Kia ora. Long stories short:

The RBNZ was forced to make a dramatic about-turn yesterday, cutting rates after the slowdown it wanted was turbocharged into a recession by the Government’s abrupt closure of construction pipelines for state-funded building of homes, schools, hospitals and water networks, and its slashing of thousands of public sector jobs shocked parts of the economy to a standstill.

The forecast of a longer and deeper recession came as Civil Contractors NZ said its 2024 survey results showed the Government’s freezing of capital spending had unnecessarily caused a crisis and was driving businesses to the wall.

A globally recognised climate activist who once served on Air NZ’s sustainability advice panel after a request from then-CEO Christopher Luxon has criticised the airline, its ‘sustainability-lite’ CEO Greg Foran and says the PM is now an “outstanding hypocrite”.

The Reserve Bank cooled out jets, and then the new Government decided to cut some of the fuel lines and dismantle the engine on approach for landing.

The Top Six things

Here’s the top six things to note in Aotearoa’s political economy around housing, climate and poverty on Thursday, August 15:

1. What happened between May & August to flip the RBNZ?

Govt’s closure of construction pipelines amplifies RBNZ’s tightening

Well, that escalated. Suddenly, the central bank is cutting rates a year ahead of its previous expectations to avoid an ugly and unnecessary recession.

