TLDR: Here’s the podcast above of the weekly hoon from Friday afternoon, where Peter Bale and I chewed over the big events of the week in geo-politics, and here in Aotearoa-NZ’s political economy for an hour in a live webinar for paid subscribers.

This week our special guests were:

Elaine Monaghan, a former Reuters correspondent in Moscow, bureau chief in Ukraine and Belarus, and former US national security correspondent for The Times, and is now a journalism professor in the United States;

University of Otago Professor Robert Patman, a Fulbright Senior Scholar and author of 12 books on international affairs and security issues;

University of Canterbury Professor Natalia Chaban, who has a doctorate from the Kyiv National Linguistic University and specialises in political communication, public diplomacy and EU Foreign Policy; and,

Stuff columnist and senior reporter Dileepa Fonseka, who writes about economics, housing and transport issues from Auckland, including reporting this week on the failure of the Infrastructure Funding and Financing Act, and the inside story on how NIMBYs strangled housing supply from the 1960s onwards.

We talked about:

evidence emerging of war crimes in Ukraine and how that had harded the resolve in both Ukraine and Europe to push Russia out of Ukraine and send as many arms as possible into Ukraine;

whether the west was culpable for Russia’s invasion;

whether Finland and Sweden might apply to join NATO;

how the war in Ukraine and China’s lockdowns were blocking global supply chains already roiled by Covid;

whether Putin could stay on if he lost in Ukraine, especially with Russia’s May 9 ‘Victory Day’ celebrations looming;

how Sri Lanka got into such a mess in recent weeks, and how China is involved;

the failure of the Infrastructure Funding and Financing Act to generate new houses; and,

new research showing how councils and Governments strangled housing supply and allowed congestion to build from the 1970s onwards.

This is our free sampler email and podcast for both free and paid subscribers and is freely available to share. It also includes my summary below of the five news events of the week from my point of view, plus links to my work through the week for paid subscribers, to give free subscribers an idea of what they’d get. A quick technical note: some subscribers may have received a repeat of yesterday’s Ask Me Anything thread in error. Substack said this morning it was having a couple of technical gremlines.

Five things of note this week

Evidence of Russian war crimes emerged

World leaders started setting up war crimes tribunals and gathering evidence of Russian war crimes in Ukraine after discovering hundreds of executed civilians in suburbs around Kyiv that had been occupied by Russian troops.

US President Joe Biden again branded Russian President Vladimir Putin a war criminal and some western leaders openly talked about the need to remove him as a war aim. NATO countries ramped up their sending of air defence and anti-tank missiles to Ukraine, and started sending heavier weapons such as tanks and artillery pieces ahead of an expected new Russian onslaught in the eastern parts of Ukraine.

Our Government announced tariffs on Russian imports and imposed new sanctions of Russian individuals and companies. PM Jacinda Ardern downplayed the need to send lethal military aid to Ukraine, although it emerged later in the week Defence Minister Peeni Henare proposed to Cabinet on Monday that Aotearoa-NZ send its Javelin anti-tank missiles to Ukraine. We have 24 such missiles and their launchers, which we were sent by the United States via Te Kaha from Pearl Harbour to Auckland in 2016 at a cost of $21m. Our army also has stocks of the Carl Gustaf M3 shoulder-launched anti-tank missiles.

National and ACT called on the Government to send the missiles to Ukraine, given they weren’t needed here now and we could restock at a later date.

Shanghai’s lockdowns are causing global economic pain

The ultra-harsh lockdowns of over 28m residents of Shanghai are beginning to hurt the Chinese economy and clog up global supply chains again. Many workers are sleeping in offices and factories and there are reports of residents shut in their tower blocks being unable to get food or medical help.

Dissent is growing online about President Xi Jinping’s ‘zero’ Covid policy, which has mandated increasingly restrictive lockdowns. They’ve worked until now with regular and delta Covid, but is now struggling against Omicron, as our zero policy did. The difference with China though is its vaccination rates are much lower than here, and China used its own much-less-effective vaccines, rather than Pfizer. For example, the vaccination rate of China’s over 70s population is less than 50%.

China’s Government is desperate to offset the growth-slowing effects of the lockdowns in China’s manufacturing and shipping hubs in the east and south. In the last two weeks it has unleashed US$2.3t worth of infrastructure spending plans, which is more than double the amount the United States, for example, is planning over the next five years.

Various factories have shut down, including Tesla’s massive new plant in Shanghai, which is designed to produce more than half of its global output. Global supply chains often begin and end in Shanghai and Shenzen, where there have also been lockdowns.

