Govt & RBNZ adding up to $4.75b in firepower for first home buyers to push up house prices

Govt removes limits for state-insured high-LVR mortgages to first home buyers & raises price & income caps for first-home buyers; RBNZ cuts risk weighting for these first home loans too

TL;DR: The Government and the Reserve Bank have tweaked lending rules and risk weightings in ways set to add up to $4.75 billion worth of state-insured loans, taxpayer-funded grants and KiwiSaver fund withdrawals for first home buyers to jump into the housing market this spring, adding to upward pressure on house prices.

Over the last year, the Labour Government has removed limits on Kāinga Ora-insured First Home Loans by banks and increased the price and income caps for First Home Grants. Those moves are set to be supercharged by a Reserve Bank decision yesterday to lower the risk weightings for bank capital calculation purposes for these First Home Loans, which will free up the banks to more than double this type of lending.

The combined effects in the coming years of a potential doubling of taxpayer-funded grants to first home buyers (an extra $500 million), an associated extra $500 million of withdrawals from KiwiSaver schemes and a more-than-doubling of state-insured 80%-plus high LVR bank lending to $6.25 billion (an extra $3.75 billion) would add up to a further $4.75 billion worth of firepower for first home buyers to bid up prices in the coming years. See more on this below.

News elsewhere in the political economy

Net migration more-than-halved to 5,785 in the month of April from 13,176 in March, but annual net migration was 72,300 in the year to April. There was a net migration loss of 10,200 residents to Australia in the year to September 2022, more than treble the rate seen from 2014 to 2019, but a third of the rate seen from 2004 to 2013.

US inflation was in line with forecasts in April at 0.1% for the month, with the measure of core inflation watched by the US Federal Reserve headed quickly to 3% and seen giving the Fed room to pause more rate hikes.

Hopes Auckland Council would be able to identify which cyclone-flooded homes would be red-stickered and eligible for buyouts were dashed yesterday as the Council simply started asking for more information.

Usually, I put in a paywall for paying subscribers at this point in the email newsletter. But I want to experiment until the end of June with publishing everything to everyone immediately to see what happens with subscription rates, revenues and email opening rates. I want to thank paying subscribers in advance, who are still the only ones able to comment and get access to our very active chat section and webinars. Join our community by subscribing in full to support my journalism in the public interest about housing (un)affordability, climate change (in)action and poverty (not enough) reduction.

Government, RBNZ set to add $4.75b of fuel to housing market

Government policy changes over the last year are set to pump as much as $4.75 billion worth of demand into the housing market by first home buyers, including up to another $500 million worth of taxpayer-funded grants, an extra $500 billion worth of KiwiSaver funds withdrawn to become home deposits and an extra $3.75 billion worth of taxpayer-guaranteed loans by banks.

Budget 2022 included the removal of borrowing limits for the Kāinga Ora-insured First Home Loan scheme and an extra allocation for a further 2,500 First Home Loans per year. Then in Budget 2022 the insurance premiums for the loans were halved to 0.5%, adding up to another $3,000 to first home buyer deposits, and the Government increased the house price cap for grant recipients in the most in-demand areas from $500,000 to $650,000. It also removed the house price altogether for First Home Loan recipients.

