TLDR: The Reserve Bank surprised no one yesterday by hiking the Official Cash Rate another 50 basis points to 3.0% and lifting its forecast for the OCR peak by around 10-15 basis points to 4.1%.

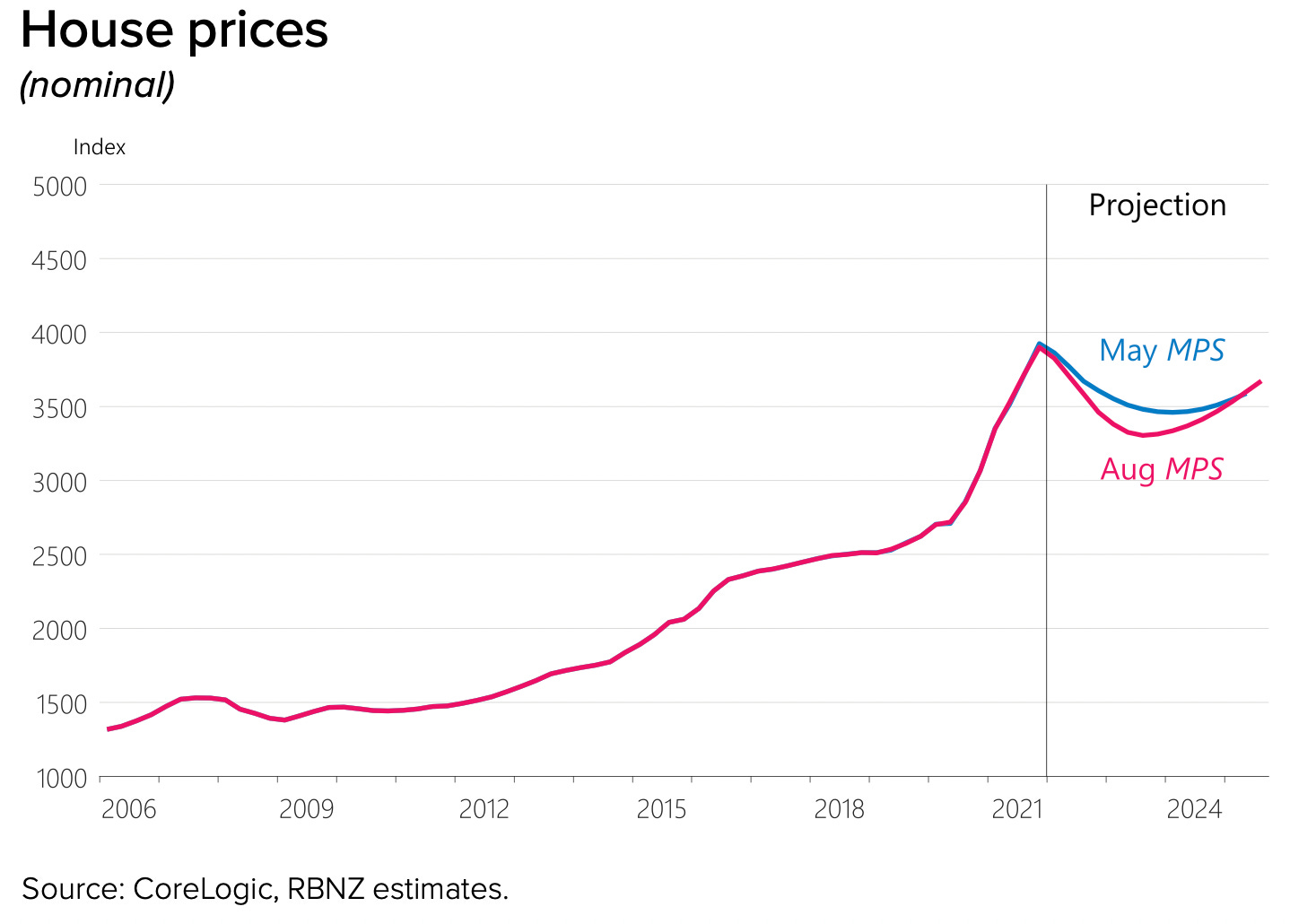

However, it extended its forecast for a peak-to-trough fall in house prices to as much as 20% by the end of next year from closer to 10-15% at its last Monetary Policy Statement in May. It saw the effects of higher mortgage rates and cost-of-living pressures taking more steam out of demand. It also saw the reverse of the ‘wealth effect’ taking enough heat out of inflation to see it sliding back into its forecast range by the beginning of 2024.

