TLDR & TLDL: The Reserve Bank surprised markets with a more hawkish tilt to its interest rate forecasts than most expected, but Governor Adrian Orr also cautioned traders who had just pushed the currency and wholesale interest rates up yesterday afternoon that the bank’s projections were no sure thing.

“We are talking about the second half of next year. Who knows where we will be by then,” Orr told the bank’s May Monetary Policy Statement news conference. Earlier, the bank released projections it would start increasing the Official Cash Rate in mid-2022 and raise it to around 1.75% over the following two years. That would make New Zealand’s central bank one of the first in the developed world to hike rates since the Covid crisis.

Economists said the steepness of the forecast rise was more than expected and they also noted the removal of the language seen in previous monetary policy committee decisions around the potential for negative interest rates and or the possible need for more easing. The NZ$ rose around 0.8 USc to a three-month high of 73.2 USc late yesterday, although it is around 72.8 USc this morning. Longer term wholesale interest rates rose around eight basis points.

But will the Reserve Bank actually be able to deliver those hikes? There have been plenty of false starts before and those who fixed their mortgages for five or more years in expectations of a very fast and big rise in interest rates have been burnt.

In my view, the Reserve Bank was right yesterday to caution about the temporary nature of the inflation spike going through over the next year as supply chains normalise and the global economy has a burst of post-Covid recovery - because the basic and deep structural headwinds for inflation are still there in spades. The appification of the services sectors of most economies has only just started, and the wage-hiking power of workers remains weak as employers keep contracting out, importing lower wages and union densities remain very low.

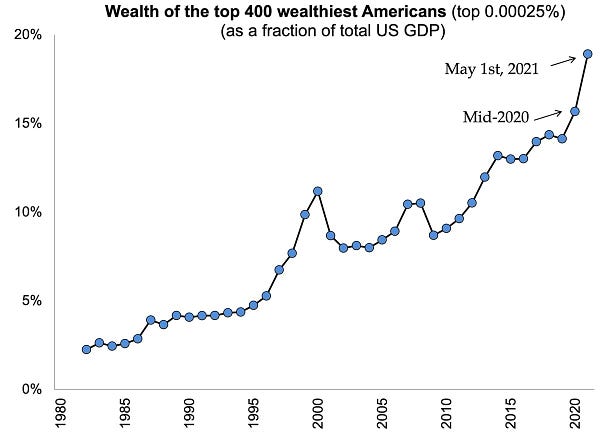

Many inflationistas argue ‘this time is different’ and that the US$10t of fresh cash printed to buy bonds from banks and pension funds will eventually start circulating among real investors and consumers, boosting real prices. That remains an open question and the history over the last 20 years is dominating by a slowing circulation of the global money supply and risk-averse and older investors stash away ever-more cash and wealth in unproductive bank accounts and stores of value, rather than in productive assets or in spending. The first priority of the very, very rich is always to preserve wealth, and the scale of the wealth now concentrated among the wealthiest is impossible to spend quickly or widely. It does mean, however, that art dealers, vintage car sales people and crypto-currency speculators are seeing plenty of asset price inflation.

RBNZ view on asset prices?

Here, the Reserve Bank now sees house price inflation dropping back towards zero in the next year or two. Of interest to house price observers is the Reserve Bank’s view on house price sustainability, which is as opaque and unfathomable as the Government’s.

Its headline (page 29) in a special section in the MPS on house price sustainability “Structural factors explain high house prices in New Zealand,” suggested the bank thought they were sustainable, if only for all the wrong reasons.

