TL;DR: The Greens have proposed a smorgasbord of $15.5 billion worth of wealth taxes annually for Labour to pick and choose from, or ignore completely, in any government-forming negotiations after Election 2023 on October 14.

So now the rule-in-rule-out game begins. Labour started carefully yesterday, saying it would roll out its own tax policy in the coming weeks. National and ACT leapt to assign all of the Green tax policy to the ‘coalition of chaos’.

News elsewhere in Aotearoa’s political economy

National pledged to end bans on gene editing and genetic modification;

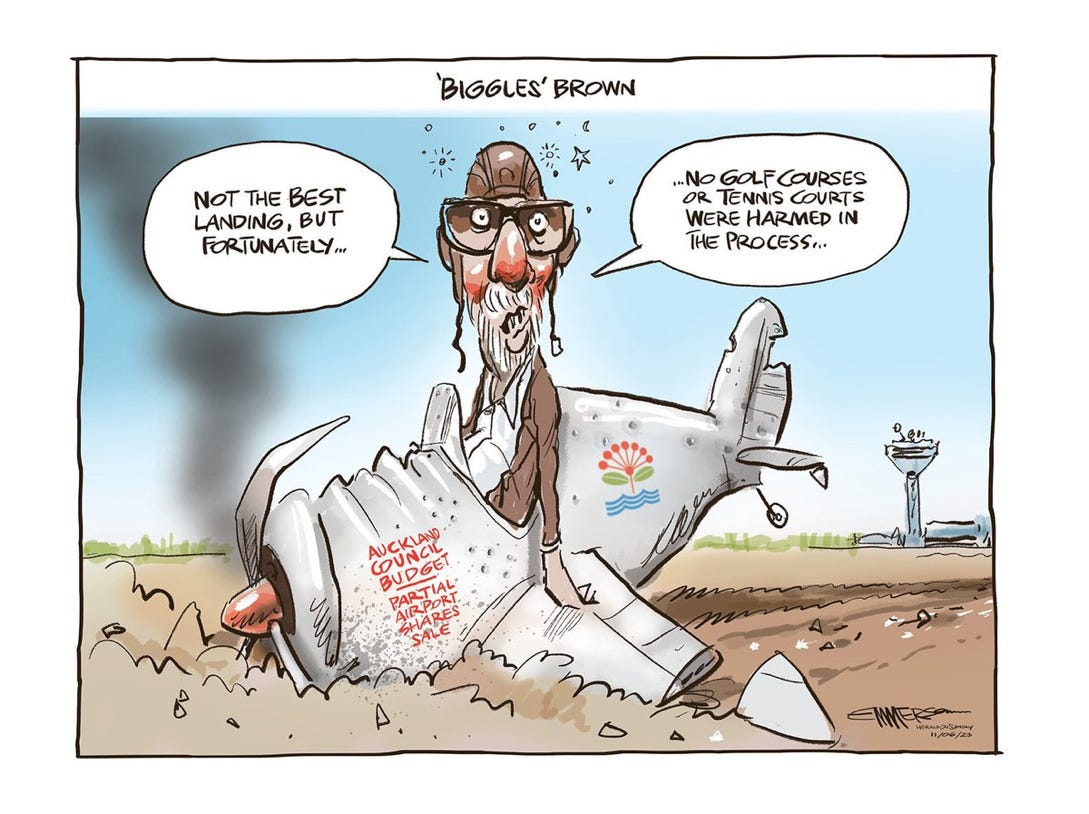

Auckland City Council agreed a compromised Budget that sold some airport shares, added more debt than Mayor Wayne Brown wanted, and cut a bit less from social services than he wanted;

A Curia - Taxpayers Union poll showed the centre-right bloc still high to govern alone with 62 seats, while the centre-left bloc including Te Pati Maori would have 58 seats; and,

The same poll found Christopher Luxon closed his net favourability and preferred PM deficits with Chris Hipkins.

Usually, I put in a paywall for paying subscribers at this point in the email newsletter and lock off the podcast above from free subscribers. But I want to experiment until the end of June with publishing everything to everyone immediately to see what happens with subscription rates, revenues and email opening rates. I want to thank paying subscribers in advance, who are still the only ones able to comment and get access to our very active chat section and webinars. Join our community by subscribing in full to support my journalism in the public interest about housing (un)affordability, climate change (in)action and poverty (not enough) reduction.

