TL;DR: Christopher Luxon’s decision to rule out National governing with Te Pāti Māori and to sound a Don Brash-like ‘one person, one vote’ alarm appears to be painting his party’s and his own support into a more extremist and less popular corner with fewer pathways to governing after the October 14 election.

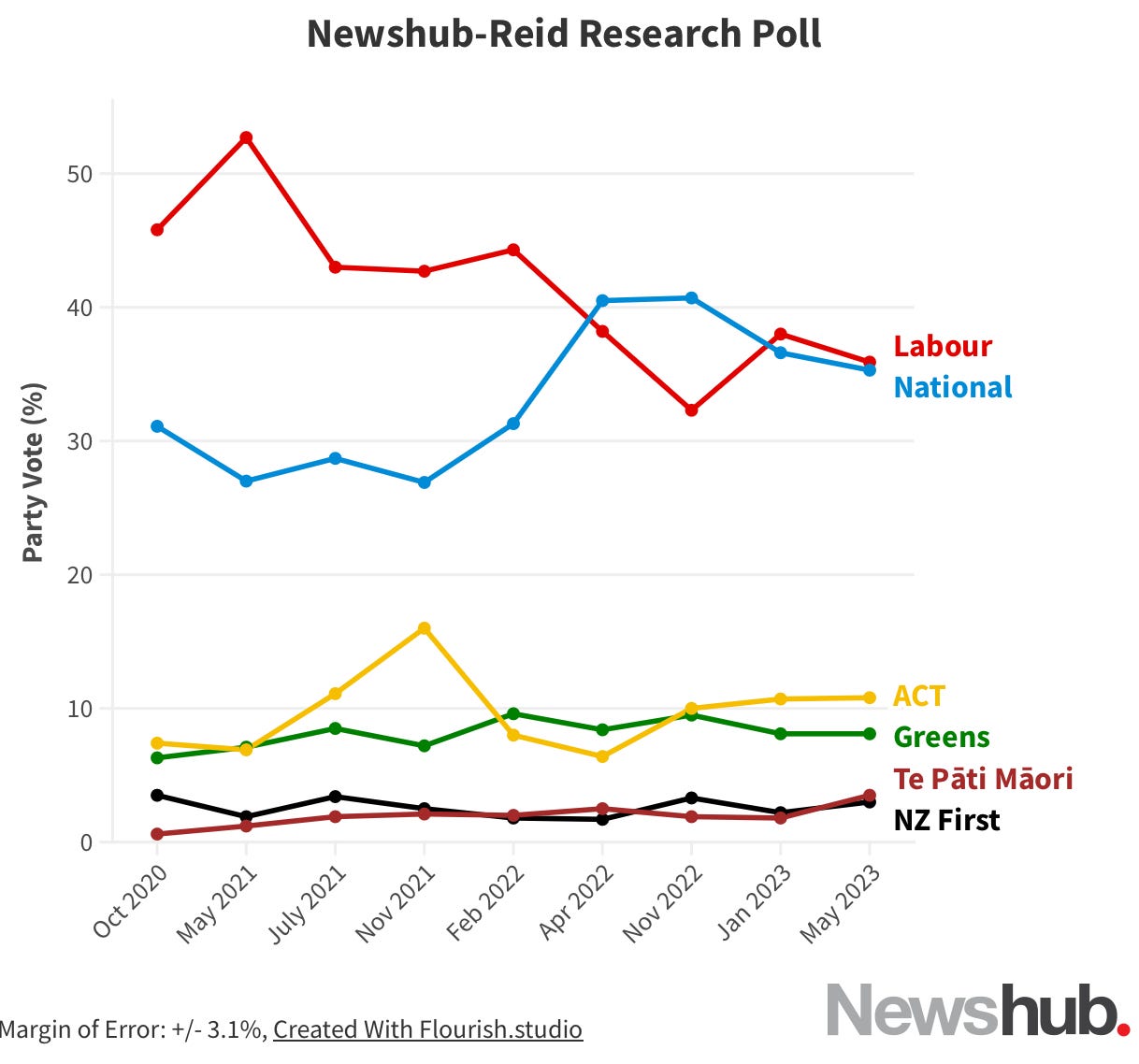

The latest Newshub-Reid Research poll out last night shows support for both National and Labour falling, with Green and ACT support virtually unchanged and the two blocs virtually tied, while Te Pāti Māori rose to 1.7 points to 3.5% and TOP rose 0.5% to 2.0%. Luxon’s own support as preferred PM slumped to a record low that was below the levels then-leader Judith Collins took with her into the 2020 election, which was disastrous for National.

Paying subscribers can see more detail, analysis and charts below the paywall fold and in the podcast above.

My pick of this morning’s news in the political economy

Luxon paints himself into more unpopular, power-less corner

Newhub published the results of its latest Reid Research opinion poll last night, showing National and Labour neck-and-neck with support levels of 35.3% (down 1.3%) and 35.9% (down 2.1%), with ACT on 10.8% and the Greens on 8.1%, both virtually unchanged. Te Pāti Māori (TPM) was on 3.5% up 1.7 percentage points, NZ First at 3%, up 0.8 points, and The Opportunities Party (TOP) at 2%, up 0.5 percentage points. National’s decision to rule out Te Pāti Māori last week looks significant, given it now clearly is in the kingmaker position. (See more in charts of the day below)

But the poll wasn’t good news for Christopher Luxon, with his position as preferred PM dropping 2.4 points to a record low for Luxon of 16.4%, which is also lower than Judith Collins’ 18.4% before the 2020 election. PM Chris Hipkins’ support as preferred PM rose 3.8% to 23.4%.

