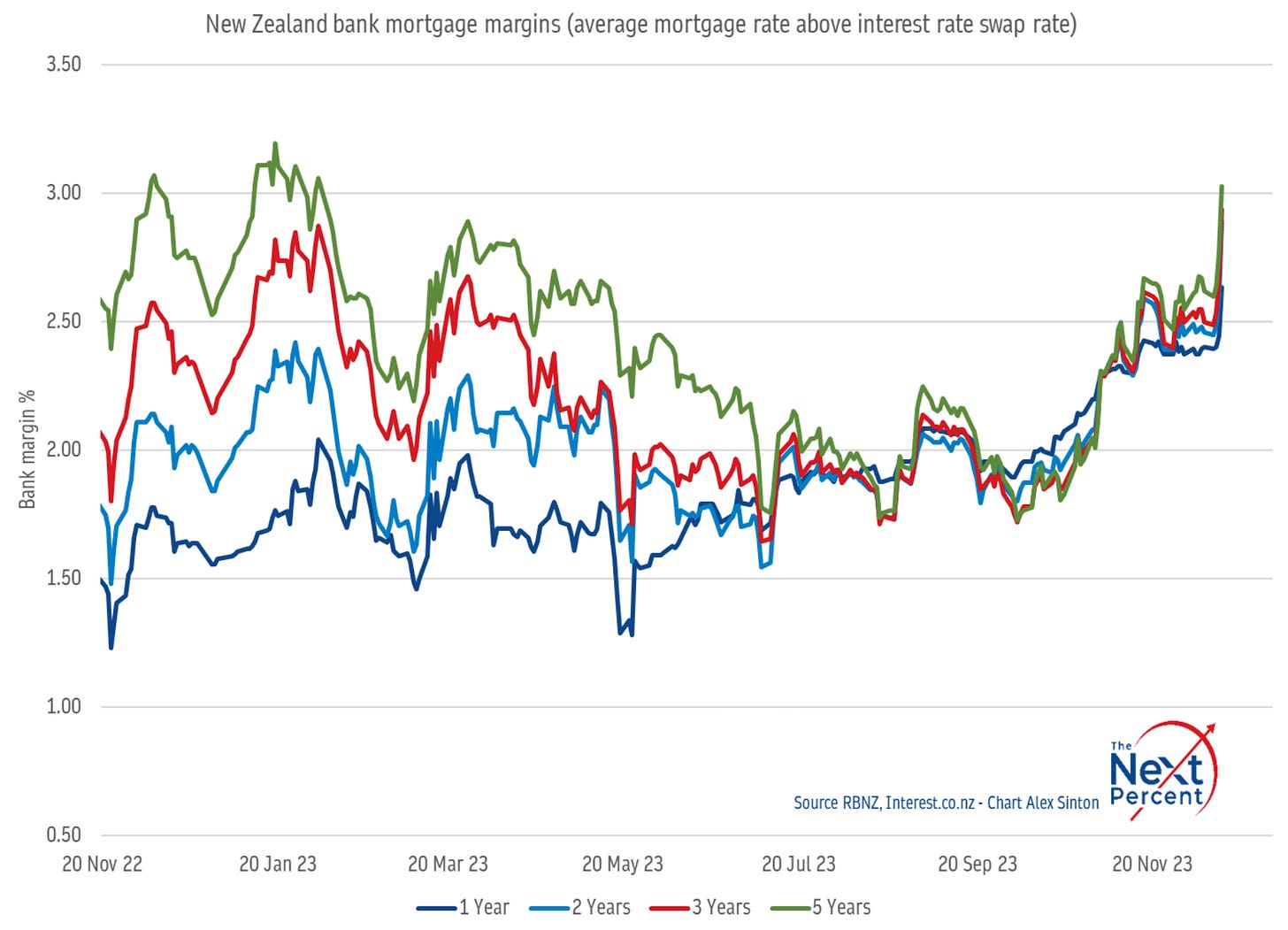

TL;DR: Aotearoa-NZ’s economy contracted unexpectedly in the September quarter, unleashing further falls in wholesale mortgage rates that mean banks could (should?) start cutting fixed mortgage rates before Christmas. (See more in updated charts of the day below)

Elsewhere in the news this morning:

The new Government’s decision to scrap the Clean Car Discount discount scheme it calls the ‘ute tax’ is likely to cost the nation up to $900 million in extra fuel import costs and the Government up to $680 million in extra carbon credit costs because the decision is expected to reduce electric car numbers by up to 350,000 and increase emissions by up to 3 million tonnes; Drive Electric

MSD is finally prosecuting larger numbers of Covid wage subsidy fraud after years of complaints it has pursued beneficiaries much more aggressively than businesses that fraudulently and needlessly claimed and retained hundreds of millions of dollars; 1News Katie Bradford

Claims of treaty breaches are being lodged with the Waitangi Tribunal over the new Government’s moves to dismantle Te Aka Whai Ora and repeal smoke-free rules; 1News, 1News

First Union, 350 Aotearoa and the Council of Trade Unions published research yesterday showing for every dollar the four gentailers invest in new renewable capacity, $2.41 is paid out to shareholders in dividends.

Usually at this point in the edition, there’s a paywall that only paying subscribers can see below and hear more detail and analysis in the podcast above. But we’d love you to join the community of paying subscribers, who can read and comment on everything inside the paywall all the time and get access to our weekly ‘Hoon’ webinar on the news of the week on Thursdays at 5pm here via YouTubeLive for an hour. The 50%-off offer is open to new subscribers until December 21.

And here’s a special, special deal for under 30s.

Also remember that anyone who is a student or teacher with a .school.nz or .ac.nz email address can sign up for the free version of The Kākā and will be upgraded to the full paid version for free.

Chart of the day

The banks are sitting on 100 bps of extra profit margin. For now.

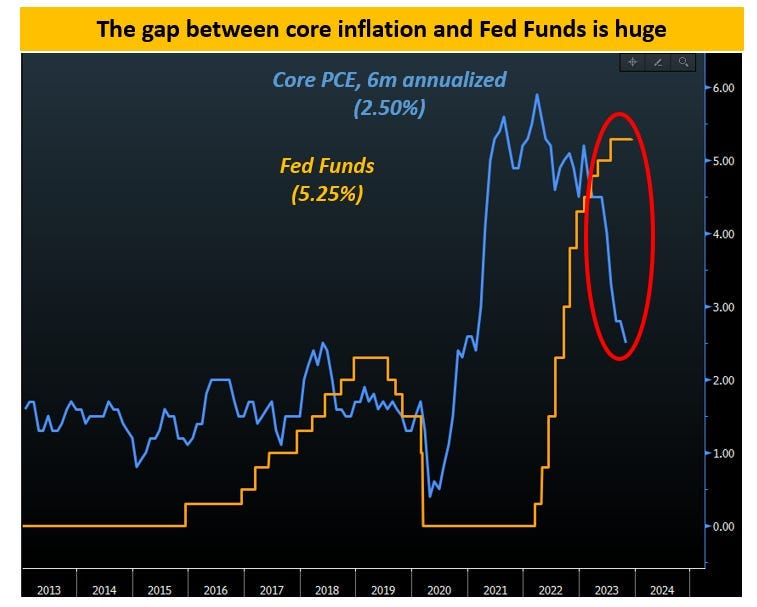

The Fed pivoted yesterday to signalling lower rates next year. Real interest rates are now rising quite quickly.

COP28 cartoons of the day

Ya gotta laugh

Ka kite ano

Bernard

Share this post