TLDR: The big global monetary policy tightening has started in earnest, but will it stick? The US Federal Reserve announced its biggest official interest rate hike since 1994 this morning. US stocks, paradoxically, rallied with relief it wasn’t worse, although only after a big selloff earlier in the week that was prompted by hints of the big Fed hike that reset expectations.

Now we’ll find out how much pain the US economy and global markets can take before the Fed and other central banks have to stop the tightening, or even resume the money printing, as they have done repeatedly over the last decade whenever they tried to force investors to go ‘cold turkey’ on the easy and cheap money.

The Federal Reserve appears determined to squash inflation rather than rescue investors again, but the European Central Bank showed overnight it doesn’t have the same resolve. Having only just signaled it will stop printing this month and will hike from below 0% next month, the ECB had to hold an emergency meeting overnight and pledge to keep printing to buy Italian and Greek Government bonds to stamp on a threatened return of the repeated European debt crises seen from 2009 to 2012. Paid subscribers can see more of my analysis on the monetary policy pivots below the paywall fold and in the podcast above.

Elsewhere in the news here and overseas this morning:

FDA set to approve Pfizer vaccine for kids as young as six months NBC News;

Russia cuts gas supplies to Germany by 40% and to Italy by 15% for ‘repairs’ AFP;

Xi tells Putin he wants to help find settlement of Ukraine War CNBC;

Truce called in gang war between Killer Beez and Tribesmen NZ Herald; and,

Mediaworks CEO tells staff Sky TV merger talks are off. Newshub

I’ll be watching out later today for March quarter GDP figures for Aotearoa-NZ, which some see showing no growth in a quarter badly affected by the late 2021 lockdowns.

Finally, it begins in earnest

This morning US Federal Reserve massively ramped up its attempts to slow inflation running at 8.6% in the world’s largest economy. The Fed hiked its Federal Funds Rate (its version of our Official Cash Rate) by 75 basis points to a range of 1.5% to 1.75%. Our OCR is currently 2.0% and is expected to be lifted to 2.5% on July 13. The range thing is normal for the Fed.

The Fed’s hike is the biggest by the Fed since 1994 and if it had been done a week ago it would have profoundly shocked global investors and markets. But the Fed appears to have nudged and winked its way to a series of articles on Monday by the Wall St Journal and others that reset expectations for the hike from 50 basis points to 75 basis points. That was handy for the Fed because it got the ugly market reaction to higher interest rates out of the way on Monday and Tuesday.

The irony is the market reaction today to the announcement at 6am NZT was one of relief. The S&P 500 was up 1.6% and the US 10 Year Treasury yield was down 13 basis points at 3.34% as of 8am NZT. That’s still worse than before the nudges and winks on Monday, but means the initial reaction looked positive.

Part of the reason for the relatively positive initial reaction was the Fed’s new ‘dot plot’ of forecasts by Federal Reserve voting members showed a rise in the Fed Funds Rate to ‘only’ a median of 3.4% at the end of this year and 3.8% at the end of next year, before falling back to 3.4% by the end of 2024.

‘This super-sized hike was unusual and may not be repeated’

To be fair, that median for the end of this year was up from the dot plot published in March showing a rise to 1.9% this year and 2.8% by the end of next year. However, market forecasts before the decision and the release of the dotplot were for the Fed Funds rate to rise to 4.0% this year.

Also, Federal Reserve Chairman Jerome Powell downplayed talk of even bigger hikes in the coming meetings, suggesting the next one might even go down to 75 basis points. Some of the more fearful economists had suggested the Fed might even unleash 100 basis points earlier this morning.

“Clearly, today’s 75-basis-point increase is an unusually large one and I do not expect moves of this size to be common. From the perspective of today, either a 50-basis-point or a 75-basis-point increase seems most likely at our next meeting.” Federal Reserve Chairman Jerome Powell talking at a news conference after the decision.

Financial markets were relieved even bigger hikes appeared off the table for now.

“There was a hawkish risk that the market would take 75 basis points and price it in to multiple consecutive meetings. The fact Powell came out against that idea was read as risk on.” BMO Capital Markets strategist Ben Jeffery quoted in the FT-$$$

So what now? We wait to see whether the global market reaction lasts, or whether a closer look spooks investors again. Much of the pain has already been delivered to the real economy through a surge in 30-year fixed mortgage rates from 3% at the end of last year to 6% this morning (Next) That in turn is hammering new home starts and existing home sales in the United States.

