TL;DR: PM Chris Hipkins as good as confirmed yesterday a market study into banks would be announced before the election and happen some time in the next year or two.

In a deeper analysis below the paywall fold in the podcast above for paying subscribers, I argue any market study should focus on why Aotearoa’s big four Australian-owned banks are able to make world-beating profits without much risk, including closer looks at:

A surge in net interest margins, partly due to cheap Reserve Bank loans and the Reserve Bank paying billions in interest on deposits of money created by the Reserve Bank during the Covid lockdowns;

How the banks have digitised their operations to massively improve efficiency by getting customers to do more work in the last 20 years, but have shared few of the financial benefits with customers, and in the process disinfranchised older, more rural, Māori and Pasifika customers and potential customers in the process;

How the banks increased their efficiency and lowered costs by pulling out of regional areas and accelerated a shift to non-cash and electronic payment systems, without investing in systems to ensure resilience to outages and access to less digitally savvy or resourced customers; and,

How banks understandably (but unfortunately) increased their profitability and reduced risks through a multi-decade process of skewing their lending and operations away from businesses and farmers and towards households and brokers chasing leveraged and tax-free gains from a tripling of residential land values.

…bank profits are growing more than twice as fast as public health spending and will be worth the equivalent of about a quarter of the health budget by the end of the year.

What a market study of banks should focus on

PM Chris Hipkins yesterday echoed and reinforced comments last week from Commerce Minister Duncan Webb that a market study into banks by the Commerce Commission is likely to be foreshadowed before the election.

Labour promised in its 2020 manifesto to carry out a market study into building materials, which was agreed by Cabinet shortly after the 2020 election and completed in December last year. On past form, Labour has signalled one or two market studies in manifestos before each of the 2017 and 2020 elections. Banking looks to be on the agenda for the 2023 manifesto.

Asked if the Government was concerned about bank profits, Hipkins told his post-Cabinet news conference yesterday:

“We’ve previously signalled that we’re concerned about the level of bank profits and that’s something that we will take some time to look at. I haven’t got an announcement for you on that particular topic today, but it is something that we have foreshadowed previously that we would look at.”

Media: Can we expect an inquiry into banking before the election?

“I certainly wouldn’t rule that out.” Hipkins via a transcript of yesterday’s news conference in the Beehive.

Given Hipkins is prone to saying he won’t play the ‘rule-in, rule-out’ game, this is effectively saying he’s likely to announce a market study of banks.

