TLDR: Aotearoa’s Australian-owned banks look set to widen their profit margins as interest rates rise, adding to a new type of inflation spiral that is more evident this time around than in the 1970s: a profit-price spiral, rather than a wage-price spiral.

ANZ jumped first late yesterday to put up its mortgage rates by more than its term deposit rates in response to Tuesday’s hotter-than-expected inflation data for the September quarter. It raised its mortgage rates up by around 45 basis points, but only lifting its term deposit rates by around 30 basis points. That widens ANZ’s net interest margin, which is its major driver of its net profit.

A profit-price spiral, rather than a wage-price spiral

So why is inflation proving so persistent and high after the supply shocks of Covid and Russia’s invasion in Ukraine? One factor that is getting a lot of attention overseas, but less so here, is the portion of inflation due to companies that have increased their market power in recent years increasing their profit margins.

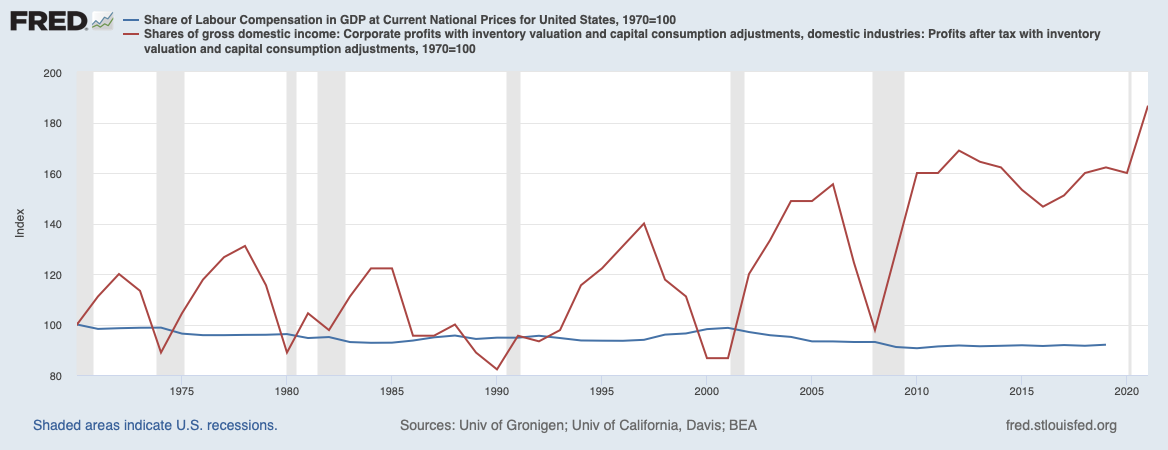

The most obvious rise has been in the United States, which is the world’s largest economy and therefore a major driver of inflation. It has seen a persistent rise in the profit share of the economy over the last 30 years, with a particular surge in the last two years.

Workers are effectively being punished for the sins of profit-gouging business owners.

Here’s the data and chart from the US Federal Reserve Bank of St Louis:

This growing concentration of the share of GDP going to company owners has followed more than three decades of lightly-regulated market consolidation and the growing power of network monopolies, along with the financialisation of large parts of the economy - housing in particular.

The same is true here, where profit margins have risen sharply in recent years as large parts of the economy (supermarkets, banking, domestic air travel, electricity, real estate agencies, fuel retailing, insurance and building materials) saw margins increase when the pressure went on.

