TLDR: Momentum is growing towards a supermarkets-style breakup of Fletcher Building’s GIB monopoly, reinforced by the Government’s increasing focus on blaming monopolies for at least some of the inflation that is eroding its popularity and has driven consumer confidence to record lows. Paid subscribers can see more detail and analysis below the paywall fold, and leave comments on further lines of inquiry.

Elsewhere in the news overseas and here this morning:

Auckland GPs report a winter flu crisis has spilled back out of A&E departments and into their surgeries (NZ Herald), while Wellington’s DHBs are giving vouchers for patients to visit GPs instead of coming to A&Es (RNZ) and the Government denied the health system was in crisis (RNZ);

Wellington Council faces a once-in-a-generation decision this afternoon over whether to approve a new 1,281 page District Plan that would enable an extra 73,400 homes in the City over the next 30 years; (Dominion Post)

The NZ Super Fund is among the bidders Spark’s mobile towers seen worth NZ$1b; (The Australian-$$$)

Kelloggs announced overnight surprise plans to spin off its North American cereals business, including its Cornflakes brand, and keep its snacks group, including Pringles chips and Cheez-It crackers; (Reuters)

Russia warned NATO member Lithuania of ‘serious consequences’ if it continued its blockade of trains through its territory to the Russian enclave of Kaliningrad; (BBC) and,

US stocks rose 2.5% this morning as bargain hunters sorted through the rubble after the market’s 6% fall last week and its 20%-plus fall this year , although it’s not clear this is a ‘bottom’ in the latest slump or another dead cat bounce. CNBC

GIB carveup and Placemakers spinoff nearer

Members of a GIB crisis taskforce set up by new Building and Construction Minister Megan Woods yesterday have called in the past for the forced sale of Fletcher Building’s GIB monopoly and its Placemakers hardware chain.

The political momentum is building towards a supermarkets-style breakup of Fletcher Building’s 95% share of the plasterboard market after the appointment of Simplicity Living’s Shane Brealey and anti-monopoly campaigner Tex Edwards, both of whom have proposed Government-imposed interventions in the past, to Woods’ new taskforce yesterday. Edwards also wants to see BRANZ, the industry-dominated setter of building material standards, abolished.

The minister also threw in a warning to Fletcher Building in her announcement not to try to enforce the trademarks on its new coloured versions of GIB.

Attention will now turn to the Commerce Commission’s draft report from its ongoing market study into building materials. That report is due next month and its final report is due in December.

Grocery duopoly measures toughened

Woods’ announcement came as Commerce Minister David Clark announced a toughening of the Government’s legislation yesterday to stop supermarkets using land covenants and lease exclusivity provisions to block competitors.

The select committee considering the Grocery Sector Covenants Amendment Bill recommended in its report a widening of the application of the bill to stop the grocery duopoly blocking non-grocery retailers from shopping centres and handing over policing of the rules to the Commerce Commission.

The bill passed its second reading in Parliament last night with the support of all parties. Hansard

Consumer confidence collapses to record low

It was the best of times. It was the worst of times.