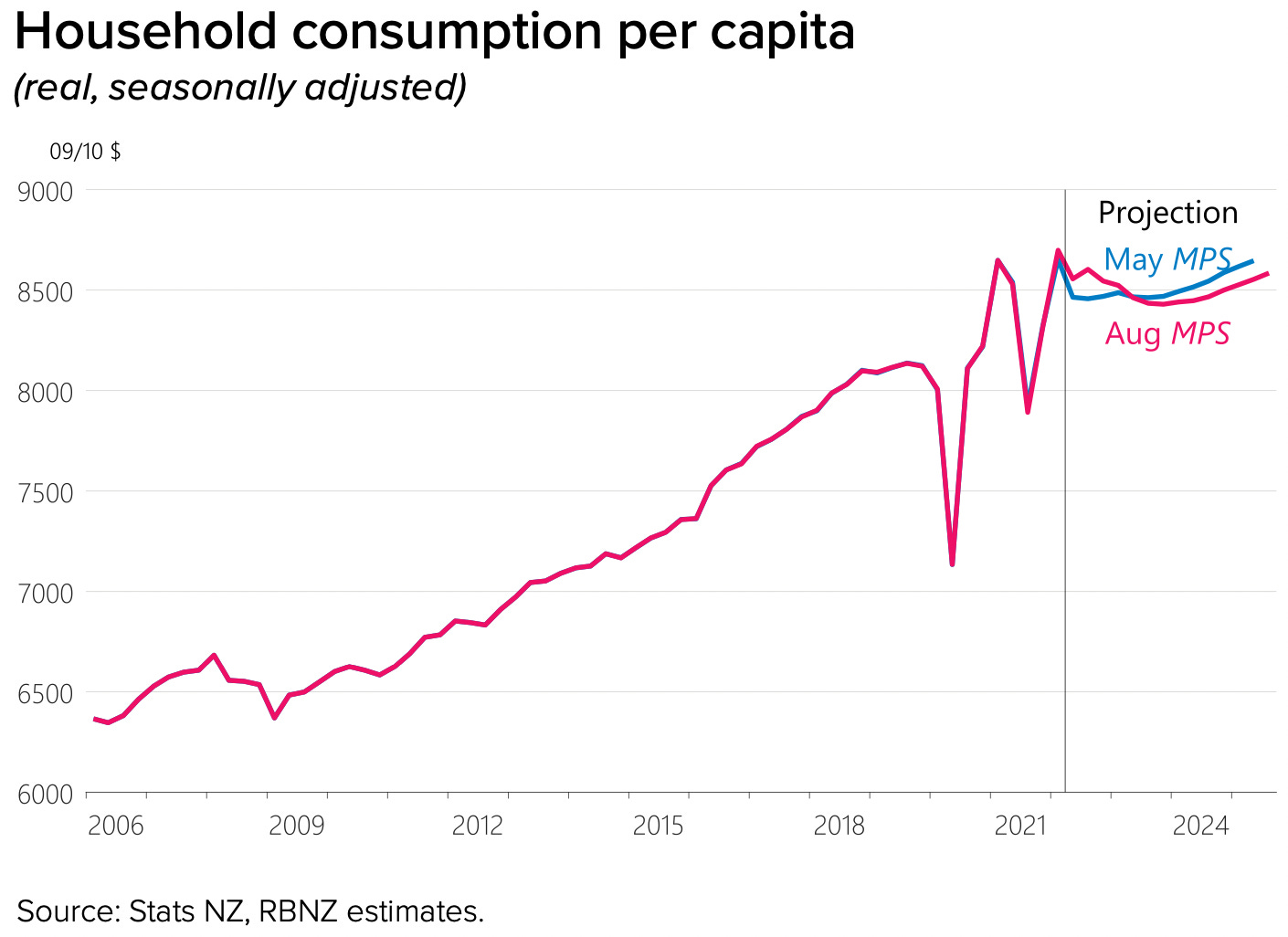

The higher mortgage rates and lower house prices will force some more recent home-buyers to tighten their belts and slow per-capita consumer spending, but the Reserve Bank is confident household and bank balance sheets are plenty strong enough to handle the hit, along with take-home pay with record-low unemployment. The most intense cost-of-living stress remains on renters, especially those with children and living on precarious work incomes and benefits.

