TLDR: Auckland Mayor Wayne Brown wants to sell the council’s $2 billion stake in Auckland International Airport to cut interest costs by $88 million per year and try to fill a $295 million budget ‘black hole’.

But he is ignoring the annual losses of over $160m a year to run the council’s 13 golf courses, which have a combined value of well over $2.9b. He also has made no case for emergency asset sales to deal with some sort of fiscal ‘crisis’, given Auckland Council’s blue-chip-level AA credit rating is stable and its interest costs are forecast by Standard and Poor’s to be around 10% of revenues for the next three years.

Brown’s case for selling the shares in Auckland Airport cannot be justified by:

the current financial outlook, given the council itself sees its main debt to revenue forecast falling well below its self-imposed limit over the next five years; its borrowing requirements are scheduled to fall over the next five years; and it has ample resources to roll over its existing debt;

the alternative investment case for asset sales, given selling the council’s golf courses would reduce the ongoing losses from running the courses of over $160 million per year and raise north of $4 billion in an asset sales process, which would lift the combination of avoided losses and interest savings to over $320m a year;

the alternative long-term investment case for keeping the council’s 18% share in the Airport is compelling, given airport traffic is rising fast back towards pre-covid levels and the shares generated returns of 22.6% per year in the five years to 2019, which is dwarfs the cost of debt at around 4-5%; and,

the alternative investment case for using the sale proceeds to invest in public transport would generate much higher returns to Auckland’s ratepayer than 4-5% per annum through reduced congestion and lower carbon credit costs in future.

So why is the Mayor talking as if there is a fiscal crisis that ‘demands’ asset sales? And if there is such a crisis, why isn’t the Mayor proposing selling the golf courses to residential property developers to build tens of thousands of new homes and open up the courses’ green spaces to the public? Or investing any share sale proceeds in public transport rather than debt reduction?

the main aim is to preserve and accelerate leveraged and tax-free gains on residential land values for land owners

The logical conclusion would be that Brown’s arguments obscure an ideological view that the public shouldn’t own shares in publicly listed companies or commercial operations and should wherever possible reduce public debt. The plan to sell shares and cut debt is also part of a long-running ideological view that the role of Government providing services and investing in infrastructure could be limited and progressively reduced over time to allow more tax cuts and to increase the privately-owned share of activity and resources in the economy.

However, I think it’s simpler than that. Wayne Brown is actually simply expressing a view held by most asset owners and investors in Aotearoa-NZ’s economy, or as I call it, a housing market with bits tacked on. That deeply held and and so-far-extremely-profitable investment strategy is that owning shares or investing in businesses in Aotearoa is vastly inferior to owning land, especially leveraged residential land, and even better if it is residential-zoned land that remains banked and undeveloped. The comparative after-tax returns on equity over the last 30 years are spectacularly higher for land bankers and residential land owners and occupiers than for investments in shares or even privately-held businesses. There’s no contest. It’s not even close and that has been by design and omission through Government policies endorsed repeatedly in local and central elections since 1984.

Wayne Brown is being exactly what he is: a property developer who has actually made most of his personal money from land price appreciation on land made valuable through rezoning and paying for water connections at a lower-than-full cost. Here’s more detail on that in the Auditor General’s report on Brown’s development project near Kerikeri. Brown was eventually forced to pay the council he was Mayor of $75,000 in unpaid development contributions.

Ultimately, the role of Government in this scenario where the main aim is to preserve and accelerate leveraged and tax-free gains on residential land values for land owners is to ensure more demand for housing from migration and lower interest rates, and less supply of housing through restricting land supply and the ability of others to rezone land for housing.