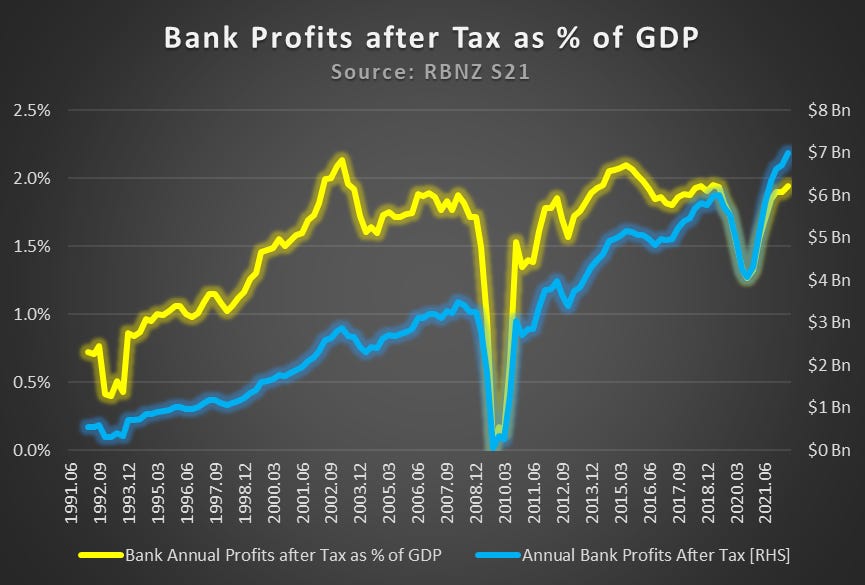

Here’s the data for Aotearoa, courtesy of First Union researcher Edward Miller in this chart via Twitter.

See more on that below in Charts of the Day, which shows how bank profits as a share of GDP are rising again, having surged over the last 30 years.

This is partly due to banks interest margins tending to rise when short term interest rates are rising, as this June 2020 paper “Does Monetary Policy Influence the Profitability of Banks in New Zealand?” from the University of Waikato found:

“The study investigates the relationship between monetary policy and bank profitability in New Zealand using the generalized method of moments (GMM) estimator. Our sample comprises 19 banks from New Zealand over the period 2006–2018. Our results suggest that an increase in short-term rate leads to an increase in the profitability of banks, while an increase in long-term interest rates reduces bank profitability.” June 2020 paper “Does Monetary Policy Influence the Profitability of Banks in New Zealand?” from the University of Waikato

Labour Finance Minister seems less worried

So where is the Reserve Bank and Treasury research into the effects of rising profit margins on inflation? There has been none that I’ve seen from the latest bout of inflation. And why would higher mortgage rates from the Reserve Bank necessarily control that inflation?

Finance Minister Grant Robertson was asked on RNZ’s Morning Report yesterday if bank profits were partly driving the rise in mortgage rates. He said profits had been high, but there weren’t signs he could see they were getting worse.

"We always ask our retail banks to make sure that they understand the environment they're operating in, that their customers are operating in. They have to have a social licence to operate and I think any New Zealander would be concerned if they were drawing excessive profits beyond what they need to reasonable margin.

"Bank profits have been high in New Zealand for a long time and I think the important thing here is that there isn't any evidence that there's a particular set of behaviour right now that's trying to overly capitalize on this.

"But they do have significant profits and we would expect them to bear that in mind and bear in mind the situation of the consumers." Grant Robertson on RNZ’s Morning Report

Punishing workers for the sins of price setters. Again.

This idea of a wage-price spiral has stuck around since the 1970s, when there was much higher unionisation rates and wage increases happened in a widespread and quick way through wage arbitration centrally. Unionisation rates are now much lower and the Employment Contracts Act has made widespread and fast wage increases much harder.

It turns out, even in the 1970s the idea of a wage-price spiral was overplayed, as this IMF research from earlier this month showed (bolding mine):

Inflation in some economies is rising at the fastest pace in four decades, while tight labor markets have boosted pay gains. That has raised concerns that these conditions could become self-reinforcing and lead to a wage-price spiral—a prolonged loop in which inflation leads to higher wage growth, fueling even higher inflation.

An examination of recent wage dynamics and the prospect of such a wage-price spiral are the subjects of an analytical chapter of our latest World Economic Outlook, which finds that, on average, the risks of a spiral are limited—so far. Three factors are working together to contain the risks: the underlying shocks to inflation are coming from outside the labor market, falling real wages are helping to reduce price pressures, and central banks are aggressively tightening monetary policy.

To better understand these dynamics, we identified 22 situations in advanced economies over the past 50 years with conditions similar to 2021 when price inflation was rising, wage growth was positive, but real wages and the unemployment rate were flat or falling. These episodes didn’t lead to wage-price spirals on average. Instead, inflation came down in subsequent quarters and nominal wages gradually rose, helping real wages recover. IMF research

Here’s an IMF video version of this research above for those who want more.