Paid subscribers can see my full analysis of the Reserve Bank’s quarterly Monetary Policy Statement below the paywall fold and in the video above that includes a special ‘hoon on the deck.’ In that, I look at Adrian Orr’s prospects for a second term and the Reserve Bank’s pointed warning to the Government to not loosen fiscal policy any further. Those wanting just an audio version can find that below the paywall fold

A negative wealth shock, but not enough to derail NZ Inc

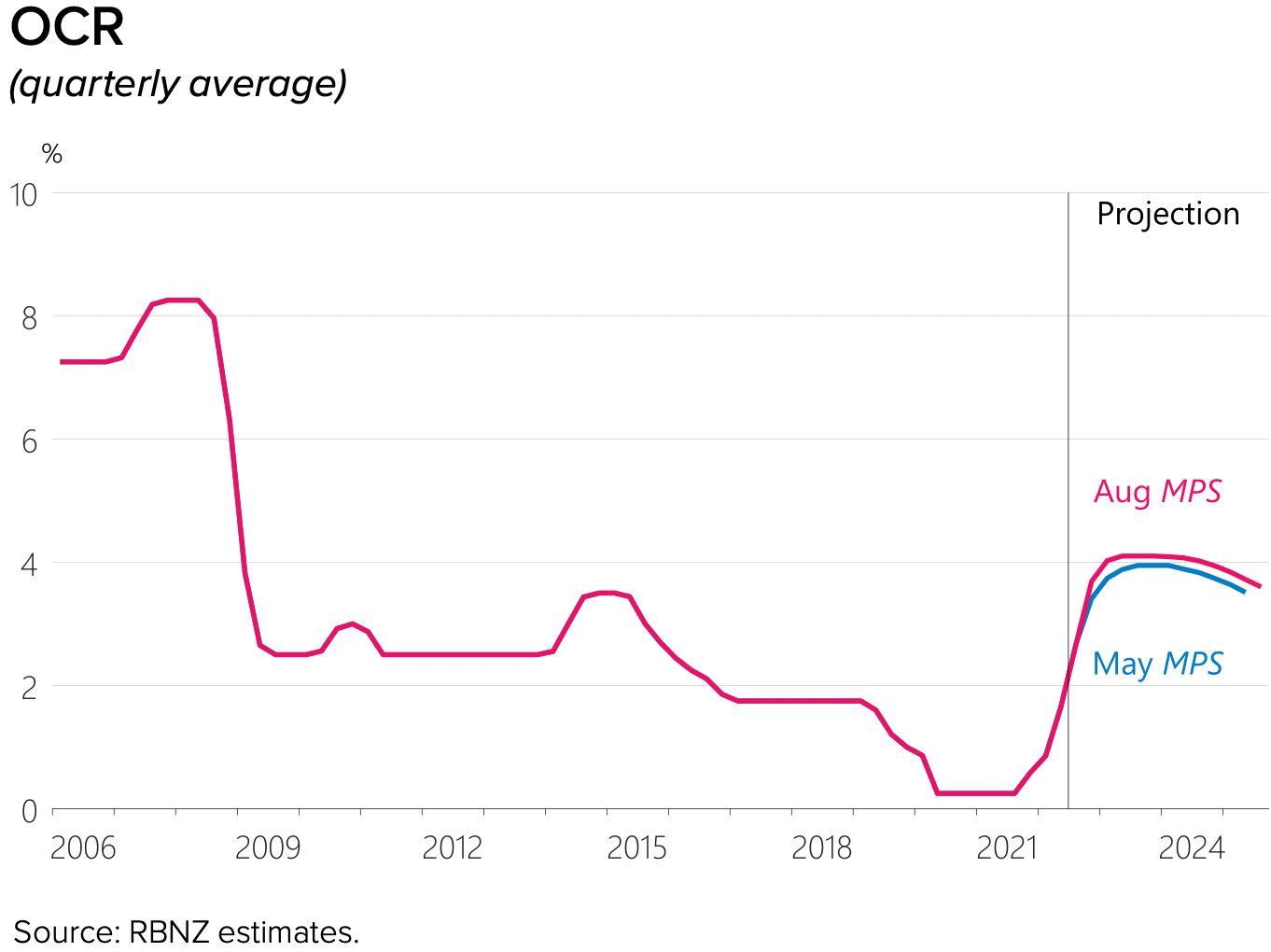

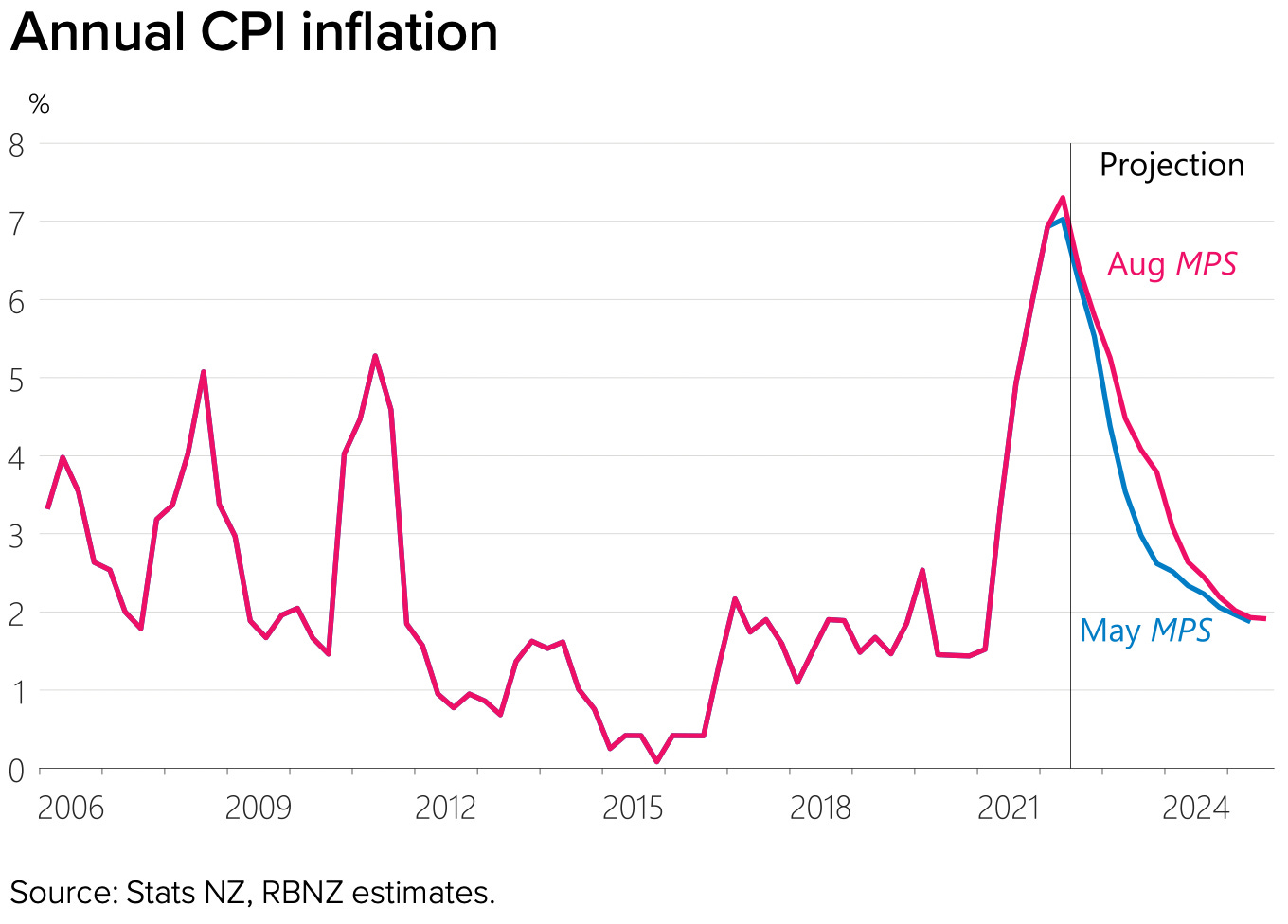

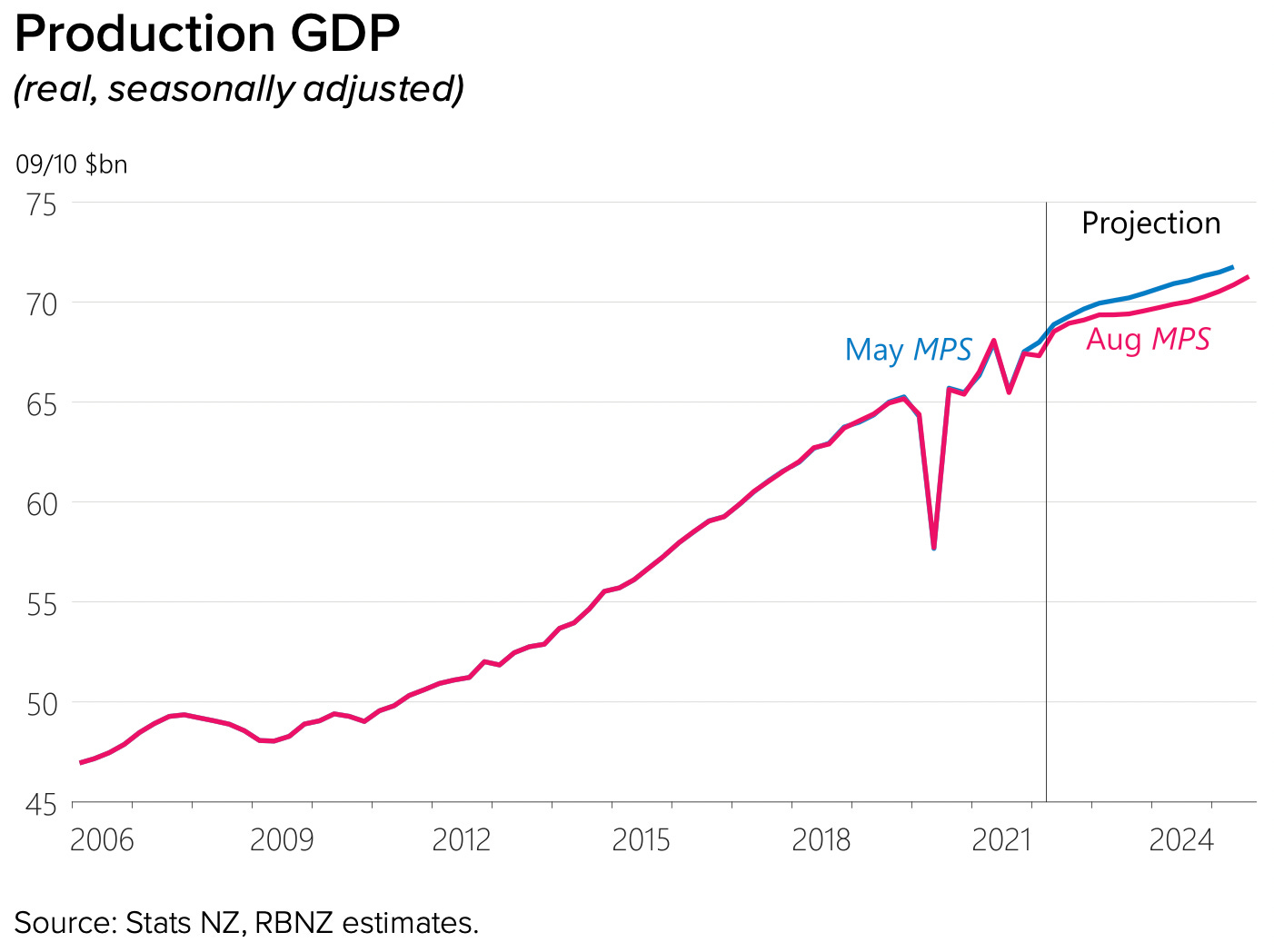

As expected, the Reserve Bank hiked the OCR by 50 basis points for a fourth consecutive time to 3.0% yesterday in its quarterly Monetary Policy Statement yesterday afternoon. It also nudged up its forecast for the peak in the OCR to around 4.1% to try to bring inflation running at 7.3% down to within the bank’s target band of 1-3% by early 2024. The bank lowered its GDP growth forecast a bit and nudged its CPI inflation forecast up a bit.