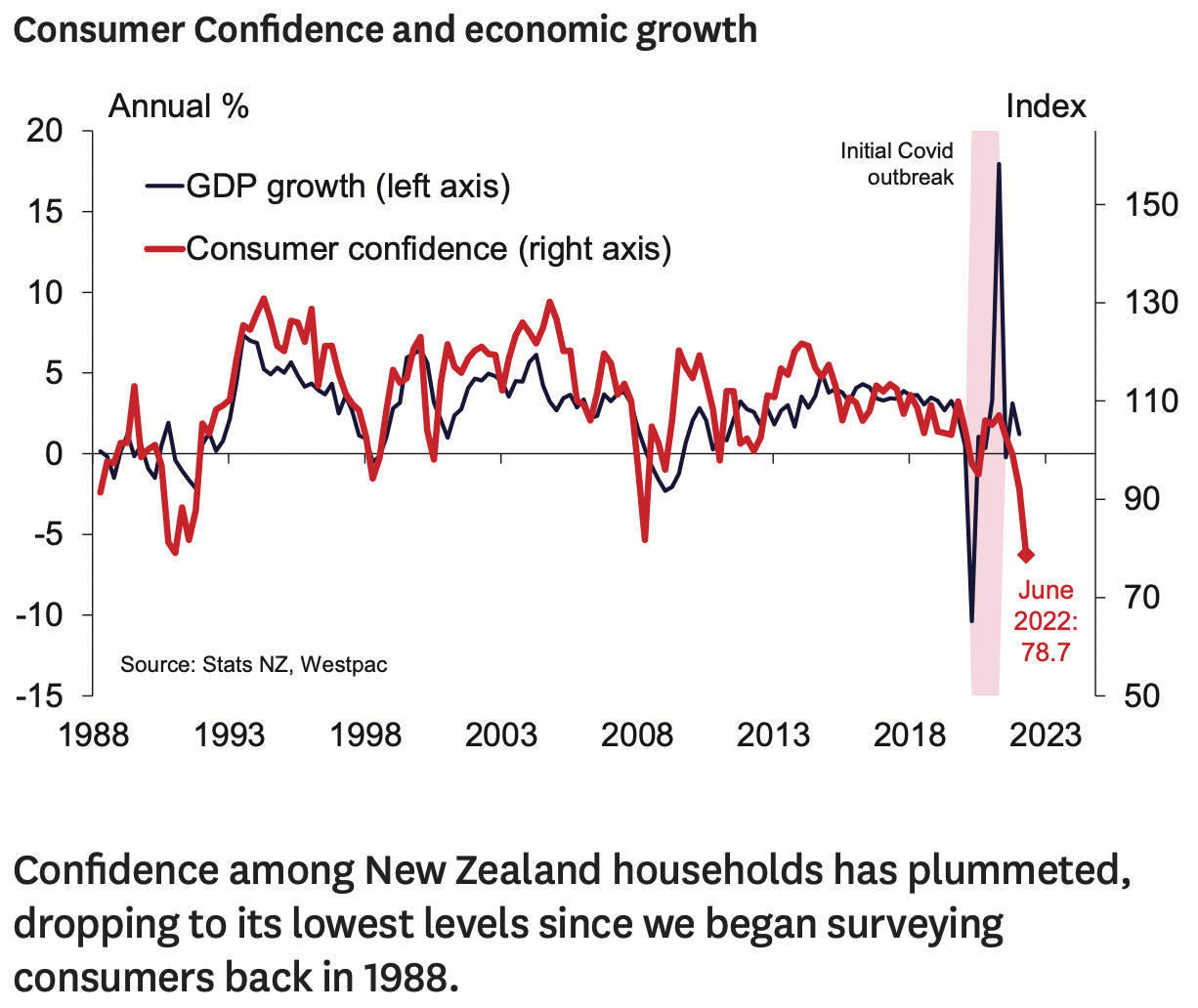

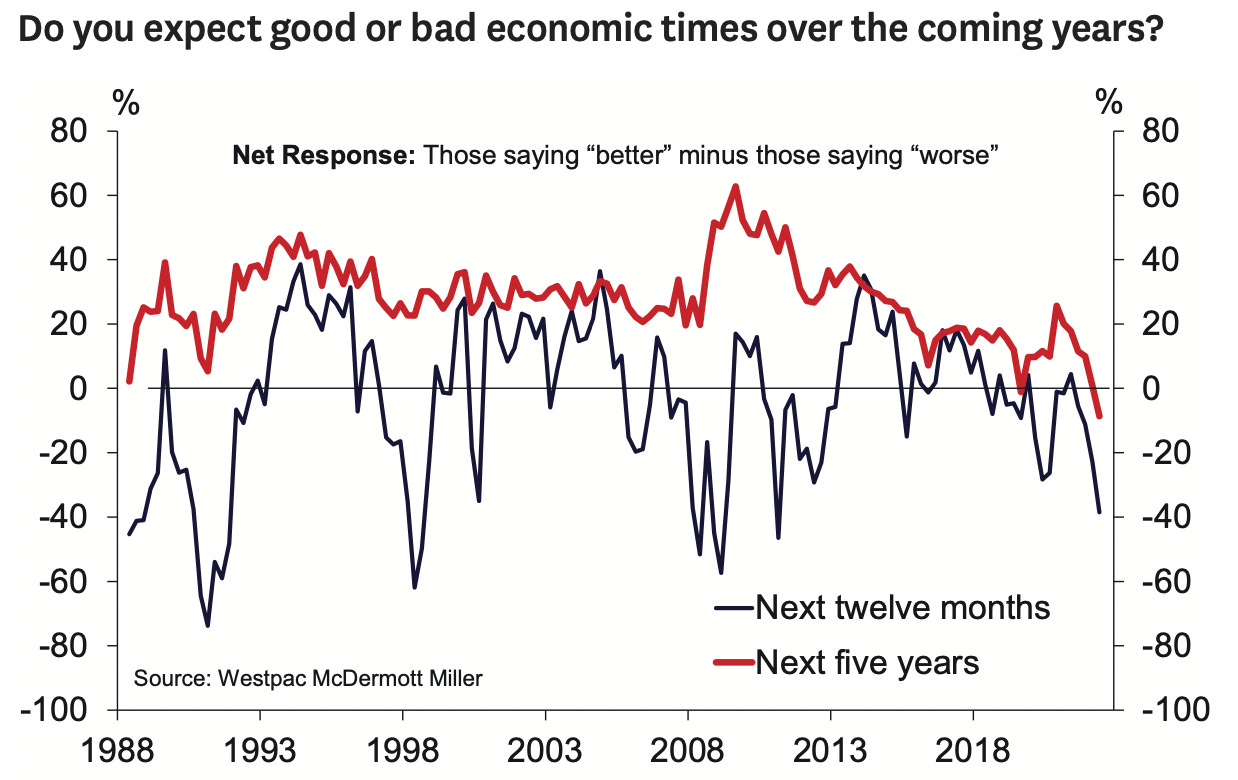

Westpac published its McDermott Miller survey of consumer confidence for the June quarter yesterday, showing the worst result in the survey’s history since it started in 1988. That is worse than in the depths of the Global Financial Crisis, worse than in the deep recession of 1990 and 1991 when unemployment rose to 10.9%, and worse than in the initial panic phase of the pandemic in March 2020.

