TLDR: PM Chris Hipkins announced a further $1 billion of spending cuts on emissions reduction last night, arguing the Government needed to ‘cut its cloth to fit’ to show households it understood their pain about higher living costs.

But in choosing to spend less on efforts to address climate change in the midst of an actual climate emergency event, Labour has fallen into the classic mistake of seeing a Government’s finances as just like a household’s, as well as overturning two decades of arguments used to justify tight budgets and low public debt.

Both Labour and National have argued since the early 2000s they needed to run budget surpluses and keep debt low to ‘save for the rainy day’. They have also both argued that spending money on emissions reductions could reduce the pain of future rainy days by making them less rainy.

Yet when the classic rainy day arrived, Hipkins and his Cabinet decided to reduce spending on emissions reductions designed to stop future days from being even rainier. In making this choice, he has exposed the real priorities of both National and Labour over the last 20 years of fiscally tight policies. It was not for saving for rainy days. It was all about prioritising low public debt, low taxes, no taxes on capital gains and low interest rates over everything else.

That makes perfect sense when you realise the most important variables for swinging median voters who own their own homes and have mortgages are:

keeping mortgage rates as low as possible and income taxes as low as possible to maximise disposable income;

keeping interest rates as low as possible by minimising public investment in infrastructure to support new land supply for housing because that maximises rises in land prices;

maximising capital gains on leveraged rises in residential land prices and keeping them tax-free because that is the main way these median voters become wealthier, can save for their retirement and become able to help their own children into their own homes.

So where does that leave young renters?

Young renters are toast in this scenario. They can vote Labour or Green as often as they like, but will end up having to pay the price of more and bigger climate emergencies, while also paying most of their after-tax income on rent and being unable to hope of owning their own homes with secure futures for their families unless they can be gifted deposits by relatives or marry into wealth.

Those who vote Green are in a particularly difficult situation. They vote for policies that can never be enacted while the Green party is the minor party in any coalition. That’s because the Green party has no leverage in any government-forming negotiations when it is in the minority because it can never credibly threaten to put National in Government. A Green vote is consciously or unconsciously wasted while the Green Party will never suggest enabling a National-led Government, unless there is a real prospect of it having a larger vote share than Labour.

The most realistic prospect for these voters now is to vote for Te Pāti Māori or TOP, who have kept their options open to ensure they have leverage, and have pro climate policies that either Labour or National might adopt to win power. A Green vote now is purely performative. It allows voters to feel better about not voting for Labour and appearing to vote for climate action and poverty reduction policies, but actually enabling a Green-washing of Labour that achieves none of those policies.

Yesterday’s announcement and the defeated-sounding statement in response from the Green Party’s co-leaders James Shaw and Marama Davidson has reinforced that, yet again, Ford Ranger Man’s love of a suburban lifestyle and land plot that makes them richer always has priority for a Labour Party in a neck-and-neck race for power.

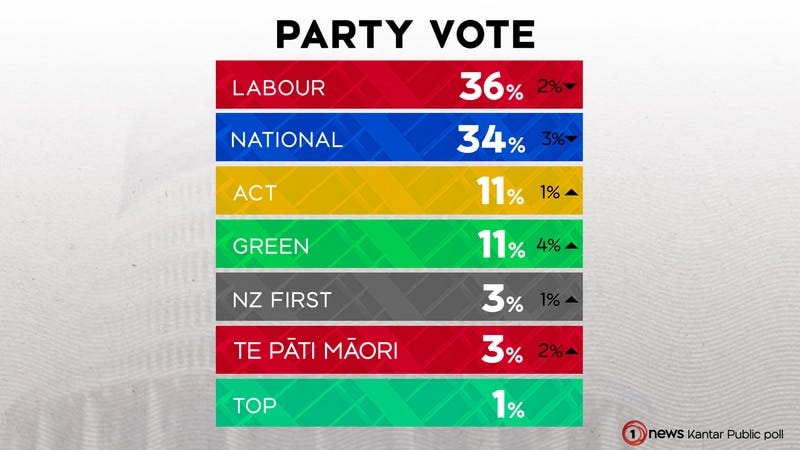

That leaves Te Pāti Māori and TOP as the only smaller party options with the negotiating leverage to extract real measures on climate change, housing or poverty improvements. Last night’s 1News/Kantar poll showed Labour would need Te Pāti Māori (up 2% to 3%) to govern.