I covered how these lockdowns and the war in Ukraine are likely to worsen commodity price and shipping inflation, while also slowing global economic growth. I also looked at how it was good news for Australia’s economy, but bad news for hopes of trying to stop our tradies jumping the Tasman for better paid jobs in and around the mines.

Ashley Bloomfield resigned unexpectedly

The Fed became much more hawkish

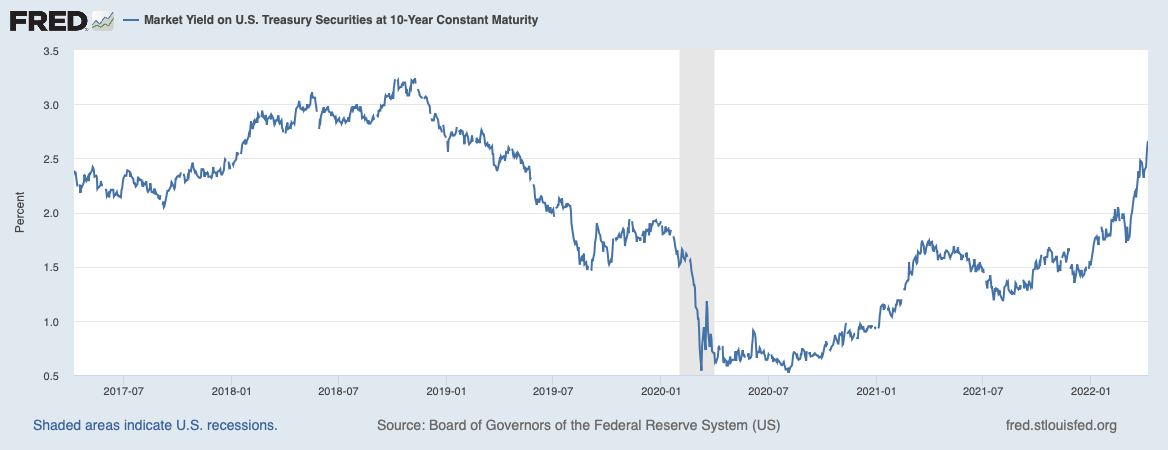

It started with speech from US Federal Reserve Vice Chair Lael Brainard, who had until been renowned as a dovish presence on the Federal Open Markets Committee (FOMC), which decides on monetary policy for the world’s largest central bank and issuer of the world’s reserve currency. She said in a speech on Tuesday that inflation was running way too hot and the Fed would have to hike fast and sell down its stockpile of US$9t of bonds quickly to get inflation under control. Then on Thursday, the minutes of the FOMC’s last meeting, which decided on a 25 basis point hike in the Fed Funds rate last month, said it had been close to going 50 basis points and wanted to ramp up its bond sales to a rate of US$95b a month or over US$1t a year.

This even-more-hawkish turn surprised markets and caused a steep selloff in US Treasury bond markets, and a less severe selloff in stock markets. The US 10 Year Treasury bond yield rose 34 basis points this week to a three-year high of 2.71%. Financial markets now see an 80% chance of a 50 basis point hike on May 4.

These comments below from former Federal Reserve Bank of New York President Bill Dudley were a particularly pungent sign of what is to come, and how the Fed is unlikely to get away with a soft landing this time.

“It’s hard to know how much the US Federal Reserve will need to do to get inflation under control. But one thing is certain: to be effective, it’ll have to inflict more losses on stock and bond investors than it has so far . . .

“As [Fed chair Jay Powell] put it in his March press conference: “Policy works through financial conditions. That’s how it reaches the real economy.”

“He’s right . . . The US economy doesn’t respond directly to the level of short-term interest rates. Most home borrowers aren’t affected, because they have long-term, fixed-rate mortgages. And . . . many US households do hold a significant amount of their wealth in equities.” Bill Dudley

This interview with him is also worth watching.

So what? - What the Fed does with interest rates is arguably the most important indicator of where the global economy and asset prices are headed. It will also be closely watched by our Reserve Bank, which is expected to put up our Official Cash Rate from 1.0% to either 1.25% or 1.5% next Wednesday.

The bottom line: The Fed has now completely shed its ‘transitional’ view on inflation and is going to crack down very hard on inflation, possibly to the point of causing a US recession. That will affect us. However, some think the Fed will over-tighten and have to be slowing down and possibly reversing by late next year. The 2-10 year spread’s dip into negative territory last week suggested just that.

That potential for interest rates to stop rising later this year or early next year is a factor I think in a likely bottoming out of our housing market with falls of as much as 10%, but not much more.

How the NIMBYs downzoned their way to greater wealth

Ka kite ano

Have a great weekend

Bernard

The week that was for the week’s end