TL;DR: My top six things to note around housing, climate and poverty in Aotearoa’s political economy on Tuesday, August 6 are:

1. Global markets rout to accelerate lower mortgage rates

Markets now see 100 bps of Fed buts by end of 2024

Yesterday’s 13.5% fall in Japan’s stock market was its biggest one-day fall since the 1987 crash and US stocks are down nearly 3% this morning. Global markets now expect the US Federal Reserve will have to cut its Fed Funds Rate, the base for global interest rates and our fixed mortgage rates, four times and by a total of 100 basis to a range of 4.25% to 4.5% before the end of the year. Markets fear the US economy is finally about to go into a recession and that the Fed held rates too high for too long. Sounds familiar?

There’s another quirk that’s less relevant on this side of the planet. Japanese stocks are being hit particularly hard because the Fed will be cutting at the same time as the Bank of Japan is hiking rates after finally ridding Japan of decades of deflation. That means those investors who bet the gap between Japanese (low) rates and (high) US rates remaining wide are losing their money. It’s called the ‘carry trade’, where traders borrow in yen and then convert into a currency with higher interest rates such as the US dollar or Mexican peso. This is all pushing the yen up, which is bad news for Japanese exporters and compounds the financial pain for the carry traders. There’s more explanation of that in this Bloomberg-gift article and this WSJ-gift article.

So what does it all mean for us here in Aotearoa?

I see everything and always through the lens of our housing market, given our political economy is a housing market with bits tacked on. It drives the economy and determines both the weekly disposable income and wealth of every family through rents, mortgage rates, house prices and building activity.

So the meaning of this latest slump is that fixed mortgage rates here will go down faster and further through the rest of the year. They’ve already started falling and that has already perked up activity in the housing market through July, as Barfoot and Thompson reported yesterday from Auckland with the first house sales figures for the month. Sales volumes of 902 in July were up 32.5% from June and up 24.1% from a year ago.

“Buyers were attracted by a combination of vendors being prepared to meet the market and anticipation that prices may be at their low point given recent movement in mortgage interest rates.

“Commentary around lower inflation numbers and the promise of further interest rate cuts led to an increase in confidence among buyers and we saw the re-appearance of multi-offers across the network.” Stephen Barfoot, Director of Barfoot & Thompson

So what does it all mean? More house sales and higher house prices over time. The main thing stopping more explosive growth is the just-introduced debt to income multiples, which stop very rapid lending growth to rental property investors.

2. News: Landlords not ready or able to deal with old renters

Speaking of the Housing Theory of Everything…

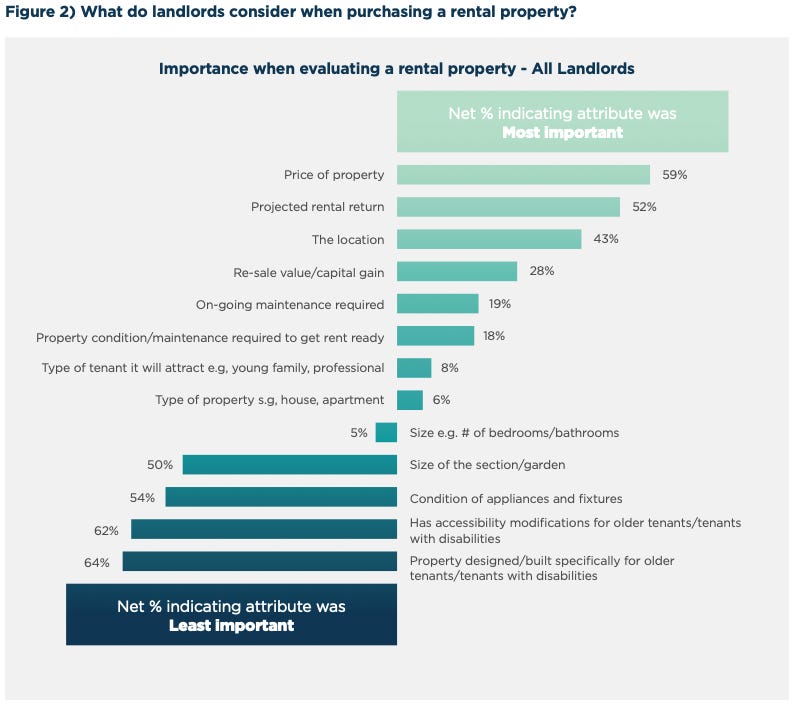

The Retirement Commission has published a policy brief from the results of a Perceptive survey of 709 landlords that found that most hadn’t rented to retirees and hadn’t thought about building modifications to make it easier and healthier for them to ‘age in place.’ That’s even though most landlords are in or approaching retirement themselves and the number of retirees needing to rent privately is expected to double to 600,000 by 2048. Most landlords expect the Government or the tenants themselves or their families to pick up the tab for any modifications.