Auckland Council’s 600,000 ratepayers are paying the equivalent of $500 for each round played by just over 1% of the ratepayers who are members of the 13 clubs

There are a few ways to do this through Government policy, including:

restricting central and local Government investment in infrastructure that would open up new land supply for residential housing, thus limiting the total supply;

reducing council and Government debt to lower interest rates by more than would otherwise be the case, which in turn automatically lifts asset values and has a double-whammy benefit of stopping new investment in infrastructure for housing and pressing down on council appetites to rezone other land for housing;

reducing public spending on public transport infrastructure that would allow more brownfields housing development closer to CBDs and therefore reduce the relative value of residential-zoned land banked on the edges of cities;

ensuring no introduction of capital-gains or new land value taxes to ensure the tax advantages of holding land relative to shares; and,

encouraging strong population growth through migration of lower-wage labour that both expands demand for housing and lowers wage inflation, which creates the double-whammy benefit of lower inflation and interest rates than would otherwise be the case.

Wayne Brown’s proposal to sell shares and cut council debt is completely in tune with this strategy above, which has been the dominant one in central and local Government governance for 30 years. Politicians and many of the officials running both councils and the big ministries actively see their role as containing and reducing the scale of Government services, debt and involvement in the economy, which creates the low supply/high demand conditions for further tax-free, leveraged and spectacular gains in residential land values. Charitably, it is because they don’t trust politicians to do the fiscally responsible thing over the long run and believe these cultural and unapproved (but very real) constraints on public debt and the size of Government. Actually, the playbook of fiscal conservatism, debt reduction and limits on tax/gdp and net debt ratios serves the purpose of starving the public sector and those voters without resources who would benefit, while further enriching landowners.

Wayne Brown’s plan to ‘sell the shares and keep the land’ is a perfectly natural instinct for a land banker and is broadly popular with the 60% of households (and more like 80% of local election voters) who own residential land. This policy embeds the settings in our housing market with bits tacked and creates a future where only those with parents able to help with deposits can hope to join or stay in the land-owning class and be able to raise their own families in the land they were born in. The rest can look forward to either a future as permanently poor renters who both pay and serve the land-owning class.

The rest who have a few personal resources, such as education, can only aim to emigrate to join the other one million compatriots who work, live and build their families overseas. It also embeds a population growth machine that sucks in ever-larger numbers of overseas and often temporary workers to replace and augment the locals leaving. That is possible because there are at least 100 million richer people in India, the Philippines, China, the Middle East and Southern Africa who want to move to a relatively (and literally) cooler, ‘cleaner’ and more stable country.

There is no emergency

Brown’s plans are not about some sort of fiscal crisis that requires emergency action. There is no emergency. I detailed below the paywall fold (now opened up)

there is no emergency for council finances;

what the alternative options would be if council decided to create such an emergency; and,

how the ‘just sell shares and bank the land’ strategy works in the current version of our political economy dominated by low public investment in housing infrastructure, brutally high housing costs, no capital gain or land value tax and low public debt.

So what did Wayne Brown just propose?

Auckland Mayor Wayne Brown announced on Friday the Council would consider this week his proposal to sell the Council’s 18% stake in Auckland International Airport for around $2 billion, which would in turn save $88 million per year.

“Over the last three years, ratepayers have paid $240m in debt servicing costs to hold a bunch of shares that haven’t paid a cent in dividends. The cost of holding these shares exceeds any return, and forecasts suggest this situation will not be reversed for Auckland Council as a shareholder in the foreseeable future. There are better uses for ratepayer capital.

“If the airport needs additional capital for new projects, Auckland ratepayers could be asked to stump up extra cash or see our ownership stake fall even lower.

“Every cent we raise from the sale of the 18 per cent minority stake would be used to lower net debt. The money we save from debt servicing in 2023/24 will be used to reduce rate rises by about a third from levels feared and, in 2024/25, and priority will be given to help support new initiatives for local boards.” Wayne Brown in a statement.

The previous day Brown announced the council had found $130 million of cost savings for the 2022/23 year to “help bridge a forecast budget hole of $295 million.”

“These savings are just one part of my budget proposal, which will help keep rates affordable for Auckland households amidst this cost-of-living crisis and rising mortgage rates.” Brown in a statement.