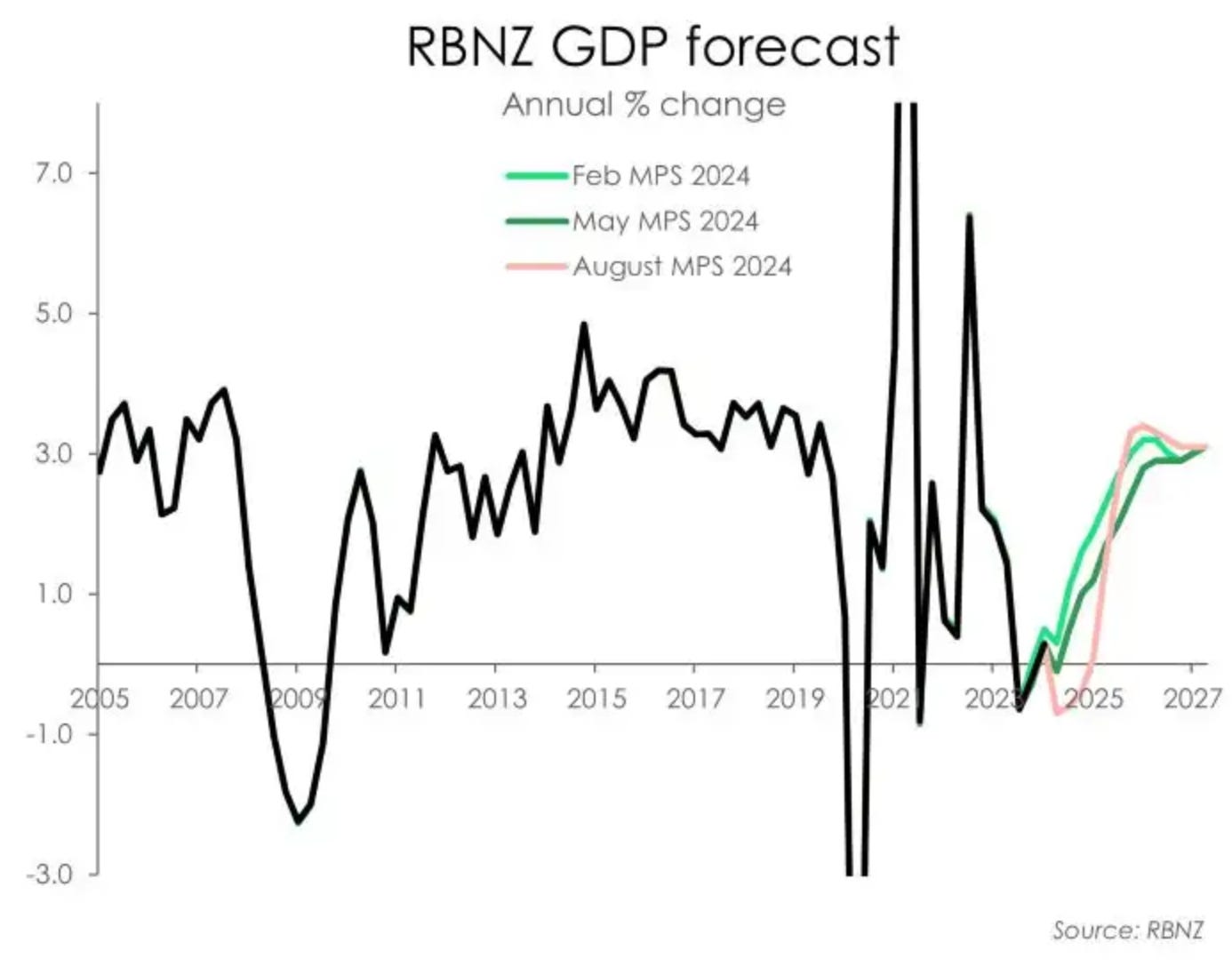

Te Pūtea Matua-The Reserve Bank of New Zealand had been bearing down on the economy with a 5.5% Official Cash Rate since May last year to engineer a slowdown that would squeeze inflation back towards its 1-3% target band. Everything was going to plan for a soft(ish) landing that would avoid a sharp recession. The RBNZ expected a little bit of help from the new Government to tighten fiscal policy, but it got many more turns of the screw than everyone expected, and now Aotearoa faces a longer and deeper recession.

The Reserve Bank cooled our jets, and then the new Government decided to cut some of the fuel lines and dismantle the engine on approach for landing. Now the central bank is having to pull back on the stick earlier than it expected and push on the throttle.

Perhaps the pilot and flight engineer should work together a bit more.

The Government’s decisions from December through to May to clamp down on the pipelines for state-funded building of houses, schools, hospitals, local roads and water networks was the moment of dismantling. The Finance Minister’s orders to ministries to cut 6.5% from their Budgets for the May 30 Budget was the moment when some of the fuel lines were cut, unleashing thousands of high-paid job cuts shocking Wellington’s economy to a standstill.

But the Reserve Bank couldn’t be completely sure of that shock to construction and Government employment when it published its forecasts in its May 22 Monetary Policy Statement. Three months ago, it was still wondering if the tax cuts that arrived on July 31 would stimulate the economy and keep local inflation high. That meant it forecast GDP would rise and that it would not need to or be able to cut until late next year (yes, late 2025).

Instead, the construction sector, first home buyers, government workers and consumers saw the Budget and realised first home buyer grants had been cut, departmental capital and wages udgets would be tight for years to come and there was no opening of the capital pipelines for homes, classrooms, hospitals, local roads and local water networks.

The ‘high frequency indicators’ of card spending, PMI, PSI, business confidence, job ads and housing market activity tanked in June as the construction sector ramped up their job cuts, subbies jumped on planes to Australia and the shell-shocked bureaucrats of Wellington stopped buying both the cheese scones and flat whites. Here’s what I wrote about the economy ‘tanking’ on July 12.

Here’s how the Reserve Bank’s GDP forecasts have changed between May 2024 (dark green) and yesterday (red):

