TLDR & TLDL: The Government has handed $1.25b in cash to property-owning business owners in two weeks and is reassuring them it has another $8b ready in the kitty for more economic support if needed. House prices are set to jump again as some of that cash is used to bid for a much lower number of new home listings during lockdown.

There’s good news on the Covid front here, but mixed news overseas. There were 49 cases in Aotearoa-NZ yesterday, the second day of lower case numbers. The R number here remains below 1.0. But Australia’s outbreak is getting worse. Victoria gave up on its elimination strategy overnight (AFR-$$$).

Coming up: Watch out in the next couple of days for news of a rejigged vaccine supply and demand strategy here. As a example of what could be done, Australia secured 500,000 extra Pfizer doses from Singapore overnight (AP). Singapore had some spare, and Australia has promised to repay them.

Plenty of Crown cash for asset owners

Finance Minister Grant Robertson has reported there is no shortage of Government funds to support the economy and property owners in particular in this latest lockdown.

He told Parliament yesterday (Question 4 in Hansard) $1.25b of Government cash had been given to businesses through wage subsidies inside the first two weeks of the lockdown, which was less than the expected run-rate of $2b per fortnight. He said there was a total of $8b in various unused funds for more support and the Government also had plenty of room to borrow more within its existing self-imposed debt limits.

Agencies are also looking to use their existing baselines, and, in addition to that, if there is a need to top up the CRRF, we can do that without going above forecast net debt figures due to the exceptional performance of the New Zealand economy, providing significant fiscal headroom to do so. Finance Minister Grant Robertson in Question Time (Q4)