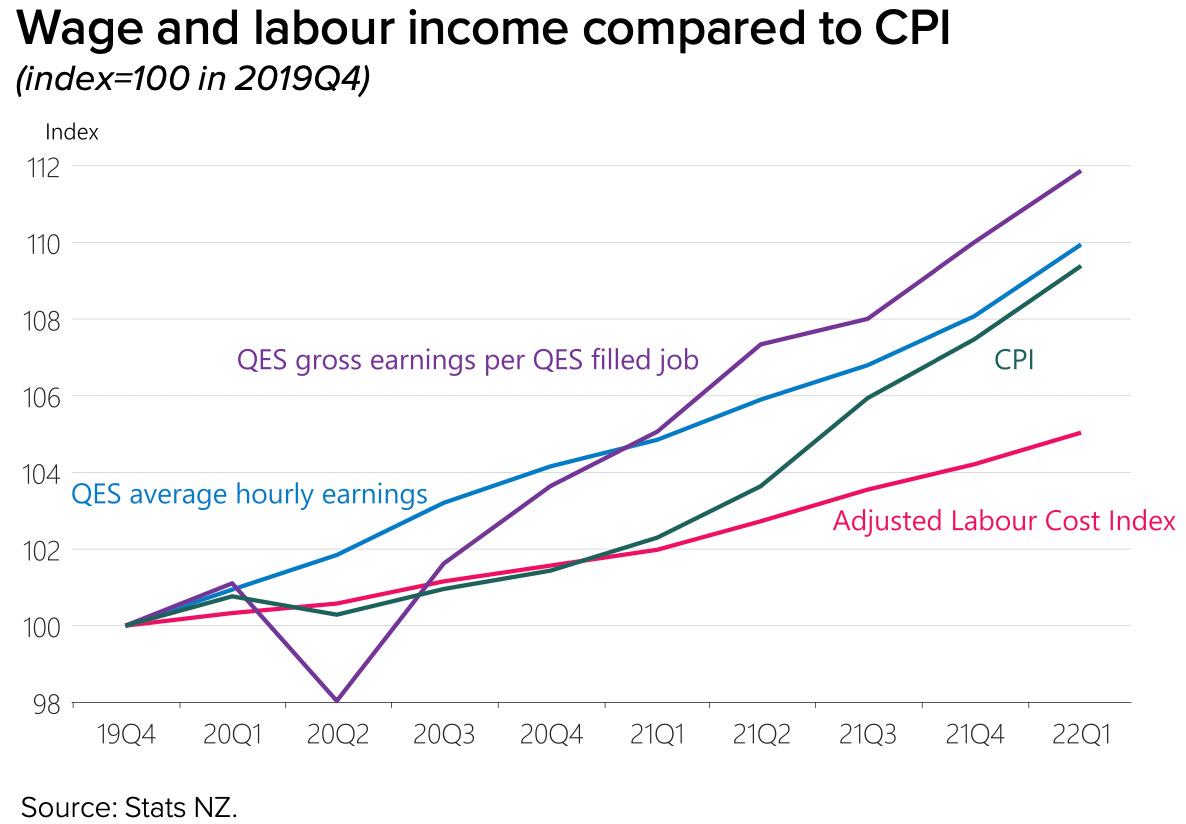

It is extraordinary, considering home-owning households are sitting on net wealth gains of over $700b since the onset of Covid and unemployment is at a record low 3.4%, along with gross earnings per job having risen faster than CPI inflation (see RBNZ chart below) since the onset of Covid, even if hourly wages are currently not.

(Not) going to Harvey Norman?

