TLDR: Just as our borders finally open fully today, economists are expecting jobs and wages figures this week to show unemployment fell to as low as a fresh record-low 2.8% in the June quarter, although average hourly wage growth rising to around 5.8% would still be under the CPI inflation rate.

The figures are likely to ramp up the pressure on the Government to loosen rules for temporary workers’ visas, especially if the hoped-for flood of backpackers and a few students to bolster the workforce for the summer doesn’t build quickly from the full border opening today.

Paid subscribers can see more detail and analysis below the paywall and in the podcast above.

Looser migration settings will come, sooner or later

The National-ACT Opposition’s calls for an immediate and wide opening of the migration tap are gathering steam as fast as a host of health, hospitality, travel and other services are wound back due to staff shortages, and as calls grow from businesses to nip any wage-price inflationary spiral in the bud.

Behind in the polls, the pressure will become intense on Labour over the next year, given population pressure on infrastructure and house prices is lower after two years of closed borders. There’s also a swathe of less-tied-down younger resident workers leaving for OEs and higher wages with lower living costs overseas. They will need replacing. High inflation is a new force pushing for more occupations to be put on skills shortages lists and for more generous residency enticements.

Labour has argued over the last couple of years that tight migration settings were needed to offset pressure on existing infrastructure, house price affordability and the wages of lower-paid workers. Those arguments are dissolving in the short term as house prices fall, population growth has stalled and wage growth perks up towards 5-6%, even if it is below current CPI inflation growth of 7%-plus.

Statistics NZ is due to release jobs, unemployment and wages data for the June quarter on Wednesday. Economists are expecting a fall from 3.2% to just under 3.0%, with some seeing it down as low as 2.8%. That would be below the Reserve Bank’s forecast for 3.1% unemployment and keep the pressure on for another 50 basis point hike on August 17 to 3.0%. However, the growing signs of impending recessions globally are continuing to drag global wholesale interest rates lower.

Our own wholesale ‘swaps’ rates fell by around 30 basis points last week, with the two year swaps rate ending on Friday at 3.74%. That means markets now see an OCR peak of around 3.8% later this year, before cuts next year. Further cuts in one or two-year fixed mortgage rates in coming weeks are now more likely, although very strong jobs and/or wages growth numbers this week would stop that.

So what? - Labour may choose before the next winter’s flu season to pull hard on the migration lever to scuttle National’s continued calls before the election. It no longer has rising house prices, suppressed wages and surplus labour as reasons to keep the controls tight. National has already promised to loosen the taps as soon as it’s elected. That means looser migration settings are likely, sooner or later.

Elsewhere in the news here and overseas this morning:

Pelosi playing with fire over China

China’s military is on high alert this morning as US Speaker of the House of Representatives, Nancy Pelosi, took off last night for a trip to a range of Asian capitals, including the possibility of a visit to Taiwan. Officials said she would visit Singapore, Malaysia, South Korea and Japan, but did not rule out a long-promised trip to Taipei, despite warnings from the Pentagon it would be too provocative. China’s armed forces are planning live firing drills in the seas near Taiwan this week and one pro-Government Chinese commentator tweeted yesterday: “it is OK for the PLA to shoot down Pelosi’s plane.” Reuters

So what? - This might turn out to be nothing. Pelosi’s previous plan to visit Taiwan was scuppered by a bout of Covid and she could still decide not to touch down in Taipei. But Pelosi has a long history of campaigning for civil rights and democracy in China and she is being egged on by both sides of Congress, who want to show they’re not afraid of Beijing. Joe Biden also isn’t allowed to stop her, although he has indicated he doesn’t want her to go.

Experts watching this are particularly alarmed. Various figures in the Chinese military and leadership have warned of actual military clashes if Pelosi does actually go to Taiwan. If this kicks off, buckle up, because a serious military conflict would make the global trade disruptions due to the Ukraine war look like a picnic.

China is much more interwoven in the global trading system than Russia was and, of course, it’s much more important to our trade relations. There would be a double whammy effect, firstly on our own direct trade with China, and then a secondary effect because China is Australia’s largest trading partner and Australia is our second-largest trading partner.

Also, keep an eye out for a speech to an Auckland business audience later today on our China relations from Prime Minister Jacinda Ardern, which she’ll deliver before a quick cross-party visit to Samoa this week.

Unexpected fall in China’s factory output

Data out yesterday showed China’s factory activity contracted unexpectedly in July, hampered by the ongoing effects of rolling Covid lockdowns to preserve President Xi Jinping’s elimination policy. China’s official manufacturing purchasing managers' Index (PMI) fell to 49.0 in July from 50.2 in June, with any result under 50 indicating a contraction in activity. The result was the weakest in three months and below economists’ expectations for about 50.4.

So what? - China’s economy barely expanded in the first half of 2022 because of savage lockdowns in Shanghai and in other cities that produce more than half of our largest trading partner’s GDP. China now looks very unlikely to meet its self-imposed target for 5.5% GDP growth in 2022 and seems ambivalent for now about unleashing yet another debt-fuelled local infrastructure binge to catch up.

That’s partly because Beijing is still surveying the wreckage of China’s apartment development bust and how to ensure it doesn’t unravel social cohesion. Pulling the property development lever would simply kick the big clean-up can down the road. Beijing has its hands full cleaning up the mess, without trying to kick off yet more projects in ghost cities.

Over 90 million apartments are either unoccupied or unfinished in China and the big news in recent weeks has been a growing boycott of mortgage repayments by owners of uncompleted apartments who paid upfront. Over the weekend, China’s leaders issued a vague statement about supporting the economy after a key meeting of its 25-member Politburo (a bit like our Cabinet), which disappointed some who were expecting a massive new stimulus plan.

This is another one of of those ‘watch this space’ items in the global economy for us. For example, over the weekend the largest of the apartment developers in China, Evergrande, failed to meet a self-imposed deadline for a detailed restructure of its US$300b of debt, of which US$20b is owed to foreign investors. This is all another headwind for the global economy and supporting the arguments of those who see inflation as having peaked and short term interest rates likely to fall next year.

Quote of the day

This is serious

“If she goes, there will definitely be a Taiwan Strait crisis, and it will definitely exceed the last one in 1995-1996. That is because China’s military capabilities by far exceed those of 26 years ago.” Wu Xinbo, director of the Center for American Studies at Fudan University in Shanghai via FT-$$$

Number of the day

US$30b - The profits reported by Exxon/Mobil and Chevron in the June quarter, which were triple their profits from the same quarter a year ago.

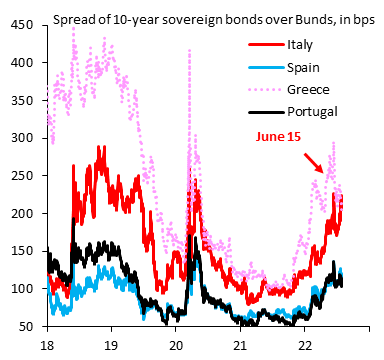

Chart of the day

Italian debt now seen riskier than Greek debt

Some fun things

Ka kite ano

Bernard

Share this post