What's news to me this morning

Up to 80% of 2,000 MSD clients in Rotorua motels from out of town; Robertson preferred cash grants to businesses than workers; Since the $12b of wage subsidies were granted, businesses have saved $20b

TLDR: Here’s a just few of the highlights of my morning reading, just to keep a regular flow of these coming through to subscribers. There’s more housing crisis news, fresh signs the inflation hawks are wrong again, and I’ve worked out the Government gave $12b in wage subsidies to employers, who have since increased their savings by $20b.

Fire-fighting with water in a drought

Tony Wall’s piece in Stuff on how Rotorua’s ‘MSD mile’ of motels houses 2,000 people, including up to 80 percent from other cities and towns, is an eye-opener. We have a housing crisis that the Government is now spending upwards of $4.3b a year helping to pay rents and paying for motel rooms.

Why isn’t that being used to underwrite $200b of house building? When you have enough money to pay the rent, you can afford a mortgage. The only problem is the deposit. The Crown has a very strong balance sheet and should use it.

Hawks shooed away again

Surprise, surprise. The inflation hasn’t arrived yet. US inflation data overnight showed core inflation actually fell to an annual rate of 1.3 percent in January, which was weaker than expected. Core inflation is up just 0.1 percent in the last three months.

That meant the US 10 year bond yield dropped from 1.56% before the data to 1.51% after. The bond market’s selloff is looking more and more like a tantrum. The big test will be tonight when the European Central Bank gets a chance to push back against higher market interest rates by increasing its money printing and bond buying.

Advance to Australia?

The Opposition is on to a winner this morning, calling on Jacinda Ardern to immediately open up a travel bubble with Australia so their tourists can come to New Zealand without having to go through quarantine. Currently, New Zealanders can go to Australia without quarantining, but Australians cannot do the same here, and many of the tourism businesses in Queenstown and Auckland are on their last legs.

Australian PM Scott Morrison said New Zealand was the one holding back Australians travelling to the likes of Queenstown and Auckland for a holiday. “If Australians can’t go to Queenstown, I’m hoping they’re going to Cairns,” Morrison said. Over to you Jacinda.

Butter and Coke shortages?

The global shipping mess continues to wreak havoc. This piece from Debrin Foxcroft from Stuff is useful, citing limits on butter and bottles of Coke in Petone.

Some economists think the sharp rise in container and air freight costs will trigger an inflationary surge, but most still think it’s temporary while the shipping lines catch up and the containers get shuffled to the right places. There’s been a real issue shipping all the medical devices and working from home gear from factories in and around Asia to America.

Also, a lot of businesses are rediscovering the need to have stocks, reversing decades of ‘just in time’ logistical practices. Turns out resilience is useful when there’s a surprise.

Would have been good here

US President Joe Biden’s US$1.9t stimulus package got its final Congressional vote this morning and Biden is scheduled to deliver a prime time television address tomorrow to get things cracking. It includes a US$1,400 cheque for the majority of households, along with US$300b aid for state and local Governments and extra tax credits for families with children.

On top of December’s US$900b and US$2.3t a year ago, America’s Government is unloading over US$5t of stimulus in a just over a year. That’s equivalent to about 25 percent of US GDP and an average of over US$43,000 per household. Over that time the US Federal Reserve has printed US$4t to buy bonds in the open market, rather than directly from the Government. That means that effectively just a fifth of the stimulus was paid for from the savings of investors in America and elsewhere.

So why didn’t we do something similar here. Our stimulus was mostly through a wage subsidy where cash went straight to employers, rather than employees. Grant Robertson told a select committee yesterday these US-style ‘helicopter money’ payments were considered here, but he preferred the wage subsidies.

"I've got a view that genuine stimulus in the economy is more likely to come from the wage subsidy scheme, than a one-off helicopter-style payment,” he was reported by Jason Walls in the NZ Herald to have said.

He said the ‘helicopter money’ stimulus worked in countries where there was a sharp economic downturn, such as America. He said he was "attracted to a form of stimulus that is enduring and builds confidence.”

