TLDR: Global investors and traders put on their rosiest-tinted glasses and looked through and past another historically large hike in the world’s most important short term interest rate this morning. They are betting mild recessions later this year in the United States, Europe and (possibly) China will do the heavy lifting needed to thump uncomfortably high inflation rates back down towards two percent next year.

The US Federal Reserve’s Chairman Jerome Powell encouraged that ‘soft landing’ view in a news conference this morning, suggesting the Fed may be able to slow down its monetary policy tightening because of an economic slowdown that has already started. The Nasdaq was up 4% in late trade and the all-important US 10 year yield was becalmed at 2.78%, indicating investors are confident the Fed has already beaten inflation.

Paid subscribers can see more analysis and detail on what the Fed’s actions and words mean for our economy and fixed mortgage rates below the paywall fold, and in the podcast above.

Powell puts a lid on rate hike expectations

It’s 75 - The US Federal Reserve announced it had hiked its key short term interest rate by 75 basis points to a range of 2.25-2.5% this morning in an effort to get annual inflation of 9.1% back under control. The hike in the Federal Reserve’s Funds Rate, its version of our overnight cash rate, was in line with market expectations. It was a second-consecutive 75 basis point hike and the fastest tightening of US monetary policy since the Fed began using the current funds rate system in the early 1990s.

Few fears - However, investors and traders still think the Fed will have to start cutting the rate again next year as looming recessions in the United States and elsewhere suck inflationary pressure out of the global economy, and because higher longer-term wholesale interest rates and price spikes in fuel and food have have already taken the edge off consumer spending appetites that had been pushing prices up. CNBC

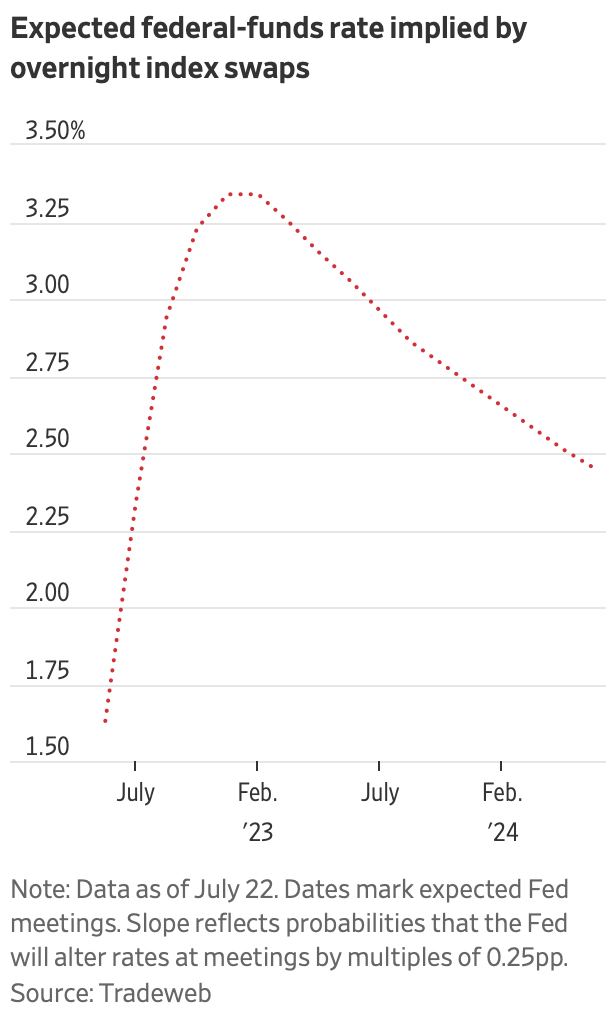

So what? - The Fed Funds rate is the most important interest rate in the world. It effectively sets the base for everything else, including the ones we pay or receive here. Expectations about where the Fed Funds rates is going drive most of the moves in longer term interest rates globally, including our ‘swaps’ rates underpinning our fixed mortgage rates. But what the Fed is doing right now is actually less important than what investors and traders think it will do in the next year or two. Right now, they’re looking out past today’s hike, especially given it was in line with their forecasts, to what the Fed might do later this year and early in 2023.

