TLDR & TLDL: Three decades of bipartisan skimping on Government spending on public infrastructure and services such as health, education and transport was always going come home to roost, and now it is at the worst possible time, in the middle of a joint public health, cost-of-living and climate crises.

For 30 years, both National and Labour have pursued low-tax and capital-lite forms of Government dedicated to restraining spending on infrastructure and staffing in hospitals, schools and in public transport in order to keep taxes low on income, non-existent on capital gains and wealth, and to keep interest rates low.

It worked in the short run to keep taxpayers happy and to inflate the value of their own assets, but is now hurting the country deeply at a time when these public infrastructures and safety nets are needed most. There is never a free lunch in the long run, especially when we under-invest in each other and our common assets.

Paid subscribers can see more on the latest examples of this under-funding coming home to roost below the paywall fold and in the podcast above. Commenters should say below if they want this opened up for the public.

Elsewhere in the news this morning:

Russia downplayed talk of a peace deal with Ukraine, while US President Joe Biden is set to talk virtually with China’s President Xi Jinping tomorrow night about Russia’s invasion later;

Russia’s Finance Minister Anton Siluanov has asked the People’s Bank of China if Russia could convert its $90b worth of foreign reserves that are in yuan into dollars and euros, but Beijing has yet to respond on a potentially explosive issue in its relations with Washington, Brussels and Tokyo;

oil prices rebounded 7-8% to back over US$100/barrel overnight on an IEA prediction that Russia’s removal from global oil trade would reduce supplies by 3m barrels a day, while the economic shock of the war in Ukraine would only reduce demand by around 1m barrels a day;

the OECD warned overnight the war in Ukraine and higher oil and food prices would reduce global GDP growth by one percentage point to 2.5% this year; and,

Deputy PM Grant Robertson has declined to criticise China’s stance on Russia, saying it was not clear what our largest trading partner’s position was yet (Newshub).

Coming up later today, paid subscribers should watch out for the invite email to my one-hour Ask Me Anything comment thread just before midday, and the invite email to our weekly hoon webinar starting at 4pm for an hour (the link is also below the fun things below).

The collective bill for under-investment just arrived

At least two items of news this morning emphasise there is always a moment when skimping on investment comes home to roost. Under-investment in public infrastructure (or more correctly a failure to reinvest surpluses and depreciation charges) always creates a liability. Eventually that long-term liability crops up in the here and now, and often in a way that is the most painful.

This is that moment.

Firstly and shockingly, last night, Wellington Water revealed that it had not been fluoridating Wellington’s water for almost a year because its fluoride treatment facilities were old and councils in the region had chosen not to invest.

1News reported last night that Wellington Water chairperson Lynda Carroll had said the Te Marua treatment plant had actually ceased treatment in May 2021, followed by the Gear Island plant in November 2021.

As RNZ reported yesterday:

Greater Wellington Regional Council Chief Executive Nigel Corry said it was an opportunity to invest in an upgraded system.

Ya think…

What skimping looks like

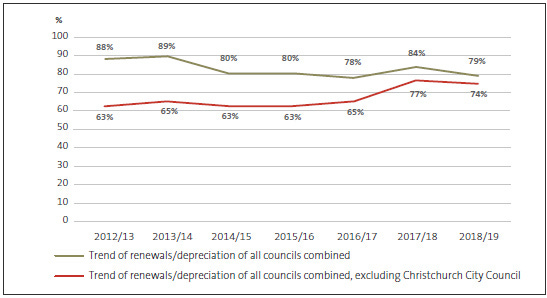

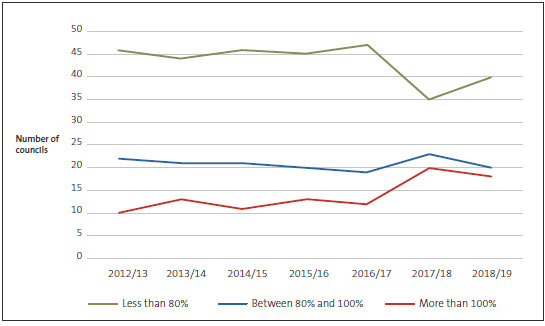

An Auditor General’s report into council spending in 2019 found all councils, excluding Christchurch’s quake-related rebuild spending, invested 63-65% of their depreciation charges for most of the previous decade, the report found.

Councils also under-invested relative to their own planned spending, which was itself much less than depreciation charges, as the Auditor General documented in this chart.

It is not all the fault of councillors and Mayors pandering to ratepayers associations revolting against rates increases and campaigning to reduce council debt.