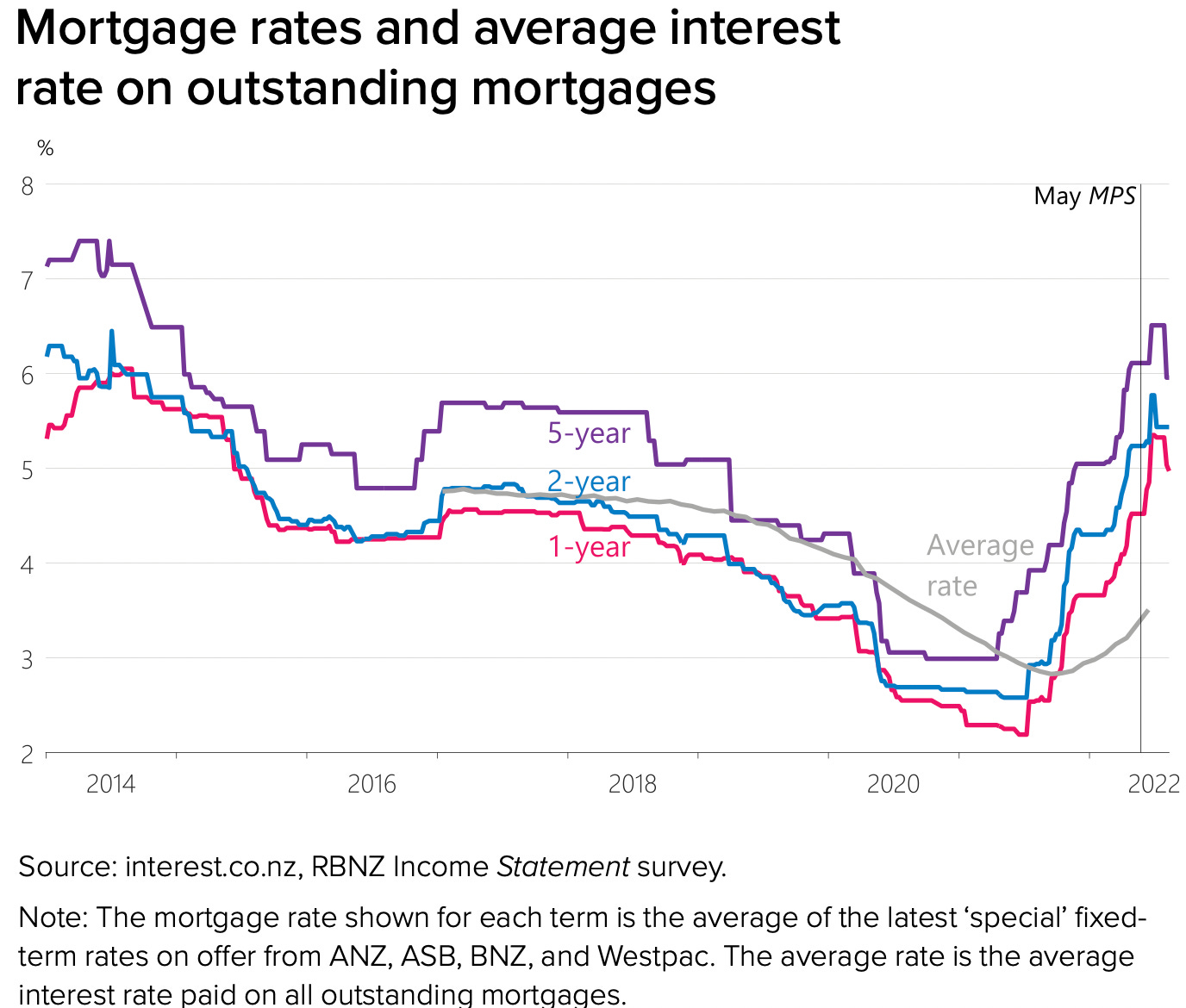

Here’s the three key charts from the MPS:

But that change in the Reserve Bank’s own forecast track for short term rates hasn’t changed the outlook for the fixed mortgage rates that most home buyers use. They have been coming off their peaks for a couple of months as the wholesale market interest rates they’re based on look over the horizon and see inflationary pressures easing globally.

However, the front-loaded jump in new fixed mortgage rates from mid-2021 has already had its effect on the housing market, and through the wealth effect, on consumer spending. The Reserve Bank ramped up its forecast of the peak-to-trough decline in house prices to as much as 20% from 10-15% in May, which it said would drag on per capita consumer spending. But it also noted spending had been resilient and household and bank balance sheets and household incomes were more than strong enough to handle the fall.

Awkward questions about a second term

The focus elsewhere was on Governor Adrian Orr’s appetite for a second five-year term and his response to scathing criticism from former bank heavyweights in recent weeks, along with the Reserve Bank’s view on whether fiscal policy was undermining its efforts to control inflation.

