TLDR & TLDL: This week, inflation worsened and is proving increasingly stressful for renters on the lowest incomes in Aotearoa-NZ. Labour fell behind National in another poll, in part because of these cost-of-living stresses and a Christopher Luxon promise to cut taxes, even though those tax cuts would go mostly to those facing the least cost-of-living stress.

In summary this week:

the oil price spiked over US$130/barrel after the United States and Britain banned Russian oil imports to ramp up even more pressure on Vladimir Putin to call off his murderous invasion of Ukraine, forcing our petrol prices well over $3 a litre by the end of the week and adding to food price inflation;

the Christopher Luxon-led National Party took the lead over the Labour-led Government in a second opinion poll for the first time since the 2020 election;

the poll was taken as Luxon promised tax cuts of just over $100 a year for those on low incomes and over $1,000 a year for those on the highest incomes;

A working group of councillors, mayors, iwi and bureaucrats proposed tweaking Nanaia Mahuta’s Three Waters plan to give councils shares in four new water entities to stop others privatising them, but the shares wouldn’t have other powers to stop water charges or block co-governance with iwi;

food poverty and rental stress are intensifying, forcing a kindergarten to make its own food parcels for parents and forcing one single mum with a new baby to spend her last $240 on tents to live in a Hastings park during a storm; and,

the Government agreed with bank suggestions to ease the blockages to mortgage lending caused by new consumer credit laws that force bankers to interrogate borrowers about their spending habits and plans for kids.

The podcast of our weekly ‘hoon’ webinar above included myself, Peter Bale and Robert Patman talking last night about these events of the week, in particular the tragedy and implications from Russia’s invasion of Ukraine, the mortgage lending changes and brief chats on Three Waters and the polls. The full text of the comments and questions from over 100 paid subscribers who attended the weekly webinar on zoom from 4pm to 5pm on Friday is below the paywall fold below.

Five things of note this week

Fuel and food inflation are running hot

Russia’s invasion of Ukraine just over two weeks ago is proving a tectonic shock for global trade, politics and economics, aside from the human tragedy unfolding in and around Ukraine itself. It is changing everything from the prices of petrol and bread, through to many countries’ plans to combat climate change and defend themselves.

It is that big and that’s why I’m spending so much time trying to understand it and bring as much useful information to subscribers here as often and soon as I can. I worked as a financial, economic and political journalist overseas for 10 years until 2003 so I can’t help it, but I also think these issues aren’t covered here in Aotearoa-NZ in the depth or with the understanding I think is needed.

Finally, I can truly justify the indulgences of my subscriptions to the FT, Bloomberg, Reuters, The Economist, The New Yorker, The Atlantic, the New York Times, the Wall St Journal, Wired, The Telegraph, The Australian, the Australian Financial Review and five Substacks. Your subscription is helping me pay for these too. ;) Thank you.

Lynn and I get up at 4am every morning to trawl through these feeds of news to make sense of it all from our perspective and point out the things that matter every day so we can all understand, for example:

why the price of petrol just rose 30c/litre to $3.20/litre and may well rise to over $3.50/litre in the coming weeks because the US and Europe have finally had enough of Vladimir Putin’s bullying and want to destroy the Russian economy, even if it hurts their own consumers and corporates;

why our mortgage rates need to rise, or why maybe they don’t need to rise, and what affect that all may have on our asset prices and rents;