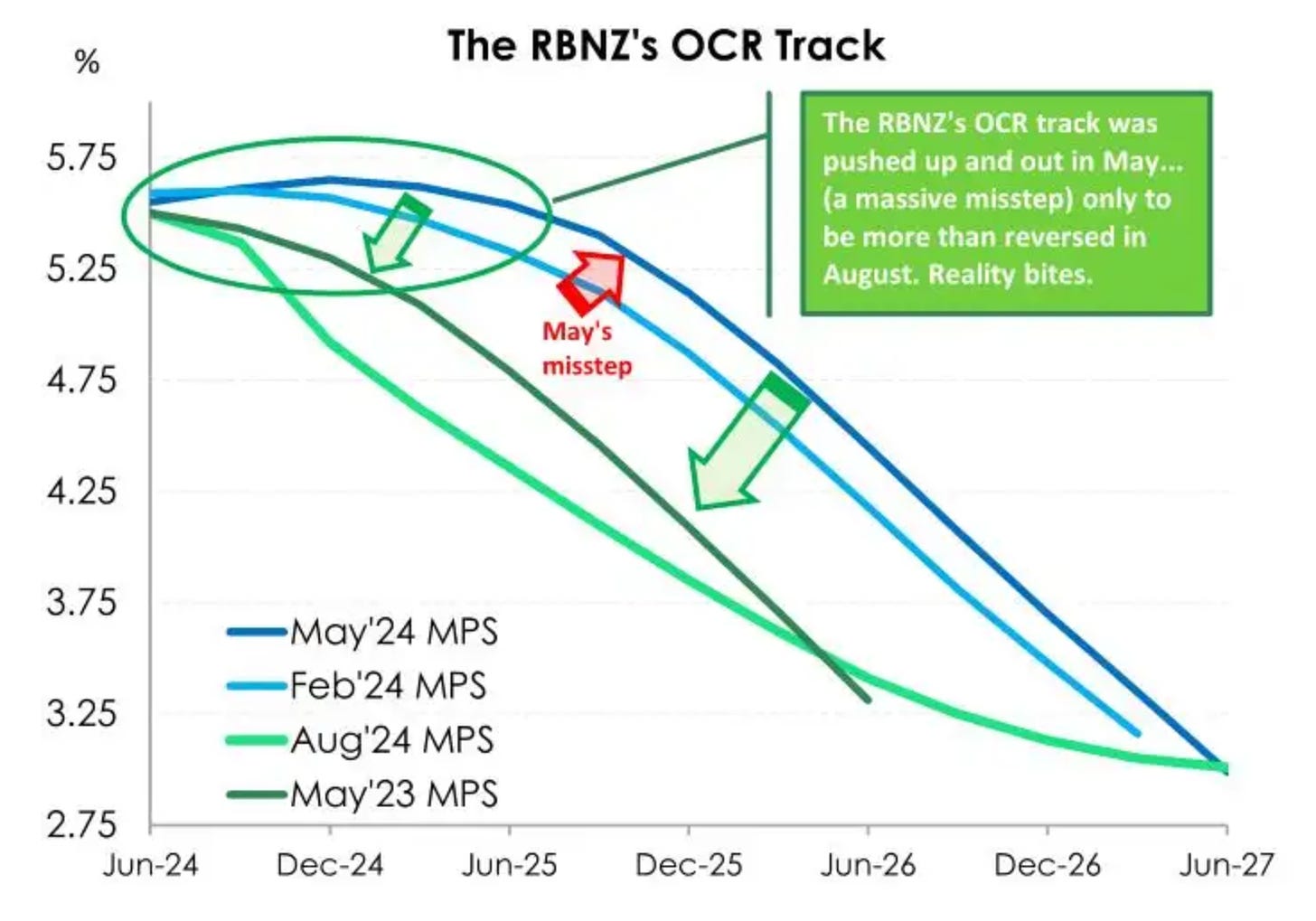

And here’s what that meant for the Reserve Bank’s OCR track between May 2024 (dark blue) and yesterday (light green):

Ironically, perhaps, the RBNZ’s May 2023 forecast appears more accurate.

Furrowed brows and perpolexed spectators

This dramatic about-face in forecasts has a few economists up in arms.

Here’s Infometrics’ Brad Olsen saying via RNZ’s Susan Edmunds the RBNZ had performed its “biggest flip-flop ever.”:

“The bank seems to have just ignored what it did in May and hope the rest of us forget - we won't.