Here’s the key section in the MPS in full:

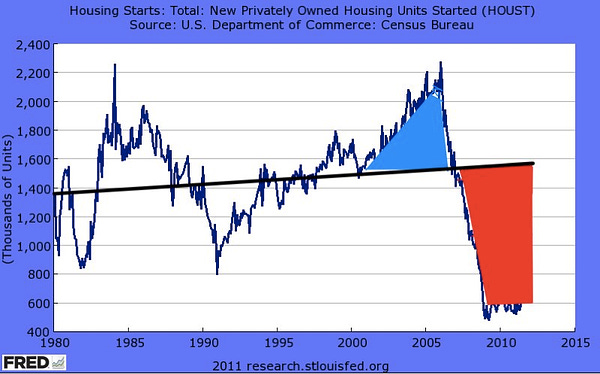

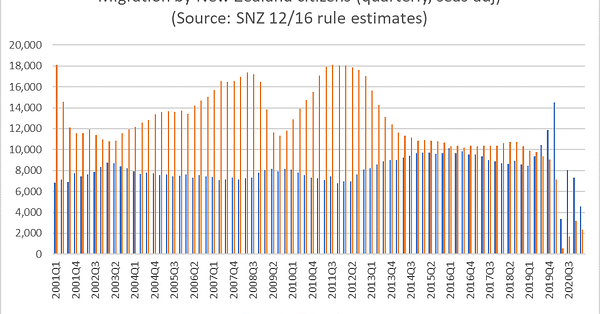

The level of house prices that can be justified by fundamental demand

and supply factors has increased over the past few years. The population has grown significantly while the supply of new homes has not grown

fast enough to meet demand. Interest rates have also been reduced to historically low levels. The current level of house prices can be explained by these factors, and could be considered sustainable if these factors persist into the future.However, it is becoming increasingly clear that some of these factors may be reversing and are unlikely to support sustained growth in house prices. Net migration has been low for over a year (figure 4.5) and we do not expect it to return to pre-COVID-19 levels in our projection, even as border restrictions are eased. High levels of building have been rapidly adding

to supply, and this is likely to be supported in the future by recent policy changes that allow for more urban development. While monetary policy will remain accommodative for some time, interest rates will eventually increase as the need for low interest rates lessens. Additionally, recent tax changes proposed by the Government are likely to reduce the prices investors are willing to pay for houses and will cause some to sell. The Reserve Bank has also reintroduced loan-to-value restrictions (LVRs) to limit higher-risk lending, particularly to investors.

As the long-run determinants of house price growth wane, behavioural factors that have accentuated house price growth, such as ‘fear of missing out’, may also diminish. Consequently, there is a risk that house prices will fall from their current levels.