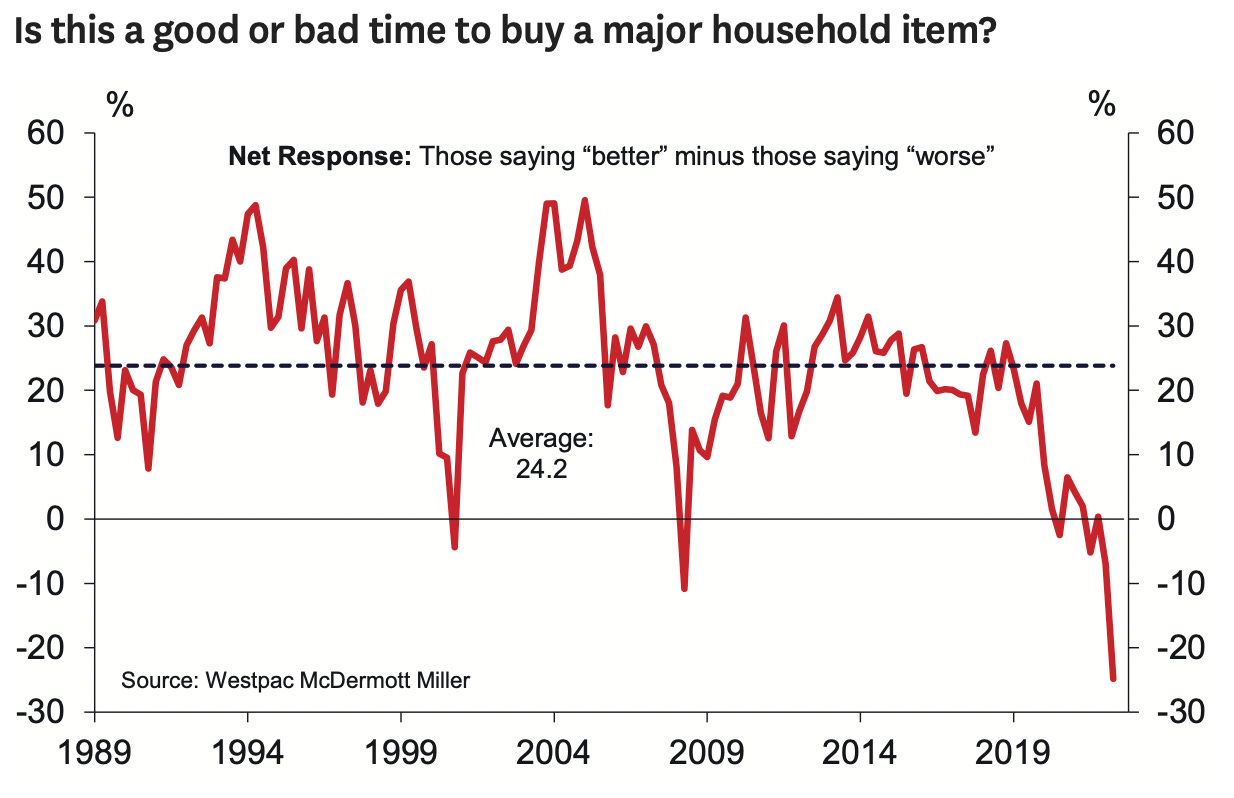

The indicators of consumer confidence fell violently across the board, including for buying a major household item. This contrasts with recent relatively buoyant sales figures for white goods and household items such as TVs and couches.

So what? - Consumer and business confidence are good leading indicators (usually) for economic growth and for political support for the Government. This year is turning into both a summer and a winter of malcontent for Labour.

Quotes of the day

Bear rally or capitulation?

“The outstanding question is whether this is simply a bounce or the bottom. I think that this could certainly be a bounce but not the bottom because the one missing ingredient is a fear-based capitulation sell-off.” Sam Stovall, chief investment strategist at CFRA Research via CNBC

“We were overdue a bear market rally, as being down for 10 out of eleven weeks is a bit extreme. It doesn’t really change the bigger picture of growth slowing down and tightening financial conditions.” Hani Redha, multi-asset portfolio manager at PineBridge Investments via FT-$$$.

Chart of the day

Less worried than before in short run, but freaked about long run

Number of the day

Consumer spending doesn’t match the ugly consumer sentiment

$1.7b - Seasonally-adjusted durables spending via credit and debit cards in May, which was unchanged from May a year ago and up 0.2% in seasonally adjusted terms from April. That’s despite the record low figures for consumer confidence overall and intentions to buy major household items.

So what? - In my view, something weird is going on with our collective economic psyche, or at least how we answer surveys. I blame social media…

Comment of the day on The Kākā

The problem with BRANZ

“Bernard, it would be interesting to dig into Branz to better understand it’s governance structure and whether it is fit for purpose for our time. It seems to me that it’s questionable that a private organisation should have so much control over materials in the NZ market, especially given the pressures in housing here.” Harrison on yesterday’s Dawn Chorus.

Some fun things

Ka kite ano

Bernard

Share this post