Greens put $15.5b worth of wealth taxes on Labour’s menu

Election 2023 may well turn into another debate about wealth taxes, but only if Labour allows any vacuum to form after an inevitable set of demands it ‘rule-in-or-rule-out’ whether it will adopt some or all of a Green tax and welfare smorgasbord laid out on Sunday.

The policy suite includes:

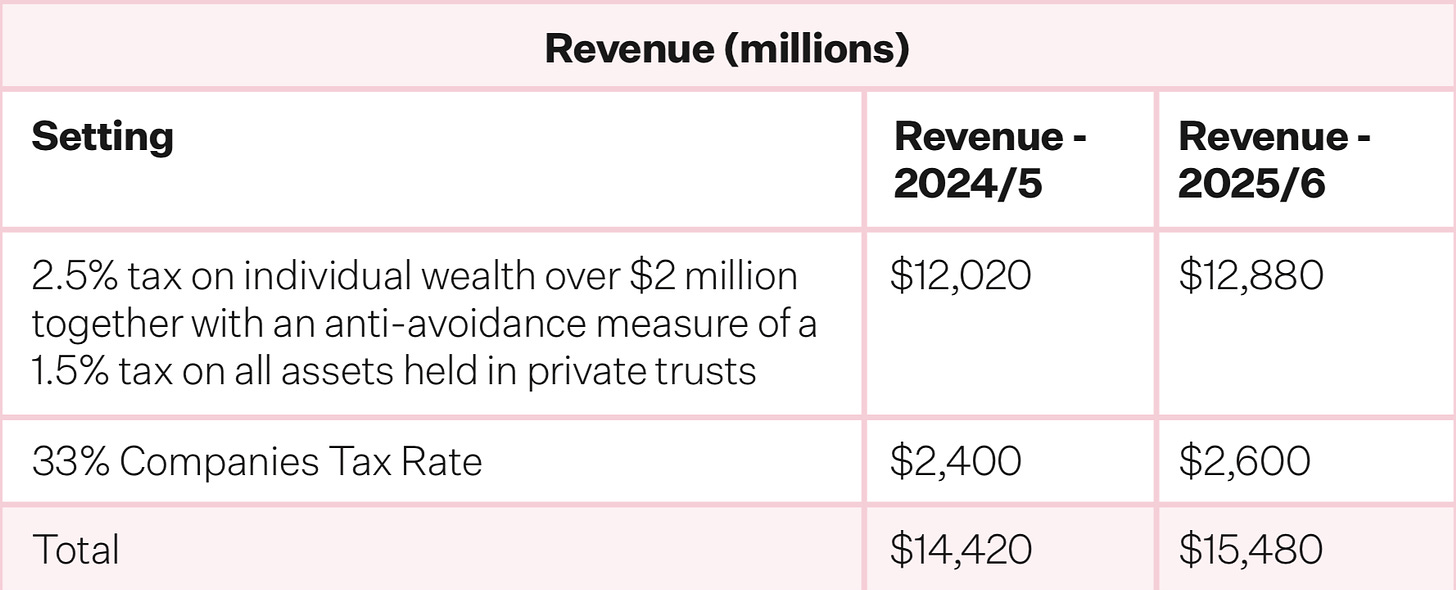

a 2.5% tax on net wealth above $2 million for individuals and $4 million for couples, which the Greens estimated would apply to about 0.7% of taxpayers1;

a 1.5% tax on wealth in privately-held trusts;

