while rich landlords get even richer.”

“National’s tax plan would overwhelmingly enrich those who already have significant assets – while harming those with the least. National should scrap their unfair and unreliable tax plans which are balanced on the backs of the most vulnerable. They shouldn’t have to pay the price of National’s plan.” CTU Economist Craig Renney in his analysis in tables detailed below.

The analysis also excludes likely $20b in (untaxed) capital gains

This analysis also doesn’t take into account the likely increase in asset values from the change in policy. Given those 346 mega-landlords are likely to have almost 100,000 rentals between them, a 20% increase in values would likely increase their wealth by $20 billion to over $120 billion at an average value of $1m per property.

How is it distributionally neutral to increase the income of less than 500 people by over $1 million each and increase their wealth by over $200 billion while 350,000 beneficiaries become $17,000 each poorer?

It clearly isn’t. National’s ‘Big Tax Switch’ of 2023 fails the fairness test set by the mentors of Christopher Luxon (ie his Air NZ Chairman John Key) and Nicola Willis (ie her Beehive bosses John Key and Bill English).

That tax switch of 2010 also included pain for ‘natural’ National supporters in corporates both here and overseas, as detailed in this 2010 fact sheet, including:

the removal of depreciation for commercial building owners;

the removal of a tax loophole between the trust rate and the top income tax rate for Trust-owning families;

the removal of R&D and depreciation tax breaks for smaller companies; and,

a crackdown on foreign companies avoiding tax on their local units by loading them up with debt.

The one ‘gain’ for corporates and wealthy families in 2010 was a cut in the corporate tax rate to 28% from 30%. The detail around the distributional neutrality came in this graphic from the fact sheet in 2010:

The tax switch of 2023 is at least spelled out to voters in the way National’s tax switch after the 2008 election was not. But it is clearly not nearly as fair, equitable or politically sustainable, in my view.

Links to news, views, papers, reports, data et al elsewhere

In housing, transport and infrastructure

Whangārei mayor hits out at Kāinga Ora amid social housing plans 1News Susan Botting

Chris Hipkins won't rule out future help for motorists if petrol prices go wild amid Israel-Hamas conflict Newshub William Hewett

'Questions need to be asked': Calls for heads to roll at Watercare amid sewage crisis Newshub Perry Wilton

The CoreLogic Cordell Construction Cost Index (CCCI) report for the September quarter found construction cost inflation was the lowest since the final quarter of 2020, with annual inflation of 3.4% vs 10.4% a year ago.

In climate, water and environment

Climate policies key to reducing cost of living too, experts say. RNZ Eloise Gibson

In a world first, Australian’s Competition and Consumer Commission (ACCC) approved Brookfield’s A$18.7 billion takeover of Origin Energy on climate grounds, saying the benefits of extra renewable investment would more than offset the costs to competition

In geopolitics

Israel readies for ground war in Gaza WSJ-gift

Finland says 'outside activity' likely damaged gas pipeline, telecoms cable Reuters

Dovish Fed officials boost Wall Street as bond yields retreat Reuters

China Says It Drove Away Philippine Navy Ship in Disputed Sea Bloomberg-$$$

In global and local markets, economies and business

Dovish Fed officials boost Wall Street as bond yields retreat Reuters

China Mulls New Stimulus, Higher Deficit to Meet Growth Goal Bloomberg-$$$

China Says It Drove Away Philippine Navy Ship in Disputed Sea Bloomberg-$$$

Chinese Copper Tycoon Goes Missing, Believed to Be Detained by Police Bloomberg-$$$

Cartoons of the day

Ka kite ano

Bernard

The great ‘one-that-got-away’ irony of the 2009/10 Tax Working Group is that their initial private draft proposal to Key was for a land-tax-for-income tax switch, but Key vetoed it on the grounds the resulting 17% fall in land prices from a 1% land tax would endanger the financial stability of New Zealand’s big-four banks, which at that point were still recovering from the Global Financial Crisis, had lower capital levels, and dairy farms were much more highly leveraged than they are now.

Wednesday’s Chorus: Tax cuts for mega-landlords to average $1.3m. Each.