The cars vs bikes culture war fires up again in Christchurch

Christchurch City Council Mayor Phil Mauger has accused Council staff of ‘running amok’ with ‘anti-car’ policies after they approved a cycle lane without going to the full council, which he said meant they needed to be ‘reined in’, The Press-$$$’ Tina Law reported this morning, quoting Mauger as saying:

‘‘The anti-car brigade have been into this. They are trying to create congestion.’’

Cr Aaron Keown said he found it hard to believe that removing a lane of traffic and creating a cycle lane in its place was classed as temporary traffic management.

‘‘This is really, really sneaky. I don’t think the public are going to be happy about this at all.

‘‘I’ve never seen temporary work look like this in my 12 to 15 years of being elected. This kind of behaviour is unacceptable.’’

But, Cr Sara Templeton said staff were upfront that the work was going to happen and councillors were aware of it.

A March 14 report that asked the council to make a decision on parking charges on Gloucester and Hereford streets near the museum, mentioned plans to put in the cycleway under a temporary traffic management plan.

It went on to say that once those works were in place, a report would go to council to seek approval for them to remain while the museum was redeveloped, which would take about five years. The Press-$$$’ Tina Law

The newly-stressed middle isn’t as stressed as long-stressed renters

Canstar analyis published in this morning’s NZ Herald-$$$ show covid-era home buyers of properties at record-high prices now face interest burdens of about a third of their disposable incomes.

Canstar’s analysis found those on average household incomes ($151,450) who purchased a property in April 2021 will now be paying an estimated 31 per cent of their income into their mortgage. The numbers are based on the average New Zealand house value of $845,491 on March 31, 2021, with a 20 per cent deposit, giving a loan amount of $676,393 taken out over a 25-year term.

Two years ago the monthly borrowing cost was $3055 based on the average two-year fixed term rate of 2.56 per cent which was just under a quarter of the average household income. Now the rates have risen to an average of 6.5 per cent for a two-year fixed term, which would increase the monthly repayments to $4451 or 31 per cent of the average household income.

“We’ve seen a perfect storm of financial pain for those who purchased houses two years ago, when property prices were at their peak and interest rates were at a record low,” Canstar New Zealand general manager Jose George said

“Since then, the costs of servicing mortgages has increased dramatically, as have day-to-day expenses such as groceries,” he said.

“It’s an incredibly difficult time for all New Zealanders, but even more so for those who purchased homes during these boom times.” NZ Herald-$$$’s Cameron Smith

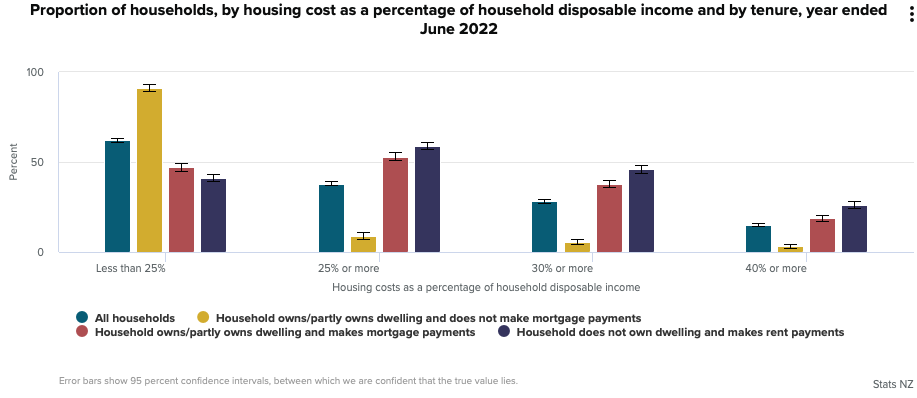

However, it’s worth remembering, as of June 30 last year, Stats NZ reported 25% of renters paid more than 40% of their income in rent, while 10.5% of those with mortages paid over 40% of their income on mortgage payments. Nearly 43% of renters paid more than 30% of their income in rent, while 20.6% of home-owners did.

It’s also worth remembering the scenario painted by Canstar is hypothetical and suggests those buying homes in 2021 all had that much income ($151,040) and debt ($676,393). ANZ figures out earlier this month show their average mortgage size was $194,000 in the six months to March this year and the average new mortgage size was $453,000 in late 2021. (See more in Charts of the day below)

The stressed middle is more stressed, but not to breaking point broadly, and remain far less stressed than renters.

$2b of flood repair money for costs estimated at over $6b

The Government announced yesterday that this Thursday’s Budget would include $941 million of operating spending and $195 million capital spending on flood repairs and recovery. That’s on top of $889 million of operating and $1.5 million of capital spending committed previously, giving a total of $2.026 billion so far.

Treasury has estimated the damage from Cyclone Gabrielle and the Auckland Floods could range from $9 billion to $14.5 billion, including $5 billion to $7.5 billion of damage to infrastructure owned by central and local government. No doubt more will be announced in the months and years to come, but the commitments so far pay for about a third of the damage.

Charts of the day

Te Pati Maori in kingmaker position

Renters are still more stressed than buyers

Ka kite ano

Bernard

Share this post