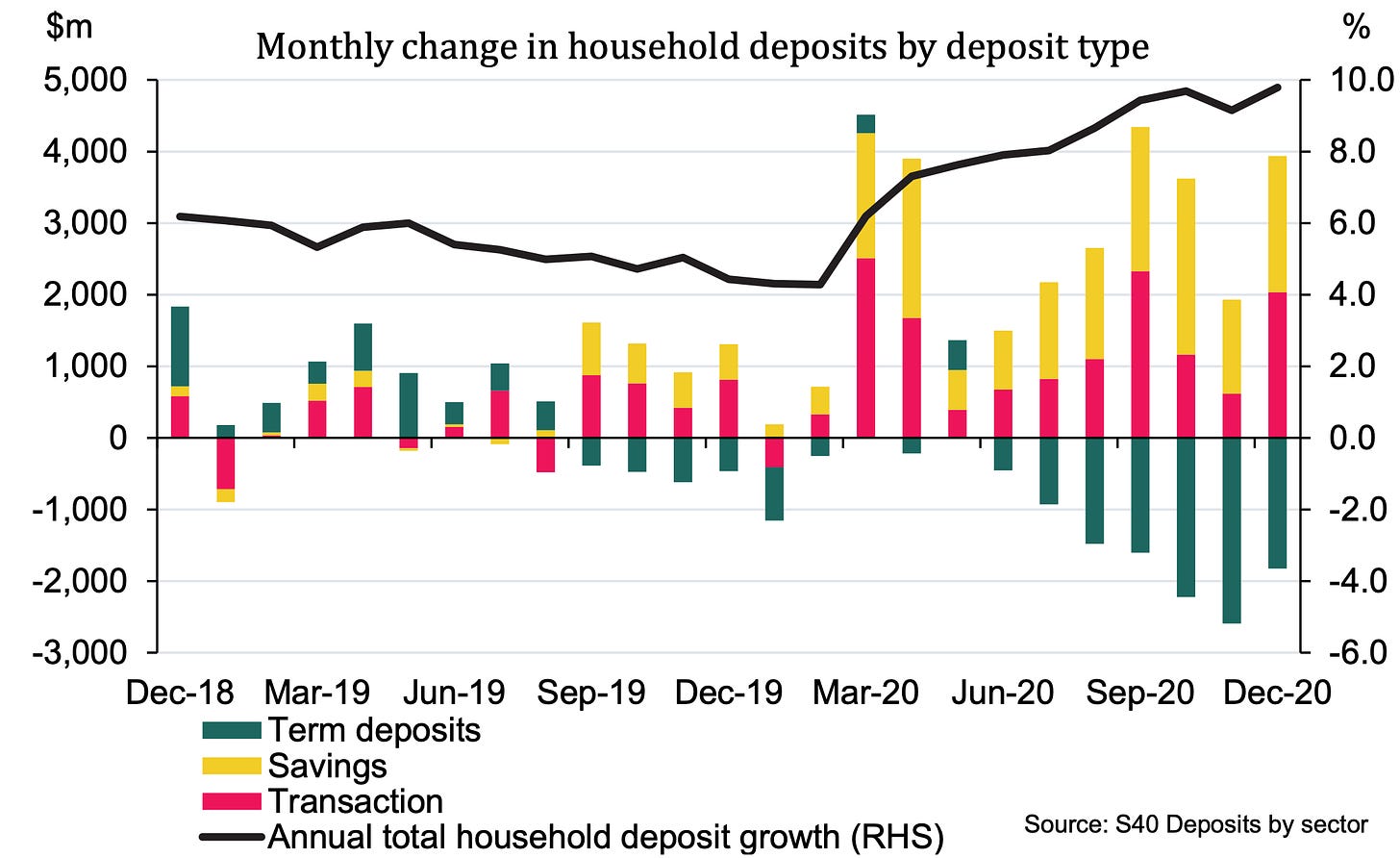

The problem is most of that $12b in wage subsidies went to businesses and business owners, who promptly saved it. Household deposits in banks rose $17b to $203b between February and December. Non-financial business deposits in banks rose by $20b between February and December.

A lot more of that money would have been spent in the economy and a lot less parked in savings accounts if there had been US style helicopter payments.

Have a great day

Ka Kite Ano

Bernard

Our Government is spending $4.3b a year helping to pay rents and paying for motel rooms. Why isn’t that being used to underwrite $200b of house building? When you have enough money to pay the rent, you can afford a mortgage

Why !!

IMO the government believed the use of motels to accommodate the displaced was a temporary phenomenon, and would automatically correct itself over time. The same as Bernanke's 6 month $4 trillion safety-net in 2008 that has never been withdrawn - still in place - now USD $9.8 Trillion

What do you think would happen if the Government cancelled the Accommodation Supplement in order to finance $200 billion house building