My view: The Reserve Bank is putting up interest rates with the deliberate aim of increasing unemployment to take pressure off wage inflation, which the bank and others have argued needs to be controlled to reduce the risk of a 1970s-style wage-price spiral.

This inflation was sparked by supply shocks that restrained capacity and allowed companies with enhanced market power to increase their margins when the system was under pressure. We have yet to see any Reserve Bank or Treasury or Government acknowledgement of this cause of inflation, or debate about whether conventional monetary policy would change this.

Workers are effectively being punished for the sins of profit-gouging business owners.

Paying subscribers were able to see more detail and analysis below the paywall fold and in the podcast above earlier this week.

Elsewhere in the news to me:

A key US interest rate jumped to a 15-year high after a central banker warned of tougher monetary policy if inflation didn’t recede;

Joe Biden will release more oil from the US strategic reserve to try to get ‘gas’ prices falling below US$4/gallon ahead of mid-term Congressional elections on Nov 8;

A possible leadership rival to Liz Truss resigned overnight and took a swipe at the British PM, who is expected to go within weeks;

The FT-$$$ reported this morning four former RNZAF pilots had worked at a South African flight training school to train Chinese military pilots; and,

The AFR-$$$ reported this morning private equity firm BGH Capital had registered company names ahead an imminent takeover bid of around NZ$1.5b for Pushpay.

In geo-politics, the global economy, business and markets

Highest since 2007 - The US 10 year Treasury yield, which is the base for longer-term global interest rates, rose 13 basis points to a 15-year high of 4.12% overnight after Minneapolis Federal Reserve President Neel Kashkari said the Fed Funds rate could be lifted over 4.75% if inflation didn’t cooperate.

"I've said publicly that I could easily see us getting into the mid-4%s early next year. But if we don't see progress in underlying inflation or core inflation, I don't see why I would advocate stopping at 4.5%, or 4.75% or something like that. We need to see actual progress in core inflation and services inflation and we are not seeing it yet." Neel Kashkari at a panel at the Women Corporate Directors, Minnesota Chapter, in Minneapolis. Reuters

Mid terms near - President Joe Biden pledged overnight to release another 15m barrels of oil from the US Strategic Oil Reserve in December to try to get petrol prices down below US$4/gallon ahead of mid-term Congressional elections due in less than three weeks (Tuesday, November 8). US officials also said they would look to buy oil to refill the reserve once prices got down to US$67-72 a barrel, effectively setting a type of floor and ceiling for US oil prices, which are currently around US$82/barrel. Energywire

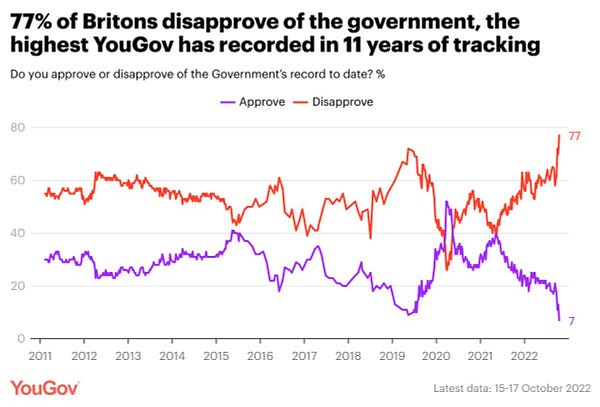

Double-digit inflation - Britain’s annual inflation rate rose back to 10.1% in September from 9.9% in August, the UK Office of National Statistics reportedovernight, which was more than the 10.0% expected by economists and close to the 10.9% reported by Germany.

‘More of a war footing’ - Vladimir Putin declared martial law in the four Ukrainian provinces Russia has annexed and said in a televised address the “entire system of state administration” must be geared up to back Russia’s war in Ukraine. His comments came as the Russian-appointed administration in the biggest city it has captured in southern Ukraine, Kherson, ordered the evacuation of up to 60,000 ahead of an expected assault by Ukrainian forces. Reuters

New UK turmoil - British Home Secretary Suella Braverman, seen as a potential leadership challenger, resigned after 43 days in the job, saying she was taking responsibility for mistakenly sending an draft official document from a personal email account, but also indirectly criticising PM Liz Truss for not taking responsibility for her mistakes.

