TLDR: PM Jacinda Ardern has accused the banks of breaching their social license by making too much profit when many taxpayers at large are struggling in the wake of covid. She is right, and now needs her apparently reluctant Finance Minister Grant Robertson to take the next step and consider imposing a covid windfall profit levy on our big banks.

Not only have the big four Australian-owned banks massively increased their profits because of the Government’s covid response, but they are now more profitable than their parents and almost all their peers in other developed economies.

They can and should thank taxpayers broadly because they benefited from the Reserve Bank giving them massive lending tailwinds in 2020 and early 2021. Also, they are now able to turbo-charge that lending growth into higher profits because banks tend to increase their net interest profit margins when official interest rates are increased to fight inflation.

It’s a taxpayer-powered double whammy generating pre-tax profits at an annualised rate of $9.2b a year for four Australian-owned private companies. Simply imposing a levy equal to the one their parents already pay in Australia would generate extra tax revenues of $2.6b a year, which would be enough to either pay for a tax cut or extra social spending, or to return the Budget to surplus sooner.

Using such a windfall tax levy to effectively tighten fiscal policy, would actually help the Reserve Bank fight inflation and avoid some of the interest rate hikes that are actually helping inflate the profits of the big four.

How did we get to here?

Late last month the Green Party proposed an one-off excess profits tax that would increase the corporate tax rate from 28% to as high as 50% for large companies in some sectors such as supermarkets, banking and electricity retailing, with the money spent on extending the recent cost of living payments or student and welfare debt write-offs. The Greens policy proposal document included the idea of a more permanent increase in the corporate tax rate and that any one-off increase could be retrospective. I’ve included my interview with Green Finance Spokesperson Julie-Anne Genter above for more detail and background on that. Here was my report on that when the proposal was made. Ardern and Robertson said at the time they had no plans and were not investigating such a tax.

Then, almost two weeks ago, ANZ reported a record annual profit of $2.3b, up 20% from a year ago because it benefited from the higher interest rates the Reserve Bank is now cranking into the economy, and because of the extra $14b of home loans it made since covid, and over a time ANZ lent less to businesses and farmers and shed staff. Problematically and accidentally, the profit came on the same day Reserve Bank Governor Adrian Orr said extra unemployment was needed to fight inflation. Here’s my report on that from then.

It all came to a head yesterday when Westpac reported record-high core annual earnings of $1.551b, up 17% as it also benefited from extra mortgage lending during covid and higher net interest margins. Then, Ardern criticised banks for consistently producing very high profits at a time when others in the community are struggling, saying they had lost their social license. But she stopped short of calling for a windfall profit tax, suggesting the high bank profits were not a result of an act of God or Government that would justify any sort of one-off or ‘special’ tax, as has been seen in Europe and Australia with windfall taxes on energy companies benefiting from the Ukraine war shock to oil prices.

Then it all exploded today when Robertson reappointed Orr for a second full five-year term as Reserve Bank Governor until March 2028, over the top of objections from the Opposition. National Leader Christopher Luxon and National Finance Spokeswoman Nicola Willis said Robertson had over-ridden convention by employing Orr for a full term when an interim one-year term would have given any new Government freedom to appoint its preferred candidate after the next election due at the end of next year.

Luxon and Willis said they would immediately appoint a fully independent inquiry into the Reserve Bank’s actions during covid under Orr if elected next year, including whether its $55b of money printing, abandonment of LVR controls and $16.4b of subsidised lending by the Reserve Bank to banks through the Funding for Lending scheme had increased bank profits. Luxon said he did not favour a windfall tax because it might discourage bank investment, but he wanted a full inquiry conducted into the Reserve Bank’s actions.

So are banks ‘too’ profitable?

We know that the Reserve Bank deliberately encouraged banks to lend much more aggressively into the housing market from March 2020 and early 2021 to support the economy through the ‘wealth effect’, whereby home owners who see the value of their homes go up can spend an estimated extra three cents of every extra $1 in their net worth. Firstly, as Aotearoa was locked down in late March 2020, the Reserve Bank slashed the Official Cash Rate to 0.25% and started printing money to buy long-term Government bonds, which was designed to lower longer term mortgage rates. Within weeks it also completely removed LVR lending restrictions in place for nearly seven years. Combined, this sparked a frenzy of bank lending that pushed up house prices by 45% by mid 2021.

