TLDR & TLDL: First home buyers and their real estate agent and mortgage broker proxies are arguing more borrowing and bigger deposit subsidies can help solve the housing crisis. Unfortunately, it may help a year or two’s worth of first home buyers, but then sentence the generation coming up behind them to even higher prices.

Borrowers and brokers just had their prayers answered by the Government when it relaxed CCCFA rules for mortgages. However, I argue below the paywall fold and in the podcast above for paid subscribers that calls for higher price caps for government-subsidised loans and grants and looser LVR rules don’t solve any long term problems.

Elsewhere in the news this morning:

oil prices bounced almost 7% overnight on growing talk in the European Union of a full oil embargo on Russian oil and fading hopes of an imminent peace deal to end Russia’s invasion of Ukraine;

Maori voters surveyed by Horizon Research for last night’s episode of The Hui say the cost of living is their main concern and 17% are looking to move their votes away from Labour;

an audit of SkyCity Casino Auckland by the Department of Internal Affairs found a litany of failures, Michael Morrah reported last night for Newshub, including the case of a banned gambler allowed to play on pokie machines for 28 hours straight.

Coming up today, I’m researching this week’s When the Facts Change podcast on whether renewable hydrogen production makes any sense here in Aotearoa-NZ. Last week I looked at petrol prices and our lizard brains.

Stuck in the bargaining stage of grief

The social and economic shock of the 40% jump in house prices during the first two years of Covid is still only just starting to register. We’ve had the denial and phases of grief over the last year. Now we’re well into the bargaining phase, where those currently in their own household formation moment do everything they can to leap onto that ladder.

It’s understandable because these moments can pass, especially when the scale of the leap now feels (and is) just so enormous, yet it appears close enough to touch because the debt servicing costs often remain less than renting. First home buyers may also think their pleading is finally succeeding, thanks to the Government’s decision to relax tougher new CCCFA rules for assessing loan affordability earlier this month.

Here’s a good example of that bargaining and the dangers inherent in this excellent article last week on Newsroom by my former colleague Nikki Mandow. She quotes a range of real estate agents, mortgage brokers and apartment developers seeing the frustration and pain of first home buyers in front of them and pleading for the Government to relax the caps on first home buyer subsidies and for the Reserve Bank to wind back its tightening of the LVR rules late last year.

They also suggest banks and/or the Government find ways to encourage banks to lend to buyers of new apartments in the same way they do for standalone homes. This is a much more legitimate and important call, which needs addressing.