Soft landing bet - Currently, they see the Fed Funds rate peaking around 3.25% to 3.5% later this year, before being cut back to this new 2.5% level by the end of next year as probably mild recessions in the United States, Europe and even China do a lot of the Fed’s inflation fighting work for it. They’re betting on a soft landing.

Elsewhere in the news here and overseas this morning:

Nuclear back-track - Germany’s Finance Minister Christian Lindner said overnight Germany should extend the life of its three remaining nuclear power plants that produce 6% of its electricity. He said it should also possibly even reopen some plants mothballed by the previous German Government after the Fukushima nuclear disaster just over a decade ago. The back-track comes after another 30% rise in gas and electricity prices in Germany this because of Russia’s decision to halve gas flows through its Nordstream 1 pipeline to just 20% of capacity. Electricity prices have quadrupled in Europe over the last year. Cleanenergywire

So what? - When even a Government that includes a Green Party at its heart is considering nuclear instead of relying on Russian gas, then it’s clear hearts, minds and levels of urgency are rapidly changing about what type of power will bridge the gap to fully renewable electricity, and how quickly it should be done.. Until Russia’s invasion of Ukraine in late February, Europe had been betting on gas being the least climate damaging and cheapest way to transition between replacing coal and oil with solar, wind and hydro-electric power. Nuclear is the rubicon yet to be crossed by Green parties here. We’re getting closer.

Woah Wuhan - Remember Wuhan? Last night Beijing ordered the closure of some businesses and public transport in a part of the megalopolis of Wuhan in western China because of outbreaks of new much more infectious strains than the one that caused Wuhan’s lockdown in early 2020. An area with just over one million people was shut down immediately last night after the discovery of several new Covid infections.

So what? - China’s strict adherence to the elimination strategy we had to abandon late last year is throwing regular roadblocks in front of its attempt to restart an economy hit hard by massive lockdowns in Shanghai and Beijing in the June quarter. President Xi Jinping is seen locked in to his elimination strategy until at least November, when he is expected to be confirmed as ‘leader for life’ at a major Communist Party Congress. Until at least then, the economy of our largest trading partner will keep coughing and spluttering as consumers stay away from the hot-pot restaurants that buy our lamb and economise on cheaper protein.

For the record here in Aotearoa-NZ yesterday

Carbon costs jump - The Climate Commission yesterday recommended tighter controls for our Emissions Trading Scheme. Carbon prices on the ETS rose yesterday after the announcement to $80/tonne for spot contracts and futures for April 2027 rose to $103/tonne.

Plasterboard coming - Housing and Building and Construction Minister Megan Woods announced the first results from her plasterboard taskforce, including that 100 containers with 220,000 square metres of plasterboard (enough for around 440 homes) were on their way to Aotearoa-NZ and would arrive in the ‘coming weeks.’

More confident - Kāinga Ora had also agreed to buy alternatives to Fletcher Building’s Gib for its next year of retrofits (400 houses) and Woods cited an MBIE survey of industry participants showing half were confident when deciding about substituting other brands for Gib. She said Elephant Board, USG Boral, ProRoc and SaveBOARD were all now approved under the Building Code as alternatives.

