Finally, Govt turns to borrowing to try to solve our infrastructure deficit

After years of trying to avoid borrowing with Crown or council guarantees to keep pristine credit ratings, the Govt will quietly allow 500% debt-to-revenue for still-on-balance-sheet water entities

TL;DR: My top six things to note around housing, climate and poverty in Aotearoa’s political economy on Friday, August 9 are:

1. It wasn’t that hard was it?

Govt gives up on fantasy of off-balance-sheet water without guarantees

Local Government, Transport and Energy Minister Simeon Brown, Commerce Minister Andrew Bayly and Local Government Funding Agency (LGFA) Chair Craig Stobo yesterday announced the key details of the National-ACT-NZ First Coalition Government’s replacement for Labour’s Three Waters, including the all-important options for councils to structure their water assets and pay for new infrastructure and to maintain existing infrastructure with borrowed money backed by a Crown guarantee.

The key details from the ministerial announcement, LGFA’s announcement and the various Department of Internal Affairs (DIA) factsheets and cabinet papers are:

LGFA has agreed to lend up to five times (500%)1 of councils’ water asset revenues immediately to help them build and maintain new and existing drinking water infrastructure, but only if the councils guarantee that debt and agree to prudent credit criteria;

LGFA will treat borrowing for water by councils as separate from other borrowing by those councils;

LGFA will look to increase its borrowing limit for non-water Council debt from the current 285% to as much as 350%;

LGFA will allow councils to keep these water assets within their existing balance sheet structures, as long as there’s clear reporting and prudent credit criteria can be met;

LGFA will allow councils to group their water assets together for borrowing purposes;

The Government, which currently owns 20% of LGFA and provides a $1.5 billion lending backstop, will look at increasing that ‘backstop’ and keep guaranteeing LGFA’s borrowing on behalf of councils;

The Government will allow councils to carve stormwater out of their ‘Three Waters’ operations and contract them out;

The drinking and waste water systems and charges will be regulated by Taumata Arowai; and,

Small water systems serving 25 or fewer consumers won’t be regulated.

So what really matters in those things?

In my view, the key thing is that the Government and LGFA are not insisting on full balance sheet separation and are no longer trying to avoid giving a Crown guarantee or council guarantees on these water assets.

Here’s the ‘money’ quote in LGFA’s release (bolding mine):

The Crown has confirmed the existing support it provides to LGFA, and as part of the review will consider whether that support will remain appropriately sized2 given the growth in LGFA’s balance sheet. LGFA.

Within that, LGFA has agreed to lend to councils without the need for ‘balance sheet separation,’ but only if councils guarantee the debt (bolding mine):

LGFA will extend its existing lending to council-controlled organisations (CCOs) to new water organisations that are CCOs and are financially supported by their parent council or councils.

So why is it important that the guarantees are staying and the off-balance-sheet thing is a deal breaker?

Both Labour and initially Simeon Brown did not want to guarantee this new borrowing in a way that would mean ‘taxpayers’ would end up ‘bailing out’ these new entities. They feared the borrowing for water might add up in the long run to a loss of control of Government debt and an eventual downgrade in Aotearoa’s sovereign credit rating. This fear of a downgrade and the resulting (small) increase in mortgage rates seems to be the ultimate force in Aotearoa’s political and economic universe.

Brown was quoted by Newsroom in February as wanting to keep the council debt well beyond the Crown’s arms length to avoid ‘bailouts’. Here’s the quote again (bolding mine)

So is he seeking a solution where neither councils nor the Government find themselves in hock for a bailout?

“Absolutely. The reality is, this is about ensuring we have financially sustainable and financially independent entities. And we want to ensure that councils have ownership of those assets, and that they put forward financially sustainable models.”

What does “financially independent and sustainable” entail? To Brown, it means neither the councils nor the Government would be called on to inject additional funds, or bail out a water provider if it’s failing to deliver.

Could the Government legislate to say that councils may not provide a financial backstop (that is, financing or grants or bailouts) for water providers? “That’s the direction we’re going in,” Brown says.

Both the suggestion of truly independent water assets and no bailouts or Government guarantee are now gone, and thank goodness, in my view.

It’s not a surprise. The ratings agencies would have given the ‘off-balance-sheet’ water entities pitifully low ratings with very expensive borrowing costs without the guarantees, which would have destroyed the main reason for the contortions in the first place: low borrowing costs.