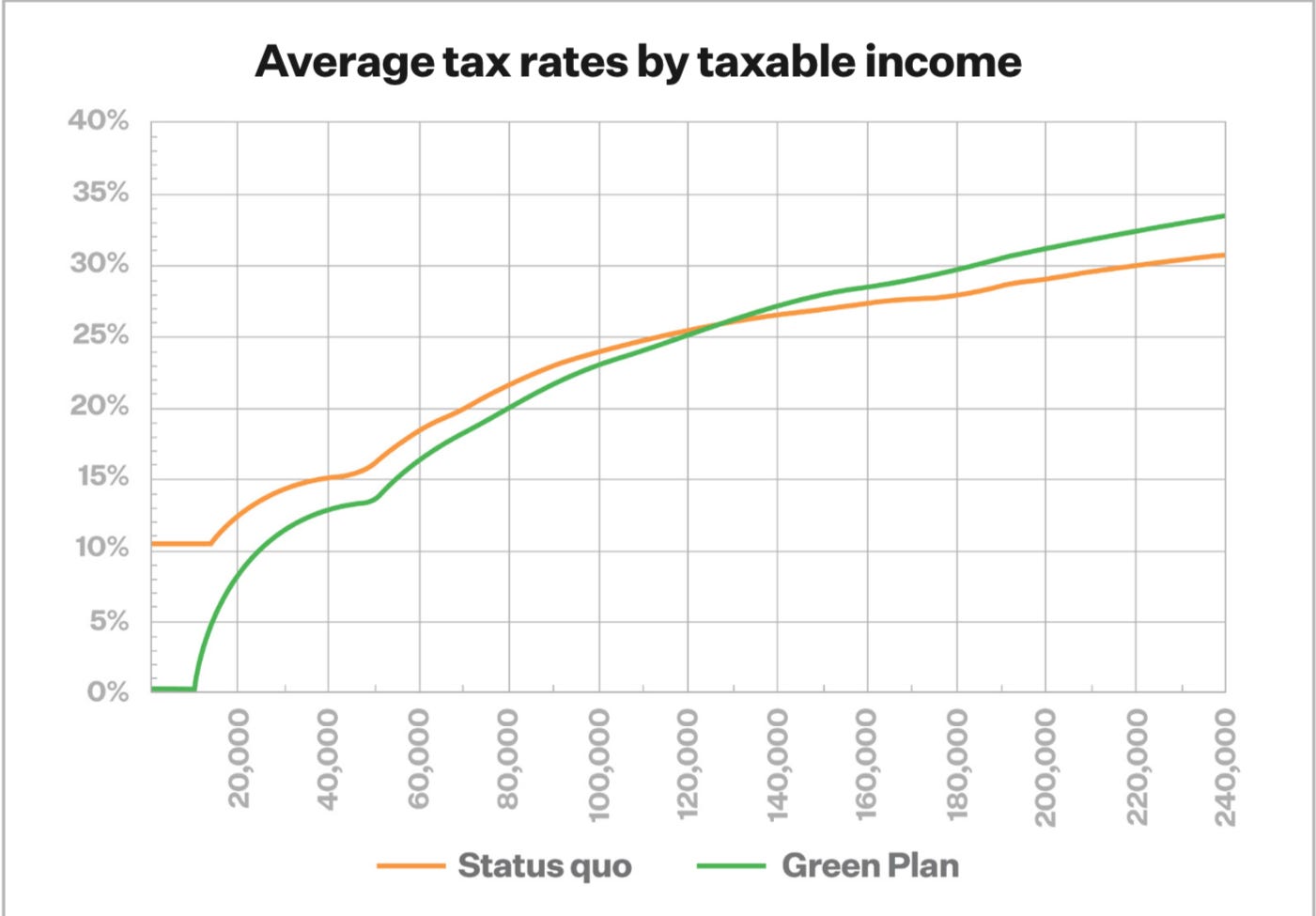

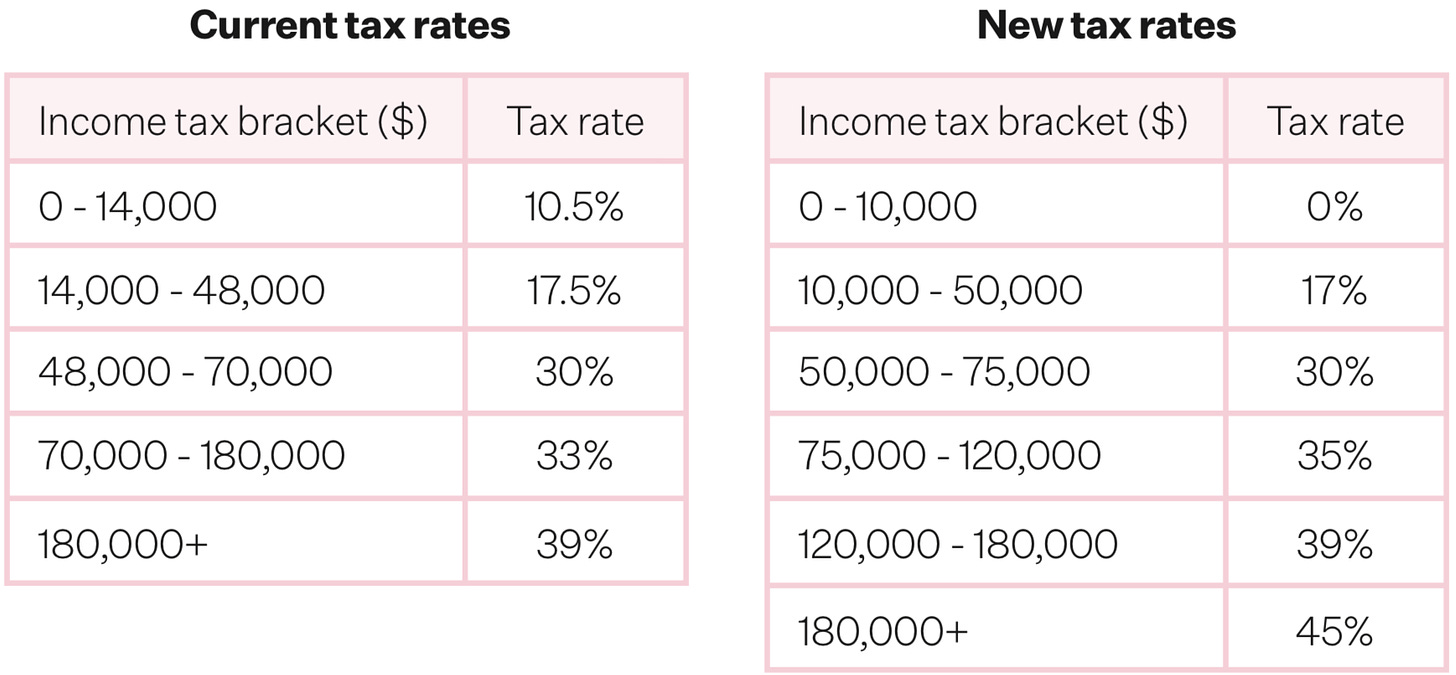

a new 45% tax rate on incomes of over $180,000 per annum;

an increase in the corporate tax rate from 28% back to its 2008 level of 33%;

a tax-free income band up to $10,000, which would increase incomes of everyone earning under $125,000 per year, with incomes up by between $16 to $26 a week for 3.7 million residents;

