TLDR: News about economic growth and inflation around the world is mixed this morning, with the balance still tipping towards recessions in Europe and China. But there was some good news out of the United States of stronger than expected GDP.

Everyone is watching the central bankers’ shindig at Jackson Hole in Wyoming this weekend like a hawk (for hawks), including our own Reserve Bank Governor Adrian Orr. Some are nervous the Fed will be much aggressive about taming inflation than most investors and traders expect, which could unleash mayhem on stock and bond markets.

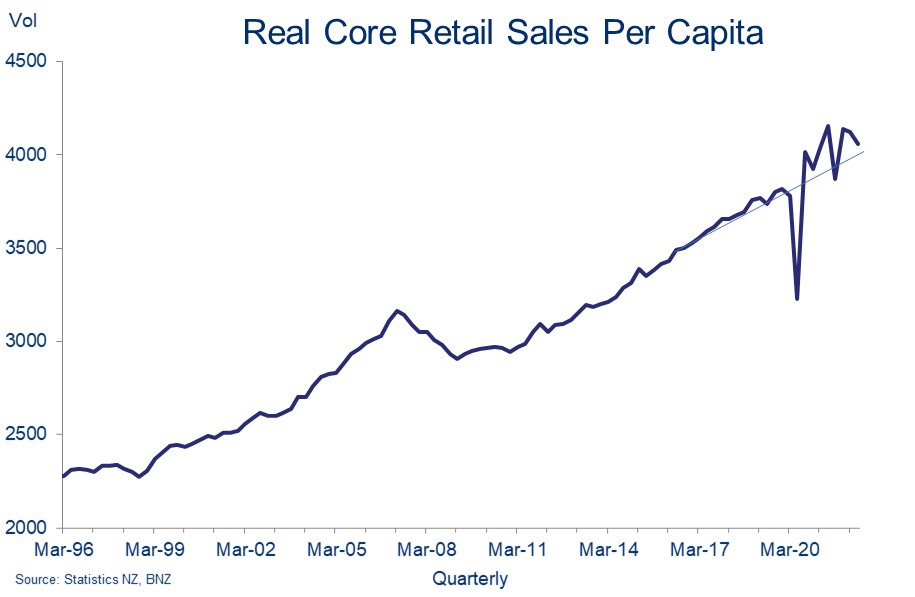

Here, our retail sales figures yesterday were weaker than expected, showing the wealth effect of a 15-20% fall in house prices in Auckland City and Wellington City. Some are wondering if Orr will need to hike quite so much if this softer demand pressure from consumers takes the steam out of inflation.

Paid subscribers can see more detail, charts and analysis below the paywall fold and in the podcast above. They’ll also get invites to my weekly Ask Me Anything session on Substack from 12-1pm and our weekly ‘hoon’ webinar from 5pm-6pm. The invite link is below the fun things.

The wealth effect kicks in

Aotearoa-NZ’s retail sales volume figures for the June quarter out yesterday showed weaker than expected consumer spending as homeowners and small businesses felt the effects of the 15-20% fall in house prices in the ‘bleeding edge’ markets of Auckland City and Wellington city over the last six months. Statistics NZ reported volumes fell 2.3% in the June quarter from the March quarter, having also fallen 0.9% in the March quarter.

Economists had expected a rise of 1.7% and the result clearly shook a few. A couple started talking about potential risks of a technical recession if the weak consumer spending extended to the rest of economic activity. Doubts about the extent of the Reserve Bank’s expected tightening of the OCR from 3.0% to 4.0% started to nudge into the commentary.

So what? - It’s another bit of evidence to suggest the demand-driven local inflationary pressures driving short term interest rate hikes may be coming off the boil. That reinforces my view that interest rates don’t go as high as most expect and that the underlying drivers for low inflation remain intact. If confirmed, it would mean fixed mortgage rates have peaked and could start falling next year. We’ll find out more with GDP data due on September 15, along with the regular barrage of inflation data from overseas and here. It’s good news for ‘Team Transitory,’ which I’m still in with not many others.