The Fed seems determined right now to look through the latest ‘Taper Tantrum’ and go after inflation with a hammer, but we’ll see. It has blinked before and this unwinding of stimulus is monumental compared to the failed attempts in 2013 (the taper tantrum) and in 2019 (when the Fed had to cut rates after a mild tightening and small amounts of Quantitative Tightening) forced it to relent with fresh rate cuts and money printing. That printing accelerated massively when the Covid pandemic hit.

The unwinding actually started today

It didn’t get as much attention as the rate hike, but the Federal Reserve formally began the process of unwinding its US$9t worth of money printing today. It started its already-foreshadowed sale back of US$47.5b/month worth of bonds back into the bond market. This rate of unwinding lasts for three months and then it is due to double to US$95b/month or an annual rate of US$1.1t. Many fear the shock of the ‘un printing’ will seize up bond markets. They are already in the most stress since March 2020 when the pandemic hit.

We’re in the middle of another ‘Taper Tantrum’ that the Fed seems determined to ignore because it has pledged to get on top of inflation. We’ll see. It’s blinked before.

The Europeans blinked before they had even started

As if to emphasise that this tightening is far from locked in or over, the European Central Bank was forced to have an emergency meeting overnight and announced it would intervene to buy Italian, Greek and Spanish Government bonds again with a special ‘defragmentation’ facility to avoid another version of the debt crises that wracked European financial markets from 2009 to 2012.

The ECB announced a pivot to tightening and the end of its still-ongong money printing programme just last week. Its deposit rate is still minus 0.5%. As I mentioned last week, Europe is much more vulnerable to a tightening because the southern European ‘PIGS’ of Portugal, Italy, Greece and Spain’ are still deep in public debt and Europe’s banks did not clean house after the Global Financial Crisis of 2008/09 in the way the US and British banks did (thanks largely to recapitalisations and rescues by British and US taxpayers).

For example, ECB board member Isabel Schnabel said this week (bolding mine) the ECB would not hesitate do ‘whatever it takes’ to keep the euro together. Analysts estimate it has a war chest of €200b to use buying southern European bonds.

“While the flexible allocation of PEPP (Pandemic Emergency bond Purchase Programme) reinvestments is one way to address fragmentation, our commitment is stronger than any specific instrument. Our commitment to the euro is our anti-fragmentation tool. This commitment has no limits. And our track record of stepping in when needed backs up this commitment.” ECB board member Isabel Schnabel

Meanwhile, the Bank of Japan is still printing money hand over fist and has actually re-invigorated its money printing to buy bonds in recent weeks, driving the yen down to multi-decade lows this week as investors shuffle the freshly printed cash out into other economies.

It’s not hard to see why investors don’t really believe the money printing is over yet.

HODL and BTFD again?

My view - The broad assumption among economists and market players is that ‘this time is different’ because the Fed in particular, and even the ECB, can’t fall back on the excuse that inflation is low and therefore the money printing to rescue stock, bond and bank investors doesn’t do any harm to economy. (Although there’s been plenty of harm done to the social contract over the last decade after repeated central bank and Government bailouts for asset owners that has finally created real wage deflationary shocks for workers who rent.)

This assumption that markets won’t be allowed to fall much by central banks because ‘there’s always a bailout’ has fueled the HODL (Hold On For Dear Life) and BTFD (Buy the F…ing Dip) movements of retail investors in particular over the last three years.

This time inflation is running rampant and central banks are supposed to be primarily about keeping inflation low, rather than keeping asset owners whole. We’ll see. My view is this very-fast monetary policy tightening is going to unleash a world of pain in financial markets and a hard stop to economic growth in the United States and Europe. Very quickly, unemployment is likely to start rising again and the inflation genie will disappear back into its bottle with a fright. Of course, that depends on the war in Ukraine ending quickly, energy prices falling and no new pandemic or geo-political shocks to supply chains. President Xi Jinping’s comments overnight about wanting to help Russia into a ‘settlement’ of the Ukraine war suggests China has had enough of Russia’s malarkey.

My expectation is the central banks will have stopped hiking by the end of the year because most of the developed world will be in or near recession. The wild card is what happens in China. If President Xi Jinping persists with his zero Covid policy and there are a cascading series of brutal lockdowns for the rest of the year, then that global economic slowdown could come even faster.