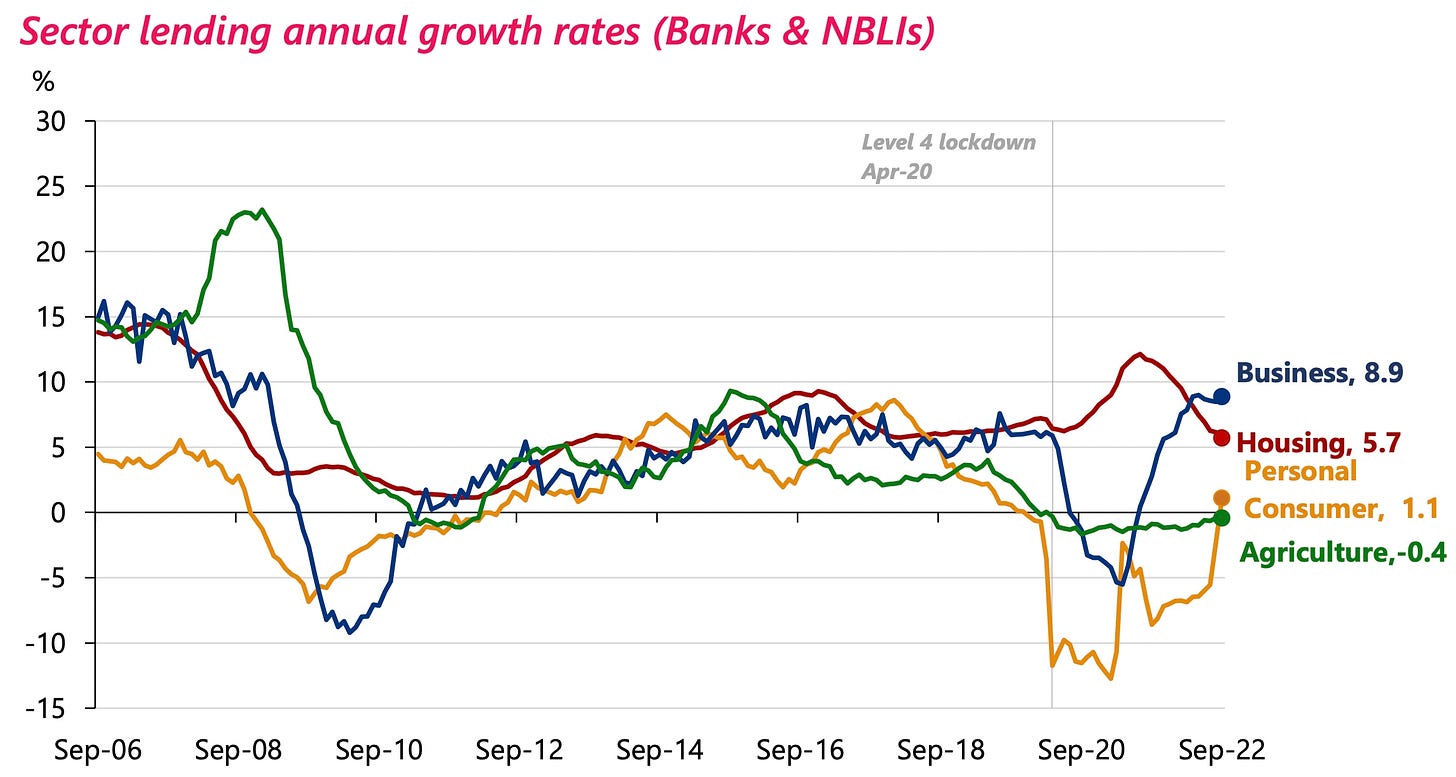

This Reserve Bank chart below showed how mortgage lending growth more than doubled to double-digit rates by early 2021, while new business lending collapsed and farm lending kept dribbling lower. Lending by the big four, ANZ, ASB, BNZ and Westpac, rose from $390b in the June quarter of 2019 to $447b in the June quarter of 2022, which is the last quarter we have complete data for. Lending by the big four grew $57b in those three years, including $47b growth in mortgage lending.