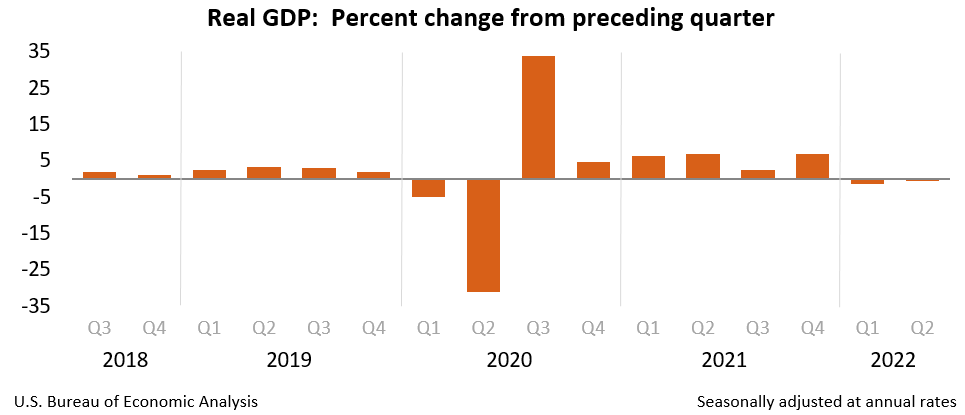

US GDP beat expectations

The second estimate of June quarter GDP in the world’s largest economy was stronger than expected overnight. The Bureau of Economic Analysis reported GDP fell just 0.6%, which was less than the first estimate of a 0.9% fall and better than the 0.8% expected by economists. Also, jobless claims were slightly less than expected.

All eyes on Jerome Powell at Jackson Hole

US Federal Reserve Chair Jerome Powell is due to talk at 2am NZT tomorrow morning about the outlook for monetary policy at the annual Jackson Hole get-together of the world’s top 100 central bankers. Reserve Bank Governor Adrian Orr is going this year, which is the first one in-person since the pandemic.

Currently, traders and investors mostly think the inflation genie is getting itself back in the bottle and Powell won’t have to drive the US economy into recession by hiking short term interest rates much more than 4%, and that he’ll be able to start cutting them again later next year.

The trouble is all the mood music coming from Powell’s fellow decision makers at the Fed has been about the need to hike until the pips squeak. Someone is going to be wrong and if it’s the markets then expect another bout of heavy selling in stock and bond markets. That’s why Powell’s speech is seen as so important.