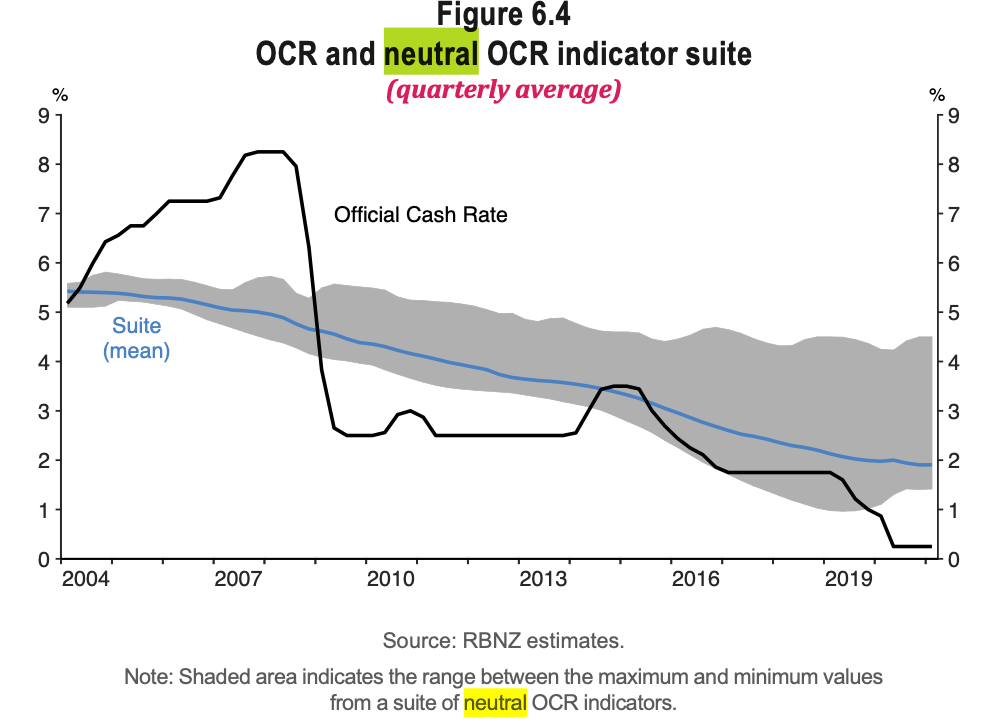

So what is ‘neutral’ now?

The problem with that view is that the Reserve Bank has been talking about future house price rises being constrained by higher interest rates for nearly 20 years. Almost every Monetary Policy Statement has forecast a reversion in the OCR to ‘neutral’ levels, all the while reducing that neutral estimate from around 5% to around 2%. Who’s to say it does not keep falling towards where the OCR is now?

The Reserve Bank has cried wolf so many times that people have stopped believing that interest rates will rise quickly back towards those ‘normal’ levels. We all remember Alan Bollard and Graeme Wheeler wagging their fingers at home buyers and saying a return to ‘normal’ interest rates was imminent and that home buyers should avoid diving in to pump up asset prices with the expectation of low interest rates forever. The trouble is more than 10 years feels a lot like forever, and those who didn’t believe interest rates would bounce back sharply have been the winners with massive, leveraged and tax-free capital gains. And every time house prices rise, politicians and the central bank re-forecast house prices as flat from that new high level. Except prices rise yet again when the forecasts of rising interest rates turn out to be wrong.

Rev it hard to blow out the cobwebs

In my view, the Reserve Bank should be adopting the ‘average’ inflation targeting approach now being used by the US Federal Reserve and the Reserve Bank of Australia, which say they want inflation to run ‘hot’ and above their 2% midpoint target for some time to offset the decade of inflation below 2% seen since the GFC. The Fed and the RBA want to see the ‘whites of the eyes’ of inflation before they pull their triggers. That means they have been reluctant to project rate hikes yet and have been comfortable allowing their economies to ‘overheat’ slightly to get inflation up substantially and reach ‘exit velocity’ so they can truly normalise interest rates sooner.

The Reserve Bank’s caution is evident in its inflation forecasts, which only barely get above the 2% midpoint by the end of the forecast period. If it was ‘redlining’ the economy to reach exit velocity, its forecasts would see inflation closer to three percent or higher, and that would be just fine. That would also mean the Reserve Bank would have left its OCR track flat, or even suggested cuts. But, for now, the Reserve Bank is taking an overly cautious approach on inflation, in my view. Another failure to exit the 22 risks further embedding expectations of very low interest rates forever, and undermines the only thing any Reserve Bank needs: public confidence that they are able to forecast accurately and keep inflation around 2% for the long run. It’s been 10 years now that inflation has been worryingly under 2%.

Not enough Govt bonds to buy

I think the Reserve Bank needs to ‘redline’ the engine with a final burst of stimulus to ‘clean out the cobwebs’ in the economy’s engine so we can get back towards that 2-3% neutral level of interest rates sooner rather than later. Ironically, I think that means signalling low or even lower interest rates right now.

One problem the Reserve Bank may think it has is a lack of Government bonds to buy to use the Quantitative Easing tool in its expanded monetary policy tool kit. The Reserve Bank acknowledged yesterday it was unlikely to get to its full $100b limit by mid-2022 as previously signalled because of the slower issuance of Government bonds as the Government’s books improve.