Then as the Reserve Bank started putting up interest rates from late October 2021, banks were able to grow both their net interest margins and their total lending.

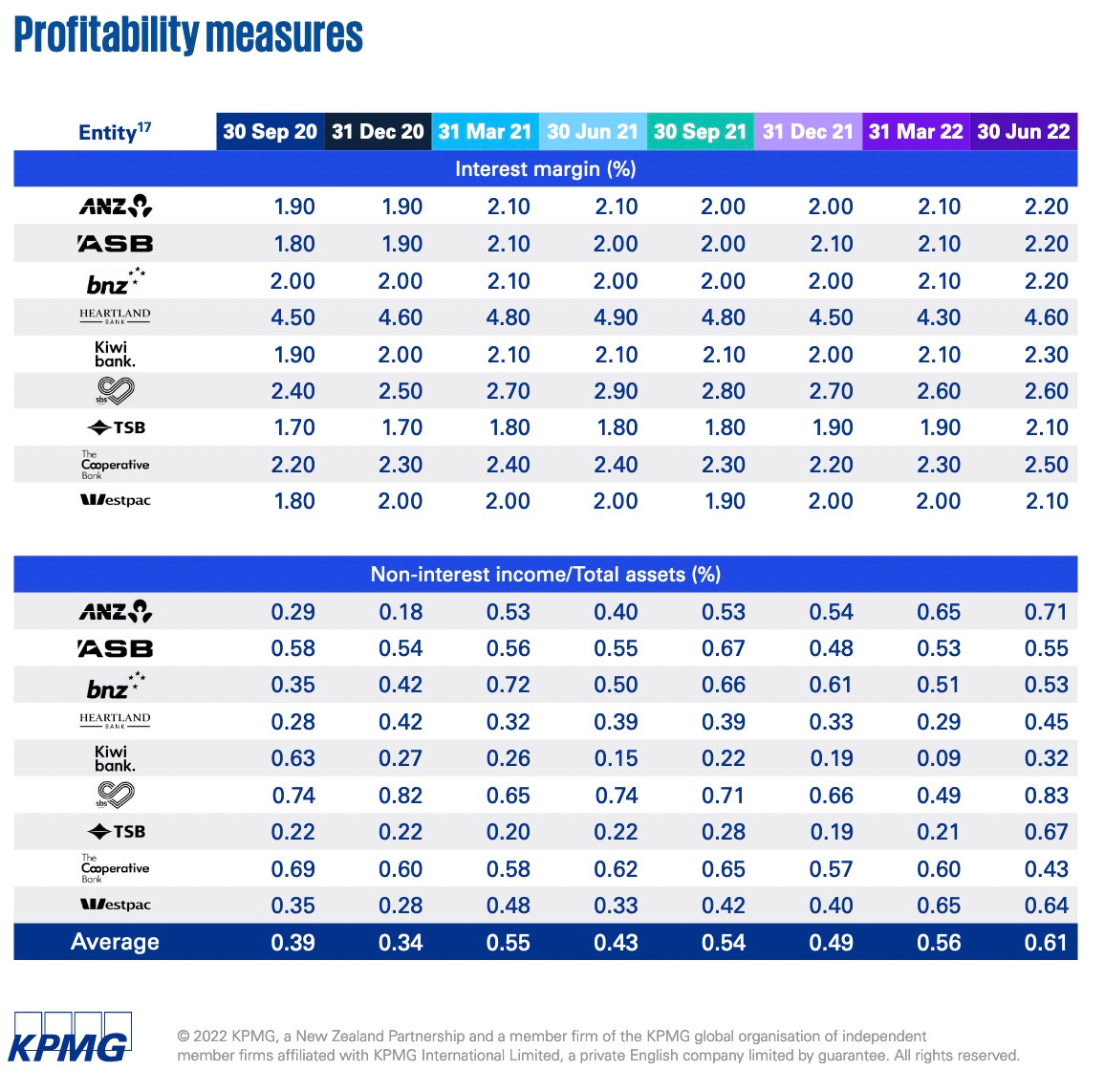

The key detail for any banker is that rising interest rates allow banks to increase their profit margins on lending. This is partly due to banks interest margins tending to rise when short term interest rates are rising, as this June 2020 paper “Does Monetary Policy Influence the Profitability of Banks in New Zealand?” from the University of Waikato found.

