TLDR: Winter is coming for Europe and it will be one of the main driving forces in the global economy in the year ahead.

The European Union is preparing massive emergency interventions in electricity markets to ease the burden for consumers and some businesses of a doubling and quadrupling of electricity costs across the continent. This is all because Russia is cutting off gas supplies used to generate electricity.

Windfall taxes to subsidise power bills

Brace for it - The European Union is preparing emergency interventions in Europe’s electricity markets and tax systems to blunt the impact this coming Northern Hemisphere winter of a doubling and quadrupling of electricity costs. The could include windfall taxes on ‘super’ profits being reported by energy firms and the forced disconnection of electricity prices from gas prices.

“Currently, gas dominates the price of the electricity market . . . with these exorbitant prices, we’ll have to decouple. We’ll have to ensure renewable energies are generated at lower costs, that those costs are transferred to consumers and windfall profits used to help vulnerable households. We need an emergency instrument which would be triggered very quickly, in weeks perhaps.” EU President Ursula von der Leyen quoted in FT-$$$

The moves come as Shell CEO Ben van Beurden said overnight Europe could face several winters of gas shortages as a result of the cuts to Russian supplies. Reuters.

The pressure is intense. Even Tesla founder Elon Musk says a quick transition to renewable is impossible.

“Realistically I think we need to use oil and gas in the short term, because otherwise civilization will crumble. I think some additional exploration is warranted at this time.”

“One of the biggest challenges the world has ever faced is the transition to sustainable energy and to a sustainable economy. That will take some decades to complete.” Elon Musk talking to reporters at an energy conference in Norway, via Reuters.

So what? - Geo-politics is driving the global economy towards higher energy costs and shortages in the most intense way in the months to come. The political reaction in countries across Europe that are under pressure will be crucial, in particular whether they keep supporting Ukraine through the dark months.

Elsewhere overseas in the news overnight, Ukraine launched an offensive in the south to retake Kherson back off Russia, UN officials visited the Zaporizhzhia nuclear plant endangered by shelling and global stocks kept falling, albeit more slowly, after the Fed’s hawkish speech at Jackson Hole.

Here, the Government is set to review the orange setting of Covid in a couple of weeks time, which may see isolation periods drop from seven days to five days.