Businesses reassured by support

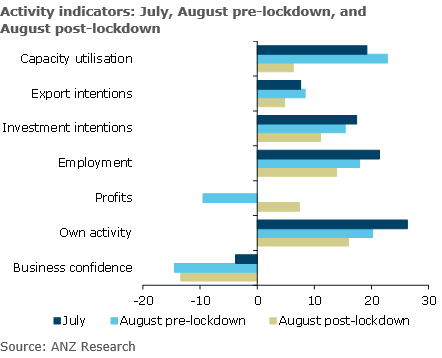

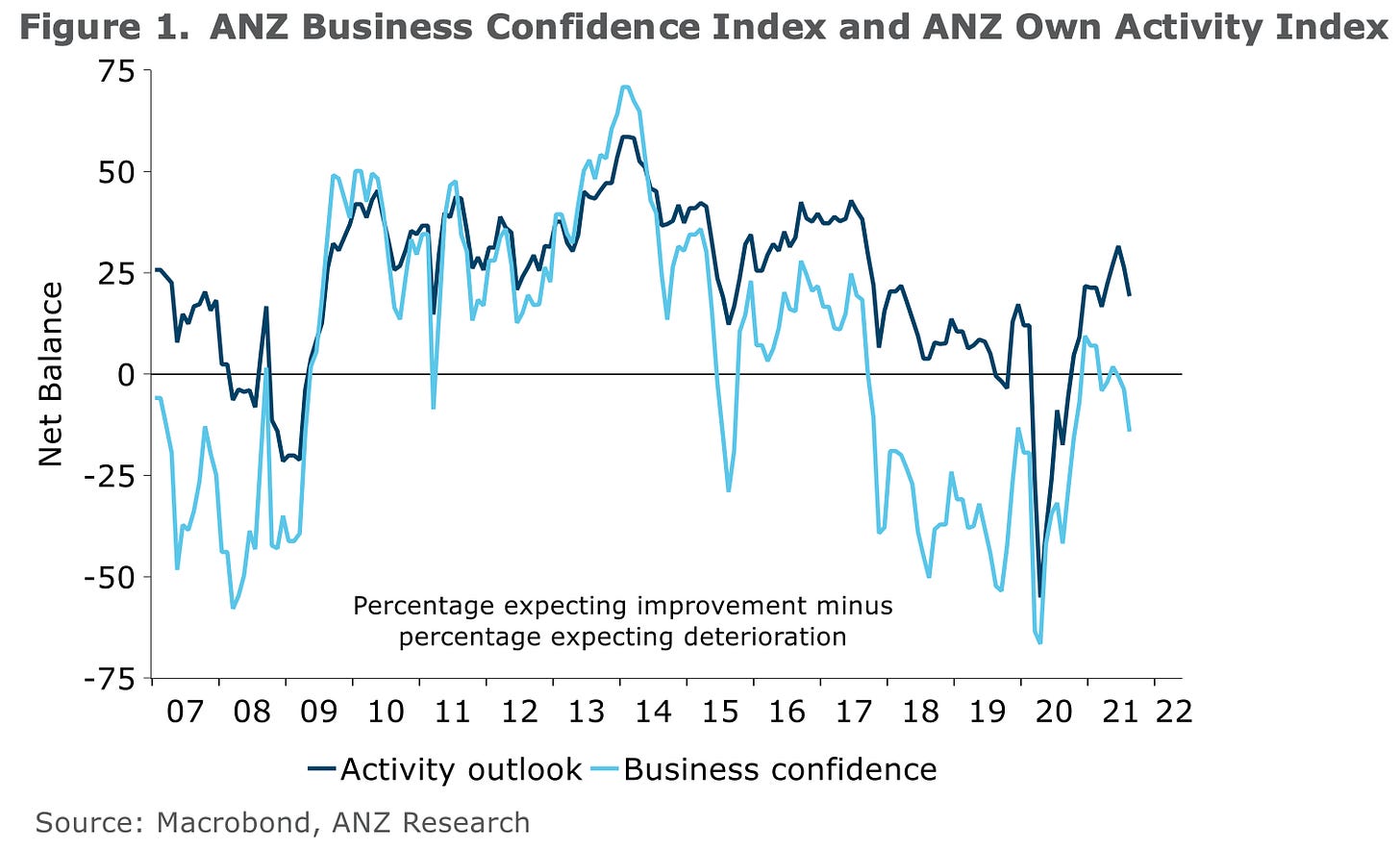

The support has been welcomed by business. ANZ reported its August survey of business confidence found a fall in confidence after the lockdown, but not as much as would be feared.

For now, the results are reassuring. Activity indicators have of course taken a hit, but employment intentions have barely budged. On the other hand, the data does confirm that key activity indicators were already peaking (at very strong levels) before this COVID outbreak occurred. ANZ Chief Economist Sharon Zollner in the ANZ Business Outlook survey.

But not to worry, house prices are still rising

The key thing to watch in our economy (a housing market with bits tacked on) is what happens to house price inflation. Values kept rising in August and agents reported strong buying interest during lockdown and a lack of new listings.

CoreLogic reported this morning that house values rose 1.6% in August, which is a deceleration from 1.8% in July and down from the peak monthly growth rate of 3.1% in April. But it still represents a double-digit annualised growth rate.

Core Logic’s Head of Research Nick Goodall noted a fresh shortage of listings and agent requests for appraisals during the two weeks of lockdown, which may boost inflation in the short term. (Bolding is mine)

“Through lockdowns it is harder for agents to source leads and for vendors to prepare their property for sale. Tracking of early market indicators, like appraisals generated by agents using Property Guru and RPNZ, shows real estate agent activity has dropped by -52% compared to the week before lockdown. This further tightening of supply could lead to some temporary renewed upwards price pressure as pent up demand competes for limited listings.” CoreLogic Head of Research Nick Goodall in his August report.