Charts of the day

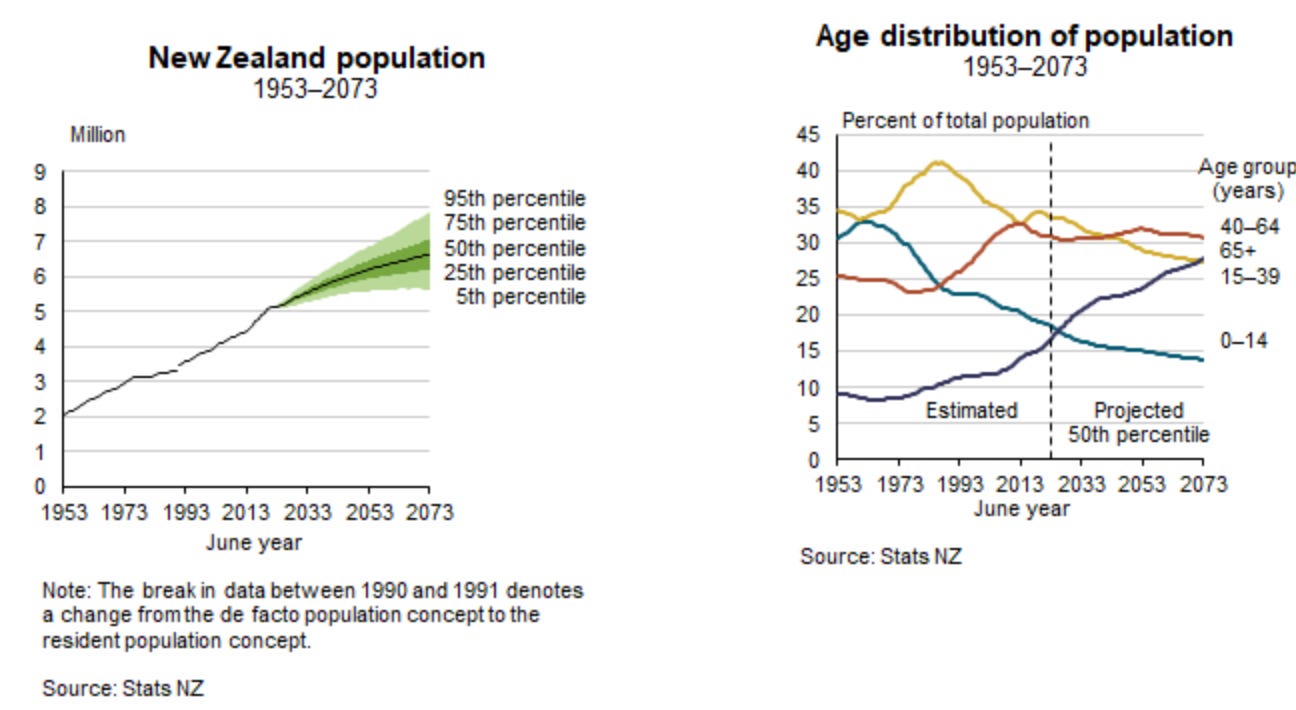

Slowing growth with assumed 25,000 a year net migration

Stats NZ published its first population projections in two years yesterday, including these charts with their central projections of the population growing from around 5.1m now to around 6m over the next generation of 25 years or so. That depends on net migration being assumed at around 25,000 a year over that period, down from as much as 100,000 per year pre-Covid, and that our population continues to grow older and have fewer babies.