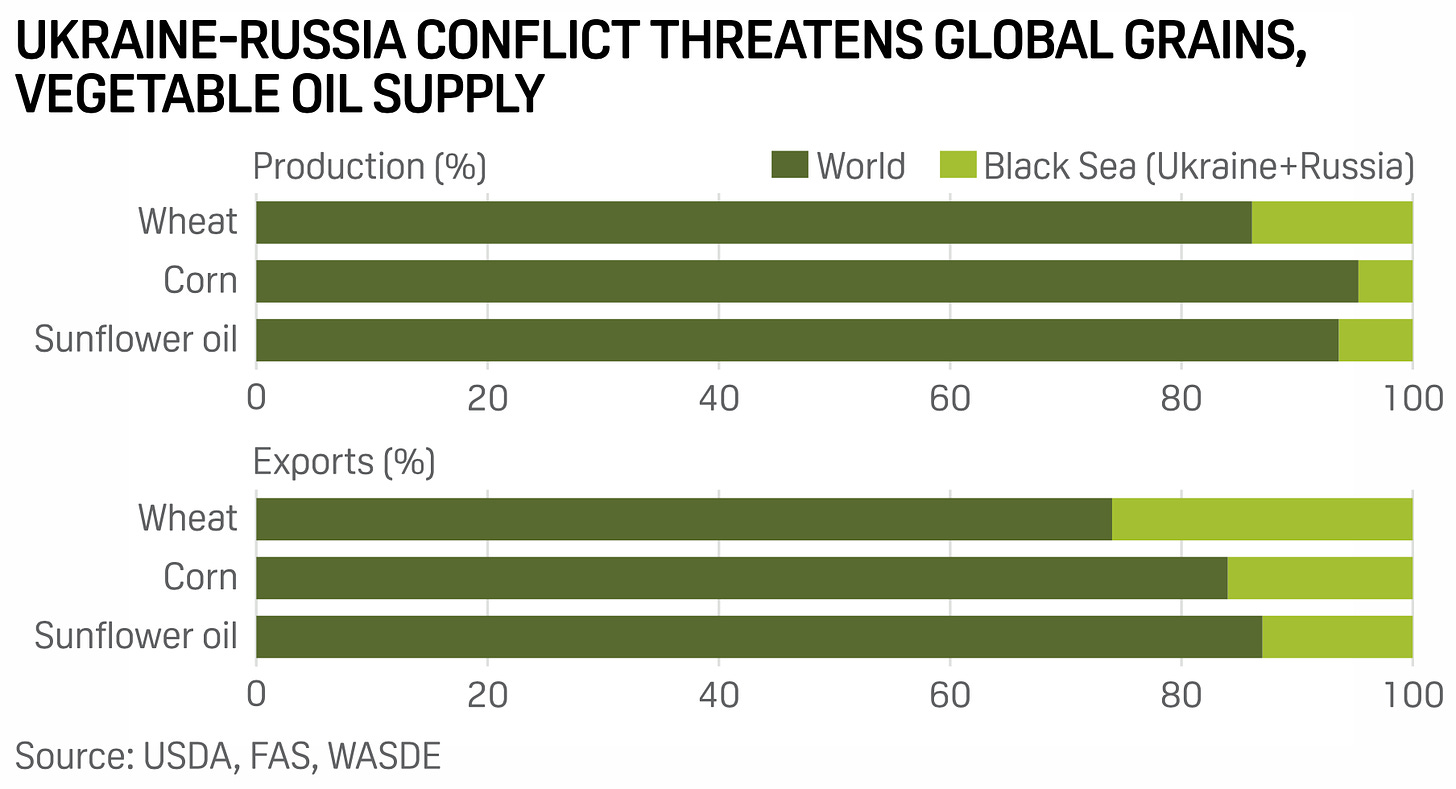

why the price of bread, grains and many proteins are likely to go up a bit because Russia and Ukraine export over 30% of the world’s wheat; and,

why farmers here are going to feel both the price of diesel and fertiliser rise sharply, although their product prices are hitting record prices for the same reasons.

Every morning I try to include these sorts of chunks of news in my emails and podcasts. I’m including a lot more overseas news than usual and looking at what it might mean because I’m starting to think this is most significant shift in global affairs and the global economy in at least the last 30 years, both of which are affecting us here at the bottom of the world daily.

That means bigger than the Global Financial Crisis, bigger than 9-11 and at least as big as Covid, although it’s hard to unravel the effects of these two things because they’re happening at the same time.

The changes happening right now are on an epic scale. For example:

over two million refugees have flooded into Poland, Slovakia, Hungary and Romania and many will then filter through to the rest of Western Europe in the coming months, making it the biggest exodus in Europe since World War Two;

oil prices up more than 30% since the invasion because Russia used to produce 10% of the world’s oil and gas exports, and (so far) the rest of the world’s exporters haven’t increased their output much;

wheat prices are up more than 30% since late February because Russia and Ukraine produce more than 30% of wheat exports and the ports for those exports are blocked, being bombarded, wrecked and/or uninsurable for container and bulk goods ships to visit; and,

Ukraine’s farmers just missed a 10-day window to plant their spring crops of sunflower, barley and corn, which means sunflower oil prices are rising fast.