"To be fair, it's probably the right move but the huge revision to the OCR track - a thing the Reserve Bank quite directly controls - shows how completely wrong they were in May.

"They try to explain it away a little bit by saying near-term economic indicators have change and are now on a weaker track - but it's not that much weaker. I've said before the indicators that have come in so far that they have said over time they watch have come in broadly as expected. They've completely ignored themselves."

He said it was "probably the biggest flip-flop" ever seen from the Reserve Bank.

"The bank clearly has no idea why the economy has apparently changed so much between May and August." Brad Olsen

A few economists said the Reserve Bank had gotten it wrong by still being too worried about inflation in May and issuing an overly hawkish commentary about not needing to cut rates any time soon.

Here’s BNZ’s Stephen Toplis in a note:

“There will be those who criticise the Bank for cutting so soon after a May MPS which introduced a tightening bias. We do not think this criticism is warranted. If the data moves against your expectations, then you move your stance. This is what the Bank has done.

“However, back in May we questioned the decision to adopt that tightening bias and we think that in hindsight folk will come to accept that May was a mistake, not today’s decision.” BNZ’s Stephen Toplis in a note

And ANZ’s Sharon Zollner also wondered whether May’s hawkish forecasts were a mistake.

“I think the Reserve Bank would have to acknowledge that May was a step in the wrong direction. They made some very pessimistic assumptions, which we pointed out at the time that we thought that maybe they should have more confidence that inflation was going to keep falling.

“But they were very worried about some productivity data and they had just had a significant upside surprise on the non-tradable inflation. But I think it is risky for the Reserve Bank to dismiss their OCR track in particular, because that is a very important signalling device for the market.

“So you can't sort of tell people, well, ignore what we said last time, but take what we're saying this time as gospel. You know, there has to be some sort of consistency there. So I think probably the upshot is absolutely take note to what they are saying, but always be aware that they reserve the right to change their minds as the data keeps coming in.” Sharon Zollner via the 5in5withANZ podcast

Perhaps, like the rest of us, the Reserve Bank has been surprised at just how hard and fast the Government’s capital spending freeze would give the economy a cardiac arrest. Read on.

2. ‘Why did you close the pipeline? The work has to be done’

Civil Contractors pleads for Government to reopen the pipelines of work

Horizontal infrastructure (roads, pipes etc) industry association Civil Contractors NZ (CCNZ) didn’t pull any punches or do any fudging in saying yesterday with the release of its annual survey of members that the Government had destroyed confidence about future work by freezing decisions and capital grants centrally and locally.

Here’s CCNZ CEO Alan Pollard in a statement on the survey of 226 civil construction professionals 24 May to 21 June 2024 (bolding mine):

“If we conducted the survey again today, the response would be even more dire. Right now, I am fielding daily emails from our members, who are deeply concerned that their businesses may not survive.

“I can’t stress enough the importance of a well-defined, committed, and funded pipeline of work. The government needs to act quickly to restore business confidence. Promises alone won’t get things built.

“Only a committed and adequately funded programme of work will give businesses the assurance they need to invest in the people and technology required to get infrastructure works done.” CCNZ CEO Alan Pollard in a statement

The survey found 64% reported a shortage of work was their main issue, vs 29% saying that in 2023, while 57% said they were having problems with central government and council procurement guidelines and work consents, up from 36% last year.

“The results of the first survey since the 2023 election paints a landscape of uncertainty, driven by a dramatic increase in the lack of work and a decline in confidence regarding future pipelines and revenue

“Given the amount of long-term infrastructure work projected, this is a poor time for the industry to down-size, but the current market means many companies are currently left with little choice.” Alan Pollard

3. Once upon a time…

Climate activist who once worked with Luxon at Air NZ criticises airline

Jonathon Porritt is a high-profile British-based climate activist who was once on Air NZ’s Sustainability Advisory Panel. By the by, his father was also a previous Governor General of New Zealand.