The Reserve Bank said this shouldn’t be misinterpreted as any sort of ‘tapering’ signal, but along with the OCR hike projections, it’s hard not to see the Reserve Bank signalling it is or will tighten. I think that’s a mistake and the Reserve Bank should have kept mentioning it may have to cut rates again into negative territory. We have not seen the ‘whites of the eyes’ of permanent inflation pressures yet, especially around wage inflation. The Reserve Bank should be using the Australian and American approach of keeping the accelerator down hard to get the rev counter up into the redline territory and blow those cobwebs out properly.

News briefly elsewhere in our political economy

Slight delay - The Ministry of Health has started talking about the big next wave of vaccinations beginning to start in late July, rather than the early July start previously indicated. Covid Response Minister Chris Hipkins denied it was a delay, but acknowledged it was unclear exactly when Pfizer would deliver the next big lump of supplies for the July start of ‘group four’ vaccinations. (Stuff)

This is another thump in the slow drumbeat suggesting full vaccination and a move to the 70% level seen as herd immunity may not happen in full this year, and that a much more comprehensive opening of the border may not happen until well into 2022. The Reserve Bank used early 2022 as its assumption for a start date for more open borders beyond the Trans-Tasman bubble. Australia’s Treasury has used mid-2022 as its working assumption for a border opening. In reality, we can’t really reopen in full until Australia does. I’d be surprised if anyone could easily travel beyond Australia now until 2023.

Melbourne lockdown? - Australasians are bracing themselves for the potential announcement later today of another snap lockdown in Melbourne after the number of exposure sites linked to the latest outbreak was lifted to 70. ABC Australia reported this morning there were now more cases linked to the current cluster than the outbreak that prompted February's five-day lockdown.

Neither confirming nor denying - PM Jacinda Ardern would neither confirm nor deny Richard Harman’s scoop yesterday that Labour and National quietly agreed to drop Raymond Huo and Jian Yang as MPs before the election because of security officials’ concerns about their links to the Chinese Government. Judith Collins and then-National Party leader Todd Muller also declined to comment. (TVNZ)