"The business of government relies upon people accepting responsibility for their mistakes. Pretending we haven't made mistakes, carrying on as if can't see that we have made them, and hoping that things will magically come right is not serious politics.

"Not only have we broken key pledges that were promised to our voters, but I have had serious concerns about this Government's commitment to honouring manifesto commitments, such as reducing overall migration numbers and stopping illegal migration, particularly the dangerous small boats crossings." Suella Braverman’sresignation letter.

In Aotearoa’s political economy

Not-so-climate friendly - Auckland Mayor Wayne Brown sent a letter to Auckland Transport last night suggesting it stops removing car parks for cycling lanes.

“You appear to have been focused on changing how Aucklanders live, using transport policy and services as a tool. Instead, AT must seek to deeply understand how Aucklanders actually live now, how they want to live in the future, and deliver transport services that support those aspirations. Aucklanders do not always have the choice of using an e-bike, a bus or even a train but rely on the roading and carparking networks to make their life functional.” Wayne Brown in a letter to Auckland Transport.

Low target strategy - National Leader Christopher Luxon said National would not release a costed Budget plan until a month before the election, Claire Trevett reported last night on NZ Herald

Luxon told the NZ Herald that while elements of its tax plan would be unveiled earlier in election year, National would not release its final fully-costed plan until after the pre-election fiscal update – Treasury's release of the state of the books about a month before an election.

He said National would unwind the list of Labour taxes that it has promised to repeal in its first term in government – which includes the top tax threshold of 39 cents for those on salaries of more than $180,000 - "but of course we want to open up the books and make sure we can phase it and see what we are dealing with."

The plan includes indexing tax thresholds to inflation and scrapping various taxes and levies Labour has introduced, but the full details of the extent and timing of it are a work in progress.

He rejected Labour's claim he would have to cut crucial services to fund it, saying Labour's current spending levels were higher than at any other time – "there's a lot of waste in it. We've never seen this level of cash being sprayed around like it is." Claire Trevett’s report last night on NZ Herald

Project ‘Pegasus’ - Australian private equity group BGH Capital moved closer to launching a NZ$1.5b takeover bid for Pushpay by registering company names, the Australian Financial Review’s Street Talk column reported. AFR-$$$

In the news in Aotearoa yesterday

Social Investment version 2.0 - National Finance Spokesperson Nicola Willis said in a speech at Victoria University’s School of Government this morning that Bill English’s social investment approach would be the “organising framework for the next National Government’s approach to the funding and delivery of social services.” Willis announced National would create a new Social Investment Fund to invest in programmes “that promise to change the lives of New Zealanders with the greatest needs.” It would start small and scale up over time.

“I can imagine, for example, a National Government might deploy the Social Investment Fund to tackle the task of delivering secure, sustainable housing for people currently living for extended periods in emergency housing.” Nicola Willis in her speech.

Coming up today

PM Jacinda Ardern is due to meet Wayne Brown in Auckland, although she won’t be holding a joint news conference, as his office had hoped.

What did I miss? What should I look at today?Scoops of the day

Quotes of the day

Dead PM walking

“How can she be held to account when she’s not in charge? Why would anyone else trust the Tories with the economy ever again?” Labour leader Keir Starmer attacking PM Liz Truss in Parliament overnight.

But not going down quietly

“I’m a fighter, not a quitter.” Liz Truss in Question Time in response.

Number of the day

‘Go now please’

53% - An Ipsos survey of 1,000 British adults found 53% wanted Truss to resign and 75% thought the Conservative Government did not have a good long-term economic plan.

Charts of the day

A lucrative business for Australia’s big four banks in Aotearoa

Thread of the day

A detailed and nuanced thread on social investment.

Podcast of the day

Longer read of the day

Longer watch of the day

Official report of the day

The Craic

Some fun things

By the way, everyone should vote for The Kākā in Bird of the Year.

Here’s where you vote. :)

Ka kite ano

Bernard

PS: My apologies for not putting an email out yesterday. I was travelling.

Share this post