Plenty of official mood music around

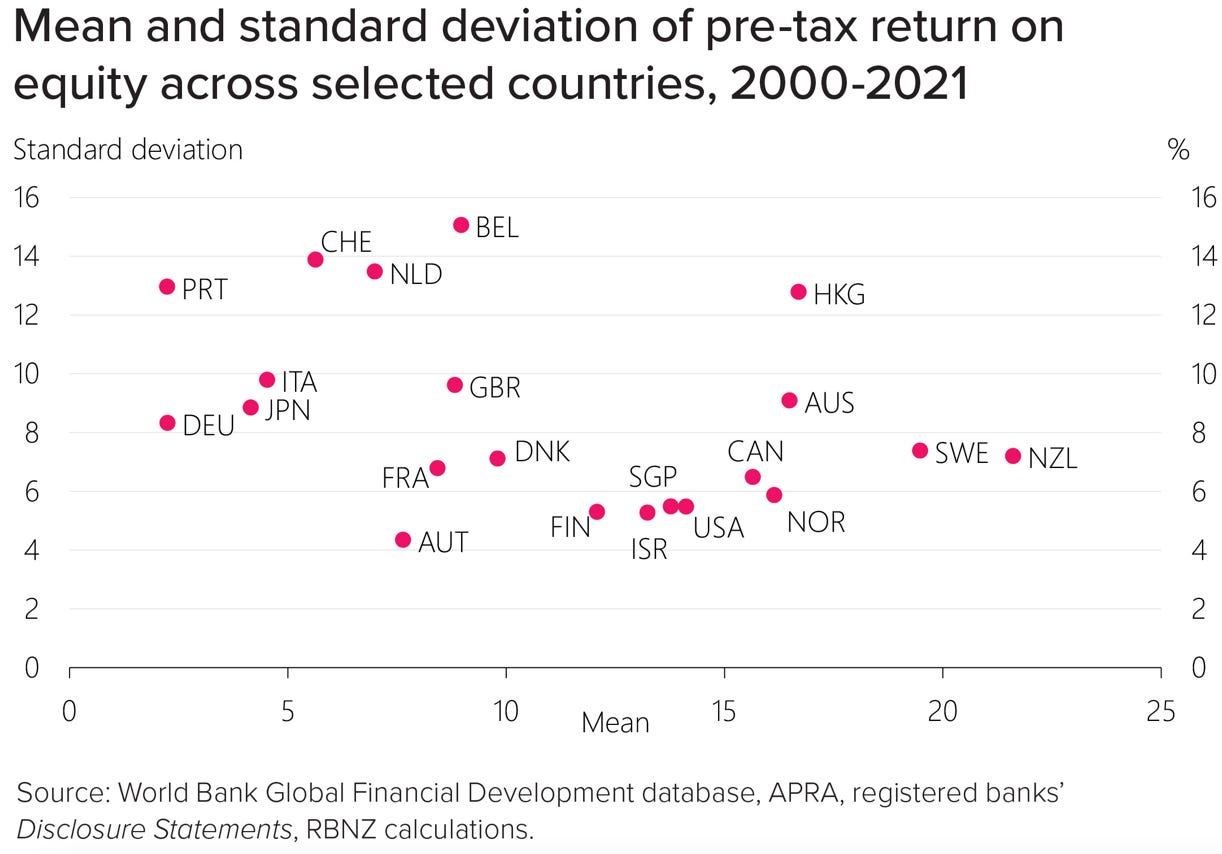

The Reserve Bank (Te Pūtea Matua) has also signaled it would appreciate a market study, particularly after publishing an extensive piece of analysis last week titled: Trends in bank profitability, which showed New Zealand’s banks were the among the most profitable in the world, but with the lowest volatility and least risk for shareholders. This Reserve Bank chart demonstrates the high-returns-for-low risk nature of bank profits here vs banks elsewhere:

Three of the big four banks have also reported their profits for the six months to March 31 in the last week, including:

ANZ NZ reporting (page 65) on Friday its half-year cash profit rose 13% or $96 million to a record-high NZ$842 million after it increased its net interest margin by 34 basis points to 2.67% and cut operating costs by $21 million, including reducing full time equivalent staff numbers by 154 to 6,785;

BNZ reporting on Thursday its first-half cash profit rose 23.5% or $157 million to a record-high $825 million, due largely to a 41 basis point improvement in its net interest margin to 2.45%; and,

Westpac NZ reporting yesterday a pre-provision1 profit of $748 million, up 8%, after increasing its net interest margin by 14 basis points to 2.10%.

ASB’s financial year ends on June 30 so it did not report in this round, but we’re likely to get an indication of how it’s going later today in a trading update in Australia from its parent, the Commonwealth Bank of Australia. ASB reported on February 15 its first half cash profit rose 11% to $822 million, driven largely by a 33 basis point increase in its net interest margin to 2.52%.

Bank profits growing twice as fast as the health budget

Collectively, the big four banks have made $3.237 billion of profit in the last six months, up 9.91% from the same half a year ago. That represents profit worth 1.658% of nominal GDP in the last reported six months, up from 1.654% of GDP in the same half a year ago. Nominal GDP rose 9.67% so the 9.91% rise in bank profits meant the bank profit share of the economy only rose slightly.

For comparison’s sake, Government spending on health is forecast to be $28.849 billion in the current year to June 30, up 4.3% or $1.191 billion from an admittedly Covid-inflated $27.658 billion the previous financial year. That means bank profits are growing more than twice as fast as public health spending and will be worth about a quarter of the health budget by the end of the year.

So why are profits so high and growing fast (albeit as fast as GDP)?

The big banks are now so big and so entwined in our housing market-with-bits-tacked-on-economy that the outsized growth of household spending, borrowing, residential investment almost automatically turns into high bank profits. When the real estate sales, development and equity withdrawal industrial complex grows faster than the real business sector and the non-real estate services sectors (such as health, education and transport), the banks do very well.

Owner-occupiers and residential property leverage their equity with bank loans to buy more homes for themselves and their kids, which the banks prefer to make relative to business lending, which is more complicated, risky and time-consuming. Effectively, our real estate obsession exists in a co-dependence with banking.