Orr added to the intrigue by declining to answer any questions about whether he wanted a second term or whether his critic's should or will have a say over his future.

However, he suggested a detailed response to the critics and assessment of the performance would be published before the end of the year from an inquiry including independent overseas experts. That would be in time for a decision to re-appoint that may assuage the concerns of the Opposition, who are currently on track to be in Government as Orr's boss in just over a year, with over four years left in a second term for the Governor.

The clock is ticking for the Reserve Bank board, Finance Minister Grant Robertson and a potential National Government-in-waiting over whether Orr deserves or should get a second five-year term before it expires in late March next year.

The heat over what would normally be a routine and apolitical decision has intensified in recent weeks because of the trenchant criticism of the Reserve Bank's performance over the last three years under Orr, and a call for full independent inquiry from the National-led Opposition, who could be in Government only months into Orr's second term. That creates the potential for a dangerous standoff between the operator of monetary policy and the operator of fiscal policy.

Orr's predecessor as Reserve Bank Governor, Graeme Wheeler, the previous Reserve Bank chair and grandee, Arthur Grimes, and the previous Reserve Bank Chief Economist, John McDermott, have all launched scathing attacks on the bank's performance under Orr, describing it variously as incompetent, reckless and conflicted. They have argued it should not have kept printing $55b through late 2020 and 2021 to push down longer-term interest rates, and that it was at least partly responsible for inflation surging to 7.3% this year, well outside the Reserve Bank's 1-3% target band.

National Leader Christopher Luxon called last month for a full independent inquiry into the Reserve Bank's creation of a "tidal wave of cash" that he argued had fuelled the surge in inflation. He pointedly refused to say whether Orr should be re-appointed, saying he wanted the results of an independent inquiry first.

Robertson rejected Luxon's call at the time, describing Luxon as "Captain Hindsight" and saying he had confidence in Orr. Robertson also said he was working with the Reserve Bank board on the issue.

However, Orr had yet to say publicly whether he would seek a second term. The issue emerged last year when Luxon's predecessor, Simon Bridges, said he would oppose Orr's reappointment in the period shortly before the 'caretaker period' in the lead-up to an election.

Orr had not been in a position to answer questions publicly about the issue until Wednesday's Monetary Policy Statement.

‘I don’t want to talk about it. Any other questions?’

He was asked if he wanted a second term or had sought reappointment.

"I don't think that's something we should talk about. Why? Because I don't make that appointment.

Asked what his own view was, given the board didn't decide whether he would reapply, he said: "I don't want to talk about it."

Asked if he didn't know if he wanted to be reappointed, he said. "I don't want to talk about it. Any other questions?" Adrian Orr

A performance review alongside the Five-Year remit review

However, Orr made a point of specifying that a review of the bank's performance review would be released publicly by the end of the year as part of the first once-every-five-years review of the Reserve Bank's new Monetary Policy Remit, which included a requirement to support full employment as well as targeting low inflation under changes to the Reserve Bank Act in 2018.

Luxon has called for the removal of the full-employment requirement.

Orr talked in the news conference about a two-step process in the five-yearly review, with an initial report including independent comment from overseas experts due before the end of the year, before a final review of the Remit early next year.

The overseas-expert-included review was painted as proxy for the independent review demanded by the Opposition. The Reserve Bank of Australia is currently facing its own independent review, which was ordered by the new Labor Government under Labor Treasurer Jim Chalmers.

Orr was asked if the review including overseas experts had been created after the Opposition's criticism. He denied that, saying it was included in the June 1 announcement of the legislatively-required five-yearly review, although was not a central part of the announcement.

"We are the most transparent central bank internationally. We offered that up free of charge in advance of recent statements. There's two legs to it. The first one is the remit itself. And part of that is a review of our monetary policy actions over the last five years. So that was announced publicly quite some time ago." Orr.

The review by overseas experts was mentioned six pages into the consultation document with the five-yearly review, thus:

"Alongside the Remit review, the Reserve Bank will undertake and publish a review and assessment of the formulation and implementation of monetary policy in the previous five years, which will be subject to external review."

Doing the review hokey kokey

Orr admitted the two-step process including the review by independent experts may not have been obvious to all.

"I know it's confusing because a review of monetary policy and a monetary policy review sound remarkably the same. So that review is of monetary policy of the past five years is part of that remit review. We are going to issue them separately so that people can have clear minds and focus because the first part that we'll put out is a review of our monetary policy activities."