Chart of the day

A housing market with bits tacked on

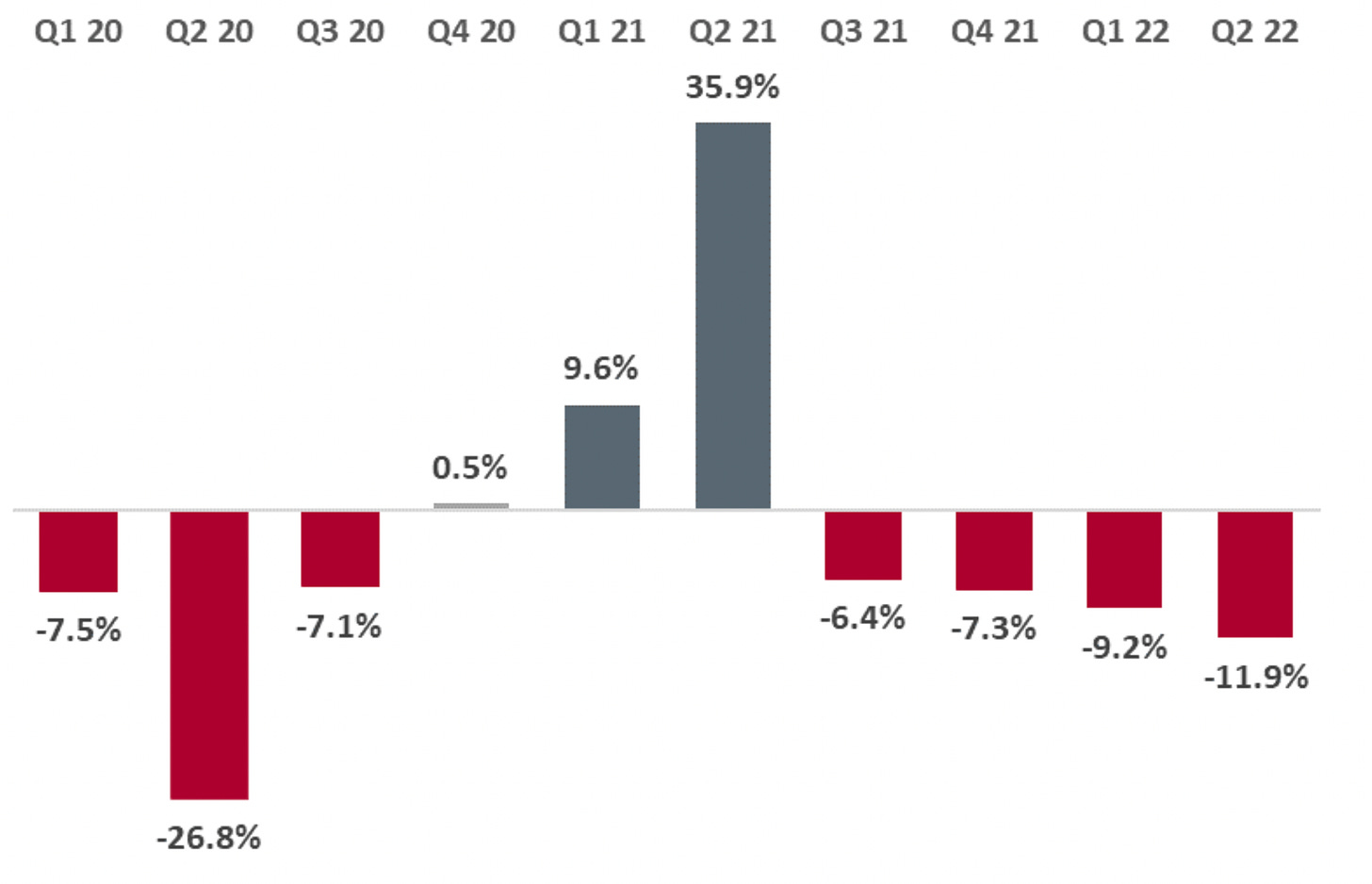

NZ business credit demand Index, Year-on-Year Changes

11.9% - Business credit demand in Aotearoa-NZ fell by 11.9% in the June quarter from the same quarter a year ago, with construction sector loan demand down 18.5%. Equifax NZ reported yesterday.

“With business confidence remaining at lows only seen for short periods of time, in the initial phases of the pandemic and around the GFC, the softness of business credit demand is to be expected. The uncertainty created by rising interest rates, above target inflation and supply-chain constraints will be impacting business credit demand, but it is the labour supply shortfalls that likely have the greatest impact on investment plans. If businesses struggle to get access to the labour to implement their growth plans, they will limit the capital they allocate and borrow.” Equifax Managing Director Angus Luffman

