TL;DR: An unholy scramble for control of African forests is emerging in the run-up to COP28, where final negotiations on international offsets (Article 6 of the Paris Agreement) will take place. The cost of New Zealand’s emissions gap may depend on the availability of cheap offsets from emerging markets. (See more detail below)

Elsewhere in climate news this week:

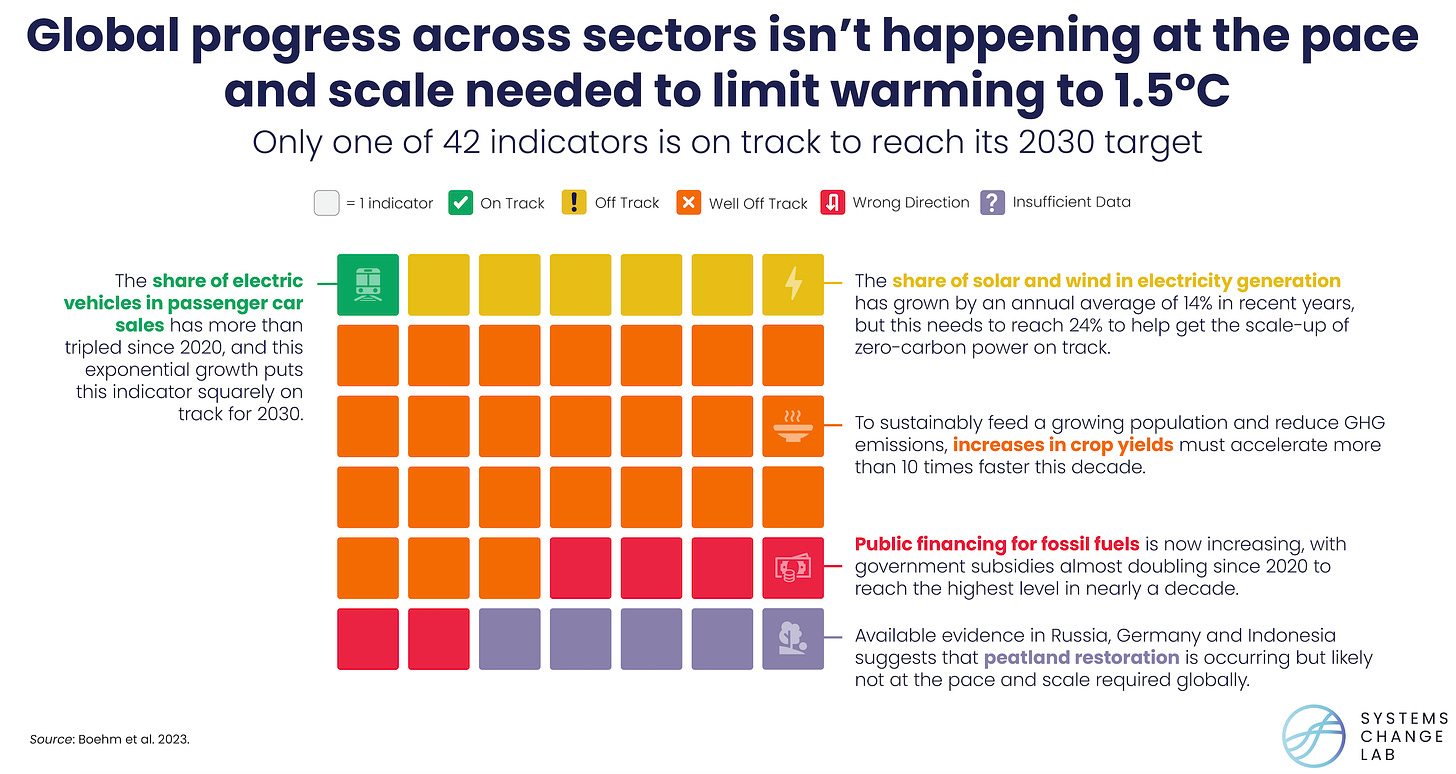

The road to climate hell will be travelled in electric vehicles according to a report out this week that shows global progress toward 2030 targets across a range of sectoral indicators are all off-track with one exception — the sale of EVs in the passenger vehicle market; and,

On a brighter note, an editorial in journal AGU Advance suggests that a social tipping point toward climate action could be achieved a lot sooner if the decreasing costs of climate action and the increasing costs of climate damages were properly accounted for.

An ugly rush to buy carbon credits for African forests

A scramble for control of African forests has emerged in the run-up to COP28, where final negotiations on Article 6 of the Paris Agreement, governing the use of international transfers of mitigation outcomes (ITMOs), are to take place. The rush to capture and control carbon credits by managing tens of millions of acres of forests across Africa is being led by a prominent Dubai Sheik (and member of the Dubai royal family) and his company Blue Carbon, set-up just a year ago.

The rush to control African forests is driven by estimates that global carbon credit trade, currently worth $2bn a year, could grow as high as $1tn over the next 15 years, as a result of Article 6.