The Green element of any coalition can be assumed and then ignored.

Paying subscribers can see more detail and analysis of the Government’s announcements below the paywall and in the podcast above. FYI. I have decided to open this one up immediately, given the public interest involved in climate issues. Many thanks to paying subscribers who support my journalism covering the political economy of housing unaffordability, climate change inaction and poverty reduction.

Elsewhere in the news this morning

US President Joe Biden had to reassure depositors in smaller US banks their money was safe overnight after the collapse of Silicon Valley Bank threatened to turn into a series of bank runs; Reuters

Biden had to say the US Government would do ‘whatever was needed’ to ensure stability, even after the US Federal Reserve, the Treasury and the Federal Deposit Insurance Corporation were forced to create a new US$25 billion fund to guarantee the uninsured deposits of high-net-worth individuals and tech firms would be fully available last night; FT, WSJ

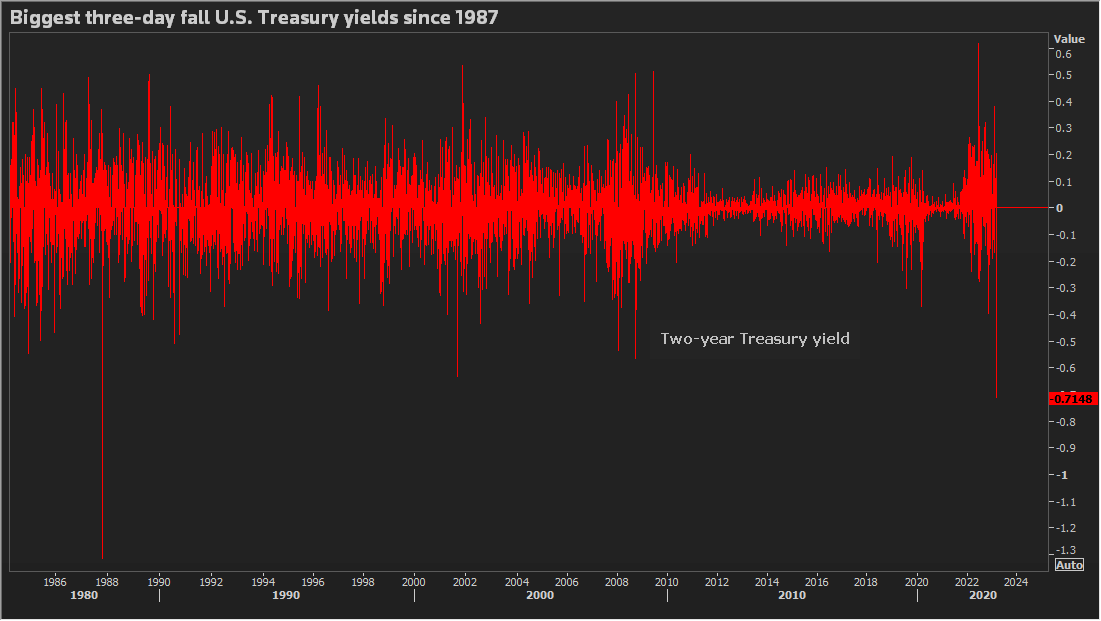

US regional bank stocks slumped 15% and investors and traders lowered their forecasts for the peak of US Federal Reserve’s key cash rate by 50-80 basis points to 4.75-5.0%, which in turn drove US 2 year Treasury bond yields down to as low as 3.98% (It was over 5% late last week); WSJ

China’s President Xi Jinping ended this week’s National Party Congress for 3,000 Communist Party cadres and invited billionaires overnight, declaring in a speech that China needed to strengthen its military to build a “great wall of steel” to defend its interests; FT

KPMG released its Financial Institutions Performance Survey (FIPS) report overnight, showing New Zealand’s banks increased net profit by 17% to $7.18 billion in calendar 2022 after a 13 basis point rise in their collective net interest margin from 1.97% to 2.10%, thanks to cheap loans from the Reserve Bank and not passing on term deposit increases to savers as fast as they were passed on to borrowers; and,

New Zealand government bond yields are also expected to fall further today, putting extra pressure on banks to offer lower fixed mortgage rates in the months to come ahead of the election.