One reason Labour, National and the councils flirted desperately and pointlessly for so long with full separation was they wanted to avoid the ratings agencies grouping the new water debts with existing Crown and council debts, potentially lowering credit ratings for councils at least, and only slightly possibly the Crown itself.3

Long story short? Officials and the new Government have finally given up on the idea that both the Government as the Crown and Councils could somehow carve off the water assets into independent ‘off-balance-sheet’ entities that could borrow in their own right without the need for either Crown or Council guarantees. Labour was thinking just as magically as National on this issue, proposing fully ‘carved off’ water entities that could charge for water and not need Crown bailouts, and not risk any sovereign or council downgrades. See more on that magical thinking from my piece in February.

So could ratings agencies downgrade councils or the sovereign?

Yes, and the world wouldn’t end. Mortgages might be a few basis points higher and council and government borrowing costs might be a few million higher with the worst case of both council and sovereign downgrades, but nothing life-threatening or unsustainable. It would just be politically uncomfortable and hurt the median-voting-suburban homeowners a tiny bit with marginally higher mortgage rates and council rates. It would make houses a bit cheaper.

LGFA and the ministers actually think they might be able to get away with no credit rating downgrades at all for the councils, and probably not for LGFA either, with no one talking anymore about a downgrade for the sovereign, which used to be the bogeyman powering the Three Waters obsession with balance sheet separation.

Stobo, for example, was also realistic that if councils were downgraded the world would not end, and LGFA wouldn’t punish the councils.

"Banks might have a different view but, you know, a credit rating change from AA to AA- is not going to substantially change our view of the credit worthiness of a council." Stobo via RNZ

We don’t know yet what the ratings agencies think, but it’s unlikely the sovereign rating is at risk. I’d also be surprised if there are widespread and massive council downgrades, and even if there was, the extra borrowing costs wouldn’t be life threatening.

Update: S&P replied to my queries with an emailed response below from analyst Martin Foo, including the following comments (bolding mine):

“The credit implications for councils may be mixed. If newly-formed water CCOs are highly leveraged (with the ability to borrow up to 500% of operating revenues) and retain some sort of financial support or backstop from parent councils, they could drag on the credit profiles of those parent councils. This will be true even if the CCOs are deconsolidated from council balance sheets in an accounting sense. On the other hand, the economic regulation regime could ensure that water charges generate more revenue than could be achieved under the status quo, where water delivery is controlled by councils and their elected councillors.

“We understand the government and LGFA are exploring whether debt limits for high-growth councils can be increased to up to 350% of revenues (from 285%). This will generally be negative for credit quality, as it will give councils that are already highly leveraged by international standards even more headroom to borrow. It may precipitate some council downgrades and further weigh on our “institutional framework assessment” for the council sector, which we already consider to be weakening. We note that LGFA’s leverage-related financial covenant limits were already lifted in 2020, to give councils buffer to deal with the COVID-19 pandemic.

“The implications for LGFA’s own credit quality are also uncertain at present. LGFA’s strong credit rating (AA+ foreign currency, AAA local currency) derives support from its high-quality loan book and wide base of council guarantors. LGFA’s loan asset quality might diminish if it lends to water CCOs that are much more highly indebted than councils and which lack the secure taxation power of councils. Again, the nature of linkages between councils and water CCOs matters. Closer linkages imply potentially stronger credit quality for water CCOs, while looser linkages (as suggested by the announcement that LGFA lending to water council-controlled organisations which are not supported by their parent councils is also being explored”) imply potentially weaker credit quality.

“The recent increase in LGFA’s borrower loan margins and borrower note subscription rates may help to gradually boost its capital ratio over time. Its recent forays into the Australian dollar market may also help to diversify funding sources.” S&P Analyst Martin Foo

My reading of those comments is that council downgrades are more likely than suggested by the ministers and LGFA, and that the Government may have to contribute more capital to LGFA to keep its own rating pristine. But the odd notch or two downgrade for councils is not the end of the world. The extra borrowing costs are minimal.

2. So what was all that about then? Wasting time.

The Crown should have gone straight to guaranteed borrowing

In my view, we’ve just wasted four years going down the dead-end of trying to make the magical thinking work of having off-balance-sheet vehicles, cheap borrowing costs and no credit ratings downgrades.