Here’s the Commission’s conclusions in the brief:

The findings from this research suggest the Private Rental Sector (PRS) is unlikely to provide sufficient accessible housing to meet growing demand in this sector.

The findings also indicate there is an opportunity for the private rental sector and property management industry to recognise the importance and value of accessibility modifications, and for greater industry dialogue to occur on supporting older renters to ‘age in place’.

The research also finds that Build-to-Rent (BTR) developers are embracing Universal Design, but the BTR sector is small and currently has few offerings tailored to older tenants.

Here’s the survey results:

In my view, this survey reinforces my view that our unaffordable (for both most renters and buyers), unhealthy and vastly under-supplied (and over-demanded) housing market is the main reason for most of our economic and social ills.

Housing dominates the landscape in the looming unsustainability of both of the two key items in our social contract: universal NZ Superannuation and freely-available hospital care. NZ Super is enough to get by on if you own your own home. Deloitte forecast last month that the home ownership rate would be only 47.9% by 2048.

The combination of unhealthy and unaffordable private rentals will simply add pressure to an already overstretched aged care, hospice and hospital system because older people living in unhealthy and unmodified private rentals will be less likely to ‘age in place,’ forcing more people to spend more nights in hospital, just as the size of that age group is exploding.

NZ Superannuation and free hospital care is unsustainable without higher taxes and an an affordable and healthy housing market. That’s not what either major party nor the voting public are assuming or wanting right now.

3. Solutions: Let’s hope the state gentailers follow suit

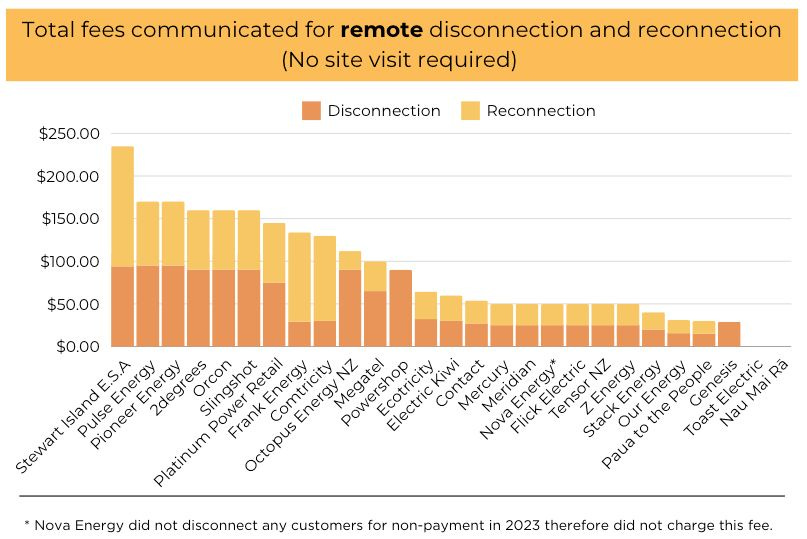

Contact Energy announced yesterday it's dropped disconnection and reconnection fees for non-payment. It joins non-generating independents Nau Mai Rā and Toast Electric as the only companies to not charge such fees. NZ Herald

This followed an excellent campaign launched last month by Common Grace Aotearoa with a research report that called for disconnection fees to be banned and for the penalty fees for pre-pay electricity to be removed. A petition got over 9,000 signatures.

Here’s the detail found in the report, and the names of who should follow suit by removing the fees (I’m looking at you Meridian, Genesis and Mercury in particular):

Here’s Common Grace Aotearoa’s Co-Director Kate Day on the news:

“We encourage other companies to follow their leadership.

“We will continue to call on the Electricity Authority to ban these fees. We will also call on the sector to envision and work towards a future where everyone can access electricity and no one gets disconnected because they cannot afford to pay.” Kate Day

Too bloody right.