That means most of the competitive action and any recycling of profits to customers is focused on discounts for fixed mortgage borrowers, while the less competitive areas such as term deposits, transaction accounts and payment network fees receive less of the recycling. Given the relative out-performance after tax over the last 30 years of untaxed gains in residential land values, households with surpluses just save them up in banks and look for opportunities to gear them up in more residential land, rather than invest them in growing either their own real businesses or putting cash into equity in others’ real businesses.

This was best illustrated in Westpac NZ’s commentary on page 53 of the full commentary for investors released yesterday by Westpac Group

The net interest margin was up 14 basis points with rising interest rates improving

deposit spreads and returns on capital balances. Loan spreads continued to decline due to a competitive mortgage market. Westpac commentary on NZ profits.

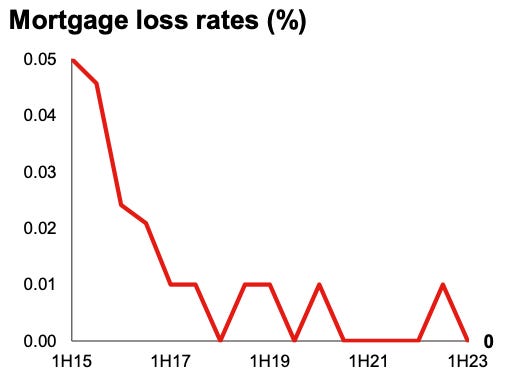

Westpac’s profits would have been higher, if not for regulatory intervention to reduce card fees for all banks and a Reserve Bank requirement to cordon off its IT systems to be more resilient. As with the other three banks, Westpac reported continued very low losses from its mortgage loans, given the sharp rises in equity and borrower incomes in the last 20 years, and very low interest rates for almost all of that time until now. Westpac grew its mortgage lending by $1.4 billion to $65 billion in the first half year from the second half of the previous year, while its business lending was flat at $32 billion.

The big four have also been very effective at reducing their cost to income ratios over the last three decades, buying up rivals such as Trust Bank, Post Bank, National Bank, Rural Bank and Countrywide and then closing duplicated branches, especially in some rural areas where the big four have pulled out altogether.

This pull-back from the regions was particularly evident during the fallout from storms earlier this year, where bank branches and ATMs in remoter rural towns and small cities were not available for days on end because of power, internet and telecommunications outages.

When efficiency trumped resilience

The Reserve Bank made a point in its Financial Stability Report last week of calling out the banks’ downgrading of resilience and accessibility in provincial areas because of what happened during Cyclone Gabrielle.

The disruptions to the cash industry caused by Cyclone Gabrielle have highlighted the lack of resilience in the cash system and its vulnerability to power, data, and road network outages, particularly due to banks reducing branch and ATM networks and retreating from offering in-branch cash services for retailers. Given the increased likelihood of extreme weather events in the future as a result of climate change, this lack of resilience in the cash sector will need to be addressed.

This will be an increased focus in our prudential supervisory engagement, as well as a consideration in cash system redesign work under our Future of Money – Te Moni Anamata programme. Reserve Bank commentary in FSR (page 24).

So is all the profit growth justified?

The Reserve Bank also suggested some reasons why the banks’ profitability was higher than their similar sized peers overseas and their smaller rivals here in its analysis last week, including:

greater economies of scale after the various mergers;

lower head office costs, given their parents’ offices are in Australia;

lower risks and therefore higher risk-adjusted returns because the big four here don’t do fancier (and riskier) things such as investment banking and funds management; and,

investors living in Australia who own bank shares can’t use the ‘franking credits’2 from the New Zealand earnings portion of their banks’ profits.

Isn’t it good to have profitable banks that are strong?

The banks themselves and the Reserve Bank (albeit in a hesitating way) have argued the high and growing profits are both a reflection of legitimate market activity and a driver of strong banks.

It’s true our banks have relatively high equity capital levels, as do their parents in Australia. But that is at least partially due to the Reserve Bank here and the Australian Prudential Regulation Authority (APRA) both having more conservative capital requirements than regulators overseas. The Reserve Bank here has also dramatically increased its requirements, relative to regulators overseas and APRA. That is forcing banks to put aside more capital now, largely by reducing dividend payments to their parents over time. In theory, that shouldn’t affect the profitability over time, but it may lead to the local units trying to create extra profits to keep up with the dividend payments.

The local bank CEOs have argued in the last week that their profitability ratios in terms of return on equity are no higher than those of listed NZX companies. That may be true, but doesn’t take into account that the profits of those NZX companies are both collectively smaller and more volatile, so therefore should attract relatively higher returns on equity than banks.