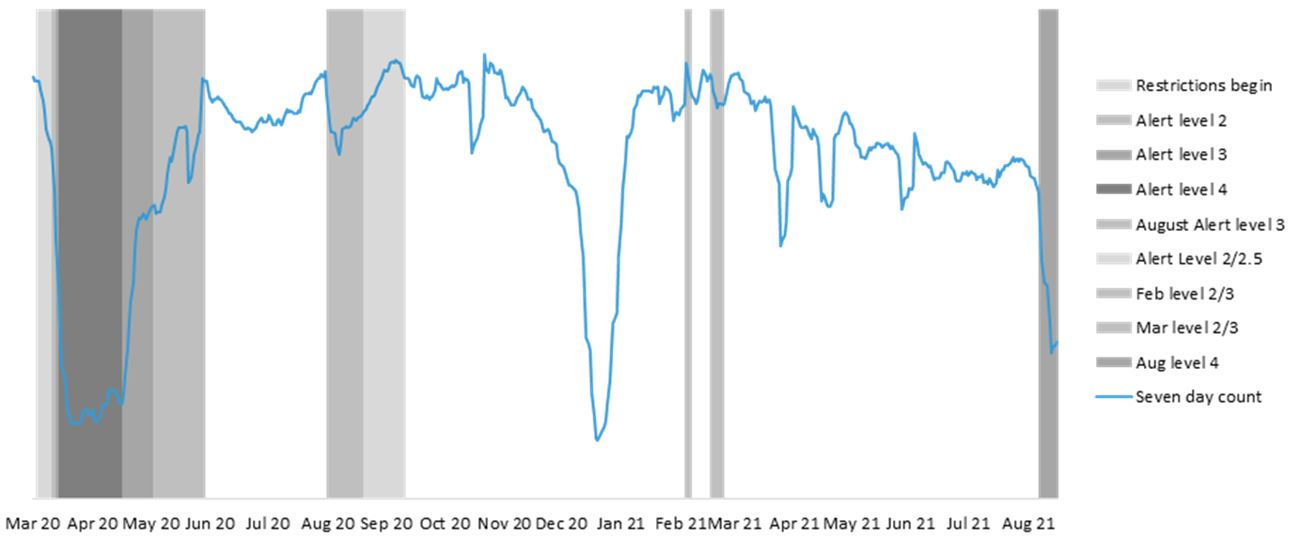

This chart shows the sharp drop in appraisals in the lockdowns, which reflects sellers not suggesting to agents they want to sell.

However, he sees higher mortgage rates and recently-reimposed Reserve Bank lending restrictions putting a lid back on inflation later this year. He says the relaxation of Reserve Bank controls and its interest rate cuts last year were big factors in the surprise 30% rise in house prices after the first lockdowns.

“In absence of these additional stimulatory measures we do not expect any Covid-induced surge in prices to linger. In fact the current LVR settings are tighter than prior to the initial lockdown (40% deposit requirement for investors) and the Reserve Bank has been very clear that the next move for the OCR is up.” Nick Goodall.

Estate agents are licking their lips

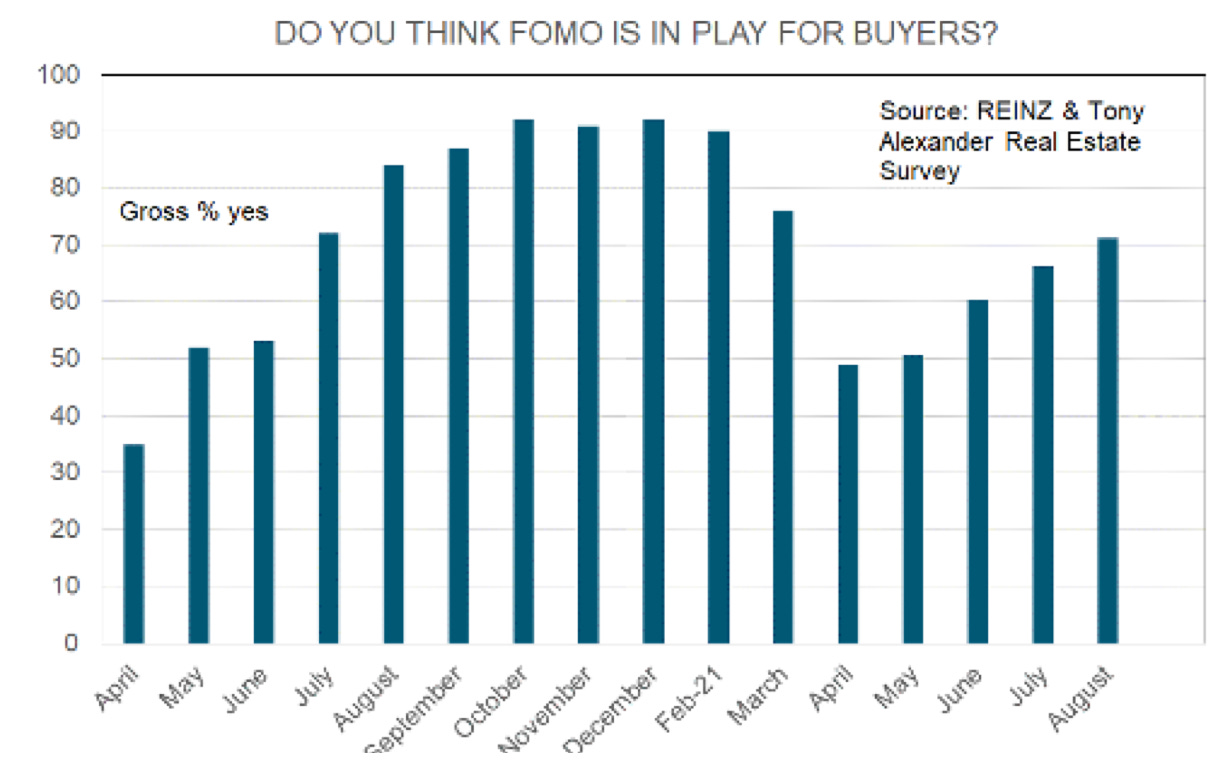

The shortage of listings and the increased interest from buyers with more time and cash on their hands is making real estate agents happy. Independent economist Tony Alexander reported via REINZ late yesterday that his survey of 325 agents on August 24 (during lockdown) found the lockdown hadn’t hit sentiment, with perceptions of FOMO rising in August from July. Agents also reported more first home buyers in the market last week.