The week before that he had warmed up the public for the cuts with this statement talking about a blowout in the Council’s budget deficit to $295 million. (Bolding mine)

“Left unaddressed, a $295 million budget hole would require rates rises of over 13 per cent, followed by further substantial increases in future years,” Mayor Brown said.

“It is by far the biggest fiscal hole in Auckland Council’s history, except for the once-in-a-hundred emergency budget when our city was put into lockdown.

“Double-digit rates rises are totally unacceptable and will not happen under my leadership.

“We aim to keep rates rises below inflation to reduce the pressure on Aucklanders now being hit by the economic and fiscal storm I warned about through the campaign and since becoming Mayor. It could still get worse.” Brown in a statement

But is the Council’s financial situation really that bad?

Warnings about “fiscal holes” and “economic and fiscal storms” are things politicians should be careful about. Former UK PM Liz Truss adopted similar ‘crisis’ language just that a few months ago, triggering a collapse in Government bond prices, which increased UK bond yields and increased British mortgage rates.

It was seen as a real crisis and the Bank of England had to bail out the British financial markets with tens of billions of pounds of money printing. Within weeks Truss had been kicked out by her own MPs, although in her case Britain is actually heavily in debt and in danger of a blowout in interest costs relative to taxes, in large part because Truss promised to cut taxes.

So what is the Council’s actual financial position? And how dangerous is it, at least in the minds and projections of the ratings agencies and bond investors who are paid to analyse the Auckland Council’s finances.