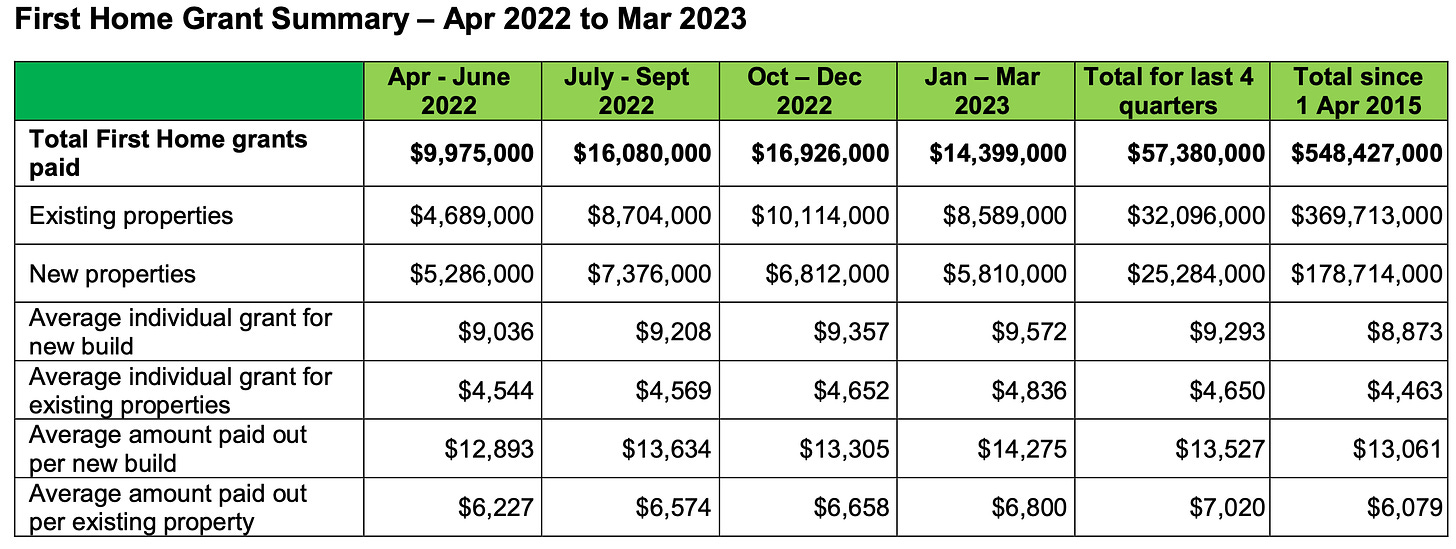

There have been over $548 million in grants paid to first home buyers since the scheme was ramped up in 2015 under the previous National Government. Over $57 million worth of grants were given last year to first home buyers, who are eligible with a maximum combined income of $150,000 per year. Use of the scheme has ramped up over the last year as first home buyers have returned to the market, Kāinga Ora’s last report for the March 2023 quarter showed.

CoreLogic’s latest First Home Buyer report shows a bounce in the share of homes going to first home buyers over the last year.

Here comes the turbo-boost from the banks

Te Pūtea Matua (The Reserve Bank) yesterday published its final preferred risk weightings for high LVR bank loans to first home buyers that are underwritten with Lenders Mortgage Insurance (LMI) by Kāinga Ora. They’re known as First Home Loans and Kainga Ora said in a recent OIA response it had underwritten $2.437 billion worth of the loans as of June 30.

The regulator decided to assign a 20% risk weighting for the loans, down from 50% currently and its initial preference for a 35% weighting because it agreed with bank submissions the lower weighting better reflected the risk of failure. The new weighting is also riskier than the 35% used by APRA, the regulator in Australia.

The bank also decided to apply the 20% risk weighting to Kāinga Whenua loans underwritten by Kāinga Ora and to reduce the risk weighting for reverse mortgages with LVRs of less than 30% to 30% from 50% previously. This is less conservative than APRA’s 50% currently, although the Reserve Bank includes a 20% repricing discount for the loan when it is written, whereas APRA does not.

Long story short: The Reserve Bank has relaxed requirements in a way that could allow banks to lend an extra $3.75 billion to first home buyers with a taxpayer-funded guarantee, along with another $1 billion worth of taxpayer-funded KiwiSaver grants for first home buyers to go with those loans and withdrawals from KiwiSaver funds. It represents a collective decision, albeit accidentally on purpose, to pump up to an extra $4.75 billion in leveraged cash into housing market valuations over time.

The Reserve Bank said it wasn’t worried about any effect on house prices in the long run, and wouldn’t worry much about it anyway in this decision.

The decisions in this paper are not expected to have a significant impact on sustainable house prices. This component has been given a low weighting for

consideration in our analysis. RBNZ report (Page 31)

Here is the full risk weightings decision Regulatory Impact Assessment report.

Reserve Bank loosens its approach after bank submissions

The Reserve Bank noted in its report it had decided to loosen its settings after submissions by banks and acknowledged they were now looser than those adopted by Australia’s banking regulator, APRA.

The preferred options above are a significant departure from the September 2022 Consultation proposals. In that paper, we stated that applying a 20% risk weight to RML loans would be unprecedentedly low within the banking prudential requirements. This remains true.

However, our key focus for risk-weights is on assessing the actual credit risk to the lender, and we have not identified any strong reasons to deviate from setting the exposure equal to the risk- weight associated with Kāinga Ora. Given their existing current credit rating this would be 20%.

Therefore, the Reserve Bank have decided to set the risk-weight at 20% for loans underwritten by Kāinga Ora; this treatment includes the Kāinga Whenua product. RBNZ Regulatory Impact Assessment report.

Perhaps ironically, one reason for the looser approach was the Government’s decision last year to pull Kāinga Ora’s borrowing programme fully in-house and into the usual pool of vanilla Government borrowing, rather than through its own bonds, but with an effective Government guarantee.