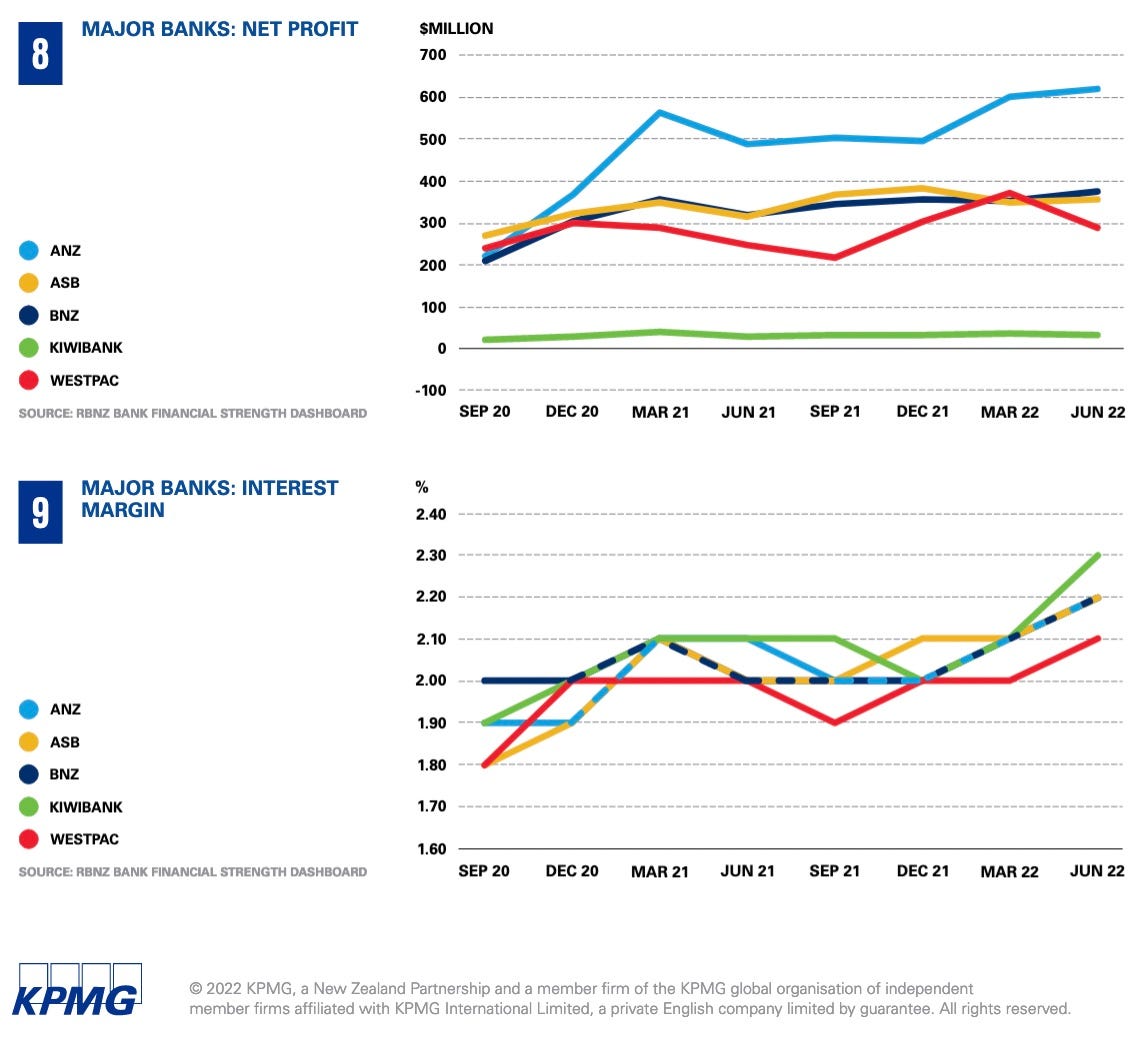

KPMG’s industry-wide analysis from the June quarter, which included all the bank results, shows this too. The profit results are quarterly.

‘We helped you. Now you should help us’

The Crown can also rightly claim the banks benefit from an implied and unfunded Government guarantee to protect them, especially now the Government is building a deposit guarantee scheme and especially after the Government’s actions during the Global Financial Crisis, when the Government created retail and wholesale deposit guarantees in 2008/09.

During the GFC and covid, the losses were socialised in the form of higher Crown debts, while the profits were privatised in the form of higher bank profits. Recovering some of those privatised profits would not only be fair, but if done in a fiscally neutral way (ie not simply using the funds to increase spending elsewhere), it would tighten fiscal policy and help the Reserve Bank bring down inflation by not having to put up interest rates quite so much.