Yesterday Porritt posted on LinkedIn about his disappointment with Christopher Luxon and Air New Zealand, especially after it gave up on its emissions reductions targets for 2030 and pulled out of the Science Based Targets Initiative two weeks ago.

Here’s Porritt (bolding mine) telling the story:

“Once upon a time, a guy called Christopher Luxon, seeking a career uplift after many a long year selling detergents and mayonnaise for Unilever, became CEO of Air New Zealand. Ten years ago, seeing serious sustainability challenges ahead, he decided to set up an international Sustainability Panel. And was crazy enough to invite me to chair it.

”Air New Zealand became a bit of a star in the aviation industry, as it seriously got to grips with its climate responsibilities. Mug that I am, I felt proud to be able to call it “the world's least unsustainable airline!” (All airlines remain seriously unsustainable).

”In 2023, somewhat improbably, that same Christopher Luxon became Prime Minister of New Zealand – as part of a right-wing coalition including two populist, climate-denying fringe parties. All those serious sustainability challenges he’d faced into at Air New Zealand mysteriously disappeared.Air New Zealand is majority owned by the NZ Government – and any profit it makes goes straight back into government coffers. So (CEO) Greg Foran's predecessor, Christopher Luxon, is in effect Greg Foran's boss as Prime Minister. The Air New Zealand Board members are just bit part players in this weird relationship.

This was not a happy combo for Air New Zealand: a number-crunching, sustainability-lite CEO, reporting to a right-wing populist Prime Minister (sporting his newly-minted credentials as an outstanding hypocrite), with a Board intent on serving its new political masters, however ignorant they turned out to be.” Jonathon Porritt via LinkedIn.

4. Quote of the day

Mayor says council needs Govt cash to address housing crisis

“We don’t have headroom with funding – we’ve reached our maximum debt ceiling because of the water reforms. It’s frustrating from a small council’s point of view, where the needs are greater. There is a huge need for housing.

“We have pockets in our area with a deprivation level of 10, the worst. Some people are living in unsafe, cold, and old housing stock. There’s a big need in this district. We will keep badgering central government to provide some state housing so people can stay in the community they desire to be in.” Ruapehu Mayor Weston Kirton via NZ Herald

