TL;DR: The newly sworn-in Cabinet will today consider how to quickly unwind anti-smoking changes legislated at the end of last year in order to save hundreds of millions of dollars a year in tobacco taxes so it can go ahead with its income tax cuts.

But the cost to the taxpayers and citizens in purely financial terms, let alone the estimated loss of 580,000 Health Adjusted Life Years (HALYs), is set to surpass $10 billion. For every dollar in tax cuts delivered to landlords and salary earners by pushing tobacco taxes back up, Treasury has estimated health and lost productivity costs of up to 20 dollars.

Finance Minister Nicola Willis has also been named as Social Investment Minister, tasked with targeted investments to reduce the long term costs to taxpayers of welfare, health, education and justice costs. The single biggest and fastest piece of social investment she could do in her first day in office would be to not reverse the smokefree laws. Treasury estimated in 2021 that the changes in smoking laws and regulations designed to slash smoking rates would create $5.25 billion in health savings over time and $5.88 billion in extra income from productivity benefits. Reversing those changes would reimpose those costs.

Paying subscribers can see and hear more detail and analysis in the podcast above and below the paywall threshold here. They are welcome to ask me to open this one up, given it fits the public interest journalism mission of the Kaka, which paying subscribers fund. I’ll open it up once we get over 50 likes.

First, do no harm

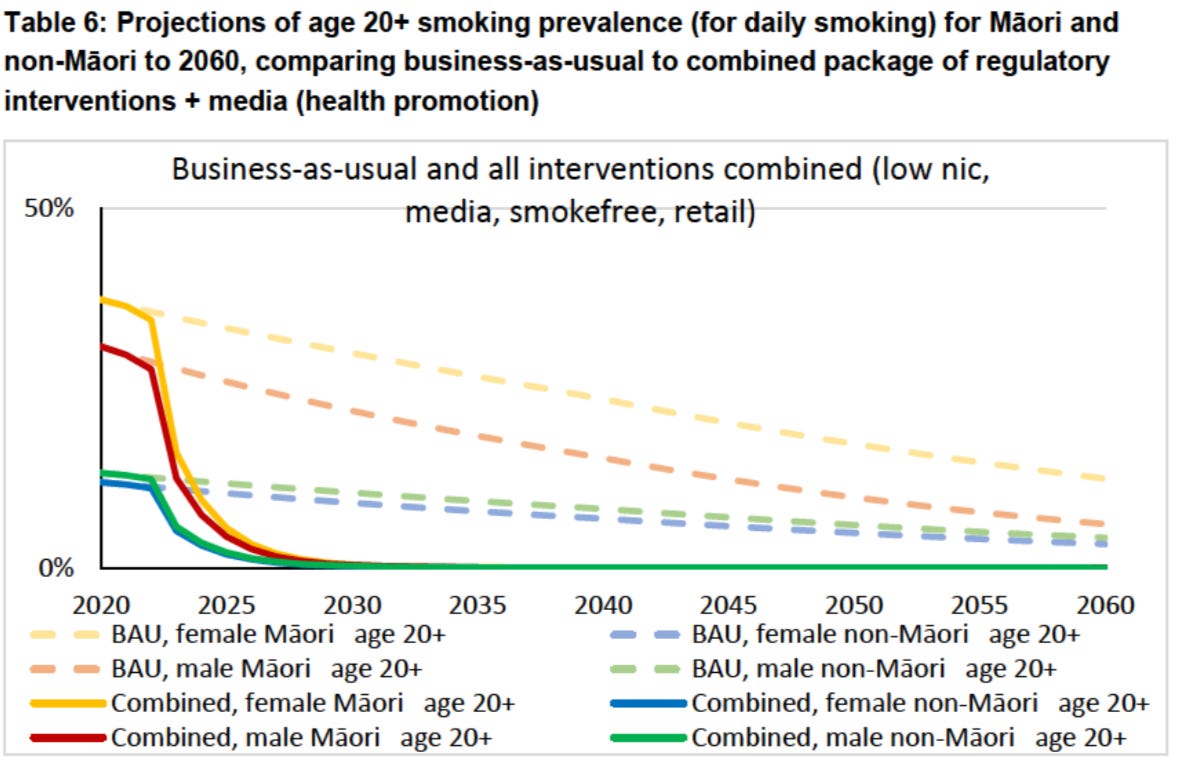

The Smokefree Environments and Regulated Products (Smoked Tobacco) Amendment Act 2022 was passed at the end of last year as a world-leading set of interventions to achieve a target set by the-then National-led Government of being smoke free by 2025. More than a third of young Māori women still smoke and the shift to banning sales for those born in 2009, slashing the number of sales outlets and cutting nicotine levels was forecast to dramatically reduce smoking rates. The details of the changes are detailed by the Ministry of Health here

Treasury estimated in its Regulatory Impact Assessment (RIA) to then-Health Minister Ayesha Verrall that the proposed changes would:

save 580,000 Health Adjusted Life Years (HALYs) using a 3% discount rate and 2.21 million years when not using a discount rate;

Cut public health costs by $5.25 billion when using a 3% discount rate and $15.5 billion without a discount rate; and,

Add $5.88 billion in productivity benefits from 25-65 year olds over time using a 3% discount rate and $16.2 billion without a discount rate.