The Government itself has spent the last 30 years planning everything it does to reduce public debt to 20-30% of GDP in order to have a ‘rainy day fund’ for a crisis. The Crown’s balance sheet has been used twice in the last 15 years (GFC and pandemic) to cushion the blows, but has Government always looked to return the budget to surpluses and cut net core crown debt to that low ‘north star’ of 20-30% as fast as possible. That led to the ‘zero’ budgets from 2012-2016 and led Labour to skimp on spending on both capital and operational spending in its first two years after 2017.

That 20-30% net debt target is the reason Treasury set up the Local Government Funding Agency to ensure Councils never borrowed so much that it would push up collective local and central Government debt so much that New Zealand’s sovereign credit rating was reduced, and therefore increased interest rates.

That, along with the dominant votes of anti-rates-campaigning ratepayers, meant councils avoided spending on infrastructure to avoid taking on debt. The Government also avoided borrowing, preferring instead to try to create complicated and expensive public-private borrowing schemes, including the likes of Transmission Gully and a trial Millbank debt issue. That was then used as the model for the Infrastructure Funding and Financing Act — a two-year-old piece of legislation that has never been used — but is always pointed to as the solution to the problem of needing to borrow, but not on the core crown’s balance sheet.

Combined with the fastest population growth in the developed world over the last decade to bolster budget surpluses (and reduce debt), central and local government has woefully under-invested in water, roading and health infrastructure. That has played out in the latest crisis through higher house and land prices as councils strangled new land releases to avoid infrastructure costs (and debt).

This is all coming to a head

Secondly, Waka Kotahi reached the end of its tether on the catastrophic PPP building Transmission Gully motorway yesterday. After a near-doubling of the estimated cost and two years of delays, the PPP contractors were refusing to allow the road to open because it wanted to pass tests that would ensure it receives its payments for a ‘perfect’ delivery.

Waka Kotahi yesterday ordered the PPP to open it by the end of the month, even though not all the compliance testing was finished.

Bizarrely, the Infrastructure Commission also spoke yesterday about the benefits of PPPs in a briefing with MPs. The Commission run by former Treasury Secretary and Reserve Bank Governor Alan Bollard is also captured by the three-decade-long mantra of Treasury officials that the Government should not be increasing its debt, and that it can somehow be laid off to the private sector. No wonder there is little progress.

Transmission Gully’s woes were all about the taxpayer driving down the price of acquiring infrastructure as low as possible and offloading the risk of delivery failure and maintenance problems to the private sector. But in the process, it created a future liability that was not accounted for, and is now landing on the heads of taxpayers, both financially and through the project being two years late. It was a false economy.

The problems in health too

This unaccounted for liabilities in the Government’s books is evident in our health system. Decades of under-funding on capital and operational spending has led to staff shortages, poor morale and insufficient capacity to deal with a crisis. Yet Treasury has never tried to estimate this liability in the Crown accounts…

Emma Russell reports this morning for NZ Herald that Waikato Hospital ER doctor John Bonning says some patients are being left in hospital corridors for up to 24 hours amid a wide staffing crisis caused by quitting and Covid stresses.

"Covid is an added complication but it's not the cause of the problem and this has been predictable, so it's a manifestation of an underfunded health system. Nurses going to Australia is really, really common because they get paid a lot more.” John Bonning

The Association of Salaried Medical Specialists also saw a crisis hitting the hospital system.

"Covid hospitalisations are escalating, routine patient care is being postponed or cancelled, clerical and managerial staff are being asked to help out on the wards, and some staff are being offered special allowances to work extra shifts." ASMS executive director Sarah Dalton.

In water infrastructure, transport infrastructure and health infrastructure, Aotearoa-NZ’s unfunded and unidentified liability from three decades of under-funding just came home to roost.

Our collective focus on debt reduction and low interest rates to get re-elected and inflate asset prices created a false sense of security because the health and productivity liabilities hiding and unaccounted for in the Government’s balance sheet have just been called.

Yet still, both Labour and National are obsessed with skimping on spending, debt reduction and lowering interest rates to win elections. When are they and the public going to realise it is simply storing up huge future costs and crises for themselves and their children?

Scoops and news of note this morning

Adam Jacobson reports for Stuff that Fletcher Building has started making staff use their own sick leave for Covid absences, rather than take Government support.

Ged Cann reports for Stuff that processing times by LINZ for subdivisions, changes to ownership records, and boundary changes have almost doubled, which is adding costs to new builds.

Corazon Miller reports for 1News on rising numbers of children forced to live on the streets in Auckland.

“One of the major barriers is the lack of supply of specific housing for young people…we often have young people crying out for help and we just don’t have the housing.” Lifewise youth worker Aaron Hendry in the 1News report.

