TLDR & TLDL: The prospect of a full reopening of the border is receding off into late 2022 as the complications and risks around the virulent Indian strain of Covid-19 and Australasia’s very low vaccine rate poke all sorts of holes in the Trans-Tasman bubble.

Elsewhere, Joe Biden is set to unveil a new US$6t infrastructure and spending stimulus plan worth 30% of GDP, brushing aside financial market and Republican warnings about inflationary pressures and betting that America’s public debt of over 100% of US GDP (US$21t) won’t be a problem. New Zealand is still fretting over its debt of 30% of GDP and the Government increased its capital spending allowance for the next four years by $4b to just $12b or about 3.5% of GDP in Budget 2021.

Meanwhile, the lack of central government funding and action to help fill the infrastructure deficit created by 30 years of under-investment and an extra 1m people arriving in the last 20 years is now cascading down onto councils, along with the need to spend on transport and infrastructure deal with the housing crisis and climate change.

Wellington City Council decided yesterday on a 13.5% rates increase and a doubling of its cycling spending to over $220m as it prepares to pedestrianise its CBD within a few years. Auckland Council yesterday confirmed a 5% rates increase and has also restrained its climate and infrastructure spending because of unplaced concerns about its debt rising.

Melbourne empties as its tracers scramble

Late yesterday New Zealand extended its temporary suspension of travel to and from Melbourne until next Friday after the city’s outbreak surged to 26 cases. Over 5,000 arrivals to New Zealand from Melbourne were ordered to self-isolate and get a Covid test. (Stuff)

The surge overwhelmed Victoria’s tracing system, given those cases had over 14,000 primary and secondary contacts at over 200 exposure sites. Over 100 of those contacts had already travelled to South Australia, Western Australia and New South Wales. Medical students were called in to help contact tracers as there was a mass exodus of Melbourne residents to the suburbs and beyond for at least a week of lockdown. (ABC)

My working assumption now is that we won’t see a proper border opening until well into the second half of 2022, because both Australia and New Zealand have yet to get vaccination rates into the double digits and the virulent Indian strain is now spreading through the UK, Europe and elsewhere. Australia’s Treasury forecast the second half of 2022 as its reopening assumption in its Budget, while our Reserve Bank and Treasury are assuming an early 2022 opening. Realistically, Australia will set the pace given most of our visitors are from Australia or bounce through Australia.

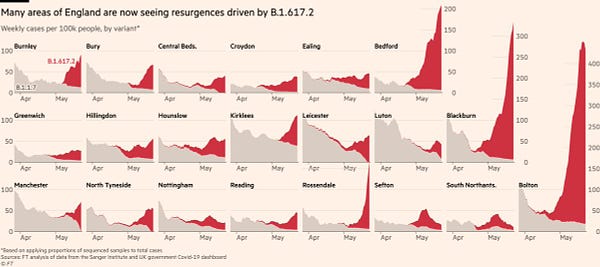

Britain’s case numbers increased overnight despite having a one-dose vaccination rate of 73% and a two-dose rate of 45%. One in 10 hospital admissions for Covid in the UK this week were for people who had had two doses of vaccine. Over 75% of cases in the UK are now of the Indian variant. Germany and France stopped unquarantined entry of Britons this week because of fears about the Indian variant, which is known as the B.1617.2 strain. See more on that below in charts of the day.

The importance of tightly controlled borders and lockdowns was reinforced again overnight when Imperial College London’s now-renowned Covid modeller, Neil Ferguson, said Britain’s decision to delay its lockdown for a week around March 13 last year is likely to have cost up to 30,000 lives. He was commenting after Boris Johnson’s adviser Dominic Cummings this week accused the Prime Minister of incompetence that cost up tens of thousands of lives. (Yahoo)

“I think that’s unarguable. I mean the epidemic was doubling every three to four days in weeks 13 to 23 March, and so had we moved the interventions back a week we would have curtailed that and saved many lives.” Imperial College London Professor Neil Ferguson.

Going even bigger in America

Elsewhere, US President Joe Biden is set to unveil a new US$6t infrastructure and spending stimulus plan worth 30% of GDP, brushing aside financial market fears about inflationary pressures and betting inflation and America’s public debt of over 100% of US GDP (US$21t) won’t be a problem. (NY Times) Meanwhile, New Zealand is still fretting over its public net debt of 30% of GDP rising to just over 40% of GDP, and the Labour Government increased its capital spending allowance for the next four years by just $4b to $12b or 3.5% of GDP in Budget 2021.

This is despite IMF reconfirming this week it was taking a much wider set of measures into account in its Article IV ‘health checks’ of economies.

“In the future, we will systematically integrate issues that have substantial macroeconomic impact such as inequality, climate change, and digital technology, so as to better deliver on our surveillance mandate.” (IMF blog on adapting its advice to a new economic landscape)

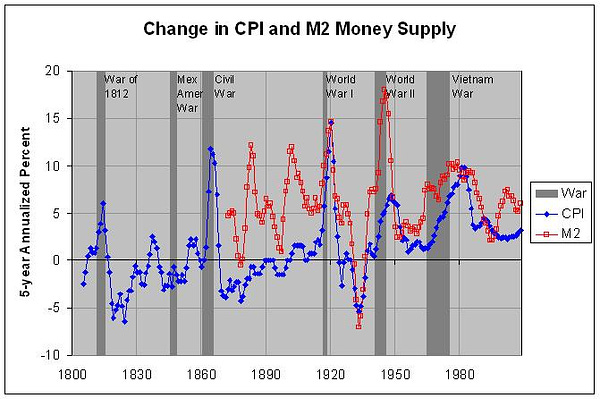

The big fear around the American and other government spending splurges is that it will run up against capacity constraints and generate a big swing up in inflation and interest rates that is financially destabilising. The inflationistas fear the current jump in some consumer and wholesale prices linked to supply chain disruptions through the pandemic will become bedded in, and that wages and prices will start chasing each other higher at the same time as unemployment staying stubbornly higher — a return to 1970s-style stagflation.

I think those fears are overdone. Overnight US Treasury Secretary and former US Federal Reserve Chair Janet Yellen again indicated markets and policymakers should hold their nerve in the wake of America’s decade-high annual inflation rate in April of 4.2%. The European Central Bank also reinforced to markets overnight it would keep pushing down on interest rates and look through the temporary inflation spike.

“My judgment right now is the recent inflation we’ve seen will be temporary, it’s not something that’s endemic.” Janet Yellen speaking to a US congressional hearing. (Bloomberg)

There was also good news on the US jobs front overnight to undermine the unemployment aspect of the stagflation fears. US jobless claims were 406,000 in the last week, which was less than economists’ forecasts for around 425,000 and new low since the beginning of the pandemic. (AP)

Briefly elsewhere in our political economy

Charts of the day

Dawn chorus: Bubble blown