It is entirely right and good that these sorts of assets are paid for with long-run bonds at sovereign interest rates, with the debt serviced by water charges. It’s where we ended up anyway.

In my view, all the sturm und drang about iwi involvement and Te Mana o te Wai was a red herring. It wouldn’t have changed the way the entities were managed financially and it was not some sort of secret asset grab. The then-Opposition parties simply jumped on it as a racist dogwhistle that worked perfectly in the sort of meme-ified and culture-war-driven politics that the coalition chose, egged on by their social media advisors Topham Guerin. It worked because these sorts of campaigns trigger a fundamentally racist streak in a big-enough chunk of the median voting block to change enough votes, at least to ACT and NZ First, if not National.

Regardless, I was never comfortable with Three Waters or a fan because of all the balance sheet subterfuge to try to achieve the impossible. It was always going to waste time and risk being distracted and pulled apart, which is what happened.

We all just lost at least four years and we still haven’t debated or agreed on the essential issues: our population has grown and is growing way too fast for the infrastructure investment possible with a Government + Council share of GDP at or below GDP. Either we increase taxes outright or create new ‘taxes’ in the form of water and congestion charging, or we act to stop the very fast population growth.

The settlement reached here and now is effectively a decision to create new ‘taxes’ in the form of water charges at least, although ratepayers still haven’t been told or understood that properly yet. Someone will have to tell them.4

3. Solutions: Let’s get borrowing, charging & building

Now it’s up to the councils to have a chat with ratepayers and get permission for the higher debt, rates and water charges, or at least ask for forgiveness after the fact. The Government could do councils a solid by backing them up and not blaming them.

After all, the Government has just avoided doing the actual borrowing themselves and claiming responsibility for the higher charges.

4. Quote of the day

Shane Jones tells us what he really thinks of the Electricity Authority

“There's nothing to stop the Crown from codifying a new set of rules, a new set of expectations under the EA. Sadly that agency has proven to be a chocolate teapot in regulating the excess behaviour of the gentailers who I feel are probably the most powerful economic institutions in New Zealand beyond the supermarkets and the Aussie banks.” Associate Energy Minister Shane Jones talking yesterday on RNZ’s Morning Report.