For the record yesterday

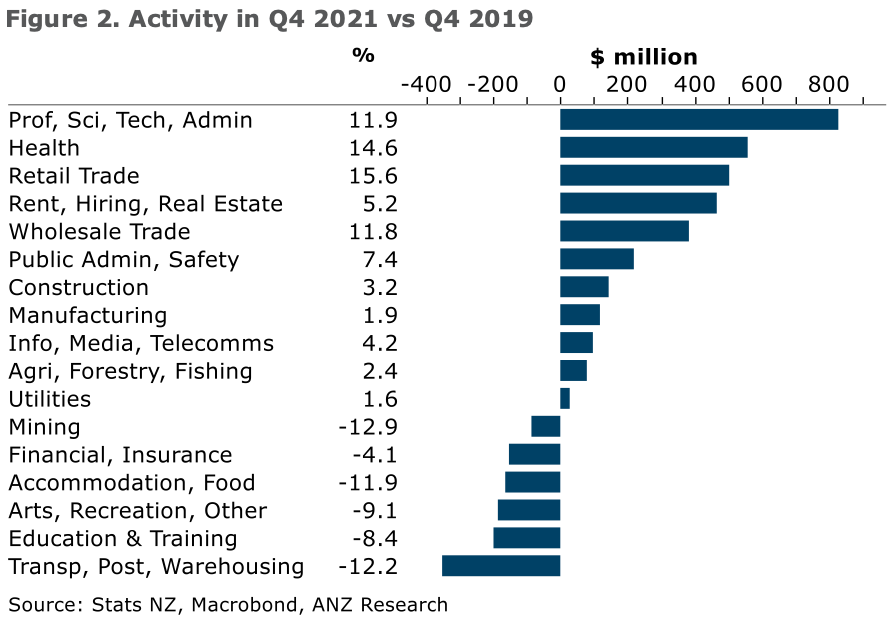

Stats NZ reported GDP rose 3.0% in the December quarter from the September quarter, which was less than the 3.5% consensus estimate and less than the 3.6% fall during the delta-lockdown-affected September quarter. But it was more than the 2.2% forecast by the Reserve Bank in late February. GDP in the quarter was up 3.1% from the same quarter a year ago.

It’s not altogether healthy

“Even looking beyond the near-term wobbles associated with the Omicron outbreak, a rather potent combo of high inflation and rising interest rates (to hopefully contain inflation) is set to erode household incomes from both ends. To prevent a hard landing, a lot depends on the revival of international tourism and education, and the labour market holding it together.” ANZ Economist Sharon Zollner in this note.

A passing - Sir Wira Gardiner, the founding director of the Waitangi Tribunal, died at the age of 78 after a long illness.

Quote of the day

Every day he puts out a video to his region’s half a million inhabitants

“What can I say, the 17th day of war, all is well, the mood is excellent. We have freedom and we’re fighting for it. And all they have is slavery. We want all of our dreams to come true and we’re moving in that direction. Together to victory.” Vitaliy Kim, the governor of the Mykolaiv region in Ukraine in a Telegram message.

Charts of the day

This ANZ chart gives a useful perspective on how different parts of the economy have fared over the pandemic.

Comment of the day in The Kaka community

“There are many reasons why NZ shouldn't send too many exports to China and you've given another one Unfortunately that's where it will end for now, as most of the companies doing the exporting are privately owned, but if China offers you x dollars for a product, but you can only get x- 1 dollars elsewhere, most companies would choose China. And should the government try to direct exports elsewhere, I can already see the headlines ("This communistic labour government"!). So until some sort of adverse event occurs, we'll keep on with the Chinese exports.

“Let's hope that all these companies are at the very least keeping alternative exporting channels open. John P in Wednesday’s article on diversifying away from China.

Useful longer reads and listens

The IEA has published a 10 point plan to reduce the European Union’s reliance on Russian gas, including buying more LNG, fixing methane leaks, buying lots more heat pumps and asking households to turn down their heaters by one degree.

Spookies, profundities, curiosities and feel-goods

A fun thing

Ka kite ano

Bernard

PS: Here’s the link to join the hoon at 4pm, although I’ll also repeat it in an invite via email just before 4pm today.

PPS: I’m a regular reader of Rabobank’s daily market commentary email because it’s written by a human sceptic. This summary nails it on the Fed’s rate hikes, and how bond yield curves are flattening, meaning bond investors see a recession coming because the Fed will tighten too much. The bolding is mine.

“We are now pricing for a policy error and the inevitable rate cuts and new QE that will have to follow. In other words, just as the Fed drives things off a cliff, Mr Market is already pricing in the trampoline at the bottom of it that will take us to even higher market-y highs.

“Are markets right about the policy error? Yes. But are they right to ignore all the pain to come and to presume the Fed will do what it always does, and provide them with so much free stuff they look like Smaug the dragon, sleeping under a pile of treasure? Here is where fingers are being crossed, because if an angry, unequal, polarised society finds out it has turned into Japan without any of its former social contract, don’t think politics, and the politics of central banking, can’t change. Then even dragons get toasted.” Rabobank in this daily email yesterday.

Share this post