TLDR: Aotearoa’s peak union body, the CTU, has proposed an Inflation and Incomes Act that takes a new approach to reducing inflation of rent, food and energy while also increasing disposable incomes of workers.

Inspired by US President Joe Biden’s Inflation Reduction Act, which is based on clean energy and infrastructure investments to reduce energy costs and emissions, the Inflation and Incomes Act would force any Government to demonstrate how it would lower core inflation of rent, food and energy prices over the long run, while also increasing real disposable incomes.

The Act, which could easily be retitled the Inflation Reduction and Disposable Income Expansion Act, is designed to work alongside an amended Reserve Bank Act in a way that turned the tables so Te Pūtea Matua (The Reserve Bank) would have to regularly judge the Government’s performance in improving core inflation and disposable incomes through supply side reforms and investment.

The Reserve Bank would still be required to target and achieve more generalised inflation targets, but would be much freer to call out the Government for not delivering on the long-run supply side reforms to reduce core inflation, including through restricting infrastructure and other public investment in a way that increased housing costs and reduced productivity growth, and by continuing to provide tax incentives for residential land investment over business investment.

The CTU proposed the Act:

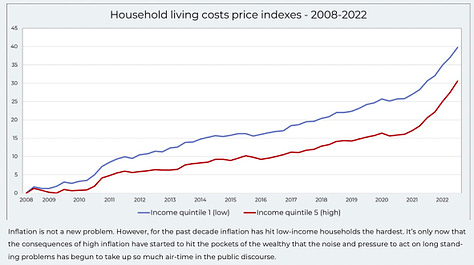

require the Government to target and stabilise core inflation over the next 10 years, with core inflation defined as the inflation basket of the poorest 20% of households, as measured by Statistics NZ’s household living costs price index;

require the Reserve Bank to assess in a letter with its half-yearly Financial Stability Report how the Government was delivering on that core inflation target and what the consequences of failure would be;

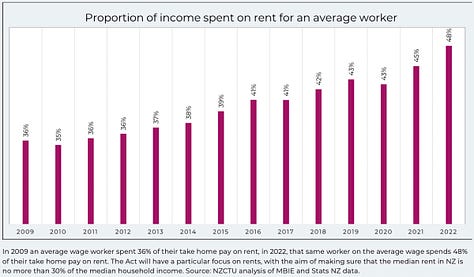

require the Government to ensure the median rent was no more than 30% of disposable income, which would be assessed at Council level;

require the Government to report on how many households lived in energy poverty;

require the Government to target increases in disposable income, including through lower housing costs, cheaper access to essential services such as health and education, and a more equitable tax system; and,

require the Government to demonstrate how it would achieve these goals within a 10-year period.

I spoke with CTU Policy Director and Economist Craig Renney about the proposal in an interview included in full in the podcast above, which is available for all.

He said the current short-term response to inflation had become too obsessed with reducing inflation quickly, with too little consideration for the consequences for individuals and communities and not enough focus on the long-run supply side response.

“We should care about tackling both the corrosive effects of inflation today and preventing it from reoccurring in the future. This means investing to lift our productivity, not short-run tax cuts. It means delivering economic wellbeing, not just economic growth.

“We might tackle inflation now, but if we fail to address inflation and cost of living pressures properly, it will emerge again in the future.” Craig Renney in the CTU’s paper on an Inflation and Incomes Act.

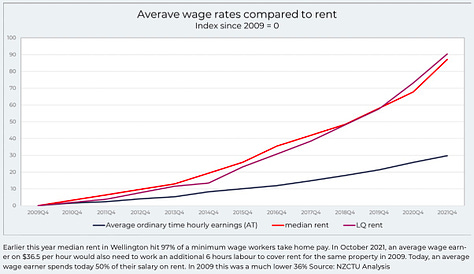

He pointed to figures showing how wages had fallen behind productivity, how rents had outpaced wages and how those on lower incomes had been hit harder by inflation than those on higher incomes.

