Kia ora. Long stories short, here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Wednesday, October 30:

The Government’s move to allow qualified builders, plumbers and drainlayers to self-consent their work faces potential hurdles from reluctant insurers and bankers wanting protection against another leaky buildings crisis.

Scoop of the day: Rob Stock reports this morning for The Post-$$$ that BNZ, ASB & Westpac have started setting emissions reduction targets for farmers, while ANZ is preparing to start targeting farm emissions.

Deep-dive of the day: An Ipsos poll shows health is rising fast as an issue of concern for voters, and that 57% support a capital gains tax on rental properties, while just 13% want one on the family home.

Solutions news: The world’s first electric hydrofoil commuter ferry service began in waters around Stockholm in Sweden

Quote of the day: Marty Baron, the former editor of the Washington Post calls Jeff Bezos’ decision not to publish an endorsement in next week’s US Presidential election an act of cowardice. Over 200,000 subscribers or 8% of the paper’s digital subscribers cancelled.

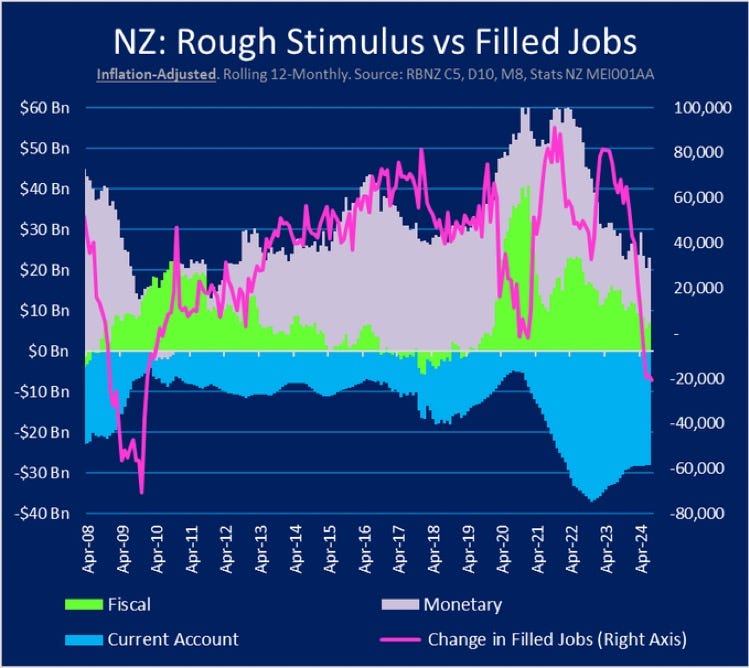

Chart of the day: The economy only grows when either banks lend more, foreigners take less out of the economy or Government and councils invest more. None are showing signs of stepping up.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. If we get over 100 likes we’ll open it up for public reading, listening and sharing.)

1. ‘Where is the ultimate backstop?

Banks & insurers may want bigger backer for self-consented homes

Building and Construction Minister Chris Penk announced plans yesterday to allow qualified builders, plumbers and drainlayers to self-consent their own work, in order to reduce average house-building and consent times from 569 days, which includes up to 10 or more council inspections per single-storey home.

There was a burst of enthusiasm from home-builders, politicians and councils hoping to avoid the time, expense and potential liabilities of inspections and any leaky-building-style problems. However, the hurdles remain of being finding willing financiers and insurers for homes without the balance sheets of councils ultimately standing behind the house.

Other markets such as Queensland that have moved consenting away from council and Governments have eventually had to create a type of Government guarantee or subsidy to bring in private insurers, who in turn are needed for banks to be confident enough to lend to owners and builders.

The Government’s vision is that insurers and guarantee schemes such as those provided by the Master Builders Association, but they are unlikely to be enough for insurers and bankers. The Master Builders’ scheme is currently limited to $1 million and for 10 years overall, with leaky-building-style issues only covered for two years after completion of the home.

Mark Graham, the former publisher of Building Guide, was critical via X yesterday:

Chris Penk’s plan for self-regulation of the building ind is madness. Group Home Builders operate on a franchise system. Clients have a contract with Individual franchisees who often don't have the financial backing to fix major issues.

The Master Builders guarantee that many clients rely on for peace of mind is, as with any insurance company, hard to claim on and minimised wherever possible. Furthermore, re-insurance companies largely pulled out of the NZ market because of the overall quality of our construction industry.

The (Licensed Builders’ Practitioner Scheme (LBP) is a wet bus ticket and is also hard to get any kind of positive outcome for clients-it was dumbed down by the Key govt from its initial stricter regulations and qualifying.

The Minister is to be lauded, however, in the promise of stricter enforcement of what regulations there are, however given National's track record, I suspect we'll be heading into another leaky homes disaster.

Quote of the day: ‘An act of cowardice.’

“This is cowardice, a moment of darkness that will leave democracy as a casualty. Donald Trump will celebrate this as an invitation to further intimidate The Post’s owner, Jeff Bezos (and other media owners). History will mark a disturbing chapter of spinelessness at an institution famed for courage,” Former Washington Post executive editor Martin Baron, who led the paper while Trump was president, said in a text message to The Washington Post on Bezos’ decision not to publish an endorsement of Kamala Harris.

6. Chart of the day: Show us the money

The Kākā’s Journal of Record for Wednesday, October 30

Housing: Building & Construction Minister Chris Penk announced that the Government would develop a scheme to allow building professionals, including plumbers, drainlayers, and builders, to build single-story houses without needing an independent inspection. Penk said the self-certification scheme would also create a more streamlined consent process for businesses with a "proven track-record". RNZ, NZ Herald

Economy & jobs: Stats NZ reported that filled jobs were down 0.9% in September 2024 compared with September 2023, led by a 13% fall in jobs filled by 15-19 year olds and a 5% fall in construction sector jobs. Health care and social assistance jobs were up 3.9%, however. NZ Herald, Interest

Economy & post: The Ministry of Business, Innovation & Employment announced a number of proposed measures to scale back NZ Post's operations and infrastructure in response to declining use of physical mail. The proposed changes include reducing urban deliveries from three to two days per week, and reducing the minimum number of postal outlets from 880 to 550. RNZ, BusinessDesk

Economy: A BusinessNZ report identified measures the Government could take to reduce small businesses’ regulatory compliance workload, including ensuring Government departments use IT systems consistently and setting up a 'first port of call' website for business owners. Associate Justice Minister Nicole McKee said businesses’ concerns outlined in the report also informed upcoming reforms to the Anti Money Laundering/Countering Financing Terrorism regime.

Economy: The Commerce Commission issued a warning to Dick Smith that they likely breached Fair Trading Act obligations by automatically signing customers up for a $149 membership subscription. From July to September 2023, Dick Smith's website required customers to pro-actively opt out of a trial membership; Dick Smith made the trial opt in after the Commission raised the issue. NZ Herald

Health: The Medical Council of New Zealand's Workforce Survey 2024 found that the proportion of Māori doctors has doubled to 5.1% since 2000, and that female doctors are predicted to outnumber men by 2025. The total number of doctors grew by 3.4% in 2024.

Cartoon of the day: The wood and the trees

Nature pic of the day: A happy place

Ka kite ano

Bernard

Will banks & insurers back self-consented homes?