Tuesday's pick o' the links

Gisborne needs 500 new homes; Essity locks out and punishes workers in Kawerau; Australia's South China Sea problem; Long reads; Profundities; Chart and Map o' the day; The Craic

TLDR: Here’s a few useful and interesting links from around the world and up and down the motu for paying subscribers from my travels from 4am to 8.30 am this morning. Enjoy!

In Aotearoa-NZ’s political economy, business and markets

Gisborne’s housing crisis - The Hui’s team have taken a closer look at Gisborne’s housing crisis in this Newshub piece.

Kainga Ora said its moved 40 Gisborne families into new homes since 2020 and another 149 new homes are currently being built.

But local housing advocate Tuta Ngarimu said the crisis is so bad it would take at least another 500 homes to ease the pressure. He told Newshub it's the worst he's ever seen and nothing appears to be changing any time soon.

"We've got these whānau, kids and babies sitting in these boxes waiting for things to happen and nothing's happened", he said.

Kawerau’s industrial strife - This dispute between Swedish multi-national Essity, which made $1.8b in profit last year, and its workers at its toilet paper mill at Kawerau is looking increasingly ugly. Here’s a Kirsty Johnston piece via Stuff on how Essity is playing very, very hard ball.

For three weeks, Grant Carncross and 144 other mill workers in the tiny Bay of Plenty town have been locked out of their workplace by the factory’s international owners, Essity. Some workers - those suspended after earlier strike action - have had five weeks without pay.

In the last few months, different groups of union workers held a series of 48-hour strikes. Then management suspended all the factory’s workers, saying it couldn’t operate while strikes were ongoing. Shortly afterwards, on August 9, Essity initiated the lockout, saying it had “no option”.

Last week, it blocked workers’ access to hardship grants from their superannuation scheme. And last night, it issued a legal threat to make 67 individual employees liable for more than half a million dollars worth of damages related to the earlier strike action.

Ructions down south - The longstanding chair of Christchurch City Council’s holding company has resigned following a probe involving the board and the chief executive. BusinessDesk-$$$

In geo-politics, the global economy and finance

The South China sea problem - This piece from a group of Australian academics via The Conversation is a few days old, but is a fresh look at Australia’s problems if there was ever a war in the South China Sea because of its reliance on refineries in North Asia. We now have a similar problem because we just closed our only refinery.

“Of particular concern is our reliance on liquid fuels imported via South China Sea shipping routes. This reliance has become more pronounced over the past few decades as all but two local refineries have closed. So even while we export crude oil, we import about 90% of refined fuels.

Our research team was commissioned by the Department of Defence to analyse threats to Australia’s maritime supply chains throughout the Indo-Pacific region (the South China Sea and East China Sea).

We calculate a major conflict would threaten routes supplying 90% of refined fuel imports, coming from South Korea, Singapore, Japan, Malaysia, Taiwan, Brunei and Vietnam.

Even if the routes between these countries and Australia do not pass through the South China Sea, most of the crude oil these countries import to produce that refined fuel does.” Australian academics via The Conversation

Just briefly:

Half of UK Conservative voters back renationalising energy firms. Reuters

One of Australia’s big four banks is looking at buying Scotpac. AFR-$$$

Singapore introduces new work visa rules to woo foreign talent. Reuters

Oil prices jump over $3/barrel on prospect of OPEC+ supply cut. Reuters

Longer reads, listens and watches

The bigger picture post-Jackson Hole

I subscribe to waaaay too many daily email newsletters about finance and markets, but there’s a couple I make a point of reading every weekday, including John Authers’ one at Bloomberg-$$$, Robert Armstrong’s one at FT-$$$ (he’s on holiday at the moment) and Michael Every’s one from Rabobank.

Every says some unlikely things for the head of financial research for a global bank. At first glance, he appears to be something of a Marxist. He’s not, but he certainly challenges the status quo with his thinking.