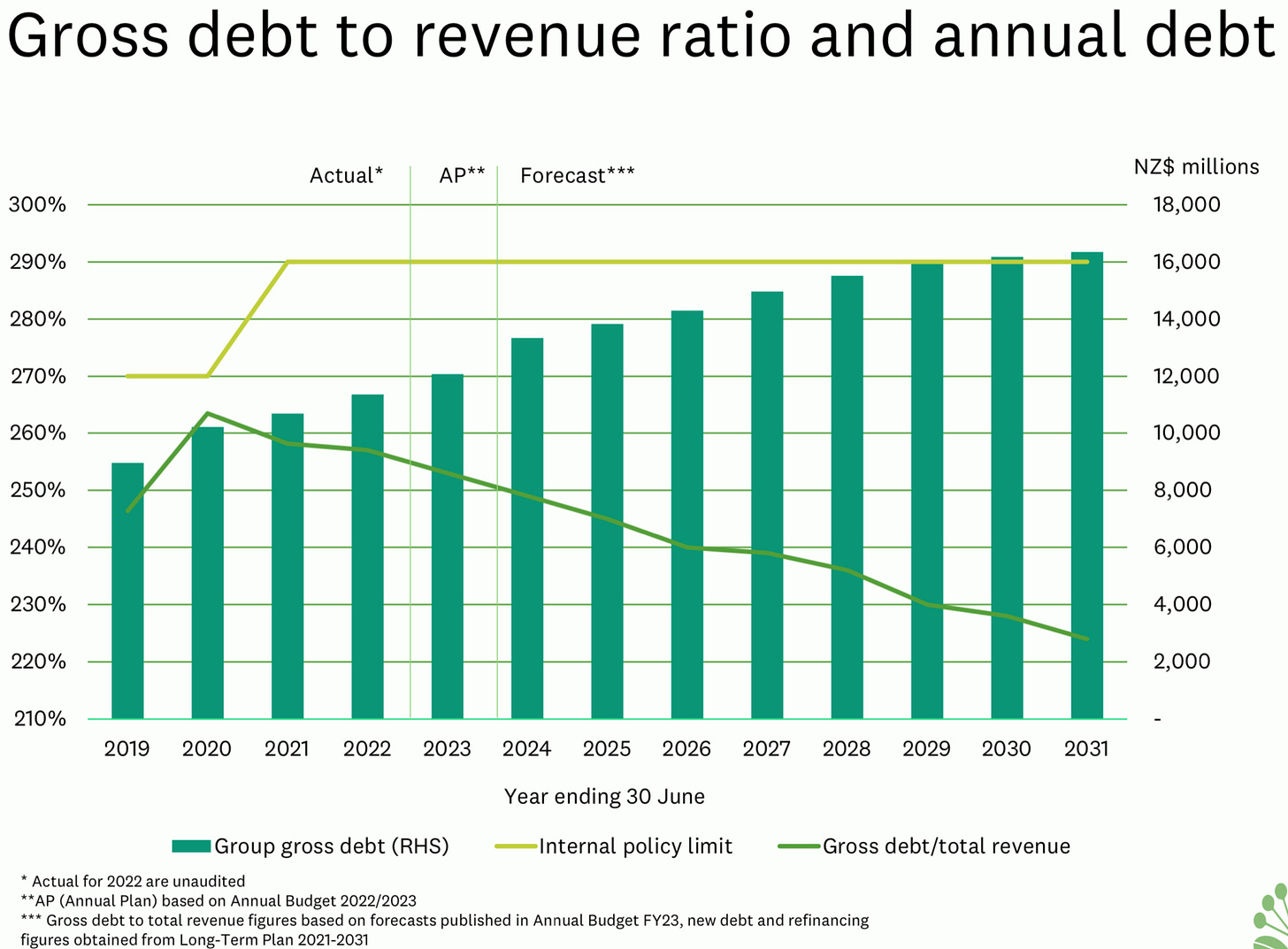

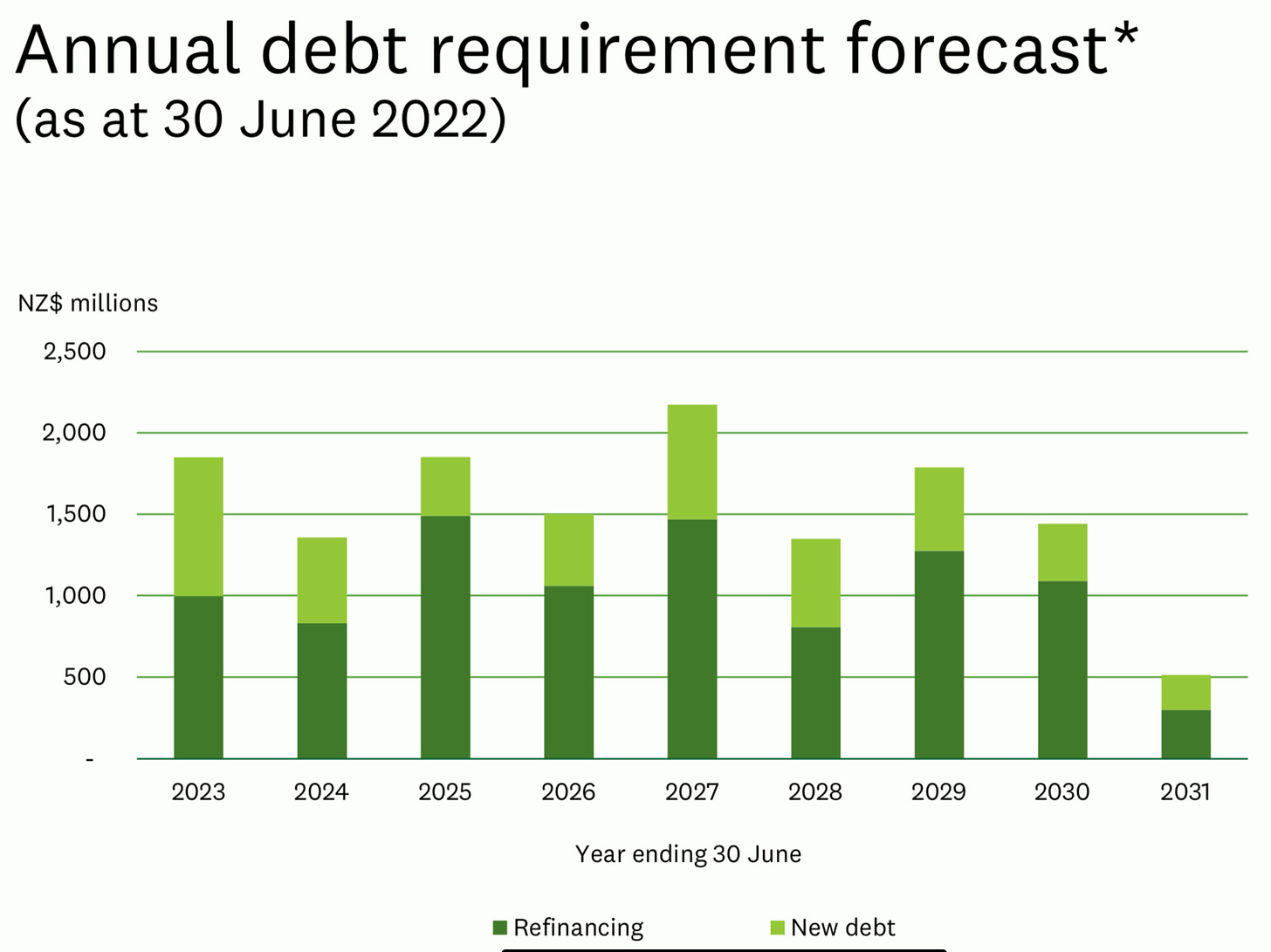

Luckily for us, the Council itself published a financial update just two months ago for the holders of the $11b worth of debt it owes to bond holders and banks here and overseas. That showed the council’s debt levels and servicing ratios well under its self-imposed ceilings and trending lower of the coming years. Here’s a few samples from the presentation.

The first chart shows the main metric councils focus on because there is a formal limit using that metric imposed on them by the Treasury-dominated Local Government Funding Agency. It is the measure of gross debt to council revenues, which is limited to 270% and is currently around 250%. It is headed for 220% over the next decade.

That measure also underestimates the strength of council balance sheets and ability to pay interest. For example, Auckland Council’s gross debt of $11.4 billion is currently worth less than 10% of Auckland’s GDP and less than 16% of the council’s assets. That compares with the central Government’s gross debt of 35.9% of GDP currently and British Government’s 102% of GDP. The borrowing costs are still just 12% of revenues and projected to fall under 10% within three years.

10% debt/gdp & 12% borrowing/revenue ratios not a crisis

Would you be worried if you mortgage was costing you less than 10% of your disposable income to service and your Loan to Value Ratio (LVR) was 16%? No. And neither should the council. Wayne Brown is talking “fiscal crisis” for a situation that is one tenth as dangerous as an actual fiscal crisis.

The Council itself appeared far from worried in April when it updated investors through the NZX in this statement:

“While there are challenges in terms of operating budgets, the Council’s projected debt to revenue ratio remains well within prudential limits. This means there is sufficient debt headroom to respond to future financial shocks.” Auckland Council in April 13 statement.

Standard & Poor’s, which is the rating agency paid to judge fiscal crises, was also very relaxed in the September 20, 2022 report that reaffirmed the Auckland Council’s AA rating with a stable outlook.

Here’s S&P’s commentary, which I’ve included at length just to reinforce the expert view on the Council’s situation:

“Auckland's budgetary performance is improving. We forecast the council's after-capital account deficits average has lowered, to about 9% of total revenues between 2021 and 2025, from 12% between 2020-2024. However, an immediate squeeze on the council budget persists.

“COVID-19-related impacts on council revenues, including slower reopening of services, reduction in fees and charges, and lower dividends are persisting longer than the council anticipated. Likewise, current economic conditions, including rising interest rates, inflation, and labor market tightness are driving up costs.

“The council's immediate response to short-term budgetary pressures leaves it well-placed for a swift recovery. The council is deferring NZ$230 million of small-scale capital expenditure over the next three years and reducing lower-priority service offerings from fiscal 2023. The introduction of a new climate action targeted rate will raise an additional NZ$57 million per year on top of planned rates increases of 3.5% per year.