“For the first time in five months agents have reported that they are seeing more first home buyers in the market, while the stepping back of investment buyers continues. But fewer investors are selling, a shortage of listings continues to rank as the biggest concern of buyers, and concerns about rising interest rates are increasing.” Independent economist Tony Alexander.

My view: There’s a significant chance of another surge in house prices in the coming months, depending on whether the Reserve Bank hikes interest rates in November and/or December. I think there’s a growing likelihood the length and breadth of these lockdowns will slow activity enough here, along with slowing conditions overseas, to stop the Reserve Bank from pulling the trigger much, or at all.

Also, there’s plenty of cash around for people who already own properties. The issue for buyers is not affordability of interest costs, it is getting hold of a deposit. They are able to easily do that by withdrawing equity from other homes that are 30% more valuable than a year ago. Also, the FOMO factor for first home buyers and others, after what happened last year, will fuel plenty of demand.

There’s also very little supply on the market as sellers also have a big case of FOMO. There is no pressure to sell with unemployment at 4.0% and who would want to miss out on another 30% rise, especially when the actual gains are much larger at the margin when leveraged.

It’s worth knowing that business owners are sitting on $1.25b in cash they didn’t have two weeks ago. Non-financial businesses were sitting on $110.1b in cash at the end of July, up from $87.1b two years ago, Reserve Bank figures show. Households who own their own homes are also cashed up with $206b in term deposit accounts, up from $181.7b two years ago, those same figures show.

It’s worth remembering that before Covid home owners spent $11b a year travelling overseas. That leaves plenty of spare cash, along with the benefits of lower interest rates, to fuel more house buying.

Don’t be surprised again if house prices jump another 10-20% over the next year if the Reserve Bank is unable to put up interest rates and doesn’t further tighten LVR and Debt To Income (DTI) multiple controls. And remember, the Government could also easily pump another $8b in cash into property owners’ bank accounts before Christmas.

Scoops and news breaking this morning

In Covid news:

Israel (pop’n 9.1m) reported this morning its highest ever number of new daily cases (11,000). It was the first country to heavily vaccinate with Pfizer (80% of adults are fully vaccinated) and is now seeing waning effectiveness and surging hospitalisations among older vaccinated people and non-vaccinated people. It has reimposed restrictions and is giving third doses. (Guardian)

A Belgian study found the Moderna vaccine produced twice the antibodies produced by Pfizer’s vaccine (Fortune) Also, the EU banned entrants from the delta-hit United States. (CNN)

In the global economy:

US consumer confidence fell to a six-month low because of delta outbreaks (Reuters),

EU annual consumer price inflation rose more than expected to a 10-year high of 3.0% in August from 2.2% in July, but the German 10 year bund yield only rose six basis points to minus 0.38% (Reuters),

US annual house price inflation rose to a 30-year high of 18.6% in June vs 16.8% in May (Reuters)

China’s services and manufacturing output was weaker than expected in August, although annual GDP growth is still seen over 6.0% in the second half of 2021,

Aluminium prices hit a 10-year high overnight, partly because China’s Guangxi province in the southwest is cutting back on carbon emissions and there is a drought in the neighbouring Yunnan province which is restricting hydro power for China’s smelters. This is great news for the Tiwai Point smelter, but bad news for power consumers and our hopes of using that Manapouri power to achieve our own emissions reductions.

In business news:

Allbirds, the sustainable shoe maker founded by former All White Tim Brown and valued last year at US$1.7b, announced plans overnight to list on the US stock market with the BIRD ticker symbol (CNBC),

Australia’s Ampol, which is already bidding for Z Energy, may also bid for Meridian’s Australian electricity assets, which have been valued at A$1b (The Australian-$$$)

Chinese property developer Evergande, which is the world’s most-indebed developer, admitted it might default on its debt (NikkeiAsia)

Signs o’ the times news

Chart of the day

Some fun things

Ka kite ano

Bernard

Dawn Chorus: $9b in Govt kitty for Covid