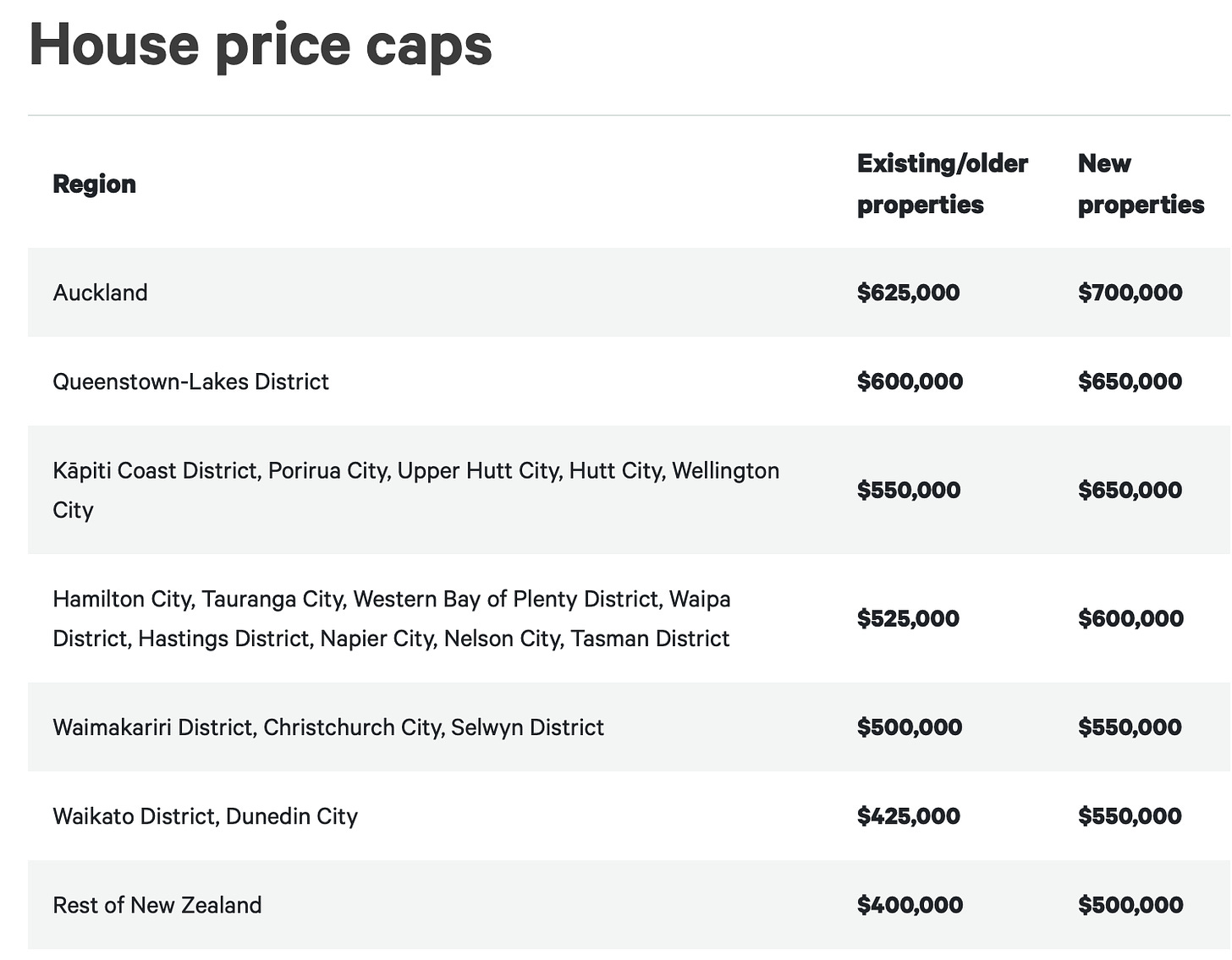

But first the pleadings to increase the price caps on the Kainga Ora loans and grants schemes, which guarantee 95% home loans and allow buyers to use gifts for their 5% deposits, as well give up to $10,000 of Government grants to go with $10,000 worth of withdrawals from first home buyers’ KiwiSaver scheme. They caps in the table below were last set in March 2021.

‘Please sir. Just one more tiny, wafer thin mint’

Here’s the quotes from Nikki’s article, firstly from an apartment salesman.

“There are no homes you can get in Auckland for $625,000. The loans and grants are irrelevant.” Andrew Murray, chief executive of Auckland real estate company Apartment Specialists.

She then quotes mortgage broker Jeff Kerwin from Nest, who says plenty of first home buyers were using the schemes five years ago, but now it’s rare.

“The first home product is exempt from the banks’ rules around 10 percent LVR, so technically the banks could write as many of those mortgages as they like and not affect their books, but the Kāinga Ora criteria mean effectively they don’t write any.”

“When supply is fixed, the government will no longer need to tinker with demand by cutting first home buyers out of the market completely. But I realise we can't build 50,000 houses overnight, so an interim solution would be to change the eligibility criteria for the First Home Loan, so that it becomes more accessible and relevant to the marketplace.” Jeff Kerwin

CitySales broker Scott Dunn would also love to see first home buyers get easier credit, especially given auction clearance rates have dropped from 2/3rds in October to less than a 1/4 now.

“Stuff is difficult to sell at the moment. Sometimes we are getting just one potential buyer turning up at an open home; sometimes no one at all.

“Covid has hit us like a freight train; people are too scared to go and look at units. Then there are the interest rate rises and the banks with the LVRs. We are saying, ‘if you are a first home buyer with a deposit, don’t wait.”

“Sometimes it feels like they go one step forward [in terms of the conditions improving for first home buyers to be able to get a property], and then they tumble back to the bottom of the hill. A lot of people we’ve been working with have been told ‘No’ so many times they have just given up.”

Surely raising the caps can’t hurt?

The temptation for politicians to agree to just one more ‘wafer thin’ mint of subsidy for first home buyers is extreme and they have repeatedly given in over the years, starting with the creation of the grants and loan schemes under National, and expanded under Labour.