"We hope to have that out in full public glory. The second part would be our recommendations to the minister on any changes, if any, to the monetary policy remit. That second part will be in the new year." Orr

The overseas review would be released before the end of the year. That would give the board and Robertson time to assess a second-term decision.

RBNZ Assistant Governor Karen Silk said former Reserve Bank of Australia monetary policy board member (2001-2011) Warwick McKibbin and former Bank of Canada Deputy Governor Larry Schembri (2013-2022) were the overseas experts for the reviews.1

A pointed fiscal policy warning

Elsewhere in the MPS, the Reserve Bank made its most pointed comments yet about the risks of an election-year fiscal blowout that makes its monetary policy job harder. It said it assumed Government spending would stay in line with Budget 2022’s settings.

“Any government expenditure above this is likely to require higher interest rates in response, to enable the domestic economy to rebalance and reach a more sustainable pace of growth.” RBNZ MPS

Elsewhere in the news overnight and this morning

In geo-politics, the global economy, business and markets

Double digits - Data out overnight showed Britain’s annual inflation rate hit a 40-year high of 10.1% in July, up from 9.4% in June and above economists’ expectations. The Bank of England sees annual inflation peaking above 13%. British wholesale interest rates rose sharply in response and British stocks fell.

Tighter for longer - US Federal Reserve officials said in minutes released this morning from their last rate-setting meeting the world’s biggest central bank would have to keep interest rates high “for some time” to get inflation under control. Reuters

Off target - Major US retail chain Target reported weaker-than-expected June quarter profits overnight after it was forced to discount goods to clear its over-stocked warehouses and attract in consumers shocked into ‘demand destruction’ by high inflation in the first half of the year.

Off line - Norsk Hydro closed its Slovalco aluminium smelter in Slovakia overnight because of sky-high electricity prices, adding to the closure by Nyrstar of its zinc smelter at Budel in the Netherlands on Monday night. Aluminium prices rose 1% overnight, which makes it slightly more attractive for Rio Tinto to keep its Tiwai Point smelter open for longer. That would further complicate the electricity industry’s hopes it can use the 13% of Aotearoa-NZ’s electricity supplies currently used by the smelter to transition to nearly-fully renewable electricity production.

Running dry - Toyota and Apple-supplier Foxconn have suspended plant operations in Southwest China because of hydro-power shortages linked to droughts and heatwaves that have emptied the Yangtze River to record lows.

‘Mega-flood’ risk after drought - California also announced power restrictions to cope with its own record drought, just as scientists warned of growing risks of a cataclysmic flood in California at some point due to climate change. Reuters CNN

Never Trump - Republican rebel and ‘Never Trumper’ Liz Cheney said after losing the primary vote for her Congress seat overnight that she was considering running for President to stop Donald Trump returning to the White House in 2024.

Just briefly:

Tensions are building between Jarden NZ and Jarden Australia after a female analyst quit amid harassment allegations, the The Australian-$$$ reports this morning.

In Aotearoa-NZ’s political economy, business and markets

RSE exploitation review - Workplace Relations and Safety Minister Michael Wood told RNZ Checkpoint last night the government would do a full review of the Recognised Seasonal Employer (RSE) scheme early next year. The review comes after Equal Employment Opportunity Commissioner Karanina Sumeo revealed last week some RSE workers brought here from Pacific nations were being exploited, bonded to unreasonable debt and living in very poor conditions.

More than once in century - Hundreds of homes in Westport and Nelson were evacuated overnight after an ‘atmospheric river’ dumped 100s of millimetres of rain on the region, forcing authorities to declare states of emergency to cope with what is seen as a third once-in-100-year flood in a year. 1News

Just briefly:

Fletcher Building reported its annual profit rose 42% to $432m and the pay of its CEO Ross Taylor pay rose 34% to $6.6m after it increased its profit margins and sales. Stuff

The CEO of Te Pūkenga (the new national polytech), Stephen Town has resigned after weeks on special paid leave. He was previously Auckland Council CEO. The formation of the new organisation had alienated staff and was massively over budget. RNZ

A fun thing

Ka kite ano

Bernard

I would pay good money to be a fly on the wall in the room when Warwick McKibbin, who is known to have strong views on monetary policy and risks of allowing inflation to get out of control, debates the bank’s performance with Adrian Orr as the review is done.

Share this post