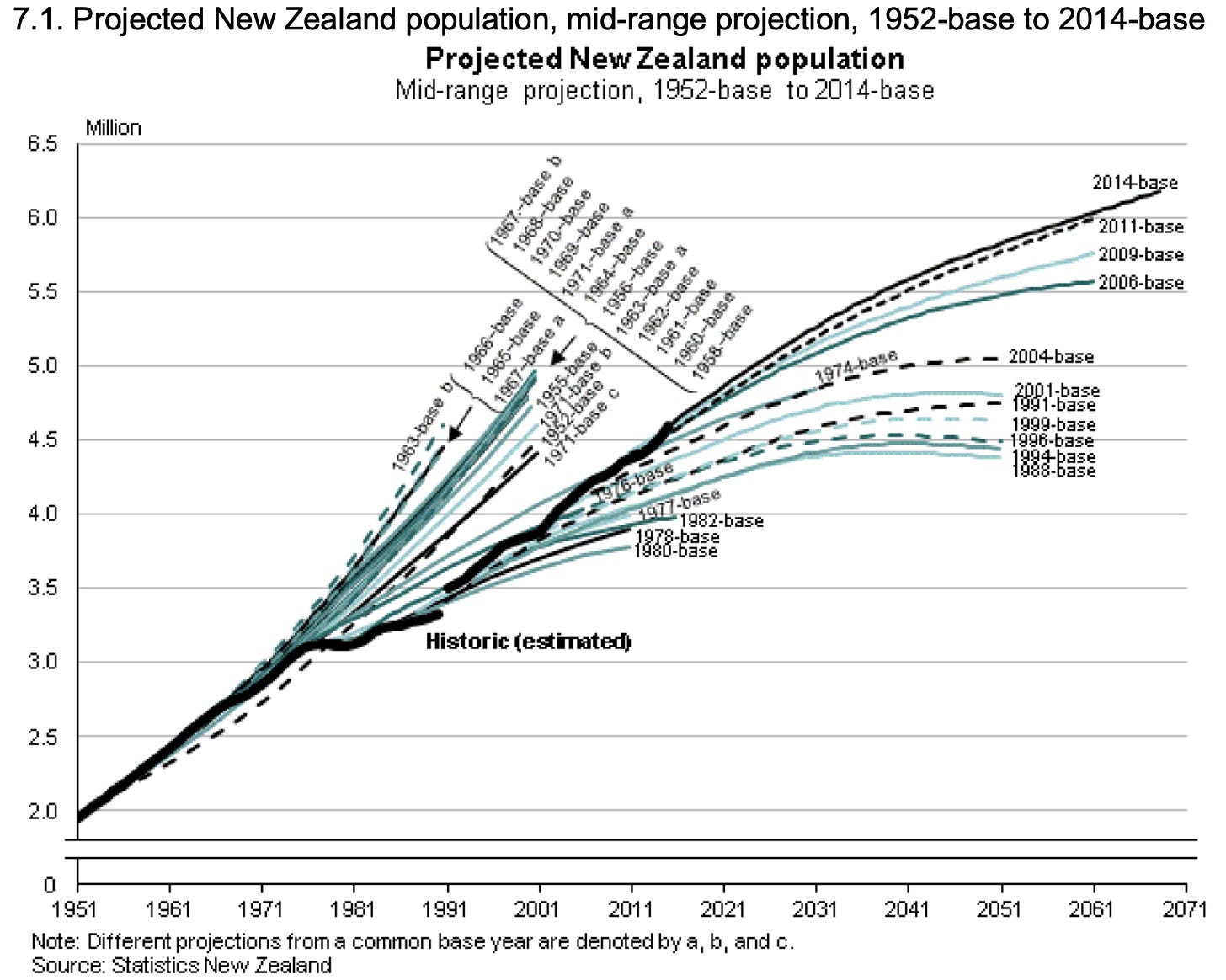

Migration & population growth was under-estimated in 1990s & 2000s

Population forecasts through the 1990s and early 2000s were consistently lower than actual population growth through the first 20 years of this century, mostly because migration was under-estimated.

So what? It meant low population growth was used as one of the reasons for not needing to invest in infrastructure. The trouble is migration was used as a lever to generate cheap GDP growth that generated budget surpluses quickly and pushed up house prices, particularly given the starvation of infrastructure investment by the Government and Councils that use these forecasts to base their long-term plans on.

Number of the day

2.1 - Stats NZ projected there will be 2.1 15-64 year olds supporting one over 65-year-old by 2073, which is down from 4.0 working-age people now and 7.1 in the mid-1960s.

So what? Taxes and/or debt will have to rise if we are to keep our existing public health and pension entitlements, with the current burden heaviest on PAYE and GST payers in that 15-64 age group. The other option is speeding up economic and real wage growth through a burst of public and private infrastructure, R&D and business investment. But that would also require higher and new taxes too.

Rinse and repeat.

Quote of the day

Grant Robertson had some fun in the General Debate in Parliament

“Mr Luxon and I are both children of the 1970s and '80s—that golden era when New Zealand had two TV channels and a ratio of sheep to people to make anyone scared. We grew up with TV shows set in exotic locations: Magnum, P.I., Hawaii Five-O, Close to Home. All these shows made rural Bay of Plenty look marvellous! No wonder Mr Luxon dreamt of holidays on the sun-drenched beaches of State Highway 33! In the morning yesterday, when confronted with his mysterious time and hemisphere bending, Mr Luxon finally said what his social media posts did not: "I went to Hawaii in July, as I tend to do." I'm not exactly sure how relatable that is. In July, I tend to remember that I haven't cleaned the guttering out and that's why there's a massive waterfall going down my property, but each to their own.” Grant Robertson via Hansard.

Some fun things

Ka kite ano

Bernard

Share this post