An Australian-style bank levy of 0.06% on the banks’ loans of $447b would raise $2.66b per year and reduce their current ‘run-rate’ of annual post-tax profits from $7b per year to around $4.3b per year.

Wonderfully profitable before covid too

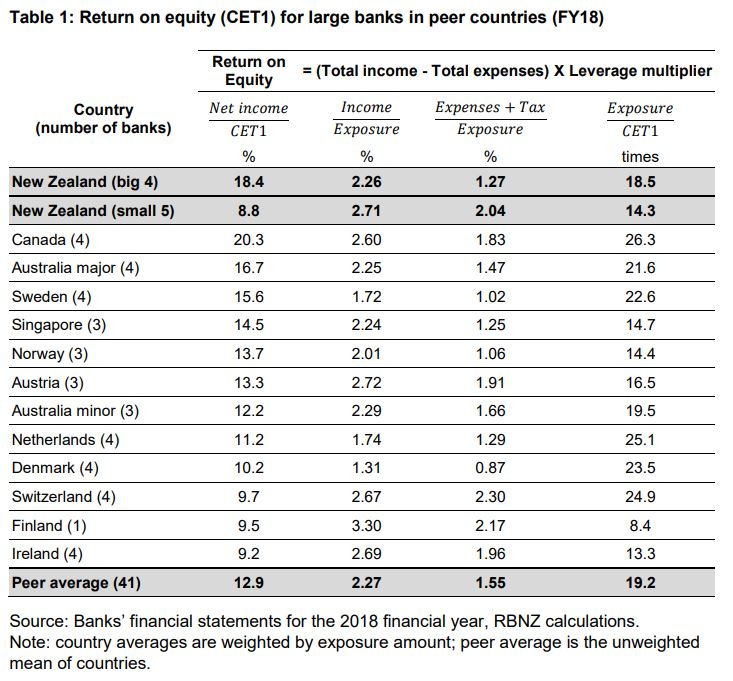

The big four were very profitable before covid as well, as Deutsche Bank analysis in Australia concluded in their assessment of plans by the Reserve Bank to force banks to hold more capital.

Deutsche's Australian-based analysts Matthew Wilson and Anthony Hoo wrote in 2019 the big four Australian-owned banks then controlled 88% of system assets.

"This unique market structure, we are yet to find another one, generates oligopoly-like returns. The four banks print an average return on equity of 15% and remit 65%, or NZ$3.25 billion, of earnings bank to the parents as dividends," Wilson and Hoo said via this Interest.co.nz piece from Gareth Vaughan.

That was also clear in this Reserve Bank table showing the big four here were more profitable than their parents, and only just behind the Canadians as the most profitable in return on equity measures.

Ka kite ano

Bernard

The case for a windfall tax on bank profits