“While not all impacts can be costed at this time, those that can suggest that the costs will be significantly outweighed by the benefits. The resultant savings in health spending and income gain from increased productivity are estimated to far outstrip the reduced revenue from excise tax.” Treasury in July 2021 RIA

‘An unconscionable blow to the health and wellbeing of all NZers’

National Māori Public Health Organisation, Hāpai Te Hauora, yesterday called on the new Government not to go ahead with the reversal of the changes, saying the reversal was “an unconscionable blow to the health and wellbeing of all New Zealanders.”

“Our communities have spoken out unequivocally against the control that tobacco companies have over their wellbeing and the future of their whānau. This action disregards these community voices in order to raise revenue to pay for tax cuts for Aotearoa’s most wealthy. Rescinding denicotinisation requirements in tobacco and reducing the constraints on retail outlets, seemingly favour economic interests over the lives of whānau. The juxtaposition of these two points underscores a tension within the coalition's priorities, one ostensibly driven by community well-being and the other, regrettably, prioritising industry interests over public health.” Hāpai Te Hauora statement

Quote of the day

Winston wants less te reo on TVNZ, RNZ & says journos took bribes

Asked how quickly he expected government departments or agencies to remove Te Reo, he replied: "Well we will see the speed in which TVNZ and RNZ, which are taxpayer-owned, understand this new message."

When it was put to Peters that they are independent, Peters said he had "never seen evidence" of that over the past three years.

He also incorrectly claimed the Government had bribed the media through the Public Interest Journalism Fund.

"You cannot defend $55 million of bribery. You cannot defend $55 million of bribery. Get it very clear," said Peters. Via Newshub

If I accused the Right Honorable Winston Peters of taking bribes he would sue me. He seems more relaxed about accusations going the other way.

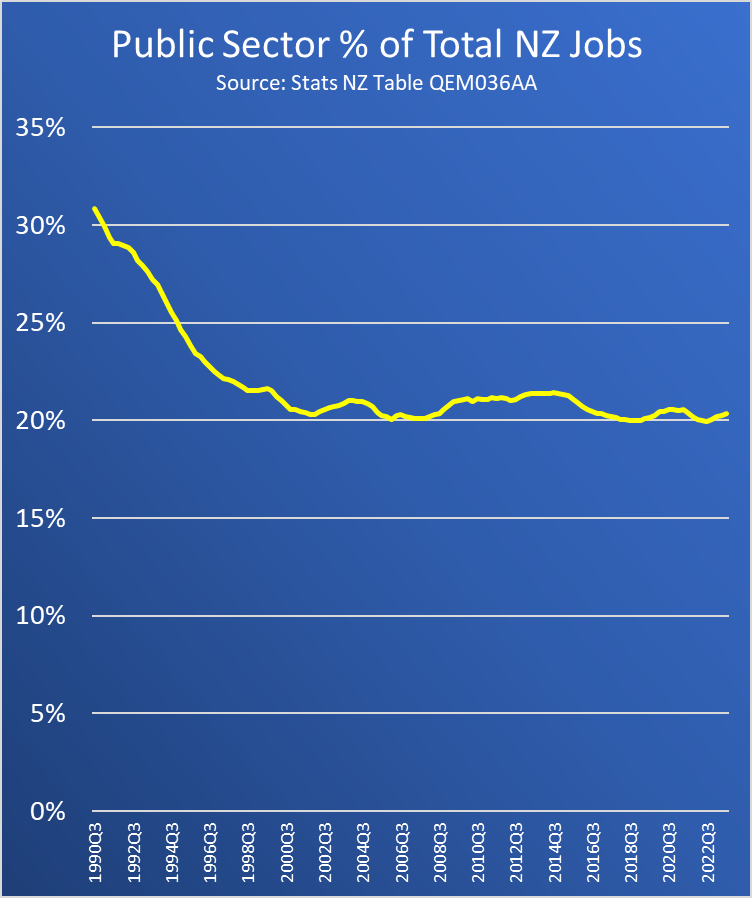

Chart of the day

What an ‘explosion’ of public sector spending actually looks like

Video of the day

Essential analysis and messages from Dr James Hansen

Cartoon of the day

The croc is on the loose now

Nature pic of the day

A happy time of the year

Ka kite and

Bernard

The very opposite of social investment