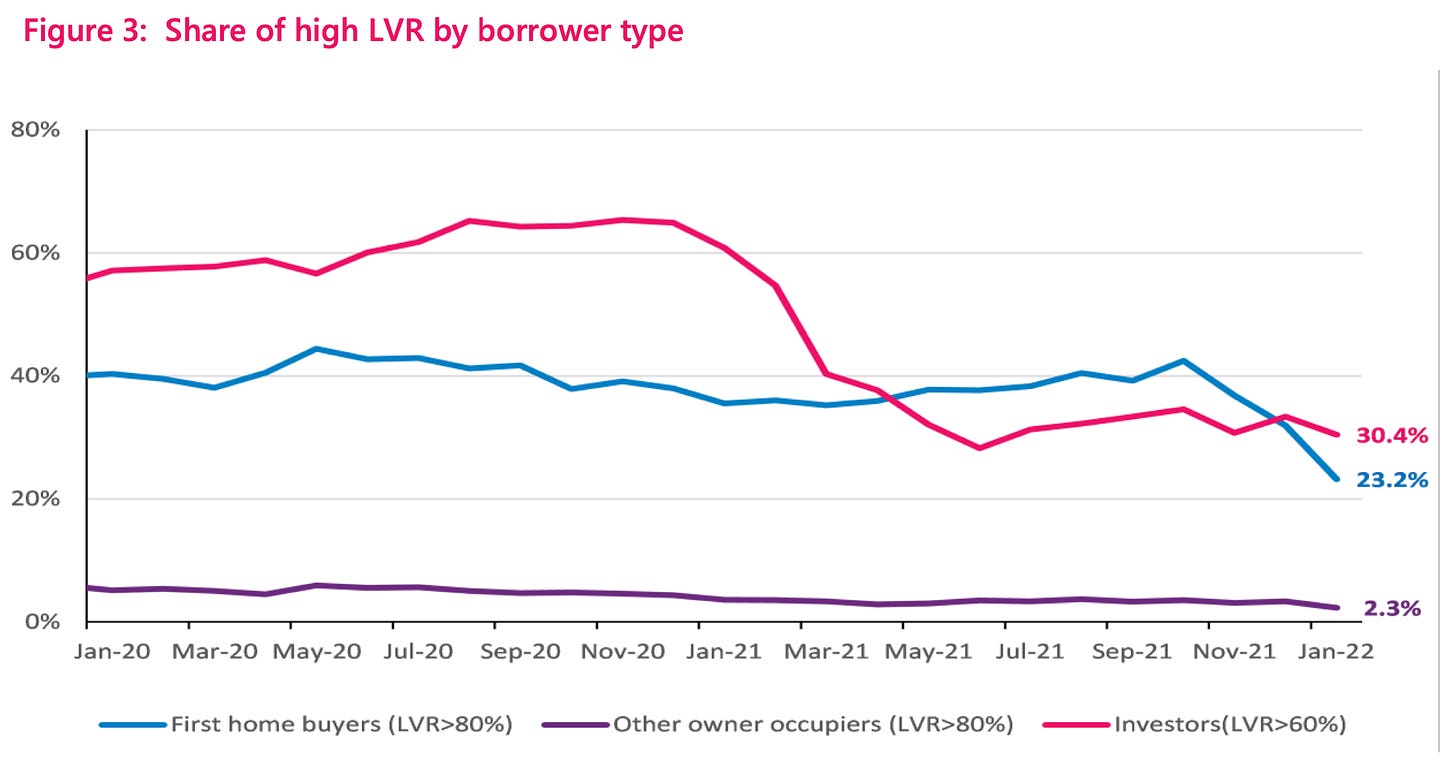

But those schemes weaponised with bank debt, lower interest rates and relaxed LVR rules were responsible for a good chunk (about 30%) of the buying that pushed up prices, especially since Covid, as this chart shows. Landlords are blamed for the surge, but first home buyers were responsible too. Their share rose last year before sliding just at the end of the year.

Various studies and Treasury advice has shown these subsidies simply pump up prices.

The bigger issue to solve is increasing supply, which can partly be achieved by switching buying demand from buying existing homes to new homes. That’s where the pleading has more relevance, and where bank lending policies on apartments are the main constraint right now, and threaten to scupper the record-high consents of the last two years.

I welcome comments and suggestions from subscribers below. Do you want this opened up for midday so you and I can share it?

Other scoops and news of note

Useful longer reads and listens

Chart of the day

Thread of the day

Spookies, profundities, curiosities and feel-goods

The Craic

A fun thing

Ka kite ano

Bernard

Dawn Chorus: First home buyers at the bargaining stage of inter-generational grief