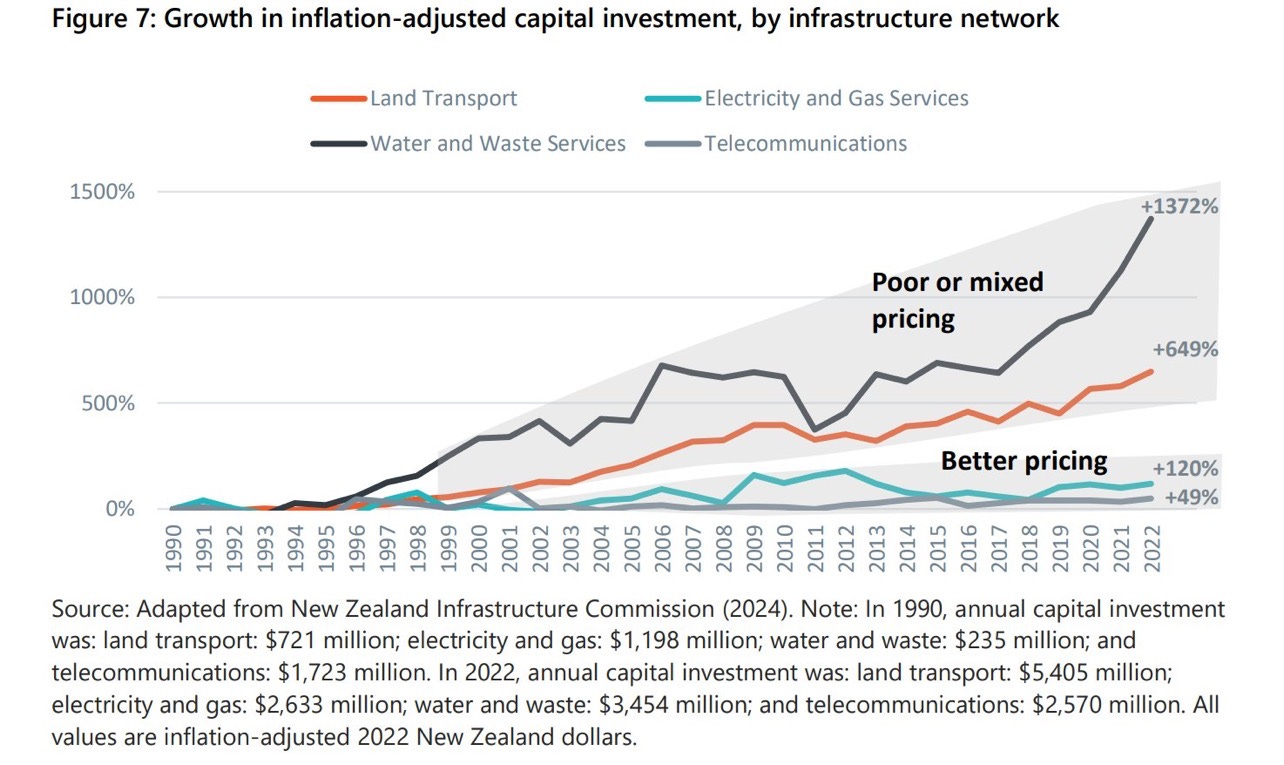

5. Chart du jour

How demand management works

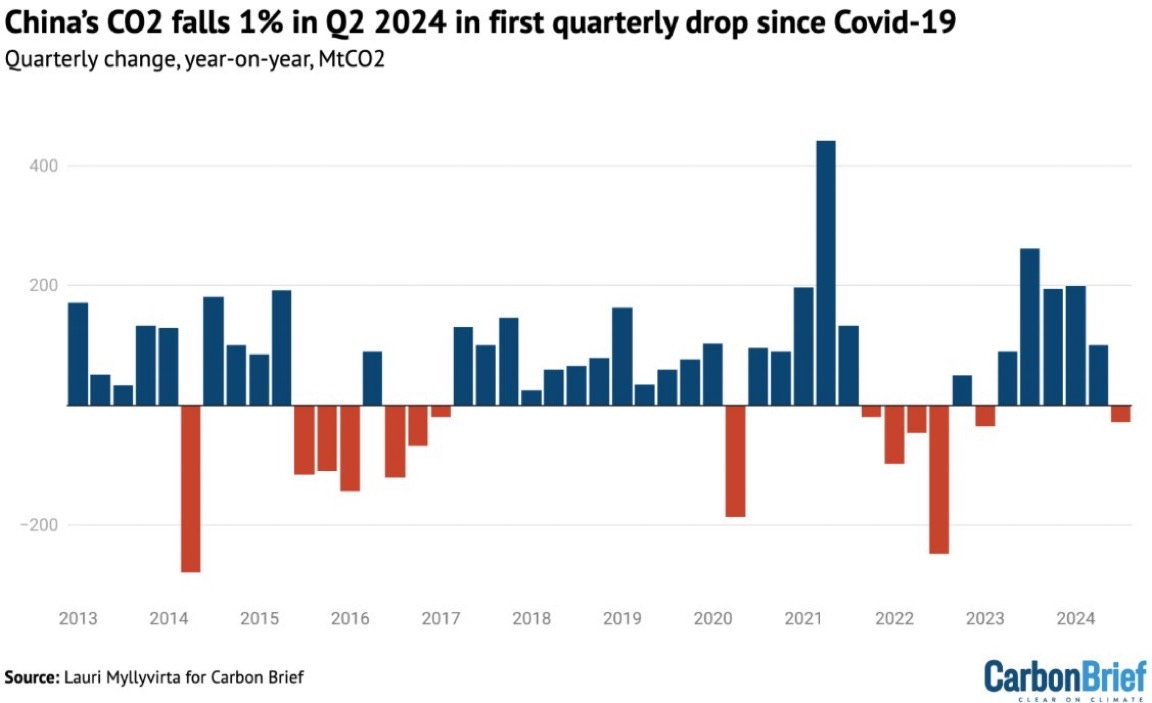

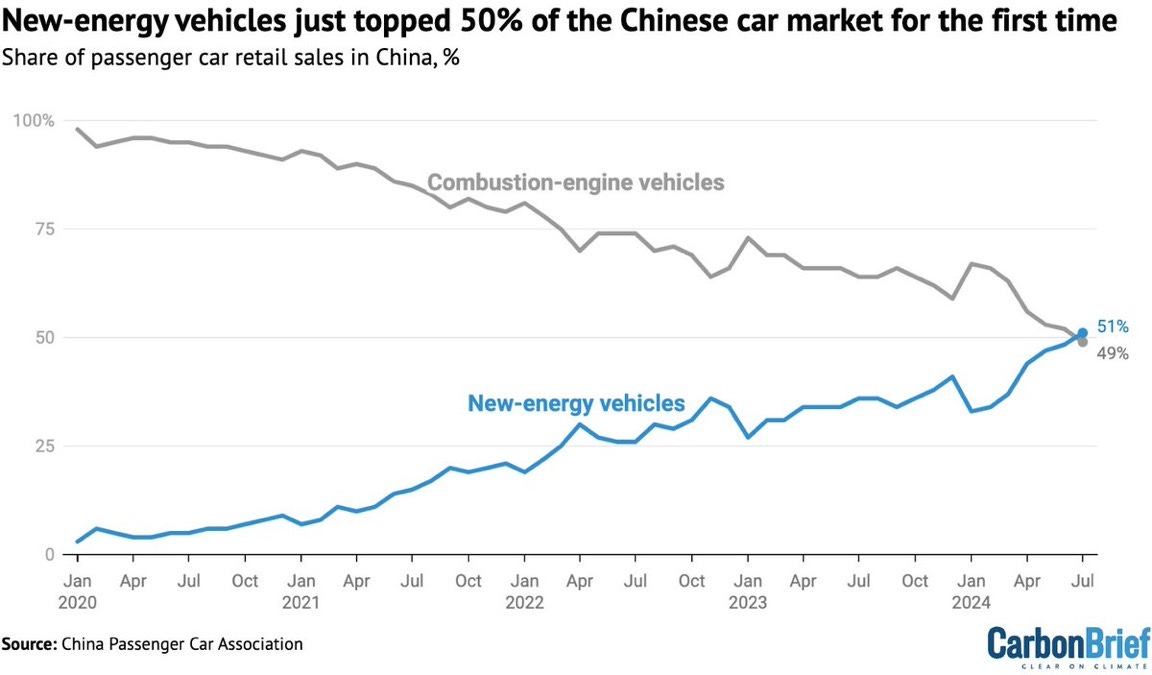

6. Climate charts of the day

An amazing and welcome milestone in China’s energy transition

Which is no doubt a factor in China’s emissions falling in the June quarter

The best of the rest

Top Six Scoops & Breaking news elsewhere on August 9

Housing Scoop: Nicola Willis open to making RBNZ ease bank capital rules NZ Herald’s Jenee Tibshraeny

Electricity Scoop: Prime Energy ‘working through’ Manawa payment default Newsroom’s Jonathan Milne

Electricity Scoop: Pan Pac shutters operations due to high energy prices BusinessDesk-$$$’s Ian Llewellyn

Housing Scoop: More than 50% of NZ schools to implement enrolment zones RNZ’s John Gerritsen

Transport Scoop: Wayne Brown's plan to 'dethrone' Auckland Transport in major CCO shake-up NZ Herald’s Bernard Orsman

Health Scoop: Outsourcing could meet demand: HNZ ODT-$$$

Top six deep-dives & analyses elsewhere on August 9

Health Deep Dive 'Thoughtless cost-cutting': 100 patients' care put in doubt by Health NZ plan RNZ’s Ruth Hill

Poverty Deep Dive: 'It’s really tough for our whānau': Schools requesting charity aid as cost-of-living bites Northern Advocate’s Brodie Stone

Climate Analysis: Companies likely to follow Air NZ in dropping climate targets - experts RNZ’s Emma Rickets

Health Research: Part-time GPs working full-time hours to get through workload, study finds RNZ’s Kate Green

Housing Deep Dive Are 1576 new homes heading to the scrap heap? Full list of developments on hold at KO One Roof’s Nikki Preston

Poverty Deep Dive: “No in-between stage’ the financial pitfalls of a single mother returning to work. A mother-of-three made headlines after discovering she was only $4.80 better off from working a part-time job. Now she has the numbers explaining her predicament. Stuff’s Hamish McNeilly

Top Six Solutions News, Op-Eds & Research on August 9

Solutions News: Eight million and still counting - tree replanting programme celebrates success RNZ