African nations have been keen to see benefits from carbon credits since the rulebook for Article 6 was approved at COP26. The African Carbon Markets Initiative (ACMI) was launched at the following COP27 with the aim of producing 300 million carbon credits annually by 2030, and where Kenyan president William Ruto described carbon credits as his country’s “next significant export”. The biggest challenge for Africa is overcoming concerns about verification and validation of carbon credits. This is where third party management of the process comes in.

Can we trust these credits?

Blue Carbon has so far signed MOUs (Memorandums of Understanding) with governments in Liberia, Tanzania, Zambia, Zimbabwe and Kenya. The Zimbabwe deal alone covers almost a fifth of the country’s landmass and is worth US$1.5 billion in funding for forest protection and rehabilitation. Liberians are protesting the deal struck with their government, citing a lack of free and informed prior consent by local communities whose land rights could be breached in a deal violating multiple laws, according to environmental groups.

Carbon credit negotiations are also suspected to be behind recent evictions of indigenous communities in Kenya. The Kenyan government claims it is evicting illegal settlers and logging camps, while local communities are forced into lengthy and costly international court proceedings to defend their land rights – and this is before the market has even opened. There is a significant history of land grabbing and verification issues surrounding forest projects under the UN REDD+ framework (Reducing Emissions from Deforestation and forest Degradation, and other activities including conservation of forest carbon stocks, sustainable forestry management and enhancement of forest carbon stocks).

REDD-Monitor tracks some of these issues here. Article 6 allows offsets from a range of Nature-based Solutions (NbS), including REDD+ projects, marking their first entry into global compliance markets. Blue Carbon plans to sell credits to governments to help them meet their Paris Agreement targets, although it is unclear how the company will qualify under the regime given their complete lack of forestry management experience.

Even the UN’s use of these credits is under scrutiny

This paves the way for some high stakes negotiations in Dubai, where Blue Carbon is hoping to influence proceedings, according to REDD-Monitor. If you are feeling confident about the UN’s ability to monitor and regulate carbon markets, you should listen to this Planet: Critical podcast episode in which Rachel Donald interviews journalist Jacob Goldberg about the year he spent investigating the UN’s claim to be a ‘climate neutral’ organisation.

The legitimacy and availability of tradeable mitigation outcomes is a matter of concern for Aotearoa New Zealand, given the country intends to meet a sizeable chunk of its 2030 targets through international purchases. The gap between planned emissions reductions and the country’s NDC has been variously estimated at anything from $3.3 to $30bn and has been growing of late.

How much New Zealand ends up paying depends on the cost per unit, according to several scenarios explored by Treasury, and reported by Dan Brunskill at Interest.co.nz, back in April this year:

“The International Energy Association (IEA) has estimated a carbon price for emerging economies at about $41 per tonne, which would mean a cost to NZ of between $3.3 billion and $4.2 billion. On the other end of the sale, the IEA also estimated a price of $227 per tonne for advanced economies in a scenario of “advanced global climate action”.

This would translate into a cost of between $18.3 billion and $23.7 billion.”

The only thing on track is sales of electric cars

That said, even in established markets, carbon credits are going cheap right now according to The State of Climate Action 2023 which suggests that a x10 price acceleration is required.

That report, released this week, looked at progress toward 2030 targets by global sector and found all but one indicator was off-track. The single on-track indicator measured the proportion of EVs sold in passenger car markets.

We’re not the only ones falling behind

Claims that reneging on its 2030 NDC targets would make New Zealand a pariah may be overstated as well. It turns out that a slew of other countries are falling behind. According to Climate Action Tracker and recent announcements the US, EU, UK, Australia and Canada are all tracking behind their 2030 NDC pledges. China is one of the few large countries that is on-track to meet its 2030 targets with their emissions looking to head into structural decline as early as next year according to the Helsinki-based Centre for Research on Energy and Clean Air (CREA).

Briefly, in other climate news this week

Close to a tipping point? - In an editorial for the journal AGU Advances, David Schimel and Charles Miller argue that “realizing that wealth at risk may exceed the cost of mitigation could drive a tipping point in human behavior”. They point to the declining costs of green energy against the increasing cost estimates for climate impacts to suggest that the cost assumptions behind current climate policy urgently need to be updated.

Carbon stores on our sea floors - A new report from NIWA, commissioned by the Parliamentary Commissioner for the Environment, found high levels of organic carbon stored in marine sediment in New Zealand waters – as much as 1% of the global total. These stocks play a vital role in regulating climate change by storing carbon for thousands to millions of years but are at risk of being released by human activities such as bottom trawling, seabed mining, dredging and anchoring.

We ain’t seen nuthin’ yet - If you think 3˚C is not too scary of a global temperature increase, Andrew Dessler at The Climate Brink would like you to know that “3°C is 60% of the temperature change that transitioned us from an ice age into an interglacial. 3°C will literally reformat the surface of the Earth.” He has some scary plots to prove it here.

Share this post