TLDR: A damning report into the death of a woman after she left an over-crowded Middlemore ED has illustrated again how stressed our infrastructure is after 30 years of under-investment.

So why has the Government just decided to remove any remaining caps on migration and loosen its settings to suck in hundreds of thousands of new migrants, while also continuing to underfund the infrastructure needed for even moderate population growth?

Migration before infrastructure again

Overcrowded and under-invested - An independent report out late yesterday into the death of a patient who could not get into Middlemore Hospital’s Emergency Department because of overcrowding found systemic problems caused by too many people and a lack of resources. 1News

“The evidence provided to me strongly reflects an overcrowded ED, a hospital well over acceptable capacity and subsequent system dysfunction. This is an unsafe environment for both patients and staff and is not sustainable." An unidentified fellow from the Australasian College for Emergency Medicine in the report.

For more on the background to the removal of the migration planning range and the under-investment, here’s my deeper-dive from the weekend, which is now open to all for sharing.

Paying subscribers were able to see and hear more detail and analysis earlier in the week

In geo-politics, the global economy, business and markets

Truss trussed up - New UK Chancellor of the Exchequer Jeremy Hunt last night gutted most of the rest of PM Liz Truss’ Reagan-era programme of unfunded tax cuts to drive economic growth through wealth trickling down from the wealthiest. It didn’t work in the 1980s and even financial markets judged it wouldn’t again. Hunt dropped £32b of Truss’ £45b of unfunded tax cuts and announced the truncation of £140b worth of gas and electricity subsidies to try to reduce debt. Reuters

Satiated for now - Hunt was trying to fend off the attacks of bond vigilantes who thought unfunded tax cuts for the wealthy were a bad idea. The initial response was positive. The 30 year gilt yield dropped 42 basis points to 4.32% and the pound rose 1% to £1.13 per dollar, despite the Bank of England reiterating overnight it would not restart its short-term money printing announced soon after Truss’ September 23 mini-budget sparked market mayhem. Reuters

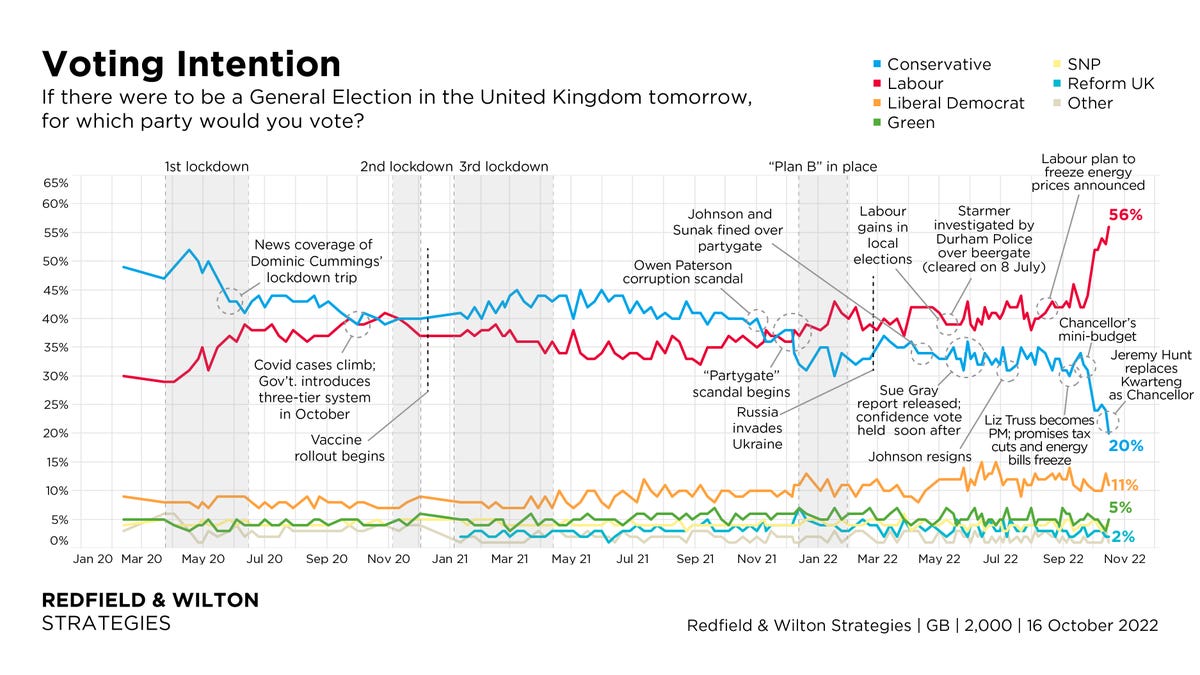

Goneburger within days - Truss is expected to be removed as PM by rebels in her party or forced to resign within days. Business leaders were scathing overnight. Labour’s lead in the polls there blew out to 36 percentage points, which is the widest margin since 1997 when Labour won power after 18 years of Conservative Government.

“She is a busted flush. As prime minister, you have to have the confidence of business, investors, the electorate and colleagues in the party. She has none of these.” Asda Chair Stuart Rose, who is a Conservative, talking to the FT-$$$

‘Not a good look’ - China delayed the release of third quarter GDP figures at the last minute last night. They were expected to show annual growth of 3.4%, well below the growth plan for this year of 5.5%. Economists said that may explain why they’re not going out in the middle of the once-in-every-five years Communist Party Congress. The National Bureau of Statistics (NBS) said the change was "due to adjustment to work arrangements," but gave no further details. Reuters

In Aotearoa’s political economy

‘Turn off the money tap’ - New Auckland Mayor Wayne Brown issued a statement last night ordering Watercare to stop work on Three Waters, describing it as a “doomed project.” However, unlike the PM, the Mayor can’t just order arms of Council to do what he wants. He needs the agree of a majority of the Council, which he hasn’t secured on this issue. The PM has said she is open to changing Three Waters, which is still going through Parliament, but hasn’t been specific.

“The proposal has not been passed by Parliament and after last weekend’s local government elections throughout the country has no chance of proceeding this side of next year’s general election.

“It is not in the best interests of Watercare, its shareholder or its customers for it to spend any more money on the doomed proposal – and that is also true of Auckland Council.

“What money Watercare or Auckland Council might have spent on Three Waters should be returned to Auckland households in the form of lower water charges and rates than would otherwise be charged.” Wayne Brown in a statement.

Two more years? - The Government wants to extend its Covid-19 restriction powers for another two years from their current expiry date of May 2023, Newshub reported last night from leaked DPMC documents.

Scoop of the day

A longer watch worth your time

I recently heard a presentation from Saul Griffith on why electrification is actually an inflation fighting measure. He’s worth watching.

Fun things

Ka kite ano

Bernard

Share this post