We considered whether or not to tie this risk weight to treatment to Kāinga Ora’s credit rating. However, last year the Government announced that future funding requirements for Kāinga Ora will be met by New Zealand Debt Management, rather than private markets.6 As a result, it is possible that Kāinga Ora may not obtain credit ratings at some point in the future. To manage this risk we have decided that it is prudent to set the risk weight at 20%, but we will reconsider this periodically if needed.

While 20% is low within our standardised framework, it is not unprecedented internationally. Additionally, in the IRB modelling framework, risk-weight outcomes below those in the standardised approach are possible for some residential mortgage loans.

In addition, while a 20% risk-weight would appear low compared with APRA’s 35% risk-weight for similar products, the guarantee against losses in the Australian programme only covers losses of up to 15% of the property’s value7. There is no such limit in the Kāinga Ora LMI product. RBNZ Regulatory Impact Assessment report.

Various studies, including in Australia, have shown first home buyer subsidies simply push up house prices for all homes, which makes them a perfect type of middle class welfare. Government grants go mostly to those with extra help from parents, high incomes and the ability to save deposits. Once applied, the higher house prices also benefit those with homes.

Notable news elsewhere

Our housing and poverty crises laid bare by FENZ

Phil Pennington has a deep-dive piece at RNZ into fire safety problems in temporary housing in the Bay of Plenty, with motels in Rotorua and Taupo a particular problem, according to Fire and Emergency checks. A taste:

The high-risk examples in Rotorua and Taupō came to light during RNZ inquiries, spurred by the fatal Loafers Lodge fire in May, into the safety risks at housing for vulnerable people.

At an emergency housing motel in Taupō that fire ripped through last year, a smoke stop door and smoke alarms were missing. Firefighters said it was "pure luck" someone was not badly hurt or killed at Berkenhoff Lodge in the midnight blaze last November.

Three months later, surprise inspections at three other emergency housing providers in Taupō found missing or dodgy smoke stop doors, fire alarms and evacuation signs.

Earlier this month, a FENZ manager in Bay of Plenty said in an email: "It was only a matter of time until someone died in a fire at one of these providers." Phil Pennington via RNZ

Oops, he did it again

Christopher Luxon’s political antennae just aren’t as carefully calibrated as those of his mentor John Key…exhibit 63…here’s Thomas Coughlan’s scoop in the NZ Herald overnight that Luxon initially ordered a taxpayer-funded Tesla for his own use, but withdrew it after colleagues warned him it was a bad look.

The Herald understands Luxon was talked out of ordering the car by horrified staff and at least one senior MP, who believed the purchase would be a massive political risk.

The order was placed last year, shortly before Luxon lashed out at the Government for its clean car discount policy, telling Newshub’s AM Show Labour was taxing people driving utes to help “wealthy Tesla drivers by giving them subsidies”. The Government’s clean car discount, under last year’s settings, took more than $8000 off the price of a Tesla.

The Leader of the Opposition is entitled to a little-known Parliamentary perk - a “self-drive” car, which is bought by Parliamentary Service for the leader’s use - it is fully owned, however, by Parliamentary Service. Thomas Coughlan via the NZ Herald

The Ministry of Fonterra Affairs and Trade

Olivia Wannan reported for Stuff yesterday New Zealand pledged to spend $375 million reducing greenhouse emissions and protecting communities in vulnerable countries, but official documents showed some of that cash promoted planet-heating dairy and meat farming.

The Ministry of Foreign Affairs and Trade funded projects to establish dairy farming in Fiji and Myanmar. Between 2015 and 2020, it also funded work to intensify meat or milk production in Laos, Sri Lanka and Uruguay.

The ministry included these projects in a list of New Zealand’s climate finance initiatives submitted to the UN. Olivia Wannan for Stuff

Only a small budget black hole

Guyon Espiner reported for RNZ yesterday that Waikato University, that is about to sack 11 staff to save money, has paid nearly $1 million to an advisory firm run by former Tertiary Education Minister Steven Joyce for promoting the university and the benefits of enrolments to students and businesses.

Vice Chancellor Neil Quigley (who has also been the chair of the Reserve Bank board since 2016 and his term expires in mid-2024) said Joyce was contracted in 2019, initially to lead a "new brand campaign and strategy for student recruitment".

Quigley said Joyce's work1 had shifted in focus from "programme and course advice for individuals to selling the wider university story" to key audiences. Guyon Espiner reported for RNZ

Ka kite ano

Bernard

PS: I couldn’t resist including this…

One fun thing

Quigley has been the chair of the Reserve Bank board since 2016 and his term expires in mid-2024.

Must admit if I was a first time buyer I would prefer lower prices rather than help to pay an inflated price and even more to a bank.

Wonderful Bernard - huge congratulations to you both and here's to many more years of companionship, fun and serious journalism 🥂