“Auckland's operating balance will remain strong, averaging 22.1% of operating revenues across 2021-2025. Immediate financial outcomes are further supported by the first tranche of the Crown's "Better Off Support Package." The council will receive NZ$127 million in one-off grants to support the transition to the "three waters" model. This grant is fully captured in our forecasts for fiscal 2023.

“Our forecasts incorporate a 10% underspend in the council's capital expenditure compared with its own budget. The Crown remains supportive of Auckland and continues to fund half of the City Rail Link project, including cost overruns. We have not included provisions for cost overruns in our financial forecasts yet because of the uncertainty involved; nevertheless, costs are likely to rise.

“Our estimate of Auckland's tax-supported debt burden (including non-cancellable operating leases) will move to about 243% of adjusted operating revenues by fiscal 2025. This is down from about 266% in fiscal 2022. While capital spend remains at high levels, the council's debt trajectory is likely to decline as it receives Crown funding via initiatives in the form of grants.

“Interest expenses as a proportion of operating revenues will average about 10.2% between fiscal years 2022 and 2024, and will remain above 10% going forward, in our view, reflecting the higher interest rate environment.

“We estimate the council's debt-service coverage ratio at 141% of debt maturities and interest payments over the next 12 months. The ratio includes internal sources of cash and liquid assets after budget needs, and NZ$1.4 billion of undrawn standby facilities.” S&P in September 2020 report.

But if it is a crisis, what would be best to sell?

Assuming there is the crisis Brown talks about, what would be the financially most sensible thing to do to rectify it, either to reduce ongoing losses and/or to repay debt?