The Reserve Bank appeared to side with the banks in its final comments in the analysis, although there was a slight passive-aggressive sting in its very last comment (bolding mine):

The benefits of profitable banks are particularly evident in the current environment, with New Zealand banks in strong positions to manage increasing stress in their lending books and a deterioration in global economic conditions.

Importantly, profitability allows banks to support their customers by taking a long-term view in times of stress. It also enables the necessary investment in systems to improve efficiency and operational resilience. Therefore, profitability puts banks in a position to earn their social licence by contributing to a sound, efficient, inclusive, and dynamic financial system. Reserve Bank comments on page 25 of FSR analysis of bank profitability.

The Reserve Bank went on to include a full analysis of financial inclusion and stability in the FSR, which made the point:

Since 2016, for instance, the nine largest providers of banking services in the United Kingdom have been legally required to offer basic bank accounts, which has contributed to inclusion and acted as a stepping stone for people to access further banking services. Reducing the unbanked population helps grow the balance sheet of the formal financial sector, and broadens the base of low-income savers and borrowers who often maintain steady depositing habit. Reserve Bank in Box B on page 26 of the of FSR

Where have all the ATMs gone?

Global Finance magazine reported in 2021 that just 1% of the population in New Zealand was unbanked, which was more than Australia and Canada on 0%, but better than the UK on 4% and the US on 7%. However, New Zealand fares much worse on access to ATMs at 63.5 per 100,000 people, less than a half of Australia’s 146.1 and less than a third of Canada’s 214.1.

…we don’t tax land or wealth, and therefore don’t invest as much in R&D and infrastructure as other countries, which means our mortgage-based banks will by necessity be larger and more profitable.

The issue of access to bank services is separate to whether the banks are generating super-profits from a lack of competition, but are certainly part of the social license issue for the banks emphasised by former PM Jacinda Ardern and noted again by the Reserve Bank last week.

A market study may well find the banks are hyper-competitive in some areas such as fixed-term mortgage lending and term deposit accounts (when interest rates are high and/or rising), but not in others such as transaction accounts, savings accounts and transaction fees.

Perhaps we should turn the finger of blame upon ourselves

But any market study may also make the point that we have the banks we want and deserve. Ultimately, the fingers of blame could just as easily turn back on the Government and voters themselves (ourselves). Without giving up on the tax-free status of leveraged gains on residential property, it’s hard to change the underlying incentives that mean our four banks earn as much in profit together as all 122 companies listed on the NZX, and with much less volatility.

We may be frustrated our banks are so profitable, but that’s just the way we have effectively built our economy and financial futures around borrowing against the value of the land under our houses, and therefore, just the way we really want it. A market study will satisfy voters and politicians looking for someone else to blame, or for a distraction from the core issue, but it won’t change that underlying problem.

Not much really changes in our housing market with bits tacked on until we we start taxing the leveraged wealth in residential land, just as other forms of income and spending are taxed here, and just as capital gains, land and inheritances are taxed in other countries.

The study may well find the reason why our banks are more profitable relative to the risks than for other similar sized banks in other countries is the same reason why the rest of our economy and society is under-invested in public infrastructure and services has underperforming on productivity relative to other countries: we don’t tax land or wealth, and therefore don’t invest as much in R&D and infrastructure as other countries, which means our mortgage-based banks will by necessity be larger and more profitable.

Ka kite ano

Bernard

PS. Do you want this one opened up entirely?

This figure is the most comparable with the others. Westpac NZ Limited Banking Group’s net profit fell 6% to $467 million from the same half a year ago, largely due to assumed bad loan charges of $154 million, including $66 million of assumed ‘weather overlay’ from storm losses. Most of the provisions are from Westpac’s business lending.

'Franking credits’ are credits attached to the dividends from a company that has already paid tax so the dividends are not double-taxed when the individual declares their income for tax purposes. The franking credits from the New Zealand earnings of the big four can be used by investors living in New Zealand, but aren’t accessible by Australian-based investors, and vice-versa. This issue of mutual recognition of franking credits between Australia and New Zealand has been a thorn in the side of Trans-Tasman relations for decades, largely because the net effect would be a large reduction in tax receipts for the Australian Federal Government, due to the large scale of the imbalance in relative dividend flows to and from Australia and New Zealand.

Share this post