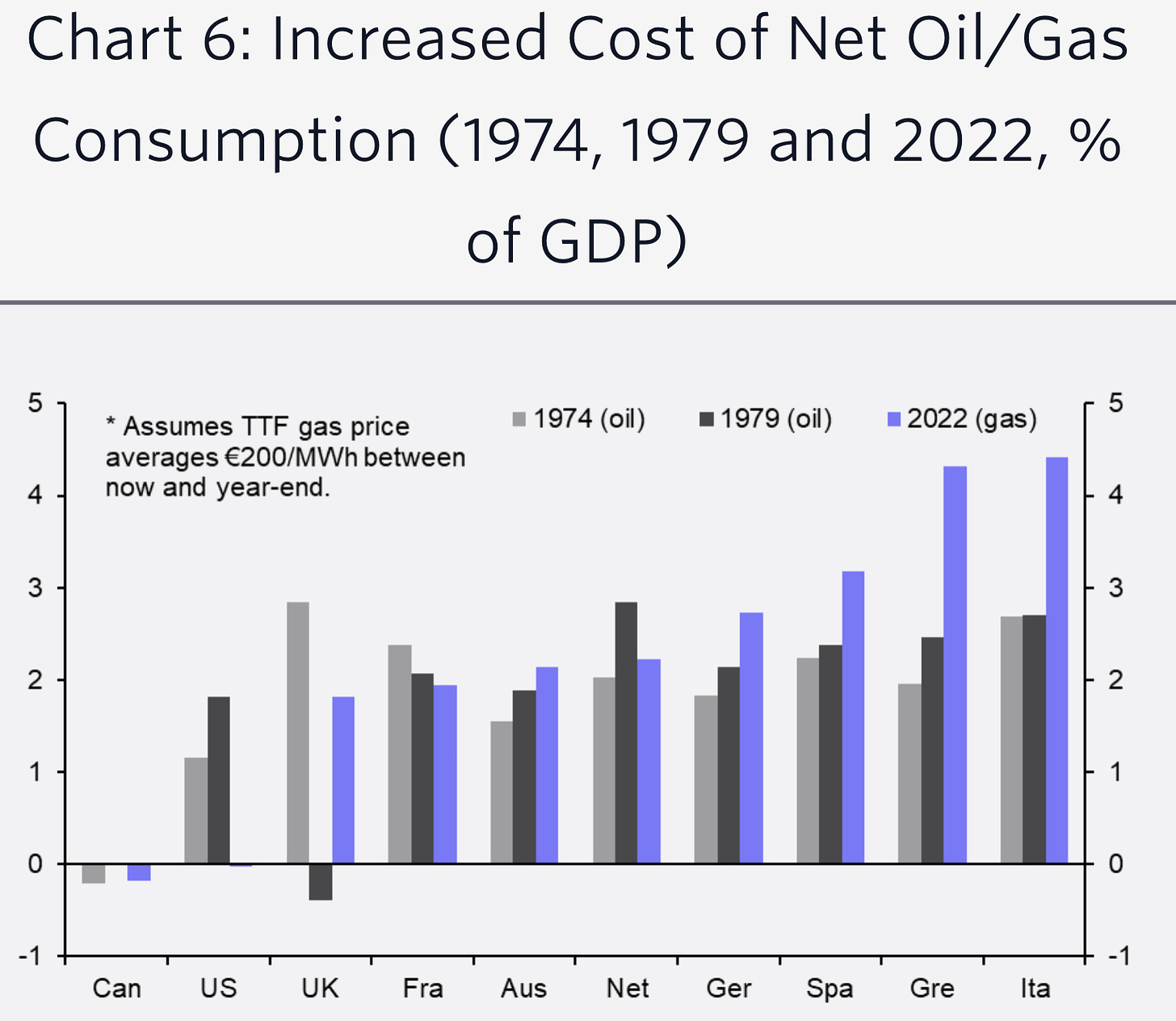

European gas shock worse than oil shocks of the 1970s

European gas and electricity prices jumped to record highs overnight on fears a three-day shutdown of Nordstream 1 for maintenance late next week may actually be the trigger for Russia to turn off its gas to Europe completely ahead of the winter.

This is a big deal for European economies as electricity price spikes are shocking consumers into cutting back elsewhere and heavy industrial plants that use a lot of power, such as smelters, start shutting down. Gas prices have risen ten-fold and the surge in electricity prices will at least double household heating bills over the winter.

This chart via Capital Economics shows how the expected hit to European GDP from the gas and electricity shocks rolling across Europe as the war in Ukraine drags on are likely to be bigger than the oil price shocks of the 1970s.

So what? - European economies are most likely to fall into recession later this year, if they aren’t already. Stagflation is a serious problem for Europe now, but the responses from central bankers will decide how big a problem it becomes and how much it spreads to the rest of the world. The European Central Bank could rapidly hike rates to contain inflation, or resume money printing to stave off recession.

The bottom line - My thesis is the deflationary forces of the recession will eventually overpower the inflationary forces of the energy price shock, which in turn will add to the disinflationary forces now gaining the upper hand in the Northern Hemisphere. But it all depends on how the Ukraine War progresses and what the ECB does.

