Will Labour hike the trust rate too?

Parker says the new 39c tax rate for income over $180,000 may create incentives to shift income into trusts at 33c rate, as seen from 1999-08. He eyes final resort of hiking trust rate if that happens

TLDR: Revenue Minister David Parker threw a pre-Christmas tax hike surprise in amongst the political pigeons today by suggesting a rise in the trust tax rate from 33c to match the new 39c income tax rate was possible.

If it happened in this 2020-23 term, it would appear to breach Labour’s promise of no new taxes other than than the new top personal income tax rate. Or it would at least require some fancy footwork to say it’s part of the same tax change.

However, it may not be necessary, given trusts aren’t as ‘pretty legal’ as they used to be as tax circumvention vehicles, and the personal income tax threshold of $180,000 is much higher than the $60,000 one adopted in 1999, which triggered a surge into trusts over the decade until the realignment of the rates in 2010.

A higher tax rate for trusts?

The Government is to introduce legislation under urgency this week to bring in a new top personal tax rate of 39c on income over $180,000 per year, as promised in Labour’s manifesto.

Revenue Minister David Parker told me and other reporters before the first Parliamentary Question Time of the 53rd Parliament the Government would give the IRD extra information-gathering powers to ensure those on higher incomes did not shift income and assets into trusts, as happened between 1999 and 2009, when the top income tax rate of 39c was out of line with the trust rate of 33c.

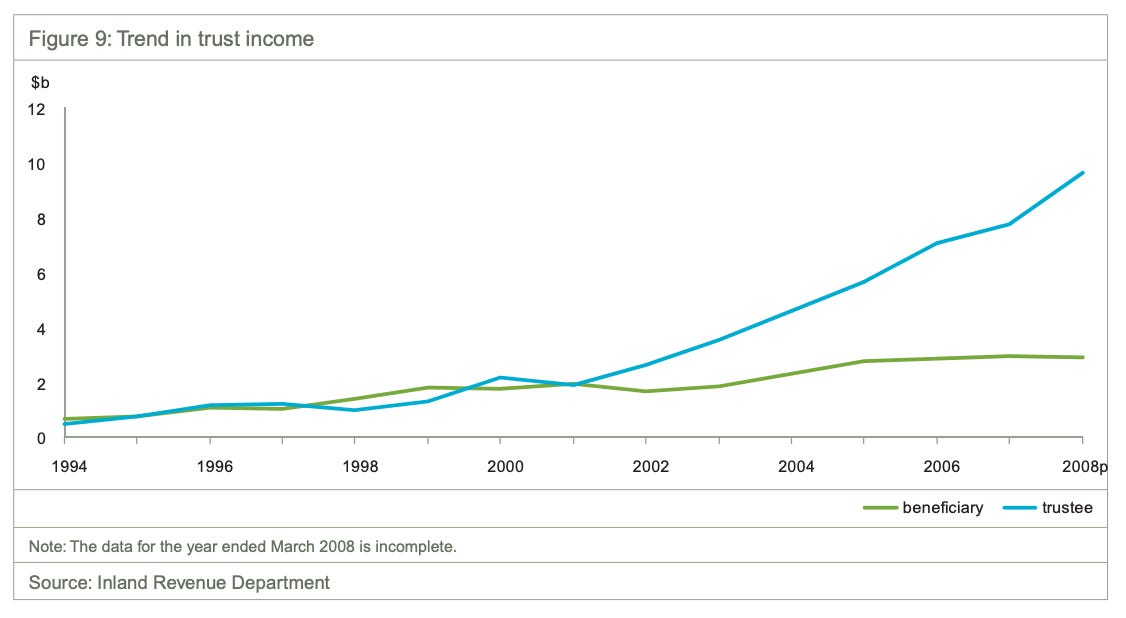

The number of trusts almost doubled between 2000 and 2008 to nearly 250,000, leading IRD to estimate it was losing $300m a year in revenue by 2007. This chart below was published in the 2010 Tax Working Group report to show how much income was pushed into trusts. Back in 2010, there was around one trust for every 18 citizens in New Zealand, whereas the trust rate in Australia was around one for every 34 citizens and one for every 294 citizens in Britain, a Law Commission report found.

Parker said there no immediate plans for the trust rate of 33c.

“We’re not doing anything (with the trust rate) on the introduction of the bill, but we are giving the commissioner an information-gathering power to see whether they’re being used for avoidance,” Parker said.

