TLDR: Various economic and market signals are flashing red for a US recession, possibly even as quickly as the just-ended June quarter. Automatic stabilisers in markets are kicking in to ensure interest rates aren’t rising much more and the inflation shock is destroying demand to steady prices.

Paid subscribers can hear more on how the global economy is adjusting to the inflation surge without the need for sky-high short-term interest rates in the podcast above.

Elsewhere in the news this morning:

Australia’s new Labor Government has announced it is launching an emissions trading scheme, just as a forecast emerges of record oil, gas and coal export revenues A$419b in the current year to June 30, 2023 and Sydney is deluged in another extreme weather event; Reuters, Reuters

China has put several cities on its eastern coast into lockdown because of fresh Covid outbreaks, including the manufacturing hub on the Yangtze delta of Wuxi Reuters

Auckland mayoral candidate Viv Beck has pledged to abandon the Auckland light rail project in favour of faster bus routes; Stuff

There are calls for former Wellington Mayor Kerry Prendergast to resign as chair of the Film Commission because a conflict of interest inquiry related to suspended Commission CEO David Strong is continuing to drag on; Dominion Post

1News’ Yvonne Tahana reported last night that the Government had not properly checked the CV of the new Director of the Suicide Prevention Office, Matthew Tukaki.

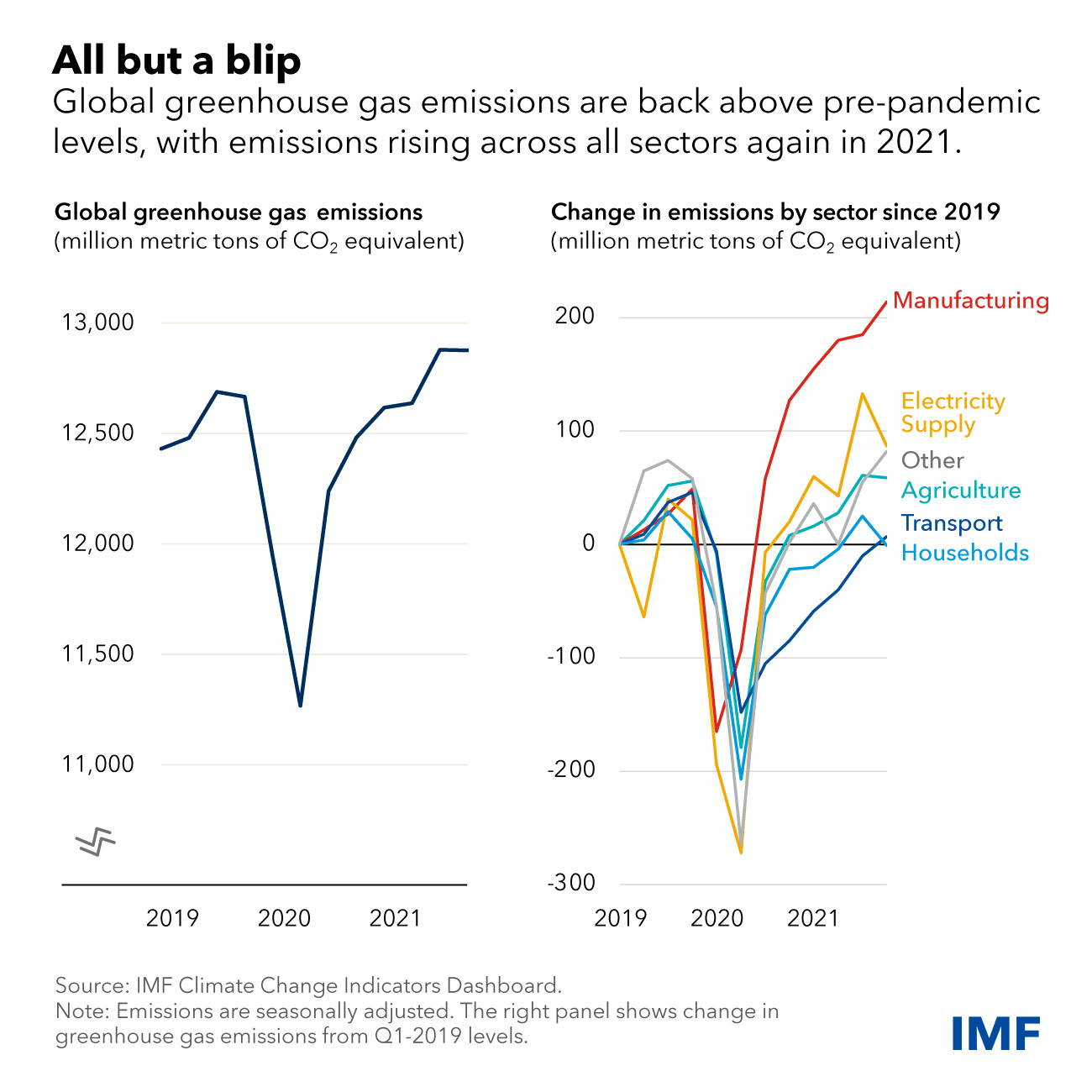

Chart of the day

Back to emissions growth

The IMF reports with this chart that global greenhouse gas emissions rebounded 6.4% last year to a new record, eclipsing the pre-pandemic peak as global economic activity resumed.

Number of the day

An automatic stabiliser

2.88% - The US 10 year Treasury bond yield dropped substantially below the key 3.0% in trading on Friday night as global bond investors increasingly see a high chance of a recession in the United States later this year that sucks inflationary pressures out of the economy and helps the US Federal Reserve avoid significant interest rate hikes.

Quote of the day

A policy mistake?

“We’re seeing demand coming back for bonds as a haven asset. There are concerns that central banks globally, in order to try and tame inflation, are now engineering not just a soft landing but pushing economies into recession.” Aneeka Gupta, research director at ETF provider WisdomTree via FT-$$$

Some fun things

Ka kite ano

Bernard

PS: I’m keeping these shorter to get them out earlier.

Share this post