Coming up later today

Migration figures for January are due at 10.45 am from Stats NZ; and,

Parliament resumes at 2pm for Question Time in the second week of a two-week session.

Choosing lower mortgage rates over climate action now

PM Chris Hipkins announced a range of moves yesterday designed to save the Government money, which were mostly about stopping or delaying spending that would have reduced climate emissions, and in one case was to restrict the use of a road safety move that was unpopular with fast car drivers.

The changes included:

stopping the clean car upgrade scheme, which would have seen $568 million spent on a ‘cash-for-clunkers’ scheme that swapped polluting old cars for cleaner cars and public transport, and which would have benefited the poorer drivers the most;

stopping the social car leasing scheme, which would have allowed poorer drivers to lease an low emissions car at an annual cost of $19 million;

limiting the Auckland Light Rail project to just one section that does not reach to the airport to save ‘billions’ and a suggestion completion could take the same 40 years that the recent Waikato Expressway took;

narrowing Waka Kotahi’s speed reduction programme to just 1% of the most dangerous roads, which will reduce the emissions benefits of lower speeds;

removing cities smaller than Auckland, Hamilton, Tauranga, Wellington and Christchurch from a requirement to prioritise public transport over driving; and,

deferring work on the refund for container scheme to avoid cost increases for consumers.

The $1 billion saved is on top of $700 million being used from the Climate Emergency Response Fund to extend fuel tax and road user charge cuts. Essentially, the Government has chosen to use $1.7 billion initially allocated to the Climate Emergency Response Fund (CERF) to cut fuel prices and reduce borrowing and public debt. This was money raised from the Emissions Trading Scheme and is being used to keep interest rates and mortgage rates lower than they otherwise be the case, and to actively encourage drivers to burn more petrol and diesel. ETS prices have fallen in recent months as the Government rejected Climate Commission advice to strengthen the scheme.

It is a classically short-term approach to winning an election that sacrifices longer-term climate action and more infrastructure investment for extra land for housing supply and public transport to ensure that fuel prices are kept low for now and that mortgage rates stay lower than would otherwise be the case, which also stops suburban land prices from falling too much.