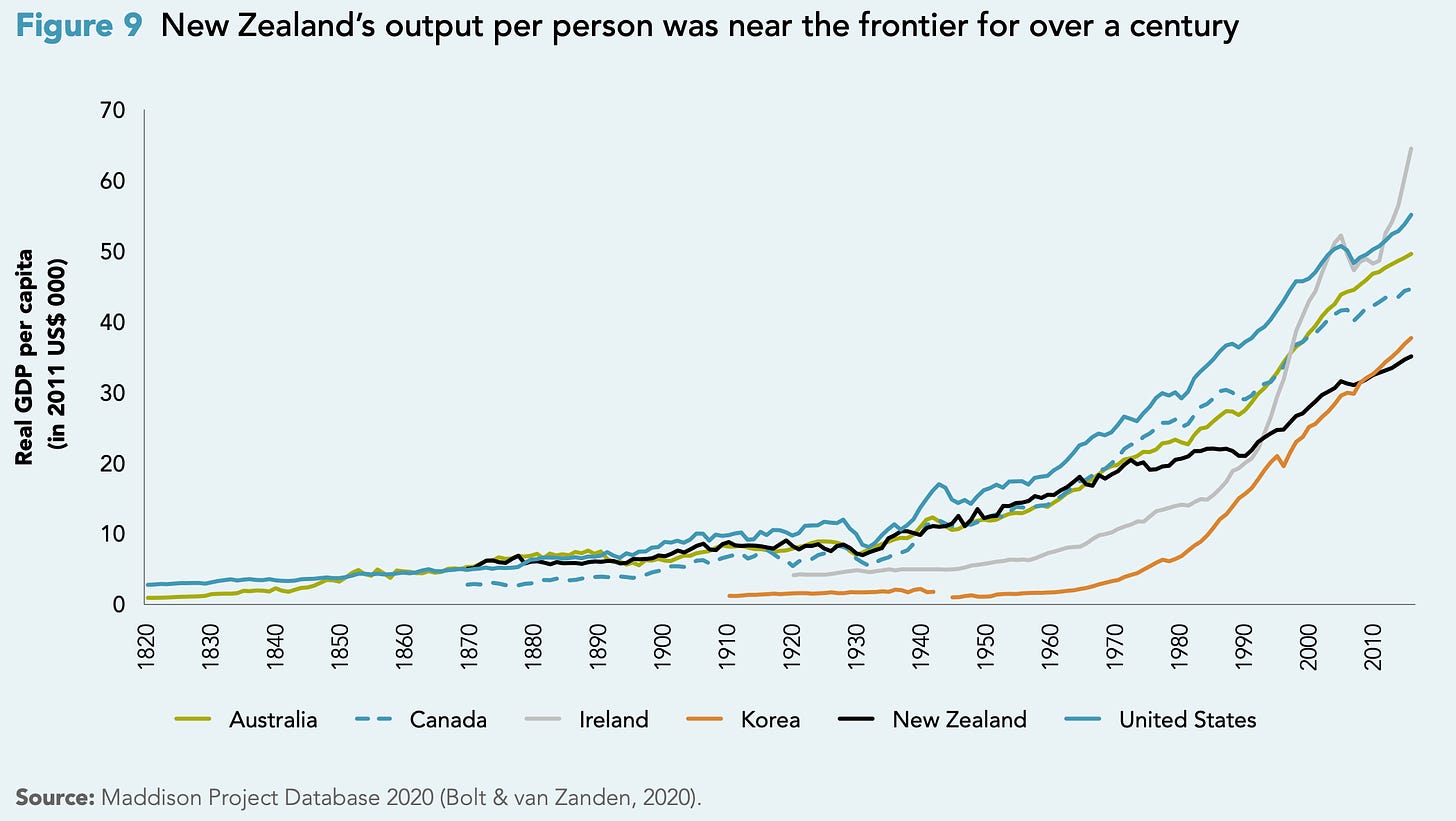

Working harder for longer and producing less - The Productivity Commission published a fresh paper this morning detailing the scale of New Zealand’s productivity growth failure over the last 30 years. It reported New Zealanders worked around 34.2 hours per week compared with 31.9 hours per week in other OECD countries, and produced around $68 of output per hour, compared with $85 per hour in other OECD countries. It’s a great restatement of the problem in one fresh package.

News briefly elsewhere in the global economy

WTF happened in Wuhan? In another room that will inflame relations between the US and China, President Joe Biden asked America’s intelligence agencies overnight to take a much closer look at where Covid-19 came from. (Reuters) This comes after a Wall St Journal investigation that suggested that an escape from a lab in Wuhan was more likely than previously thought.

Big blows for big oil There were two big victories for climate activists overnight. A Dutch court ruled Shell would have to shrink its emissions by 45% from 2019 levels by 2030 to comply with human rights law. (CNBC) Meanwhile in America, and also overnight, a climate activist hedge fund, Engine No 1, successful managed a shareholders’ revolt to put two members onto the board of Exxon. (Reuters)

Popcorn was shovelled Politicos in Britain were agog overnight as Boris Johnson’s former right-hand-man Dominic Cummings unleashed on the Prime Minister in spectacular and very public fashion. Cummings told a public Parliamentary Select select committee Johnson was unfit to govern, that his response to Covid was chaotic, that Johnson at one point early in the pandemic suggested he get injected with the virus to show it wasn’t serious, and that tens of thousands of Britons died needlessly. (Guardian)

This quote from Cummings is the best among a calvalcade of pithy and cutting one-liners:

“Nobody could find a way around the problem of the prime minister, just like a shopping trolley, smashing from one side of the aisle to the other.”

Locked out of Europe Finally Meanwhile, France joined Germany overnight in requiring all British arrivals to do mandatory quarantine because of fears they would spread the dangerous Indian variant in Europe. (France24)

Charts of the day

Dawn chorus: RBNZ's hawkish tilt surprises