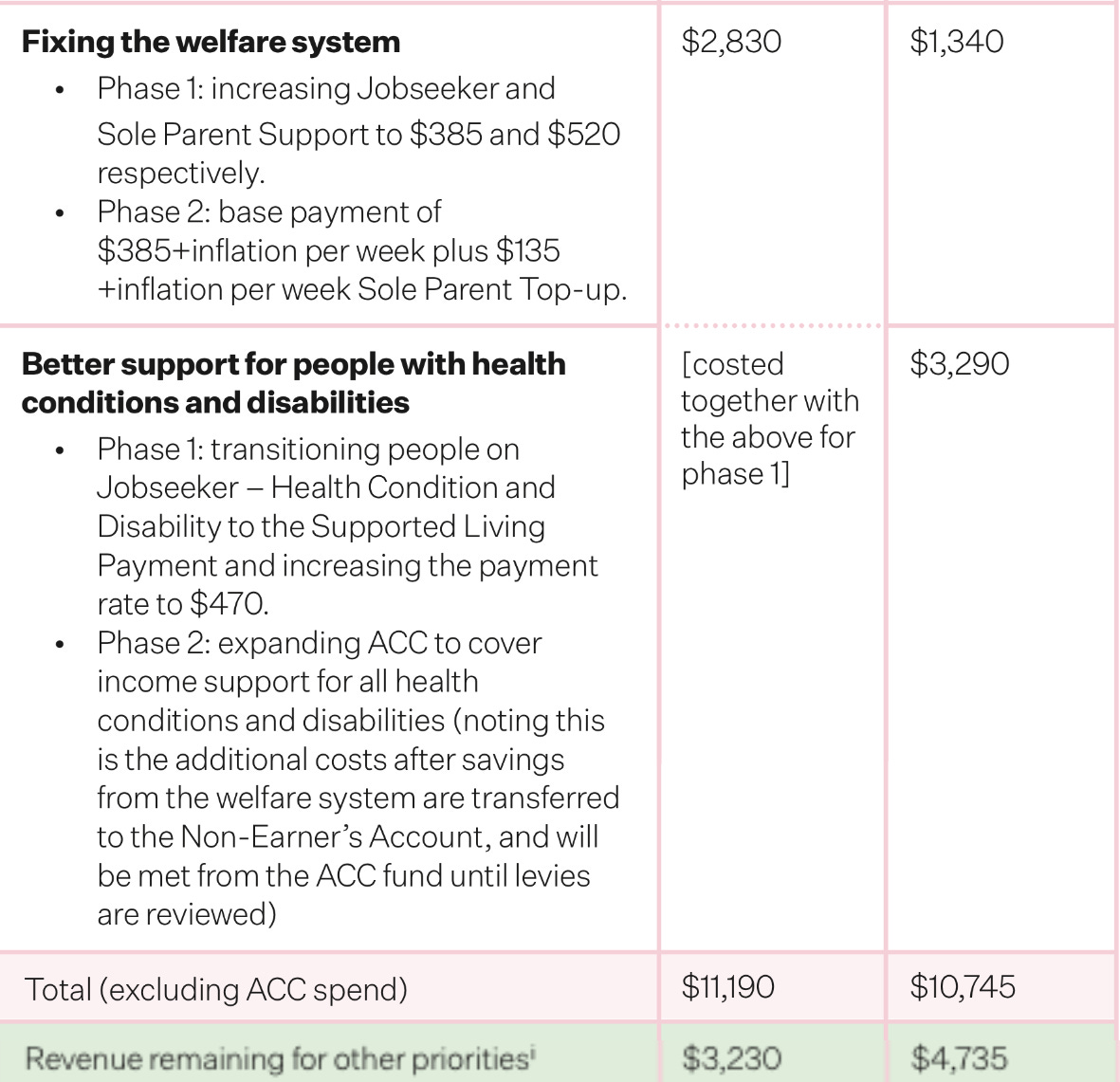

a guaranteed income for those in or out of work, along with students, of at least $385 per week for an individual or $770 for a couple, or $725 for a single parent2;

the replacement of Working For Families with a single payment for caregivers of $215 every week for the first child, and $135 a week for every other child;

the lifting of the abatement threshold for this payment from $42,000 per year under Working For Families to $60,000 a year, along with reducing the abatement rate from 27% to 18%;

a payment of $140 for every child under three, which doubles and universalises the existing Best Start payment; and,

the reform of ACC into the Agency for Comprehensive Care, which would provide a minimum payment of 80% of the full-time minimum wage for those not in work because of a health condition or disability, paid for by switching to a flat levy rate for employers and removing the maximum threshold for employees.

Here’s the policies in chart and table form

So how might Labour react?

The last time the Greens proposed a wealth tax, Labour completely ruled it out before the election. Finance Minister Grant Robertson didn’t rule in or out a wealth tax in his first comments last night, saying only that Labour’s tax policy would be relased ‘shortly.’

National and ACT wasted no time in trying to insert the Green wealth taxes into any vacuum created in the gap until Labour’s official policy releases.

“This massive tax grab by the Greens is exactly what the country doesn’t need – but unfortunately it is exactly what Kiwis can expect from a Labour-Greens-Te Pāti Māori Coalition of Chaos.” National Finance Spokeswoman Nicola Willis in a statement.

Labour is most likely to adopt the $10,000 tax-free threshold.

Cartoon of the day

‘No golf courses were harmed in the making of this budget’

Ka kite ano

Bernard

PS: Lynn and I are on holiday, so these emails are shorter.

The Greens’ Election 2020 wealth tax policy was for a 1% wealth tax on individuals with wealth of over $1 million, which it then estimated would apply to 6% of taxpayers.

The Green Election 2020 policy was for a $325 per week guaranteed income.

A Green smorgasbord of wealth taxes