On that front…

House prices bottoming out

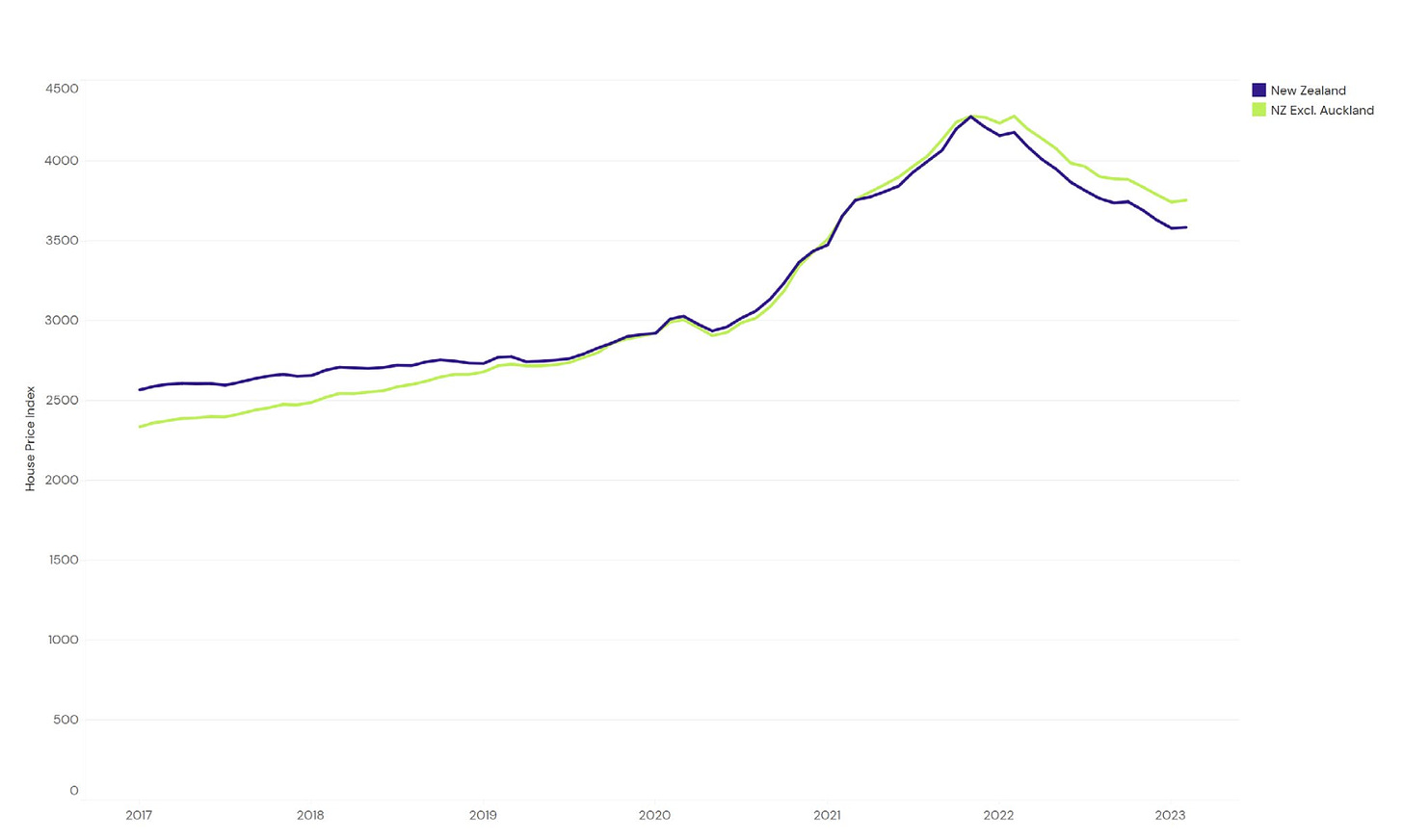

REINZ reported data this morning that its House Price Index bounced in February by 0.1% nationally and 0.3% outside Auckland. The index for the hardest-hit market of Wellington bounced 0.2% in February.

The plan to win back Ford Ranger Man is working. Last night’s 1News/Kanter poll showed Labour able to form a Government with Te Pāti Māori and the Green Party, which is in line with the trend seen since Labour’s pivot to less climate spending.

Six quotes of the day

Joe Biden’s ‘whatever it takes’ pledge last night

“We will not stop at this. We’ll do whatever is needed on top of all (this). Americans can have confidence that the banking system is safe. Your deposits will be there when you need them.” US President Joe Biden overnight after two banks were closed and stocks in others fell sharply. CNN

Fund manager wants full guarantee. Current it’s US$250k per account

“Our economy will not function effectively without our community and regional banking system. Therefore, the @FDICgov needs to explicitly guarantee all deposits now. Hours matter.” Pershing Square CEO Bill Ackman via Twitter. He is a well known fund manager.

Some see the Federal Reserve unable to hike rates next week

"The bank run was precipitated by the Federal Reserve's overly hawkish policy. The bull case is that this will finally knock some sense into them (the Fed) and they will stop raising rates.” Jay Hatfield, founder and CEO of Infrastructure Capital Management via Reuters

What the sharp fall in US interest rates means for us

"Against a backdrop of other central banks pulling in their horns, there will be less pressure on the RBNZ to tighten as well. Given the significant mortgage repricing yet to come through the system and the economy on the verge of recession, if the banking crisis in the US means an earlier end to NZ’s official tightening cycle, then that might end up being a good thing.” BNZ Markets Strategist Jason Wong in a morning note

‘Our Government wants you to know we’re quite like your household’

“Stopping some of our plans and putting others on a slower track gives us the bandwidth to focus on these immediate priorities while also saving some money so that we can provide a little bit of extra support to help families with increasing costs. It’ll also help to keep downward pressure on any domestic-related inflation. I want New Zealanders to know that the Government’s doing its bit and is cutting its cloth to suit the times that we are in.” PM Chris Hipkins announcing $1b of cuts and project delays to help fund the Gabrielle rebuild (Post Cabinet news conference transcript.)