4. Quote of the day

Solar cheap at the current price, and the future price

“I’m just stunned by the wholesale rate of power. My new install costs me about 4c per kWh and the price of electricity on the wholesale market is above 80c for most of the day. The ROI on solar, exported at the wholesale rate is quite frankly remarkable,” Rewiring Aotearoa CEO Mike Casey via X

5. Good News Chart of the Day:

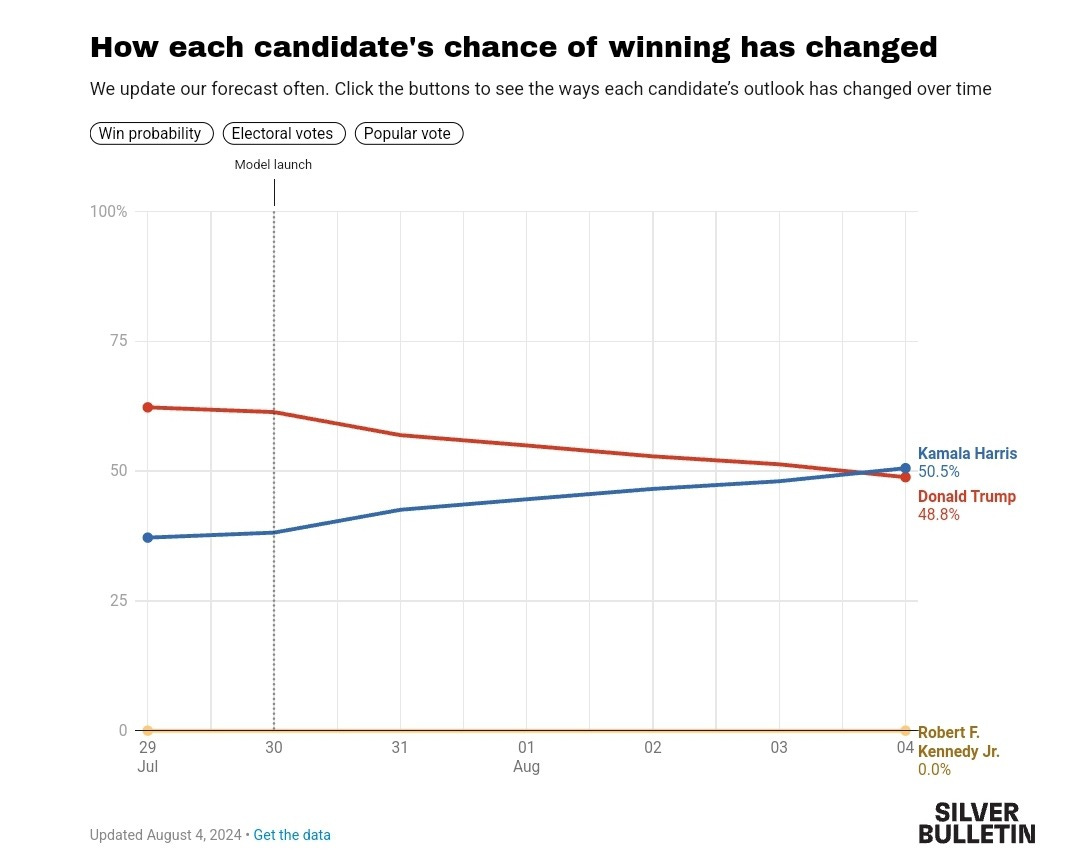

Kamala Harris seems to have caught a ‘Jacindamania’-like wave

6. Climate graphic/chart/pic of the day

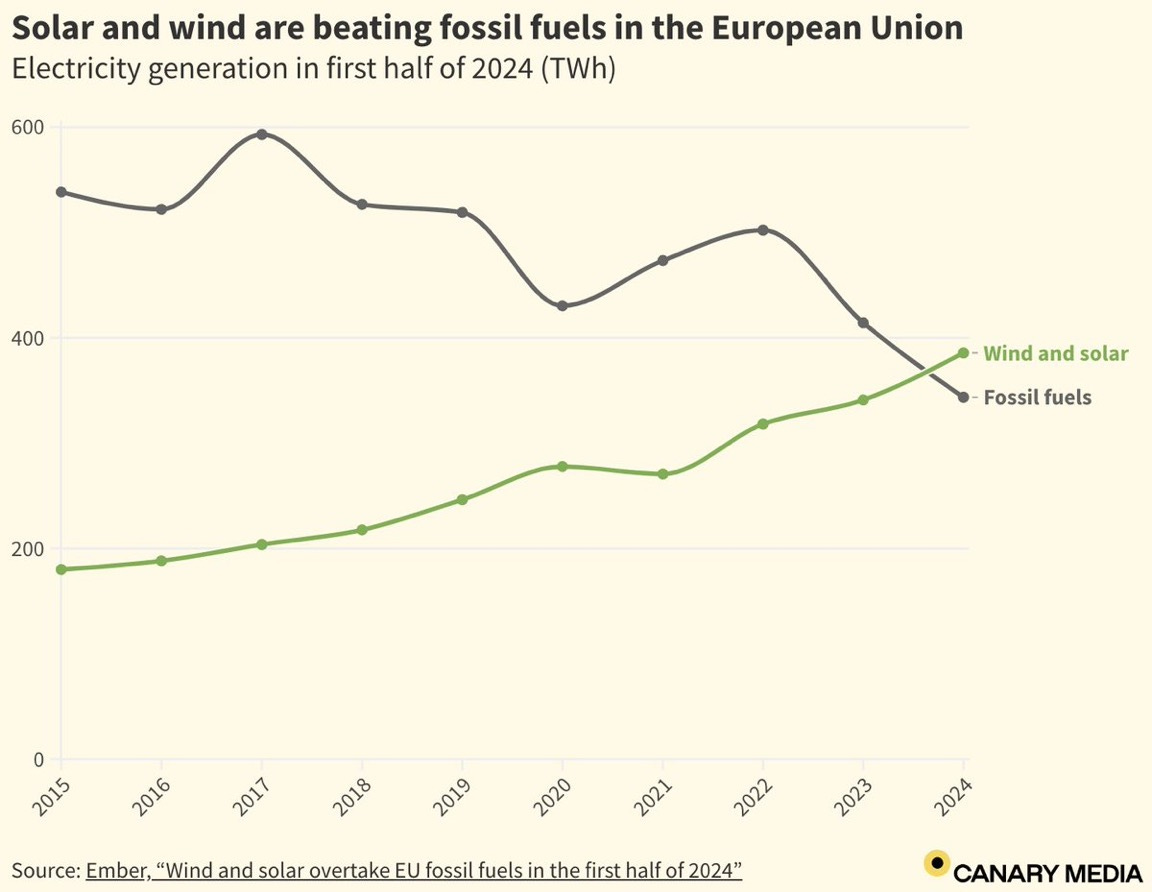

Some more good news

The best of the rest

Top six scoops and deep-dives elsewhere

Deep Dive: Crunching the Numbers: Kiwis spending half their household income on rent RNZ’s Checkpoint

Interview: Doctor urges end to 'political football treatment' of healthcare RNZ

News: Private rental sector unlikely to keep up with pensioner demand - Retirement CommissionRNZ

Scoop: International investigation exposes China’s world-dominating fishing tactics The Listener-$$$

News: Fraction of incorrectly paid cost-of-living support returned RNZ

Journal of Record for Monday, August 5

Social welfare: Social Investment Minister Nicola Willis announced that the new Social Investment Agency is now seeking a Chief Executive. News: NZ Herald-$$$’s Thomas Coughlan

Justice: Advocacy group Aotearoa Justice Watch released a report detailing allegations of human rights abuses by police and corrections officers it received between 2022 and 2024. Sixty-two people complained of mistreatment ranging from illegal searches, police tampering with evidence, sexual abuse, and excessive use of force resulting in severe injuries.

Climate: IAG published the results of its seventh annual Ipsos poll taken in June, finding for the first time that less than a third of New Zealanders agree that the country’s current response to climate change is on the right track, compared to 37% last year. The vast majority of respondents also expect worse and more frequent floods and storms in the next 30 years. News and reports: Interest

Health: Te Whatu Ora-Health NZ Commissioner Lester Levy appointed Ken Whelan and Roger Jarrold as Deputy Commissioners. Health Minister Shane Reti appointed Whelan to work with Te Whatu Ora's board as a Crown Observer in December, while Roger Jarrold has served as chief financial officer for Fletcher Construction, Downer NZ, Kordia Group Ltd, and the former Auckland DHB. News and reports: RNZ

Economy: Westpac changed its forecast for the first RBNZ rate cut to October from November, adding it saw two 25 basis point cuts by the end of the year. Westpac's longer-term forecast remains for the OCR to fall to 4.5% in May 2025. News and reports: RNZ

