TL;DR: Stronger-than-expected US inflation data out overnight is expected to delay the first US Federal Reserve rate cut into the second half of 2024, which in turn would hold mortgage rates here higher for longer, possibly into next year.

Elsewhere, IRD data shows nearly 50,000 beneficiaries of New Zealand Superannuation are being paid $1.1 billion per year in benefits while also earning more than $100,000 per year, or a total of over $5 billion in gross income from jobs, investments and private pensions.

That $1.1 billion in taxpayer funds being paid to rich people compares with the extra $1 billion in benefits being paid to the extra 79,000 people on the main jobseeker, sole parent and supported living benefits in the last five years, given those benefits are lower per person than NZ Super and growing at a slower rate. Paying subscribers can see more detail below and in the podcast above. They are also able to ask me to open this one up to the public in the comments and by liking this article. I’ll open over 50 likes.

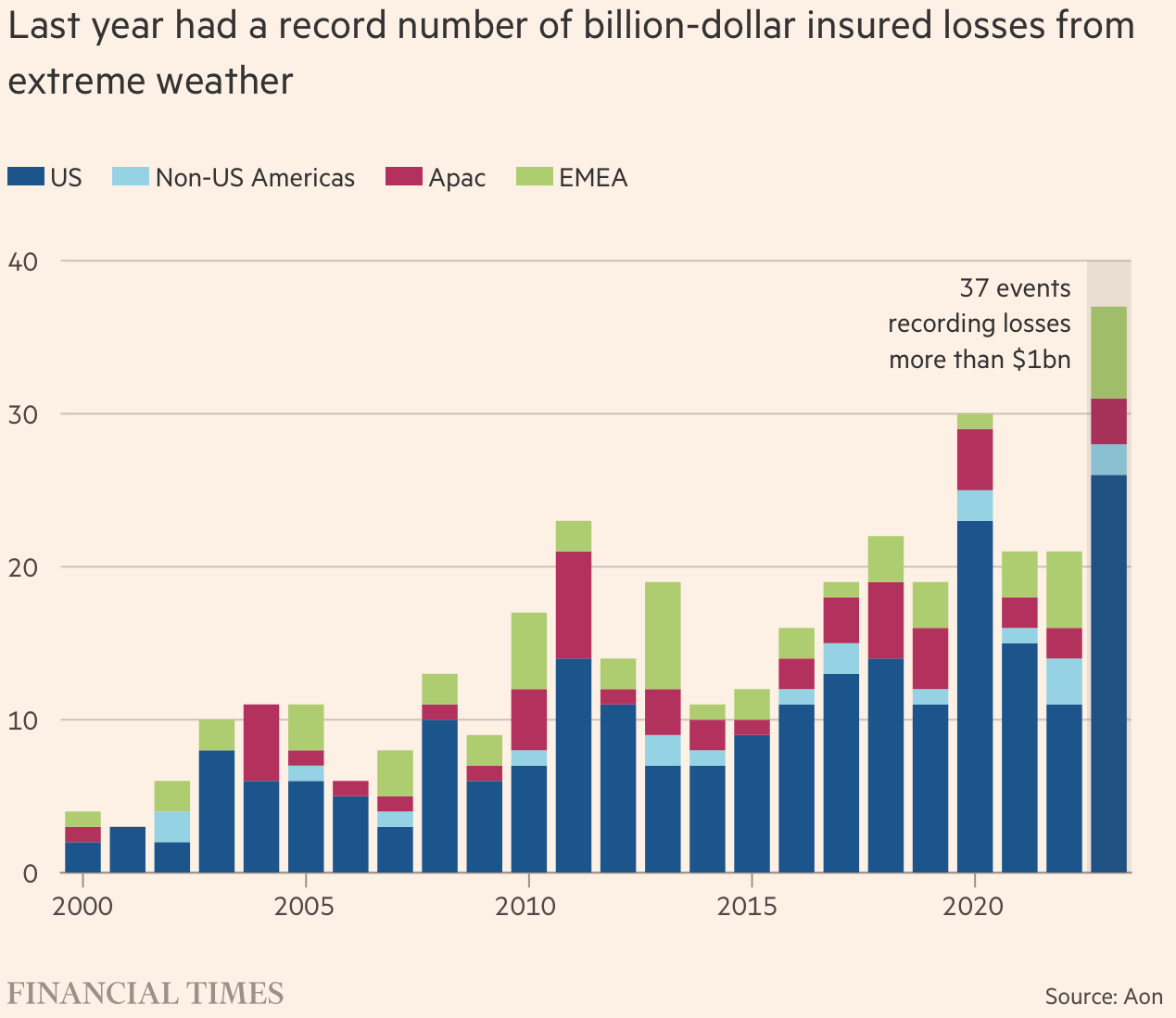

Also, insurers report a structural shift higher in flood and storm damage premia because of climate change, which is being described as another way the rising cost of carbon and inaction on emissions reduction is finding its way into the global economy.

In news elsewhere in our political economy:

Auckland Mayor Wayne Brown announced last night he had ordered Auckland Transport to immediately stop work on projects funded by the Regional Fuel Tax, which the Government announced last week would end on July. The projects suspended include the Eastern Busway, the Great North Road cycleway and various speed bumps. The announcement did not include the words ‘climate’ or ‘safety’.

Finance Minister Nicola Willis has told a select committee she wants the IRD to raise more revenues from its audit programme, The Post-$$$’s Rob Stock reported this morning.