National now well out of line with other conservative parties on China

“China represents a country that has very different values to ours. It presents an epoch-defining challenge to us and to the global order. It’s a regime that is increasingly authoritarian at home and assertive abroad and has a desire to reshape the world order. We’ve recognized it as the biggest state-based threat to our economic security.” UK PM Rishi Sunak in a speech on China via Politico Europe

Six charts of the day

Labour could govern with Te Pāti Māori in this 1News poll

Christopher Luxon’s personal popularity is sliding

Smaller US bank stocks were hit hard overnight

The US 2 year Treasury yield fell the most overnight in 25 years

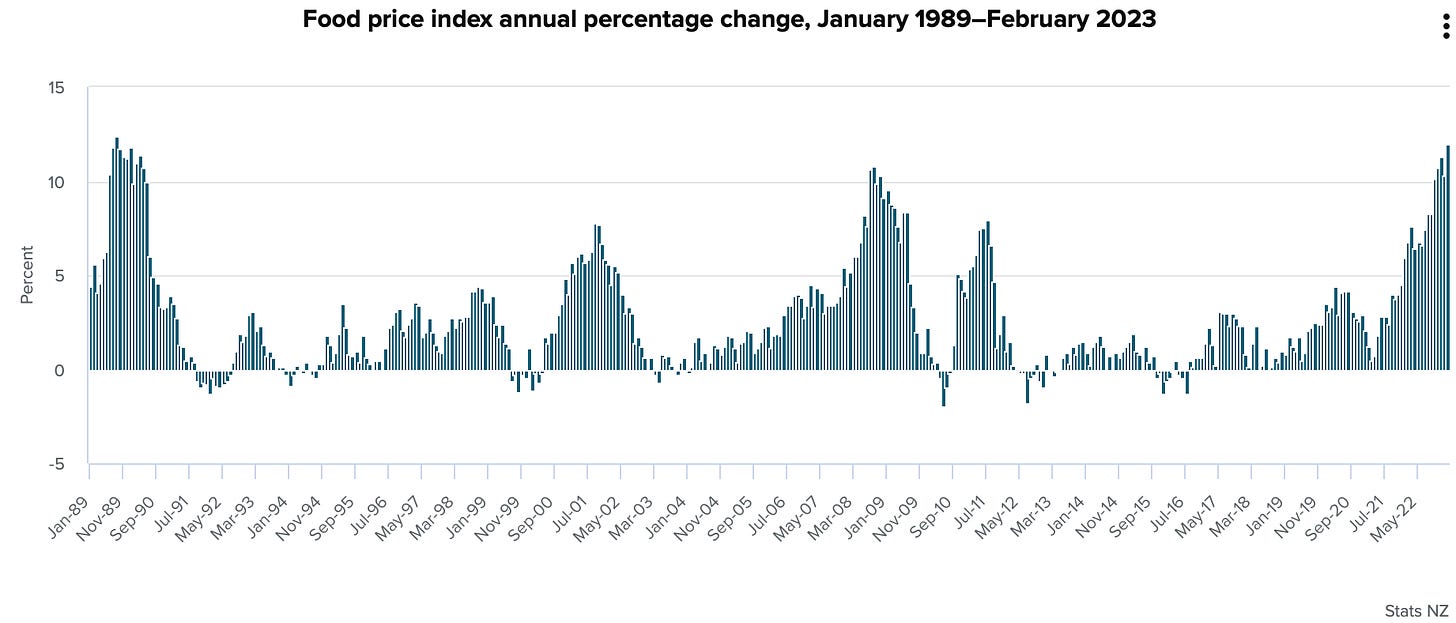

NZ annual food price inflation of 12% in Feb highest since Sept 1989

But will fruit and vege growers receive the higher prices too?

Profundities, curiosities, spookies and feel-goods

Fun things

Ka kite ano

Bernard

Share this post