“And if they are, we’ll move on it.”

Parker added that if those powers weren’t enough the government could realign the rates by lifting the trust rate to 39c.

“We’re going to monitor it. If that behaviour becomes apparent then we’ll move to increase the trust rate to stop it being used as an avoidance loophole,” he said.

If it was done during the current 2020-23 term it would appear to breach Labour’s promise of making no other income or wealth tax changes than the new 39c top tax rate. However, court rulings in favour of the IRD in recent years such as Penny and Hooper have made the use of trusts to avoid tax more difficult and less popular, and the high level of the $180,000 may not prove as much of a trust-opening catalyst as the 39c rate in 1999, which was set at $60,000 per year.

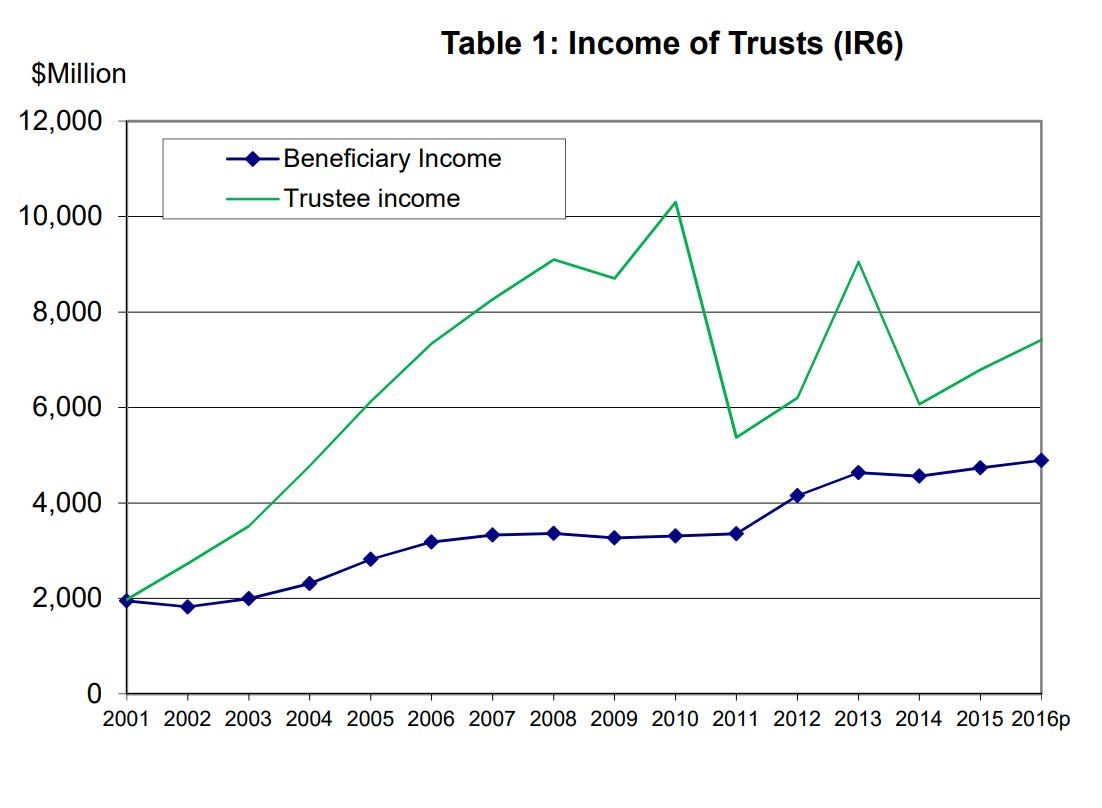

An updated version of the chart above was included in a 2018 Tax Working Group background paper showing the gap between trustee income and beneficiary income had narrowed in the years after the alignment of the top income tax and trust rates at 33c in 2010.

What is your view on whether the return of the ‘gap’ between the top tax rates will trigger a new rush into trusts? Or are tax advisers suggesting other tactics? Are tax advisers already suggesting the creation of new vehicles?

Tell us what you’re seeing the comments below.

cheers

Bernard

Following that thought perhaps the onus should be on the creator of the trust to show why they should not have to pay the top rate. After all It is the income that the tax is receiving that is being taxed isn’t it?

My lawyer told me to talk to my accountant about my family trust as it was proably no longer worth having with the current law changes, It is just for one house my daughters live in. They can't afford to buy their own.