Here’s a sample of last night’s missive:

“We have a hole where productive investment needed to be to prevent our crisis, as food prices soar, European energy hits mind-blowing highs, France’s Macron says it is “the end of abundance”, Germans stockpile toilet paper, and Belgium’s PM warns of the next TEN European winters being difficult.” Rabobank’s Michael Every.

A Foreign Minister speaking bluntly

Thanks to a recommendation from Every, I went to have a look at this interview by Straits Times’ Lynlee Foo with Singapore’s Foreign Minister Vivian Balakrishnan about rising threat levels in the Asia Pacific. He is blunt, clear and clear-eyed about the risks.

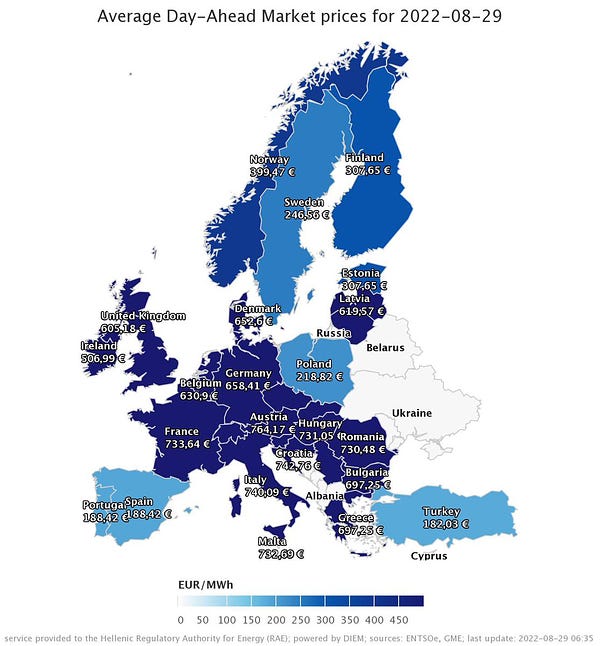

Map of the day

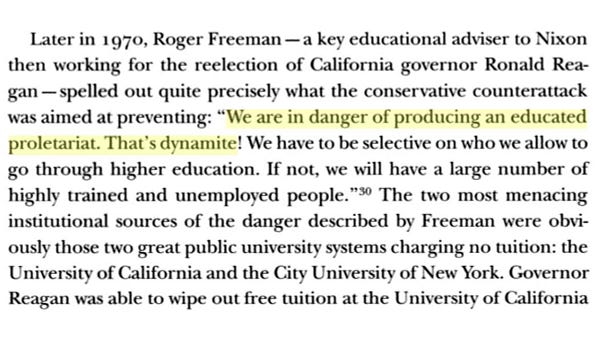

Chart of the day

Profundities, curiosities, quirkies and feel-goods

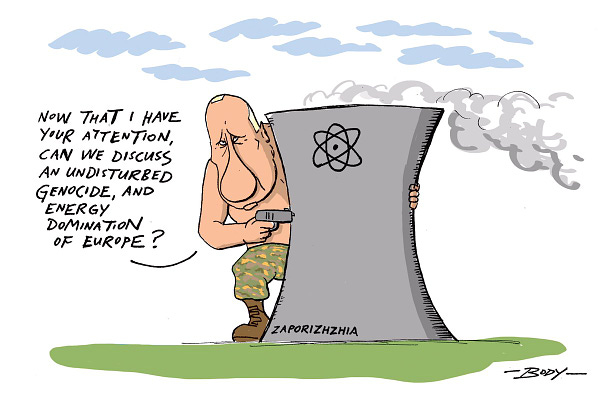

Cartoon of the day

The Craic

Ka kite ano

Bernard

The end of abundance, said the capitalist. Try this instead: https://www.amazon.com/End-Scarcity-Dawn-Abundant-World-ebook/dp/B0B55HC35L/ref=sr_1_1?crid=2H2AYX45BIY9T&keywords=the+end+of+scarcity+kristen+ragusin&qid=1661118741&sprefix=the+end+of+s,aps,113&sr=8-1

Can't recall you joining the voices warning about closing the refinery. Hindsight Harry strikes again.