Number of the day

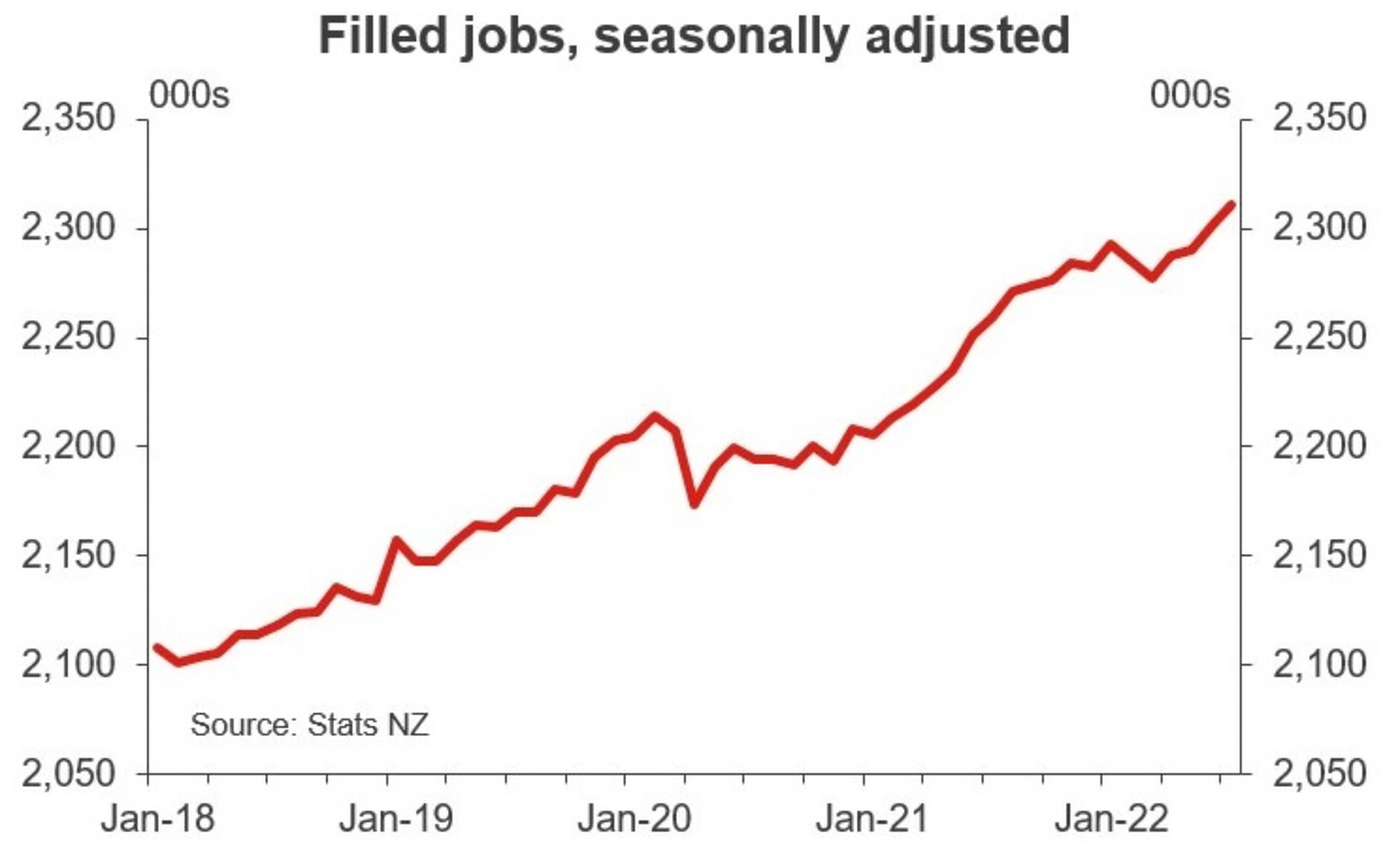

Still, employment is growing, even at ‘full employment’

2.31m - There were 2.31m people employed in July, up 0.5% or 10,863 from June, Statistics NZ reported yesterday from administrative data provided by IRD. Also, gross wages measured on an accrual basis rose to $13.8b in July, up 7.8% from the $12.8b reported in July a year ago.

Comment of the day

Captured Government

“Thank you for sharing the (as usual) excellent writing of Danyl Mclauchlan. Coincidentally, I'm in the middle of reading David Graeber's 'Utopia of Rules'. These are a series of long-form essays, and a fascinating explainer for why bureaucracy exists and - as per Danyl's focus - the incentives that cause its corruption.

“Bureaucracy is such an easy target for the opposition. Especially as I agree with Danyl that there 'appears' to be a lot of waste this government term. Even if we generously grant than Labour are pointing our country in the right direction with all this spending, they have done a shockingly bad job of communicating *where the money is actually going*. And I expect they'll lose the election on that alone. National and Act will repeal a bunch of stuff and all we will have from billions spent is a bunch of richer lawyers and consultants, plus some thick reports hidden away at the bottom of filing cabinets.” Tim in Monday’s Dawn Chorus.

A fun thing

Ka kite ano

Bernard

Share this post