Christchurch City Council is threatening to suspend its special events promotional spending of $2.9 million over three years to save money, just as the new $683 million Te Kaha stadium is due to open from 2026. Newshub’s Kaysha Brownlie reported last night.

Higher for longer

Data out overnight showed US annual inflation was slightly stronger than expected in January at 3.1% vs 3.4% in December, forcing bets on when the US Federal Reserve will start cutting out towards May from March. The consensus forecast was for a 2.9% annual rate. The S&P 500 fell 1.4% from its record highs as the US 10 year Treasury bond yield rose 11 basis points to 4.28%.

So what? Financial markets lowered their expectations of a May cut to 30% from 50% before the data. The Fed Funds Rate is currently in a range of 5.25% to 5.5% and sets the base for global interest rates, including the wholesale ‘swaps rates’ rates that underpin bank fixed mortgage rates here. This is likely to delay the prospects for mortgage rate cuts in Aotearoa-NZ to later in 2024 or even 2025, which will frustrate Government and borrower hopes for early mortgage cost relief.

The new carbon cost: insurance

Global insurers are ramping up their premia for flood and storm insurance globally after 2023 was its worst year for insurable loss events. They’re also pulling out of some markets seen as most vulnerable to climate-change-driven extreme weather events, including the likes of California, Florida and some parts of Europe, Australia and New Zealand. These changes are pushing through an effective climate-change inflation shock and forcing Governments to consider intervening in some markets to subsidise or outright provide flood and storm insurance. Some insurers are now describing these higher premium as a type of higher cost of carbon, along with carbon taxes. Here’s a useful backgrounder in this FT-gift article: The uninsurable world: what climate change is costing homeowners.

So what? Forced insurance and banking retreats are rippling across the globe, often faster than consumers and governments can react and often triggered by extreme events such as Cyclone Gabrielle. Neither the Labour-led or National-led Governments have grappled with whether to provide some state-backing to flood insurance beyond EQC cover for land damage. Building damage is not covered by EQC. These issues should be considered in the Climate Adaptation Act process, which was stalled at the end of last year and has yet to be revived by National-ACT-NZ First. The danger is consumers, land-owners and taxpayers are overtaken by events again, forcing the sort of ad-hoc, reactive and make-it-up-as-we-go-along approach to issues such as buyouts, flood protection infrastructure investment, managed retreat orders and de facto insurance retreat.

$1.1b in benefits paid to 50,000 earning over $100k/year

Just imagine what Mike Hosking would say if he learned 50,000 New Zealanders on incomes of over $100,000 were also being paid around $23,000 a year in publicly-funded benefits designed to keep them out of poverty by ‘hard-working Kiwi taxpayers’. It doesn’t seem fair does it?

But that’s exactly what is happening every year now, and it’s a major contributor to the expected rise in Government spending on NZ Superannuation over the next four years of nearly $6 billion a year by 2026/27 to $26.4 billion. We heard a lot during the election campaign about the ‘blowout’ in total Core Crown spending of nearly $60 billion a year to $140 billion in the six years of the Labour Government. Over a tenth of that increase came from rising NZ Superannuation costs alone. There has not been a chirrup of protest by any party about this ‘blowout’ in Government spending, and especially not by the NZ First, ACT and National parties, who have professed to be against unnecessary and unfair Government spending on people who can afford to look after themselves.

The detail about the nearly 50,000 high-earning people on New Zealand Superannuation who also receive up to $23,000 a year in average payments was in the Retirement Commissioner’s report yesterday into the sustainability of NZ Superannuation, which recommended a move to means-testing would be fairer than delaying the age of eligibility for NZ Super.

Inland Revenue data for the 2017/18 financial year showed that around 30% of the 732,004 superannuitants (218,606 people) had taxable income over $30,000 and around 4% (31,048 people) had taxable income over $100,000 (Inland Revenue, 2020). The percentage of superannuitants earning these amounts has increased since then. In the 2021/22 financial year, 33% of superannuitants (270,564 people) had taxable income over $30,000 and 6% (49,368 people) had taxable income over $100,000 (Inland Revenue, 2024). Retirement Commission report.

The highest profile recipient of NZ Superannuation is Deputy PM Winston Peters, 78, who is now receiving a salary of $334,734 as Deputy PM, on top of his couples rate NZ Super of $22,800 per year. He also declared in his last publicly-available pecuniary of interests register for 2020 that he was a member of the Parliamentary section of the Government Superannuation Fund. MPs in the scheme before 1992 (Peters was elected in 1978) receive a defined benefit linked to their final salary that is also indexed to inflation. It is not known how much Peters is receiving, if anything, but he was in the scheme in 2020 as Deputy PM.

The Government Superannuation Fund’s 2023 annual report notes that there were payments worth $4.6 million in 2023/24 to members still alive in the Parliamentary Scheme, and no active contributors. That would tally with the retirement of Nick Smith and Peters being out of Parliament in 2023. They were the only ones still in Parliament in the 2017-2020 term who were elected before the 1992 cutoff for joining the defined benefit scheme.

If Peters was receiving an annuity from the scheme, as he would be entitled to do having stopped being an MP and Deputy PM from 2020 to 2023, then he would have received an annual salary similar to their final salary, with additions for multiple years of service. It is indexed to inflation. The NZ Superannuation payments are indexed to wages, while main benefits are indexed to inflation.

Cartoon of the day

False economies

Timeline cleansing nature pic

Hiding in plain sight

Ka kite ano

Bernard

Share this post