Economy: Food Safety Minister Andrew Hoggard announced that New Zealand will not adopt a shared infant formula standard with Australia, citing certain restrictions on labelling that "do not suit the New Zealand context". Instead, New Zealand will implement its own infant formula standard over the next five years. News and reports: RNZ, 1News

And finally, some fun things

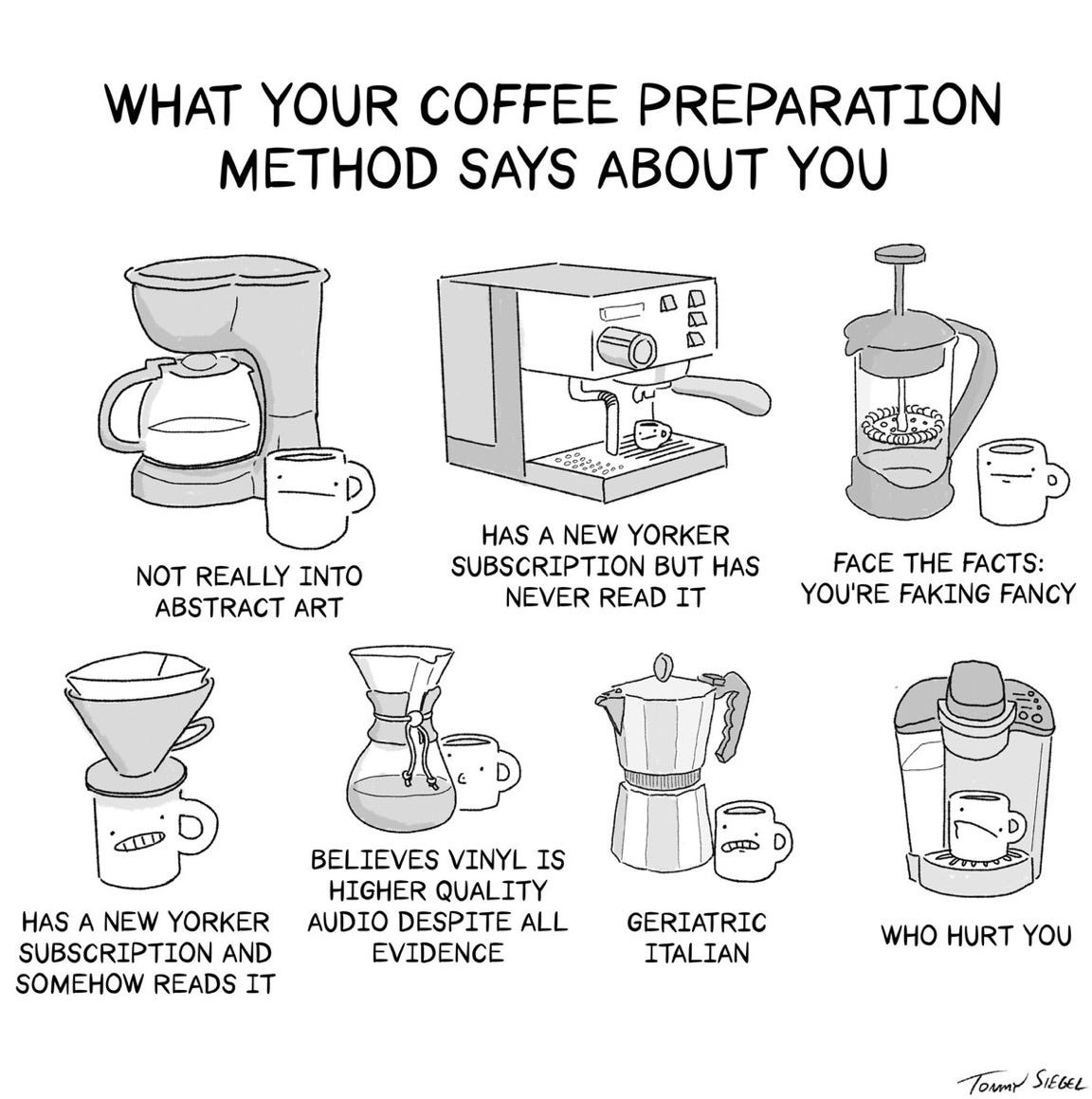

Cartoon of the day

I aspire to be a coffee snob

Timeline-cleansing nature pic

‘I’m keeping an eye on you…’

Mā te wa

Bernard

PS: I am thrilled to bits with today’s nature pic.

Share this post