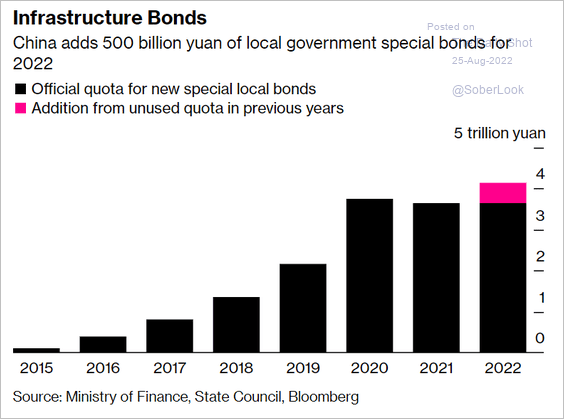

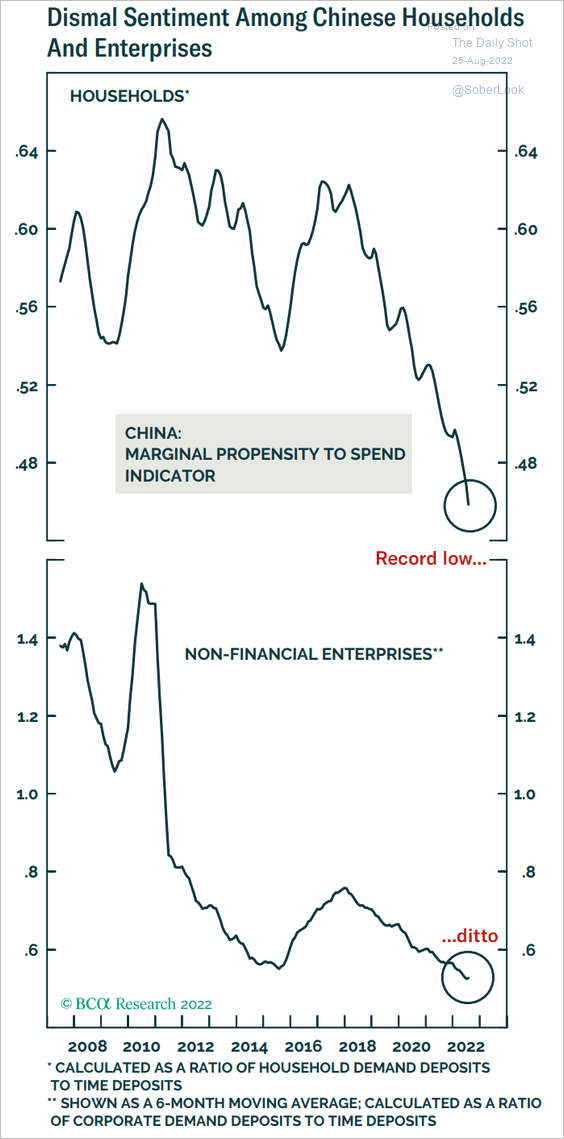

China unveils a new US$150b stimulus plan

China released the details overnight of a new one trillion yuan (US$150b) stimulus plan to bolster infrastructure spending and ease some of the debt loads of local governments hammered by the collapse of apartment developers. But most observers saw the intervention as marginal and unlikely to turn around dire consumer sentiment and stalling industrial output in the wake of Covid lockdowns and the apartment sector collapse.

So what? - We depend on Chinese consumers buying our meat, dairy, fish and wine for the biggest chunk of our export receipts. We also need China’s construction sector to buy our logs to box up concrete. We also depend on Australian consumers as our second-largest export market. In turn, Australia is dependent on China’s iron ore and coal buyers, who need it as the raw ingredients for the steel and concrete used in the infrastructure.

The bottom line - It’s still unclear whether China is going into a very heavy recession. Beijing has managed to pull the levers to avoid big slowdowns in the past, but this time might be different because its local governments and apartment developers are mired in debt and consumers are very cautious because of the Covid lockdowns. There is also a big demographic headwind building because of its falling working-age population. There’s a big leadership meeting in November, which might be President Xi Jinping’s opportunity to ease his Covid elimination focus. That will be a key moment.

Some fun things

Ka kite ano

Bernard

PS: Here’s the link for today’s ‘hoon’ webinar for an hour at 5pm.

Friday's Chorus