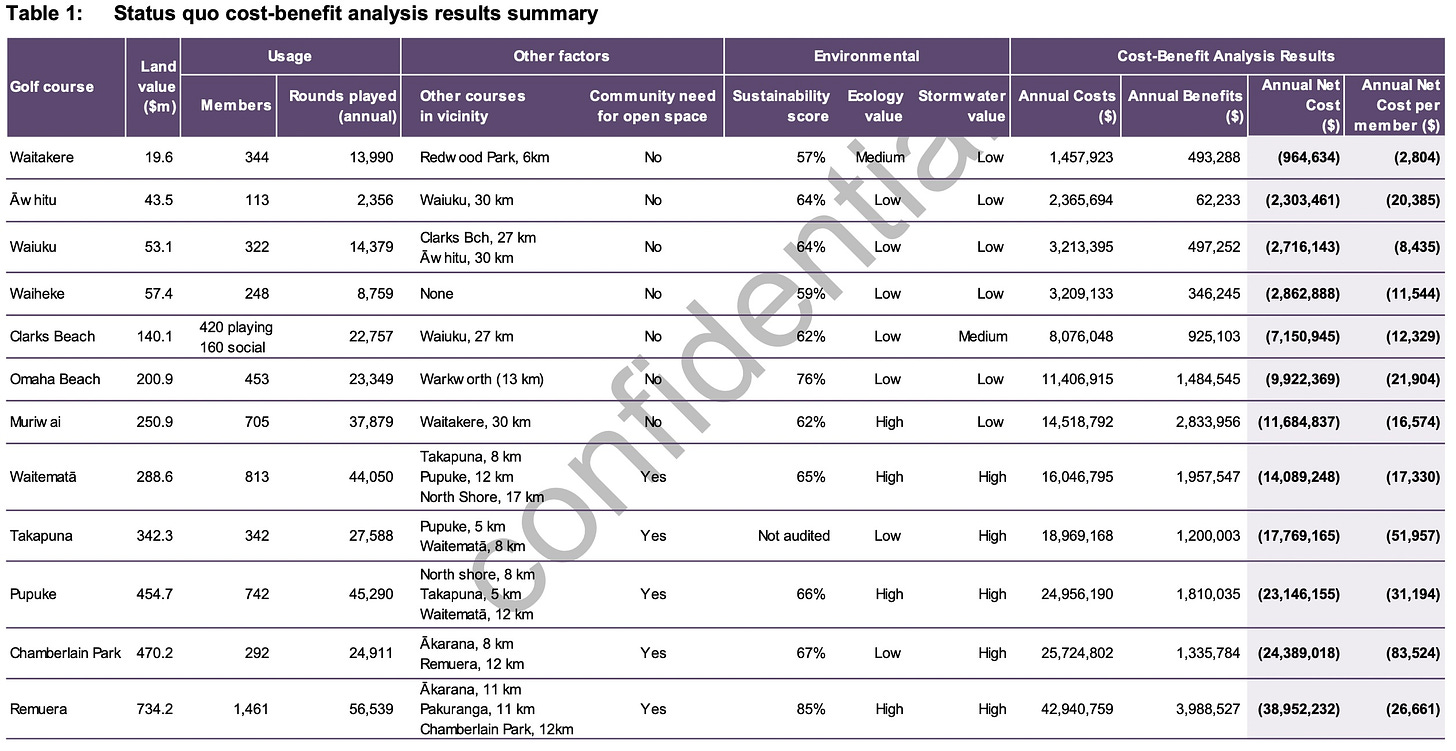

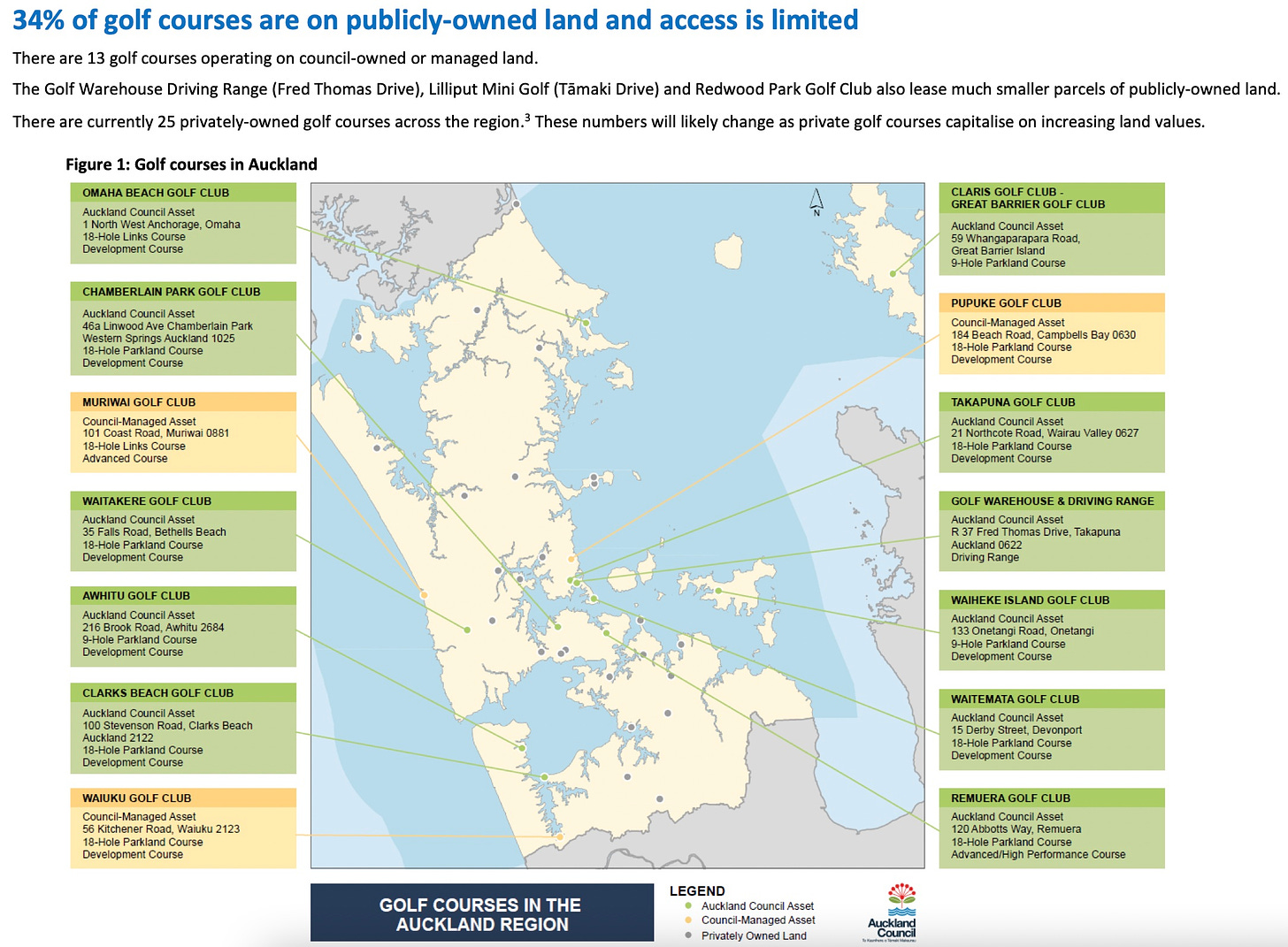

The Council could easily sell its 13 golf courses, which MartinJenkins estimated in a 2018 report were then valued at $2.9b and were costing over $160 million in effective losses and subsidies from the Council to the clubs’ 6,415 members. That’s the equivalent of $500 of public subsidy for each of the 321,000 rounds played each year.

Let that sink in. Auckland Council’s 600,000 ratepayers are paying the equivalent of $500 for each round played by 6,415 of the courses’ members, or just over 1% of ratepayers. That subsidy doesn’t also take into account the tens of thousands of houses that could be built on that 535ha of land, which would in turn generate rates revenues for the Government. This MartinJenkins table shows the costs of holding the courses, while the Auckland Council map below shows where the courses are.

his

Given the surge in land values since 2014, when the courses were valued in the report, the Council would comfortably receive over $4 billion, which would reduce interest costs by over $160 million per year and reduce ongoing losses by over 162 million per year.

So why doesn’t Wayne Brown want to sell the golf courses?

Selling the courses for residential property develop would increase the effective supply of land for housing in Auckland, which would devalue the value of land already held by landowners who vote in council elections. Those 6,415 golf club members will no doubt also be influential beyond the sheer number of votes, which was less than 1% of the 405,149 people who voted in the 2022 local elections.