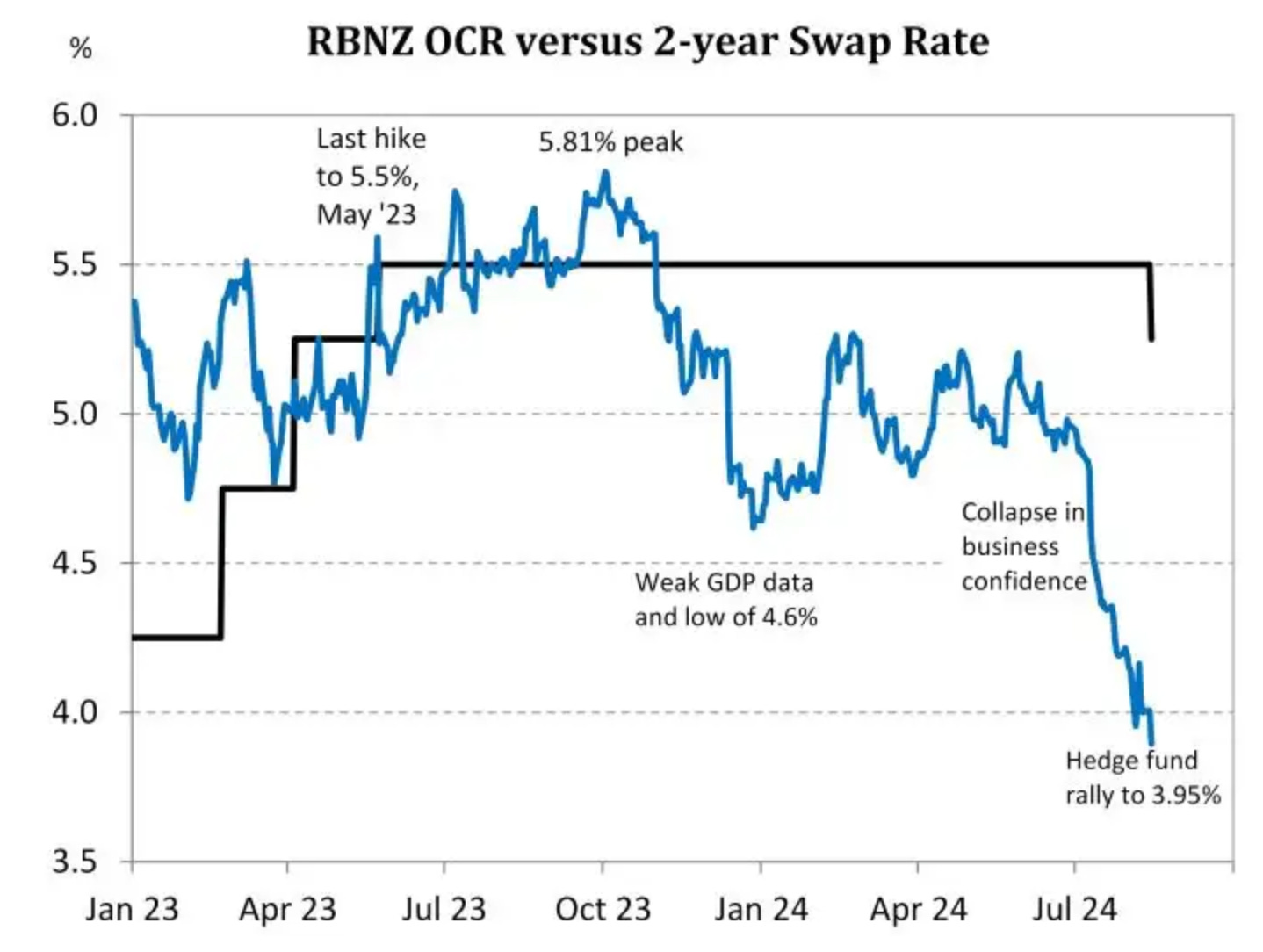

5. Chart of the day: Rockets and feathers

Wholesale rates have fallen 100 bps. 2 year fixed rates are down 50 bps’

