Whats news to me this morning

Fed stays loose and sees no rate hikes until 2024; Cabinet set to decide on Trans-Tasman travel bubble on Monday for early-April start; Carterton tells residents to boil water until further notice

TLDR: Interest rates are likely to stay low for longer, thanks to the US Federal Reserve signalling this morning it won’t increase its key short term interest rate from its current 0.25% level until 2024 at least. Meanwhile, it plans to keep printing US$120b a month to buy bonds to drag down on market interest rates.

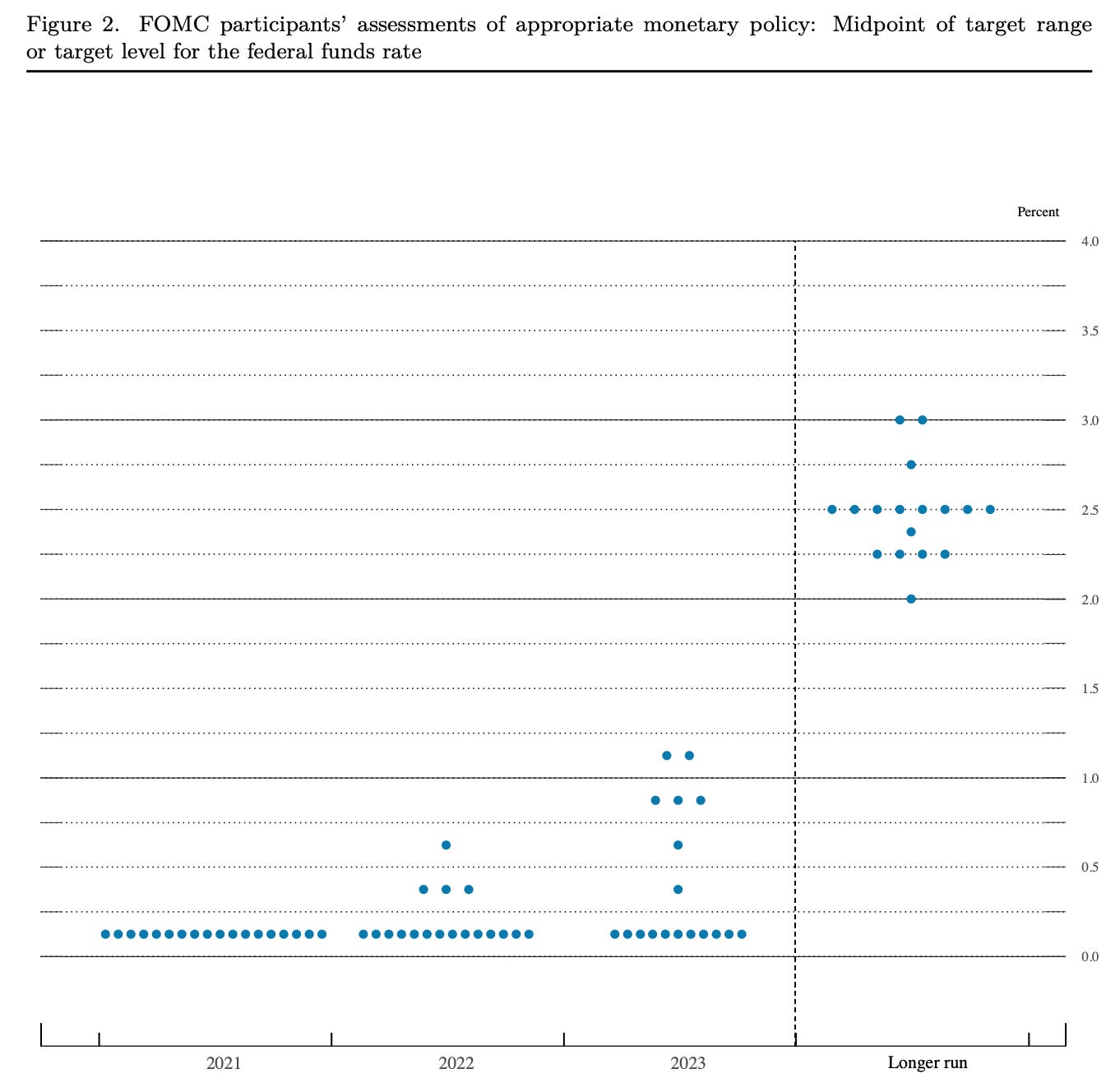

For now, the Fed-fighting inflationistas are facing a wall of money printing to keep bond prices high and yields low. The question is for how long. The famed ‘dot plot’ of FOMC member forecasts shows the median expectation (dotted line in chart) is still for no rate hikes through until 2024. But three members saw a hike next year and seven of the 18 saw a hike by 2023, up from five in the December decision. (See chart below)

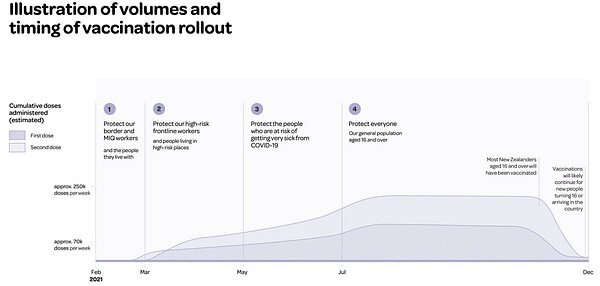

Elsewhere, the drums are beating for a travel bubble with Australia, which could be announced as early as after next Monday’s cabinet meeting, with travel able to start by early April.

Briefly in our political economy

In the global political economy

Useful bits and pieces

Threads worth unravelling