Solutions News: Concerned residents have taken it upon themselves to find solutions for Lake Camp, saying local authorities are simply caught up in bureaucratic red tape. 1News LDR’s Jonathan Leask

Solutions News: Gisborne Mayor wants a law change to revitalise derelict buildings 1News

Solutions Op-Ed: A tool not a panacea: telehealth is overhyped as a solution to New Zealand’s rural health-care crisis, says Kyle Eggleton, University of Auckland The Conversation

Op-Ed by Ernie Newman: Time to tighten NZ competition law amid Foodstuffs merger debate NZ Herald

Solutions Op-Ed: Most high-income countries ban direct advertising of prescription drugs – why does NZ still allow it? David Menkes, University of Auckland, Barbara Mintzes, University of Sydney, and Joel Lexchin, York University, Canada The Conversation

Op-Eds & columns elsewhere on August 9

Op-Ed by Keith Scott: Whither the Windle as the state builds houses ODT

Op-Ed by Synteche Collins: NZ’s battle with human trafficking: time for a change via Transparency International

Op-Ed by Ray Deacon: A lifeline for New Zealand’s failing infrastructure The Press-$$$

Op-Ed by Michell McCormick: New water plan adds the critical missing piece of the puzzle. Continuing to avoid this investment in our water infrastructure would simply have been irresponsible.The Press-$$$

Housing Interview: How NZ went from home-owning leader to housing crisis Charles Waldegrave on RNZ Nights

Op-Ed by Dr Michael Johnston Hey, innumerate teacher, leave them kids alone! Newsroom

Top Six Journal of Record items on August 9

Infrastructure: Local Government Minister Simeon Brown & Commerce and Consumer Affairs Minister Andrew Bayly announced a new water service delivery plan to allow council-controlled organisations to borrow up to 500% of their operating revenues from the Local Government Funding Agency. Legislation is expected to be introduced to Parliament in December 2024.

Construction: Building and Construction Minister Chris Penk announced a new amendment bill to extend the remediation deadline for earthquake-prone buildings by four years. Meanwhile, the Government is undertaking a full review of the earthquake-prone building system, which Penk said "lacks clarity".

Poverty: Children’s Minister Karen Chhour instructed Oranga Tamariki to begin giving quarterly reports on various key performance indicators. Indicators include frequency of visits to children in care, timeliness in responding to reports about children, how well complaints are handled, and youth offending. RNZ

Economy: The Reserve Bank's latest Survey of Expectations found annual inflation expectations were lower for all time horizons, while unemployment was expected to increase over the next two years. News: Interest

Business: The Commerce Commission announced Foodstuffs North Island has been penalised $3.25 million by the Wellington High Court for using land covenants to block competitors from opening supermarkets in Newtown, Petone, and Tamatea. RNZ, 1News

Infrastructure: Wellington Water announced the resignation of its Chief Executive Tonia Haskell following last month's release of an independent report criticising the organisation's transparency and culture. RNZ, The Post

And finally, some fun things

Cartoon of the day

KISS

Timeline-cleansing nature pic

Honey in waiting

Mā te wa

Bernard

That compares with the 285% borrowing limit that LGFA currently imposes on the high-growth councils, including the likes of Auckland, Wellington, Christchurch, Tauranga and Hamilton.

It’s certainly not going to be ‘appropriately sized’ smaller. So what will actually happen? The Government is going to increase the size of its guarantee for the lending linked to council-owned water assets.

The Voldemort of our political economy.

Hey ratepayers. Local Water Done Well means higher volumetric water charges if you have them (Auckland, Tauranga, Kapiti) and new water charges if you don’t (Wellington, Christchurch & Dundin). It might also mean slightly higher rates because of higher debt and lower credit ratings. Ok with that? I am. You should be too. But it’s a pity the Government and Councils didn’t mention this.

Electricity News: Gentailers That Were Set Up To Make Profits Surprised To Be Accused Of Profiteering

So no new taxes then, just translates to new charges for water. Also in the news, higher power prices are on the way due to the rort that is the NZ electricity market and the best that the smirking twerp (aka Minister of Energy) can do is witter on about building expensive and unnecessary LNG import terminals. FFS, I need to have a lie down to deal with the bullshit let alone the cost of living.