How a Government could cut inflation and lift incomes

Renney detailed a range of policies that could be included or referred to in the Act, which would reduce housing, food and energy cost inflation while increasing disposable real incomes, including:

replacing petrol and diesel vehicles with cheaper-to-run electric vehicles through subsidies and a hard end date for imports of petrol and diesel vehicles;

electrifying public transport and making it free for school children on weekdays;

shutting the Huntly power station to stop importing and burning millions of tonnes a coal each year;

progressively buying back into state ownership the 51% state-owned gentailers and former state-owned power companies using dividends paid by the gentailers to the Crown, in order to ensure stable prices and 100% renewable electricity generation;

opening up Crown land for new supermarket developments so as to increase competition;

introducing a windfall tax on excess profits made by energy, petrol and supermarket companies;

introducing a levy on larger banks;

creating a tax-free threshold for those on lower incomes, paid for by higher marginal tax rates on those on higher incomes and alternative taxes, including a comprehensive capital gains tax (excluding the family home);

making the student loans repayment system more progressive to ensure newly graduated workers are not hit immediately with a 45% marginal tax rate;

introducing a Government-provided first home buyer mortgage with a fixed interest rate for 25% to buy Government-built homes built through a Ministry of Green Works;

lowering fees for GPs, prescriptions and dental care;

extending free school meals more widely;

expanding tax credits for public and private research and development;

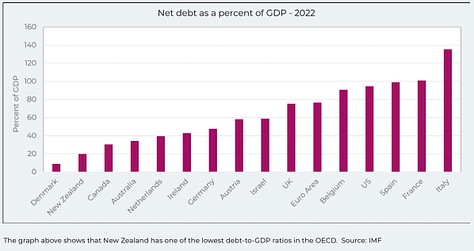

using more Government debt to fund investment in a way that has sustainable funding costs, rather than an arbitrary target on net debt to GDP ratios; and,

creating a new ‘value for money’ test for analysing new spending and investment by Government that assesses the opportunity costs over the long run of not making the investment.

“Value for money should highlight the cost of non- investment — the true opportunity cost. It would produce an estimate of the ‘liability’ the Crown faces for future expenditure set alongside the debt and operating balance consequences of an investment.” Renney

So would it work and could it happen? Yes and no.

My view - The approach outlined above would break the current fiscal ‘rules’ set by the current Labour Government and implicitly agreed to by National, which include:

keeping long-run taxation at or below 30% of GDP;

having a net debt ceiling of 30% of GDP;

requiring the Government to run surpluses except during and shortly after natural and financial crises; and,

ruling out a capital gains tax or wealth tax while PM Jacinda Ardern is in politics.

The approach outlined is anathema to the bi-partisan consensus of the last 30 years around protecting and embedding the economic reforms of the late 1980s and early 1990s, including:

cutting and repressing public investment to allow tax cuts,

continuing to not tax capital gains on residential land while also not subsidising pension savings; and,

running fiscal and monetary policy to keep overall inflation low and interest rates low, even at the expense of higher unemployment and lower wage growth.

The Labour Party is showing no signs of adopting this with its current leadership. The Green Party advocates many of the policies above, but can be safely ignored by Labour in any Government-forming negotiations because the Green Party has pledged never to support a National-led Government. Only Te Pāti Māori and The Opportunities Party (TOP) are sympathetic to some or most of the policies outlined above and could leverage them into any Government of the centre-left or centre-right. New Zealand First blocked a capital gains tax and various public transport projects in its term in coalition with Labour from 2017 to 2020.

The only realistic pathway to these policies being enacted would be a change of leadership at Labour and a rise in political support for either (or both) Te Pāti Māori and TOP, given both have not ruled out using their leverage to force either Labour or National to adopt some or all of these policies.

However, the policies make sense for any Government wanting to address the longer-term covid-era and war-era supply shocks with longer-term supply responses. I’ve talked more about that mismatch between our current monetary policy response to inflation and the reasons for that inflation in this piece earlier today.

Ka kite ano

Bernard

CTU wants new Act to cut inflation and lift disposable income