TLDR: Auckland’s housing market sunk further into its winter deep freeze in June, but some banks are beginning to try to stimulate new mortgage lending again and may even soon be able to start cutting longer term interest rates, thanks to cooling expectations of inflation in the global economy dragging down wholesale interest rates.

Paid subscribers can see more detail and analysis below the paywall fold and in the podcast above.

Elsewhere in the news overnight and this morning here and overseas:

China’s latest Covid lockdowns and mass testing restrictions in some eastern provinces escalated further overnight, with further cases found in the partially locked-down industrial centre of Anhui and an outbreak building in the gambling hub of Macau; Bloomberg

The Peter Thiel-backed crypto-lending operation Vauld suspended withdrawals overnight after seeing nearly US$200m worth of deposits withdrawn in the three weeks since the crashes of the Luna crypto-currency and the collapses of fellow crypto-lender Celcius and crypto-hedge fund Three Arrows Capital; CNBC

Kellogg lost a High Court challenge overnight to new British regulations that will stop more sugarey breakfast cereals such as Cocopops and Frosties from being displayed prominently in supermarkets (Aotearoa-NZ has no such regulations, despite some of the highest type-II diabetes rates in the world); BBC

Kāinga Ora is considering importing plasterboard in bulk after a survey found half of its 98 house-building projects were now stalled or disrupted because of supply chain issues, including GIB shortages, Katie Bradford reported for 1News last night; and,

MBIE announced late yesterday most seismically vulnerable buildings are not imminently dangerous and can remain occupied while seismic remediation work is planned, funded and undertaken, which will take some pressure off landlords in tenants in Wellington and many other provincial towns and cities hit hard by quake-prone notices.

A cash-back blowtorch to Auckland’s deep freeze?

Banks can handle weak new lending growth for only so long before they have to stimulate demand and volumes with special deals, and potentially mortgage rate cuts. Watch out for the potential for one and two year mortgage rate cuts in the coming weeks, even though the Reserve Bank is forecast to put up its Official Cash Rate next Wednesday by another 50 basis points.

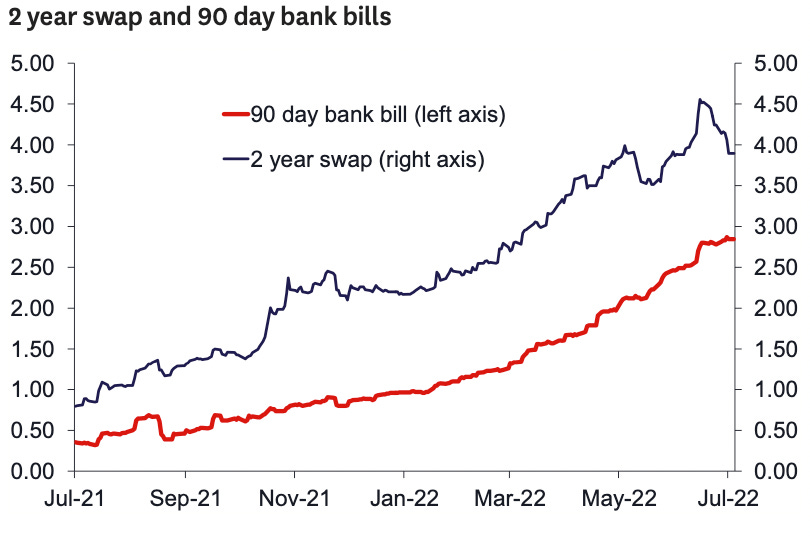

The banks may have room to cut if they want because one and two year wholesale ‘swap’ rates, which are a cumulative market expectation of where traders and investors expect the Reserve Bank to move interest rates and its rate forecasts, have fallen 50 and 75 basis points respectively over the last three weeks. That’s because of growing fears globally of recessions in the United States and Europe, along with the chilling effect on inflation from falling food and metals commodity prices.

The two-year swap rate, which is the basis for two-year fixed mortgage rates, has fallen a peak of 4.56% on June 16 to 3.80% yesterday as markets wind back their expectations of how high the Reserve Bank lift its OCR to over the next couple of years. The Reserve Bank itself forecast in May it saw the OCR rising to a peak of 3.95% over the next two years. Economists actually see the Reserve Bank only being able to lift it to 3.5% before the combined effects of slowing local and global economies force the Reserve Bank to take its foot off the brake. Now markets are starting to shift their expectations lower too.

There are plenty of signs of waning demand for credit, which some banks want to turn around with special deals.

Sales at a 12 year low

Auckland’s largest real estate agency group, Barfoot and Thompson, reported yesterday it handled 684 sales in June, down 12.5% from May and down 45% from June a year ago to a 12-year low. It also said its total listings had fallen 0.5% to 4,676 by the end of the month, despite listing more than 1,255 new properties. That means almost 600 properties were pulled unsold from Barfoot’s listings in June.

A feature of this housing downturn is many vendors are not under pressure to sell because they have jobs and most of them face debt servicing costs that are well down on the worst periods of 2007/08 when the last big housing downturn happened.

The cash-backs are coming

Some banks are even applying their marketing techniques to get some heat back into the market.

BNZ announced yesterday it would offer up to $10,000 of ‘cash-back’ to new home loan customers, joining Kiwibank, who announced a similar offer of up to 1% of the home loan or a maximum of $10,000 three weeks ago.

The fall in swaps rates from peaks in mid-June will give some room for lower mortgage rates too, especially if next week’s Reserve Bank decision (which does not include new forecasts) suggests the inflation heat is coming off the boil and it may not have to hike rates quite so much.

Chart of the day

Commodity prices down to March levels

Number of the day

What if Russia lashed back at oil caps?

US$380/barrel - JP Morgan has warned that an attempt to cap Russian oil prices at US$50-60/bbl could trigger Russian production cuts of up to 5m barrels per day, which it forecast would increase oil prices to US$380/bbl. A 3m cut would lift prices to US$190/barrel. Reuters That would lift petrol prices in Aotearoa-NZ towards the NZ$6/litre mark.

Quotes of the day

‘Just imagine what could have happened’

“New Zealand has just experienced one of its most intense house price booms in history – prices rose almost 50% between mid-2020 and the end of 2021 – at a time when net migration slowed sharply, homebuilding was running at multi-decade highs, and tax settings were made less favourable for property investors.” Westpac NZ acting chief economist Michael Gordon in a weekly note.

Also, on the housing supply constraints (bolding mine):

“The National Policy Statement on Urban Development (NPS-UD) directs local councils to remove overly-restrictive planning rules and enable higher housing density. But the need for the NPS itself points to deeper-rooted issues: why are councils not incentivised to provide more housing in the first place? This may be a question around who bears the costs of development; it may be concerns around liability for shoddily-built homes. Again, these are not new insights – if there’s been little progress on dealing with these problems, it has not been from a lack of people pointing them out.” Gordon.

Some fun things

Ka kite ano

Bernard

The cynical me says banks may cut their fixed rates, but with volume drying up they'll be looking to expand their margins to ensure they keep their revenue growth moving in the right direction. Don't expect the cuts to be quite as big as the falls in wholesale rates.

Kind regards, ex bank product manager

ANZ moved quicker than expected.

Agree, this feels like competition for market share, because total lending growth is slowing. It is likely to have little impact on the housing market.

The more relevant change in bank lending practices were when ASB, ANZ and westpac all suspended high LVR lending. This will have a material impact on total lending volume