In other geo-political, economic, business & markets news

US retail sales drop 0.3% in May unexpectedly - YahooFinance

China industrial output and retail sales data for May better than forecast - Reuters

Automated driving tech a factor in hundreds of US car crashes - NPR

Apple buys streaming rights to US Major League Soccer for US$2.5b - Deadline

Scoops and news of note here in Aotearoa-NZ this morning

Verrall confirms pre-departure tests for overseas flights end June 20 - RNZ

Simplicity Living says trademarking of coloured Gib anti-competitive - RNZ

Auckland Council starts approving non-Gib products in new homes - RNZ

Heritage listing saves Kāinga Ora flats on Wellington’s Dixon St - DomPost

Ardern says Govt won’t help Christchurch fund stadium cost blowout - The Press

Useful longer reads

Quote of the day

President Xi tells everyone he wants the Ukraine war over

“All parties should push for a proper settlement of the Ukraine crisis in a responsible manner. China is willing to continue to play its due role in this regard.” President Xi quoted in a readout of a call he had overnight with Russian President Vladimir Putin.

Biden attacks oil major super-profits in refining

“I understand that many factors contributed to the business decisions to reduce refinery capacity, which occurred before I took office. But at a time of war, refinery profit margins well above normal being passed directly on to American families are not acceptable.” US President Joe Biden in letters sent overnight to Marathon Petroleum, Phillips 66 and Chevron.

Number of the day

What happened when Russia squeezed its gas supplies

22% - Gas prices in Europe rose 22% to €118 per megawatt hour after Russia reduced gas supplies to Germany through the Nordstream 1 pipeline by 40% and to Italy by 15%, ostensibly to repair the line. Germany accused Russia of political motives for the squeeze.

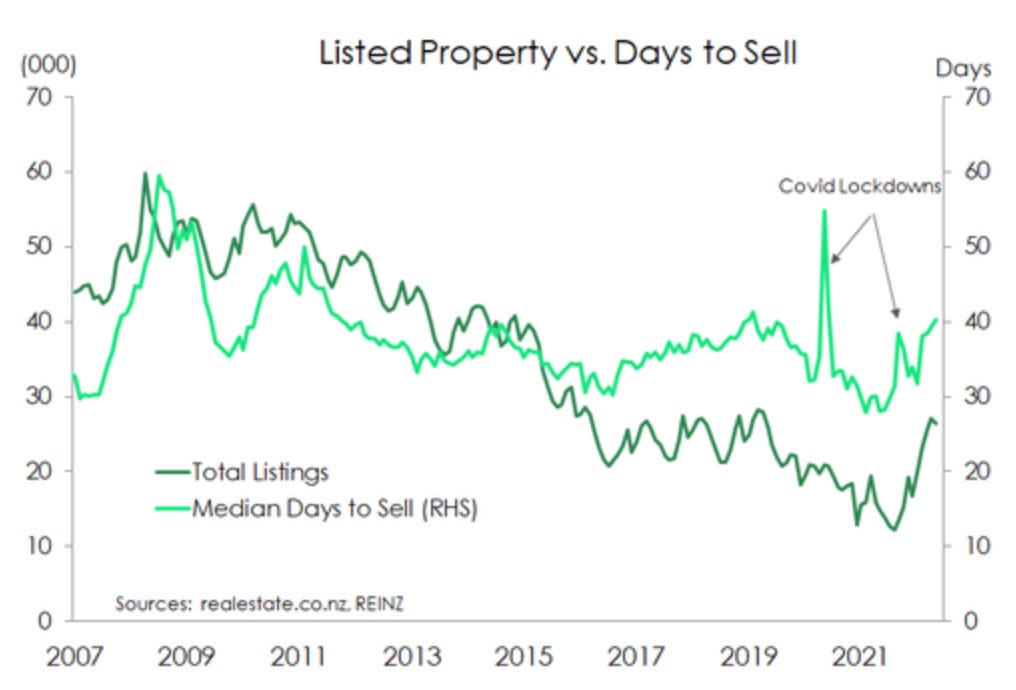

Chart of the day

Underneath the housing market’s fall

This chart via a briefing note from Kiwibank’s Economists shows how the median days-to-sell rose in May to 40 days and is now over the long-run average of 39 days. Meanwhile, listings also rose in the Real Estate Institute’s data released yesterday to pre-Covid levels. The national median price is now down 6% from its November peak, while Auckland City and Wellington City are down 10-12% from their peaks.

Fun things

Ka kite ano

Bernard

Share this post