It’s also anathema for a land banker to sell land all in one hit in a way that would both devalue the rest of the holdings and increase housing supply. It’s simpler and more lucrative just to hold and wait to drip-feed the plots out onto the market.

Elsewhere in the news in our political economy since Friday:

US jobs and wages growth data was hotter-than-expected, but investors and traders still believe the Federal Reserve will pivot to slower rate increases next month and will have to cut rates late next year to revive an economy in recession by then;

European and other G7 leaders agreed to a US$60/barrel price cap on Russian oil exports carried on ships insured and financed by European Union, US and British financiers, although Russia has already bought a ‘shadow fleet’ of oil tankers to carry the oil to its main new customers, China and India; Reuters

China relaxed more covid controls in Beijing and Shenzhen as authorities fine-tuned their policies in the wake of the widespread wave of protests a week ago; Reuters

Over two years after it was passed, the Infrastructure Funding and Financing (IFF) Act designed to replace Government grants for local infrastructure was finally used for the first time to provide $175 million of funds for 13 transport projects in Tauranga; Beehive

Although the Government also announced $350 million worth of grants to 46 councils for transport projects; and, Beehive

The Government backed down on plans to entrench Three Waters entities in public ownership through a clause that would require a 60% Parliamentary vote to change the ownership rules; Beehive

Substacks of the day

I subscribe to

who writes for a closer look at the US economy and US interest rate policy. She was particularly encouraged about the prospects for a safe landing this week.I also follow

over atThread of the day

Ka kite ano

Bernard

Share this post