This S&P Global analysis published yesterday is a useful backgrounder on all of this, including this chart showing the Ukrainian and Russian shares of exports and production of these grains and oils.

National took a poll lead over Labour

National got 39% support to Labour’s 37% in TVNZ’s Kantar poll on Thursday night. It was the second poll after Roy Morgan’s poll to show National in front for the first time since the 2020 election.

The poll was taken last weekend when new National Leader Christopher Luxon was announcing plans for tax cuts, which I looked in more detail here.

Food poverty and rent stress are rising here too

I wrote on Thursday about an increasing number of signs of cost-of-living stress.

The real issues with Three Waters

This week a governance working group recommended the Government tweak Three Waters to ensure councils could stop the four new water entities being privatised. I wrote in more depth about the problems with Three Waters on Wednesday.

Putting a prop under the housing market

On Friday morning the Government announced tweaks to new credit laws to make it easier for banks to lend to home owners without having to interrogate them about their spending and investing habits and plans.

I wrote about it in the context of the effective Government Guarantee for home owners.

FYI below for hoon participants, there is a transcript of selected comments and questions in the webinar, including links we’ve included.

00:08:02 Peter Bale: https://mailchi.mp/a92baf6911fe/bulletin-world-weekly-a-weather-report-for-the-world-2459774?e=1d76093927

00:08:46 Bernard Hickey: Welcome questions here on the chat or in the formal Q&A function

00:12:05 Fiona: What exposure does Deutsche Bank have to Russian investments/customers/trade? Just how wobbly is our global banking system?

00:12:24 Jonathan Suckling: Fuel prices to rise 40-50cents tonight apparently?

00:12:43 Dave H: Have we still got those shrink wrapped sky hawks that we could lend them?

00:12:45 Mr Anderson: I think the problem is 'how to get them there' as soon as they fly out of a NATO base and land in the Ukriane, hey preto escelato

00:13:04 JA: Any prospect of the NZ estates owned by Oligarchs being seized?

00:14:54 Your Servant: Mr Luxon looks almost exactly like the CEO in Dilbert.

00:21:05 R: Question for Dr. Patman as well as Bernard and Peter.

1.) should Russia pull out of the Ukraine and retain the lugansk and donetsk regions, as well as the land bridge to thr Crimean peninsula, how long will the sanctions against Russia last?

2.) what is the economic future for Russia here?

3.) are they serious when they talk about nationalising businesses? This is economic suicide in thr medium term surely?

00:21:31 Garry Moore, Mairehau, Christchurch: How much was a weak report from the Commerce Commission a result of putting compliant people on these boards

00:23:23 Paul Kennedy: Hilarious that the duopoly is found to bully suppliers... but given THREE years to please stop that while the new oversight agency find a bus ticket to wet.

00:23:40 Brett Tamahori: Man, it's a pity we don't live in a country that produces a vast amount of food, that would be nice.

00:30:57 Ryan Stowers:

00:34:35 Bernard Hickey: https://www.ft.com/content/02095093-329b-4b66-9f80-13d07350014c?emailId=6229d4a323e92a00234cb104&segmentId=d16cd453-7bb5-45ba-728c-35ca5739b9f6

00:47:29 Peter Bale: https://www.theguardian.com/books/2015/feb/04/nothing-is-true-and-everything-is-permitted-peter-pomerantsev-review-russia-oil-boom

00:59:54 Peter Bale: Thomas Friedman on Putin having no way out: https://www.nytimes.com/2022/03/08/opinion/putin-ukraine-russia-war.html

01:01:29 Peter Bale: Here is an excellent story on the question of whether we should have stopped him in Georgia: https://edition.cnn.com/2022/03/01/opinions/georgia-former-soviet-putin-ukraine-antelava/index.html

01:04:40 Ryan Stowers: An alternative view point on Putin from John Mearsheimer on Ukraine Invasion, https://www.nytimes.com/2022/03/09/opinion/ukraine-russia-invasion-west.html

01:04:49 Paul Kennedy: The only country with more top 5 results at Eurovision in the 21st century than Ukraine - Sweden, and... Russia. Make of that what you will.

01:06:14 Pat Clark: John Mearsheimer works from a flawed theory, that being the Ukraine is a western proxy.

Share this post