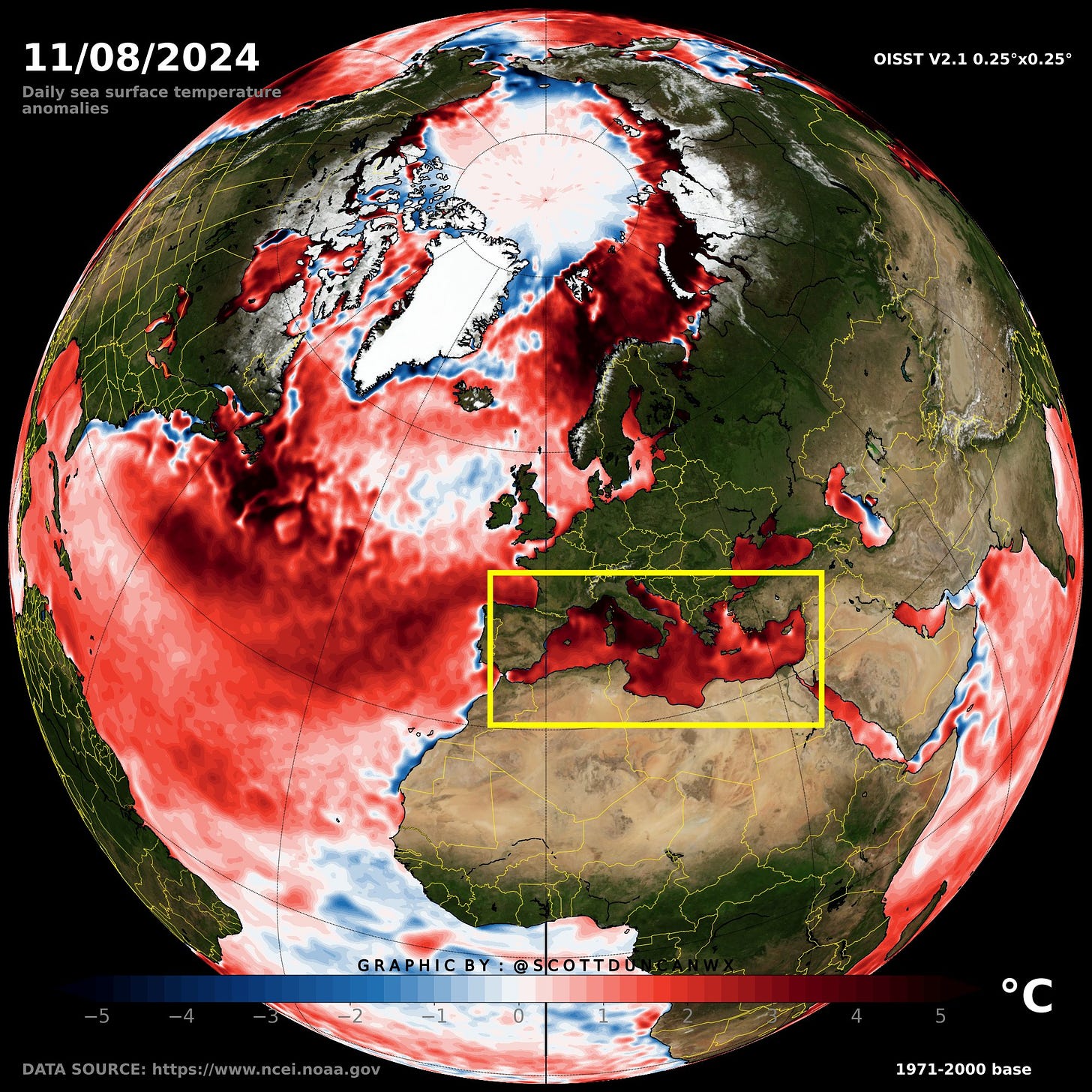

6. Climate graphic/chart/pic of the day

Mediterranean frogs set to boil

The Kākā’s Journal of Record for Aug 15

Economy: The Reserve Bank cut the OCR to 5.25%, saying that inflation is returning to within the Monetary Policy Committee's 1-3% target band. The Committee noted NZ's economic contraction in recent months, and said restrictive monetary policy and falling net migration may be playing a role. RNZ, Interest

Poverty: Children’s Minister Karen Chhour said a young person who chose to opt out of the Palmerston North boot camp pilot will "not have this option" once legislation for the programme is passed.

Economy: Parliament’s Primary Production and Finance and Expenditure Select Committees announced the terms of reference for an inquiry into banking competitiveness, including price and profitability of banking services, possible barriers to competition and lending to Māori organisations and individuals.

Poverty: Immigration Minister Erica Stanford & Foreign Affairs Minister Winston Peters announced that the pause on accommodation cost increases for Recognised Seasonal Employer scheme workers will be lifted, and only "experienced" RSE workers will have to be paid 10% over the minimum wage. Additionally, the RSE's cap will rise by 1,250 workers to 20,750, and employers will have to pay workers an average of 30 hours a week over four weeks.

Housing: The Environmental Protection Authority approved fast-track consenting for a Remuera retirement village. The Upload Road village will have 183 independent living units and 60 aged care units over roughly three hectares.

Climate: The Ministry of Transport released research on heavy vehicle operators showing that only 51% have committed to reducing their carbon emissions. Truckers said barriers to zero-emissions and low-emissions vehicle uptake included high up-front purchase costs, insufficient in-house maintenance skills and equipment, and a lack of charging locations.

Finally, some fun things

Cartoon of the day: Trump and Musk warming up

Timeline-cleansing nature pic

Spring is springing

Mā te wa

Bernard

Share this post